1 The Classical Theory of Inflation

advertisement

1 The Classical Theory of Ination

1.1 The Level of Prices and the Value of Money

1. When the price level rises, people have to pay more for the goods

and services that they purchase.

2. A rise in the price level also means that the value of money is

now lower because each dollar now buys a smaller amount of

goods and services.

3. If P is the price level, then the quantity of goods and services

that can be purchased with $1 is equal to 1=P .

1.2 Money Supply, Money Demand and Monetary Equilibrium

The value of money is determined by the supply and demand for

money.

For the most part, the supply of money is determined by the

Fed.

1. This implies that the quantity of money supplied is xed

(until the Fed decides to change it).

2. Thus, the supply of money will be vertical (perfectly inelastic).

There are many determinants of the demand for money.

1. One variable that is very important in determining the demand for money is the price level.

2. The higher prices are, the more money that is needed to

perform transactions.

3. Thus, a higher price level leads to a higher quantity of money

demanded.

In the long run, the overall price level adjusts to the level at which

the demand for money and the supply of money are equal.

1.3 The Classical Dichotomy and Monetary Neutrality

Classical Dichotomy is the theoretical separation of nominal

and real variables.

In the 18th century, David Hume and other economists suggested

that dierent forces inuence real and nominal variables.

According to Hume, changes in the money supply aect nominal

variables but not real variables.

Monetary Neutrality is the proposition that changes in the

money supply do not aect real variables.

1.4 Velocity and the Quantity Equation

Velocity of Money is the rate at which money changes hands.

To calculate velocity, we divide nominal GDP by the quantity of

money:

nominal GDP

velocity =

:

quantity of money

If P is the price level (the GDP deator), Y is real GDP, M is

the quantity of money, and V is the velocity:

or

Y

V = PM

M V = P Y:

This is known as the Quantity Equation:

1. The quantity equation shows that an increase in the quantity

of money must be reected in one of the other three variables.

2. Specically, the price level must rise, output must rise, or

velocity must fall.

3. In data, it seems to be the case that velocity is fairly stable,

while GDP and the money supply have grown dramatically.

When the Fed changes the quantity of money (M ), it will proportionately change the nominal value of output (P Y ).

The economy's output of goods and services (Y ) is determined

primarily by available resources and technology. Because money

is neutral, changes in the money supply do not aect output.

This must mean that P increases proportionately with the change

in M .

Recall Friedman (1968):

\Ination is always and everywhere a monetary phenomenon."

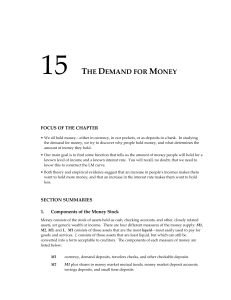

2 The Demand for Money

2.1 Keynesian View of Money Demand

As seen above, the early literature on money did not concern

individual choice|money demand|per se.

Keynes' search for a simple model of money led him to distinguish three motives for holding money:

1. Transactions motive: People hold money to undertake planned

transactions.

2. Precautionary motive: People hold money to buer themselves against (income and expenditure) shocks.

3. Speculative motive: People hold money to speculate in its

value.

2.2 Allais-Baumol-Tobin Model

Allais-Baumol-Tobin model abstracts from the speculative and

precautionary motive and concentrates on transactions motive.

If a consumer holds money (M ), he will lose its foregone interest

(R M ).

If he goes to the bank, he will encounter /trip shoe-lace costs

(transactions costs).

Let c be the spending rate (per year).

Let T be the interval between trips. For example, T = 121 year.

Then, total transaction costs = 1 .

And, total amount of money needed per trip = c T .

Finally, the average money holdings (m ) will be 21 cT . Why?

T

Average money holdings are simply the cash in hand during the

period divided by the lenght of the period, or,

Z

1

1

1 2 m = T c(T ; t)dt = T cTt ; 2 ct 0

0

2

1

1

cT = cT

= cT 2 ; cT 2 =

T

2T

2T

2

Now, the consumer's optimization problem is simply

1

1

min R cT + :

2

T

The rst term is the foregone earnings and the second transactions costs.

The First-Order Condition is simply

=0

1

Rc

;

=)

2

T2 r

T = 2

=)

T

T

T

?

Rc r

r

2

c

2

m = 12 cT = c4 Rc

=

2R

?

Notice that

1. c " =) T #, m

"

2. " =) T ", m

"

3. R " =) T #, m

#

?

?

?

4. In other words, increase in interest rate reduces the demand

for money.

2.3 Empirical Research on Demand for Money

Start from expression for the average money holdings we just

derived,

r

05

c

m = 2R = 2 c0 5R;0 5

and take logs from the both sides

:

:

:

log m

= 0:5 log + 0:5 log c ; 0:5 log R:

2

This motives regression equations used in the empirical research

on demand for money:

log

M = + log y ; log R ;

0

1

2

P

t

t

t

t

where we have included the price level and replaced consumption

with income.

See McCallum (pp. 43{47) on empirical results concerning the

regression above and its generalizations. Unfortunately, estimated coecients on @ log(M =P )=@ log R (the interest elasticity of money) tend to be very small. He summarizes:

\: : : attempts to provide reliable econometric evidence on

money demand behavior have not yet been highly successful."

t

t

t

Casey Mulligan and Xavier Sala-i-Martin (1996) observe that the

negative eect of the interest rate on the money demand involves

two kinds of eects:

1. A higher interest rate motivates people to transact more frequently between money and nancial assets. [This is what

we just saw.]

2. If there is some cost in using interest-bearing assets at all|

for example, for establishing a money-market account|then

a rise in the interest rate should motivate people to use these

assets.

Therefore, the interest elasticity of money demand should be

nonlinear. When interest rates are low, people do not bother

to pay the cost of using interest-bearing assets. When interest

rates are high, they do! The empirical evidence in Mulligan and

Sala-i-Martin supports this hypothesis.