sixflags , inc . annualreport 2 0 0 0 - Corporate-ir

advertisement

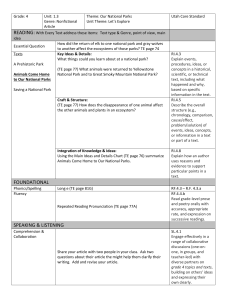

s i x f l a g s , i n c . a n n u a l 2 0 0 0 r e p o r t Enchanted Village & Wild Waves Seattle Six Flags Darien Lake The Great Escape Lake George Buffalo/Rochester U n i t e d S t a t e s Six Flags Marine World Vallejo/San Francisco Waterworld USA Sacramento Denver Six Flags St. Louis Concord St. Louis Six Flags Hurricane Six Flags Magic Mountain Harbor Los Angeles White Water Bay Frontier City Los Angeles Six Flags Great Adventure & Wild Safari Animal Park Cleveland New York/Philadelphia Chicago Six Flags Elitch Gardens Waterworld USA Boston/Hartford/Springfield Six Flags Worlds of Adventure Six Flags Great America Oklahoma City Oklahoma City Six Flags Hurricane Harbor Dallas Six Flags Over Texas Six Flags New England Wyandot Lake Columbus Six Flags Hurricane Harbor Six Flags New York/Philadelphia America Washington D.C./Baltimore Six Flags Kentucky Kingdom Louisville Six Flags Over Georgia Atlanta Six Flags White Water Atlanta Dallas Six Flags Fiesta Texas Six Flags AstroWorld San Antonio Houston Six Flags WaterWorld Houston Six Flags SplashTown Houston M e x i c o Six Flags Mexico Mexico City M a p L e g e n d ■ Theme Park ■ Water Park Six Flags Holland Amsterdam, Holland Bellewaerde Warner Bros. Movie World Ieper, Belgium Düsseldorf, Germany Six Flags Belgium Brussels, Belgium Walibi Schtroumpf Metz, France E u r o p e Walibi Rhône-Alpes Lyon, France Warner Bros. Movie World Madrid, Spain (Under Development) Walibi Aquitaine Toulouse/Bordeaux, France P a r k L o c a t i o n s T h e W o r l d ’ s T h r i l l C a p i t a l . ith 38 theme and water parks in seven countries, Six Flags owns and operates more parks than any other company in the world. Of those parks, 25 are Six Flags-branded. This number includes Six Flags Belgium, which is being rebranded in 2001. ■ Six Flags has 30 parks in the U.S. alone and 16 of the largest theme parks in North America. Approximately two-thirds of the population of the continental United States lives within 150 miles of one of our parks. ■ Six Flags expects to continue to grow both domestically and internationally – through the growth of existing parks and the selective acquisition of new properties. This continued global growth will cultivate ever-broader recognition of the Six Flags brand and industry position. C o n t e n t s Shareholders’ Letter 2-9 Nor th American Park Pr ofiles 10-27 Eur opean Park Pr ofiles 28-31 Price Range Of Common Stock 33 Financial Repor ting 34-70 Directors 73 t o o u r s h a r e h o l d e r s ach year when I compose my letter to shareholders for our annual report, I always close by thanking our employees for all their efforts and acknowledging their tireless contributions to our success. This year I want to begin by thanking them for their exceptional performance in 2000, under very trying circumstances. We are clearly blessed to have the most talented group of theme park professionals in the world working to build value for our Company. There is simply no question that our employees are our finest assets. ■ Never has our employees’ operating skill been more tested or more apparent than during the 2000 season. We began the year with great optimism. Coming off a terrific operating performance in 1999, highlighted by 40% growth in our adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”), and with strong capital and marketing programs in place for 2000, we felt poised for a very strong season. Unfortunately, as the year unfolded, we encountered the most difficult operating conditions in memory – extremely adverse weather that existed for an extended period during our core summer season in a broad range of U.S. markets. These extremely difficult operating conditions persisted throughout a substantial part of last season. We were also hurt by the relative decline in the value of the Euro and the impact that had on the translation of our European results into our U.S. dollar financial statements. 2000 Performance Given these issues, we are very pleased with our overall operating performance in 2000, with 11% growth over 1999 in our full year adjusted EBITDA (including our Company’s share of the EBITDA from our four partnership parks). This strong performance speaks volumes about the skill and experience of our park operating teams and their ability to improve theme park performance in even the most challenging operating environment. It also inspires strong confidence as we head into our 2001 season. ■ Consolidated revenues in 2000 were a record $1.01 billion, an 8.6% increase over 1999 revenues of $927.0 million. This revenue growth was driven primarily by a systemwide attendance increase of approximately 8.8%. We continued to do an excellent job in 2000 controlling our expenses and improving our operating margins. EBITDA margins grew from 32% in 1999 to 37% in 2000. The revenue growth and margin improvement combined to produce adjusted EBITDA for 2000 of $402.5 million as compared to $363.2 million in the prior year. This represents an increase of $39.3 million, or 11%, over the 1999 results and an increase of $144 million, or 55%, over pro forma 1998 adjusted EBITDA. ■ Again, those results were achieved in the face of very difficult operating conditions. Throughout June, July and the first part of August, we had to contend with abnormally cool and wet weather in a significant number of major markets – particularly Left to right: Jim Dannhauser, Chief Financial Officer Kieran Burke, Chairman & Chief Executive Officer Gary Story, President & Chief Operating Officer in the Northeast, Midwest and Mid-Atlantic regions. We are very encouraged that the latter part of the operating season saw a strong rebound in performance when more normal weather patterns returned from mid-August forward. For the period from the end of July to the conclusion of the main operating season in October, attendance at our consolidated parks grew by 12.5% on a same-park basis, with revenues up by 14.3% over 1999. This powerful recovery demonstrates unequivocally that our core season difficulties were a direct result of the aberrant weather we experienced. This performance under these conditions also makes a powerful statement about the strength of our Six Flags brand and the earning power of our business. Knowing we can perform at this level during difficult times gives us a great sense of confidence and optimism for what we can achieve in the future. ■ In addition to the solid revenue and cash flow growth we achieved companywide in 2000, we were especially pleased by the strong market reaction to our newly branded Six Flags parks. Those four parks, which included our first two international Six Flags parks in Holland and Mexico, enjoyed spectacular full seasons, with year-over-year growth of 43% in attendance, 66% in revenues, 16% in per capita spending, and over 100% in park level cash flow. The strong response to the brand internationally is very exciting, particularly in Europe where we own several parks and have a very significant opportunity for both internal and external growth using the brand and our licensed characters. Our European parks performed very well in 2000. Total European attendance in 2000 was in excess of 6.7 million people, with year-over-year revenue growth of 9.5% and EBITDA growth of 79% on a constant currency basis. Establishing Six Flags as an internationally recognized brand will clearly accelerate the growth of our European parks and enhance the overall value of our Company. Upcoming In 2001 Our capital and marketing programs for 2001 are now being implemented. We are rebranding our park in the Brussels market, which will become Six Flags Belgium. With the successful debut of our Six Flags Holland park last year, and the strong market reaction to the introduction of the Six Flags brand in conjunction with the utilization of our Looney Tunes, DC Comics and other animated characters licensed on an exclusive basis from AOL Time Warner, we are very optimistic about the upcoming season for our latest extension of the Six Flags brand in Europe. The branding effort in Belgium is part of a capital program which includes the addition of major rides and attractions to a large number of other parks. This is a powerful capital program which should drive strong growth and generate substantial free cash flow after interest expense and capital expenditures. Although extensive, our 2001 capital program will be significantly less than we invested in each of the past two seasons. This lower capital investment level reflects the fact that a significant number of our rebranding efforts and the larger levels of capital expenditures associated therewith have been concluded. In years to come, we should see increasing levels of annual free cash flow as our EBITDA continues to grow and our annual level of capital expenditures for our existing parks remains at these lower levels. Our ability to generate free cash flow growth over the next few years will be an important factor in driving the value of our shares in the public market. ■ As part of this year’s capital program, we are making several improvements, including a major steel coaster, to our Six Flags Over Texas park as part of its 40th anniversary season and the 40th anniversary of our Six Flags brand. We are also devoting a portion of our capital investment program to in-park spending opportunities at several of our major market parks. This trend will continue in future seasons as we seek to take advantage of the opportunity to increase these high margin revenues systemwide. ■ We expect to achieve same-park EBITDA growth in 2001 of approximately 10% over 2000, and approximately 15% growth including the contribution from our three most recent acquisitions described below. ■ In addition to delivering strong internal growth by driving the core business of our existing portfolio of parks and expanding those parks into complementary activities, we continue to selectively take advantage of the numerous acquisition opportunities that exist for us in domestic and international markets. Acquisitions continue to be both strategic and immediately accretive to our cash flow. We are very pleased to be able to add three interesting parks to our portfolio ahead of the 2001 season. These three acquisitions demonstrate the numerous opportunities we have domestically and internationally for external growth through selective park acquisitions. Recent Transactions In December 2000, we acquired Enchanted Village & Wild Waves, a water park and children’s ride park located on approximately 65 acres in the Seattle, Washington market. Seattle is the 14th largest city by population in the country and there is no direct competition in the market. The park has averaged over 500,000 in annual attendance over the last five years and will be a good cash flow generator for us. There is also room to expand the water park and dry ride component, the group sales areas, and the quality and number of revenue outlets with controlled expenditures which should drive good growth. ■ In February 2001, we acquired the former SeaWorld® Ohio park in Aurora, Ohio from Busch Entertainment Corporation. The 230-acre marine mammal and sealife park is located immediately adjacent to our Six Flags Ohio theme park and water park. We are combining all three parks under the name Six Flags Worlds of Adventure. Together with our hotel and campground properties, this gives us a 690-acre complex, creating one of the largest entertainment destinations in the Midwest. The entertainment value and power of the combined theme park, water park and marine wildlife park marketed under one gate with our Six Flags brand will allow us to drive attendance and revenue growth at the combined facility. In addition, we will achieve significant expense savings operating the parks as one. Taken together, this should enable us to drive significant EBITDA growth for controlled investment levels. Moreover, the combined facility significantly enhances our competitive position in the Cleveland core market, as well as our ability to draw visitation from numerous outer markets. ■ We are also pleased to have been selected by the City of Montreal to acquire La Ronde, a 146-acre theme park located near downtown Montreal on the former site of the 1967 Montreal World’s Fair. This is a terrific opportunity for us. Montreal and the province of Quebec provide a large residential population and significant numbers of tourists from which to attract park patrons. The park enjoys a superb location and already generates attendance in excess of one million visitors on an annual basis. With appropriate marketing and investment and the introduction of our Six Flags brand and Warner Bros. characters, we can transform La Ronde into a world-class theme park over the next several years. ■ To provide additional capital to fund these three acquisitions and to enable us to take advantage of the numerous opportunities we have for internal and external growth by investing in our business, we concluded a convertible preferred stock offering in midJanuary 2001, raising gross proceeds of $287.5 million. The preferred stock has an 8.5-year term, a 7.25% dividend and a 20% conversion premium when issued, making the conversion price $20.85 per share. ■ We also recently concluded a refinancing of certain of our public debt in order to continue to simplify and increase the flexibility of our capital structure. With these financings in place, we have ample liquidity and committed financings to pursue our business plan, no maturities in our debt structure until 2006 and no meaningful amortization in our bank facilities before December 2004. Given the uncertain state of the capital markets at the present time, we are very fortunate to be in such a strong financial position with significant levels of liquidity available to pursue growth. ■ In addition to uncer tainty in capital markets, there is general concern about the depth and duration of the current slowdown in the United States economy and the impact this may have on many businesses. Historically, the regional theme park industry has proven to be largely recession resistant. At Six Flags, 90% of our customers come from within 150 miles of each park, over 55% of our business comes on a group, season pass or other presold ticket, our customers spend an average of 8-10 hours in our parks, and we deliver a substantial entertainment value for an affordable price. Given the proximity of our patrons and this strong price-value relationship, we believe that we will hit our performance target of 15% EBITDA growth in 2001, even in the face of a weakening economy. Global Growth And Rebranding Our confidence in the future is based on the many strengths and assets we have built in our Company over time. We are today the world’s largest regional theme park operator with thirty-nine parks, including La Ronde, (quadruple the number of our nearest competitor) in seven countries serving nearly 50 million guests annually and generating over $1 billion in consolidated revenues systemwide. ■ Our parks include a broad spectrum of entertainment venues including theme parks, water parks, animal parks, marine mammal parks, amphitheaters and ancillary hotels and campgrounds. With thirty domestic parks, Six Flags has achieved an unparalleled national footprint – one which provides incredible geographic diversity and which simply cannot be duplicated. Our reach is extensive. Approximately two-thirds of the population of the continental United States (175 million people) live within a 150-mile radius of our parks. Our parks serve each of the ten largest metropolitan areas of the country and eighteen of the top twenty-five. We own sixteen of the largest theme parks in North America, and for the 2001 season, twenty-five of our parks will be branded Six Flags facilities. ■ Internationally, we currently own seven parks in five European countries, including a major Warner Bros. Movie World park in Germany, with a second one under construction in Madrid. This strong foothold in Europe gives us the opportunity to duplicate the dominant market share we have achieved in the United States. We also own the largest park in Mexico City, with over 20 million residents living within 50 miles of the park. This park gives us a gateway into the Latin and South American markets, and our pending acquisition of La Ronde will give us our first park in Canada. ■ Enhancing our unique network of parks are our priceless brands and character licenses which enable us to accelerate the growth of the parks we own today and those we acquire in the future. We have worldwide ownership of the Six Flags name, the preeminent brand name in the regional theme park industry. Our exclusive long term licenses from Warner Bros. and DC Comics give us access to a stunning array of characters and intellectual property whose breadth and scope appeal to our entire family audience. The impact of branding on our business has been tremendous. We will continue to add our Six Flags brand name and our licensed characters to the parks we own or acquire to accelerate their growth and to enhance the family entertainment experience of our guests. ■ I look forward to reporting to you on our progress in 2001 and what we hope will be an outstanding year. Sincerely, Kieran E. Burke Chairman and Chief Executive Officer