%

THE DOW JONES BUSINESS AND FINANCIAL WEEKLY

Q&A

www.barrons.com

JUNE 17, 2014

4 Mid-Cap Stocks Growing Faster Than the Market

Rob Lanphier of William Blair & Company has beaten the market in good times and bad. Here’s what he likes now.

By TERESA RIVAS

Small and mid-cap stocks have had

a monster half-decade, with the Russell

2500 Index logging a compound annual

growth rate above 24% in the five years

ended 2013. Rob Lanphier says that kind

of outperformance isn’t likely to be sustainable.

The observation might seem obvious,

except that Lanphier is co-manager of

the William Blair Small-Mid Cap Growth

Fund (ticker: WSMNX). Generally, fund

managers are not scrambling to lower expectations for their asset class, but after

their “unbelievable run,” Lanphier is lowering expectations.

The manager says the rising tide

“raised all boats indiscriminately” in recent years, but now is the time when

higher-quality names can distinguish

themselves, as interest rates creep up

and euphoria fades. His team looks to buy

companies with market value between

$500 million and $8 billion that they believe have strong management and can increase earnings faster than average over

a number of years.

That strategy has paid off, allowing

the fund, which gets a four-star rating

from Morningstar, to generate returns

of 9.9% in the past decade, beating the

9.7% for the Russell 2500 and peers in its

category. Not only did Lanphier and his

team beat the benchmark last year, when

small-caps were on a tear, they also outperformed in 2007, 2008 and 2009, during

the worst of the recession and the sector’s

rapid rebound.

Today, Lanphier sees opportunity from

health care to transportation, with companies that have a long runway of growth

ahead.

Read excerpts from his conversation

with Barrons.com below.

Barrons.com: Let’s talk about Stericycle

(SRCL), your largest holding. You added

to your position at the end of the first

quarter.

Lanphier: Not only is it our largest hold-

ing, but it is also our oldest holding in

the portfolio. We’ve been a holder of the

company ever since it went public [more

than a decade ago.]. Sometimes it has

been a bigger position, sometimes it has

been a smaller one. The investment thesis

on Stericycle is the notion that this company should be able to grow stronger for

longer: It should be able to sustain midteens earnings growth for an extended

period of time. I can’t think of another

company in the portfolio where I have

that level of conviction, and at the same

time if you looked at the valuation, which

is at about 25.5 times the next 12 months,

that’s below not only its five-year record

from a multiple standpoint, but it is also

below the relative multiple to the market.

Medical hazardous waste [collection

and disposal] is Stericycle’s core business,

whether it is in hospitals or dentist offices

or tattoo shops. The regulatory environment around medical hazardous waste has

become increasingly onerous over time,

and in this case that’s a positive: Stericycle is really sitting in the catbird’s seat.

It is by far the leader in this business,

domestically and internationally. About

70% of their revenues today are domestic, but over time you should expect that

they will gain increasing traction, particularly in Europe as the regulatory environment over there continues to become

more onerous as well. A couple of years

ago it created a division called StrongPak

Manager’s Bio

Name: Robert Lanphier

Age: 58

Title: Partner, William Blair & Co.; co-portfolio manager

Education: B.S. in management, Purdue

University; M.B.A., Northwestern University Kellogg Graduate School of Management

Hobbies: Reading, travel, hiking, snow

skiing, tennis and golf

for hazardous waste in general — things

like paint cans, aerosol cans that would

be used in a retail setting. So whether

you are CVS Caremark (CVS), Walgreen

(WAG), Home Depot (HD) or Target

(TGT), you are under tremendous scru(over p lease)

The Publisher ’ s Sale Of This Reprint Does Not Constitute Or Imply Any Endorsement Or Sponsorship Of Any Product, Service, Company Or Organization.

Custom Reprints 800.843.0008 www.djreprints.com DO NOT EDIT OR ALTER REPRINT•/

• REPRODUCTIONS NOT PERMITTED 48989

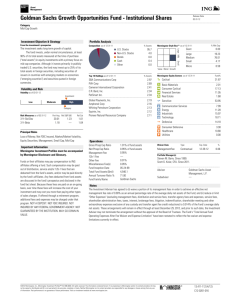

Fund Facts

(as of June 3, 2014)

William Blair Small-Mid Cap

Growth Fund (WSMNX)

Assets:

$703.6 million

Expense Ratio:

1.1%

Front Load:

None

Annual Portfolio Turnover: 53%

Yield:

None

Source: Morningstar

Top 10 Holdings

(as of April 30, 2014)

Stericycle

j2 Global

Six Flags Entertainment

Old Dominion Freight Line

Affiliated Managers Group

Gartner

Robert Half International

Portfolio Recovery Associates

Sirona Dental Systems

HealthSouth

Source: Morningstar

SRCL

JCOM

SIX

ODFL

AMG

IT

RHI

PRAA

SIRO

HLS

tiny to handle hazardous waste in a very

defined way. So Stericycle is not resting

on its laurels, even as its core business

continues to do very well.

Your second-largest holding is Six Flags

Entertainment ( SIX ).

Six Flags is badly misunderstood. It is

an amusement park leader that frankly

has an enormous opportunity to monetize

many aspects of the amusement park by

new management that came in about four

years ago. The cost of an admission ticket

for an all-day experience is still relatively

low: This new management team sees this

substantial pricing power that they could

achieve and still grow admissions at the

same time – you get about a 4% increase

in pricing per year that is just the in-park

admission costs, which [leads to] margin

expansion. Six Flags has tremendous free

cash flow, and when you add back a dividend yield and some buybacks, you end

up with what could be a mid to high-teens

total return per year, and we really believe that could be sustained for the next

three to five years. The other thing to

keep in mind is that in a city you are not

going to have more than one amusement

park: They are pretty much a monopoly

to that area.

Old Dominion ( ODFL ) is a name I imagine

that has benefited from the resurgence of

transport.

If you look at the valuation, at 20 times

next 12 months, it is above its absolute

price/earnings ratio on a five-year basis.

But it is right in-line on a relative market-multiple basis. If you looked at the

top seven publicly traded less-than-truck

load (LTL) carriers, they together represent about 65% of the LTL market share,

with Old Dominion at 7% of that 65%. But

if you look at the revenue growth, Old

Dominion is growing dramatically faster

than any of the other players, and they

represent 35% to 40% of the total earnings before interest and taxes (EBIT) of

those seven companies. So this is a company that is not only growing faster than

the industry but is doing so more profitably than its peers.

I think that because of the margins

and the free cash flow that Old Dominion

has been able to generate, it is able to

reinvest in technology and in services at a

time when its competitors are struggling

to raise their margins to acceptable levels. Old Dominion is generating more and

more cash, which it is reinvesting and at

the same time giving back to shareholders in the form of dividends and share

buybacks. So not only does it have the

highest margins and the highest returns

in the industry, but from our standpoint as

long as it can continue to execute there is

no reason to think that’s going to change

any time soon. And their employees share

in the company’s success via constant and

consistent wage increases and above-average benefit packages, so Old Dominion

attracts and retains employees better

than anybody else in the industry.

A smaller position is Middleby ( MIDD ).

Lately we’ve been adding to it. Middleby

is a leading manufacturer of food service

equipment to the restaurant and food processing industry — it focuses on making

restaurant kitchens much more efficient,

in terms of energy savings, labor savings,

footprint of machines. As a result, there

is significant value-add, on average probably saving close to 30% of the total cost

to either a fast-food or casual-dining commercial kitchen environment; the payback

is usually less than two years. It has a

blue-chip list of clients, and we think it

can grow top line at midteens and bottom line at 20%-plus for the next three

years. So why now, other than the fact

that the multiple came down to 21 times

[after a disappointing first quarter]? It

acquired Viking, a well-known brand that

was poorly managed. Middleby has created a complete redesign and is launching more than 50 different Viking products this year with a commercial level

of sophistication that Viking never had

previously. At the same time it completed

the purchase of all of Viking’s distributors around North America, which adds

probably 1,000 basis points [10 percentage points] of margin by capturing that

distribution for themselves. Middleby had

a goal when it acquired Viking of getting the EBITDA [earnings before interest, taxes, depreciation and amortization]

margins from 8% up to 20%, and at the

end of 12 months they were at 19%.

Thanks.

The opinions and forecasts expressed in the article referenced are those of Rob Lanphier as of June 17, 2014, and may not actually come to

pass. This information is subject to change at any time based on market and other conditions and should not be construed as a

recommendation of any specific security. Not all securities held in the portfolio performed as favorably as those discussed, and there is no

guarantee that these securities will continue to perform favorably in the future. There is no guarantee that the Fund will continue to hold any

one particular security or stay invested in any one particular sector. Holdings are subject to change at any time. Investments are subject to

market risk.

Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Small and

mid-cap stocks are also more sensitive to purchase/sale transactions and changes in the issuer's financial condition.

After 7/31/2014, this material must be accompanied by a William Blair Fund Update, which includes performance data and top ten portfolio

holdings for the most recent calendar quarter.

The Small-Mid Cap Growth Fund’s Class N share 1-year, 5-year and 10-year performance returns as of May 31, 2014 are as follows:

Period Ending 5/31/2014

Small-Mid Cap Growth Fund

Russell 2500 Growth Index

1 YR

5 YR

10 YR

16.98%

18.51%

19.45%

20.97%

9.87%

9.64%

Expense Ratio for Class N shares

Gross: 1.46%

Capped: 1.35%

The Small-Mid Cap Growth Fund’s Class N share Morningstar Ratings as of May 31, 2014 are as follows:

Period Ending 5/31/2014

Overall 3 YR

5YR

10YR

Small-Mid Cap Growth Fund

Number of Funds in Mid Cap Growth Category

4

631

4

564

4

412

4

631

The Fund’s Adviser has contractually agreed to cap the Fund’s Expense Ratio until 4/30/15.

Performance cited represents past performance. Past performance does not guarantee future results and current performance

may be lower or higher than the data quoted. Returns shown assume reinvestment of dividends and capital gains. Investment

returns and principal will fluctuate with market and economic conditions and you may have a gain or loss when you sell shares.

For the most current month-end performance information, please call +1 800 742 7272, or visit our Web site at

www.williamblairfunds.com.

Morningstar Ratings™ are as of 5/31/14 and are subject to change every month. The ratings are based on a risk-adjusted return measure

that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent

performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next

22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted average of

the performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar Rating metrics. The Morningstar Mid Cap

Growth Category represents the average annual composite performance of all mutual funds listed in the Mid Cap Growth Category by

Morningstar.

©2014 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content

providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information.

Please carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. This and other

information is contained in the Fund’s prospectus, which you may obtain by calling

+1 800 742 7272. Read it carefully before you invest or send money.

William Blair & Company, L.L.C., Distributor.