CITADEL BUSI ESS ACCOU T / BUSI ESS LOA APPLICATIO

advertisement

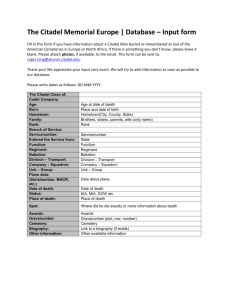

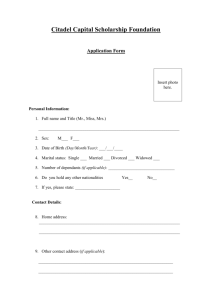

CITADEL BUSIESS ACCOUT / BUSIESS LOA APPLICATIO Part 1 - Business Information Account Number Type of Entity: Date Business Established: Individual/ Sole Proprietorship C-Corporation Partnership (General or Limited) Limited Liability Company State of Incorporation/ Organization: S-Corporation Non-Profit/Community Organization Business or Sole Proprietor Name Tax I.D. Number DBA (if applicable) Website/E-mail Principal Place of Business Address (not P.O. Box) Business Phone City, State, ZIP Mobile Phone Describe Business Product or Service Offered Annual Sales (last full year) For regulatory purposes the following information is required for all accounts: 1) What is the primary purpose of the depository account? (i.e. payroll, operational, general transactions, business savings, etc.) 2) What is the anticipated source of funds for deposit into the account? (i.e. retail sales, internet transactions, invoiced sales or services, cash activities, contributions or membership fees, etc.) 3) Do You anticipate sending or receiving domestic and/or international wire transfer from this account? 4) What do You estimate Your average monthly CASH deposit amounts to be? 5) What do You estimate Your average monthly CASH withdrawal amounts to be? Applicants responding “yes” to the following questions are not eligible for membership or loan products at this time. 6) Does Your business, association, or organization provide, intend to provide or in any manner facilitate gambling services (internet or otherwise)? 7) Does Your business, association, or organization provide check cashing, ATM services, or any other type of financial intermediation or cash brokering services? Part 2 – Account Ownership / Certificate of Authority / Authorization for Information (All owners, partners or LLC members must be listed below with ownership percentages totaling 100%. The signature and identification of each person is required. Businesses or corporations with more than four owners, partners or LLC members are not currently eligible for Citadel business accounts or business loans. Each person who signs below certifies that: A. The use of any Citadel deposit account, product or service by the entity, business or proprietorship (the "Customer") acknowledges receipt and acceptance of Citadel's Account Agreements and Disclosures. B. In addition to the business entity, up to four individuals / owners are permitted on a Citadel business account and are classified as joint owners of the depository account. As such, each individual listed below is authorized to: (1) Enter into, modify, terminate and otherwise in any manner act with respect to accounts at Citadel and agreements with Citadel or its affiliates for accounts and/or services offered by Citadel or its affiliates (other than letters of credit or loan agreements); (2) Authorize (by signing or otherwise) the payment of Items from the Citadel account(s) listed in the name of the Customer (including accounts opened after the date of this Authorization for Information and Certificate of Authority) and the endorsement of items presented for deposit, cashing or collection (see Citadel's Account Agreements and Disclosures for further information including the definition of "Item"); (3) Give instructions to Citadel in writing, orally, by telephone or by any electronic means in regard to any Item and the transaction of any business relating to the account(s), agreements or services listed in the name of the Customer with the understanding that the Customer indemnifies and holds Citadel harmless for acting in accordance with such instructions. C. If a code must be transmitted to Citadel in order to authorize an Item, and the code is transmitted, the Item will be binding on the Customer regardless of who transmitted the code. D. The information provided in the Customer's business account application is correct and complete, that each person who signs this application below holds any position and maintains ownership as indicated, and the signature appearing below the person's name is authentic. E. No dissolution, bankruptcy or insolvency proceedings with respect to the Customer or any owner, partner or LLC member have been commenced. F. If the Customer is a corporation, the corporation is a duly formed, validly existing corporation in good standing under the laws of the Commonwealth of Pennsylvania (or other State of the United States). Part 2 – Account Ownership / Certificate of Authority / Authorization for Information - continued G. The partnership agreement, articles of incorporation/by-laws, or articles of organization/operating agreement submitted to Citadel with this application is a true, complete and current copy and the same are in full force and effect this date without modification. By signing this Authorization for Information, You authorize Citadel Federal Credit Union (Citadel) to obtain a consumer credit report and any other information relating to Your individual credit status in connection with the opening of a business account or upon application for a loan or other product or service offered by Citadel in which You are an owner, principal, member, guarantor or other party for this business. Your authorization includes periodic credit reviews completed by Citadel and applies to the approval, servicing & collection of accounts, loans and any other product or service made or extended to the entity, business or proprietorship. You understand that Citadel requests this information to comply with federal regulations and to reduce fraudulent accounts, to prevent access to accounts & financial information by unauthorized persons, and for other legitimate business reasons. Should the information obtained from any such verification or report cause Citadel to decide to deny the account or loan application for the abovenamed business, You also authorize Citadel to communicate, either explicitly or implicitly, to any other owner, principal, member, guarantor, director or officer of the business that the denial was based in whole or in part on such information. Citadel will only allow others to offer products and services to You when We believe these products and services to be of value. We partner only with businesses that share high standards for protecting the information We have about You and that follow strict confidentiality requirements. Share Your information Do not share Your information Note: The Internal Revenue Service does not require Your consent to any provision of this document other than the certifications required to avoid backup withholding. #1 - Print Full Legal Name of Owner, Partner, Officer, or LLC Member SSN # Position/Title Percentage Owned Home Address Phone Number Identification Type Identification Number State of Issuance Signature Date of Birth #2 - Print Full Legal Name of Owner, Partner, Officer, or LLC Member SSN # Position/Title Percentage Owned Home Address Phone Number Identification Type Identification Number State of Issuance Signature Date of Birth #3 - Print Full Legal Name of Owner, Partner, Officer, or LLC Member SSN # Position/Title Percentage Owned Home Address Phone Number Identification Type Identification Number State of Issuance Signature Date of Birth #4 - Print Full Legal Name of Owner, Partner, Officer, or LLC Member SSN # Position/Title Percentage Owned Home Address Phone Number Identification Type Signature Identification Number State of Issuance Date of Birth Expiration Date Expiration Date Expiration Date Expiration Date Citadel Business Loan Application Checklist The following loan application checklist is provided to help in preparing and submitting a business loan request. Based upon the size and type of request, the following documents should be included (some information may not be required for certain loan requests; please check with Citadel if there are any questions). Basic Package – Defined as all loan requests under $50,000 with a total Citadel exposure less than $100,000 (exposure is defined as the total of all business loans currently with Citadel including the new loan request). □ □ □ Completion of a Business Account/Business Loan Application. Copy of the most recent corporate tax return (if the company is a sole proprietorship, a copy of the personal tax return is required instead). Completion of a Citadel Personal Financial Statement (All owners, partners or LLC members are required to complete a statement). Please note: Businesses or corporations with more than four owners, partners or LLC members are not currently eligible for Citadel business accounts. If you are requesting an equipment loan, vehicle loan or other non-real estate asset purchase: □ Copy of Invoice or Sales Contract. Standard Package – Defined as all loan requests $50,000 or over and/or with a total Citadel exposure $100,000 or greater (exposure is defined as the total of all business loans currently with Citadel including the new loan request) AND for all real estate financing requests. □ □ □ □ □ □ Completion of a Business Account/Business Loan Application. Copies of the corporate tax returns for the past three years (if the company is a sole proprietorship, the financial results of the business will be shown on the personal tax returns) OR business financial statements for the past three years (the financial statements should include both an income statement and balance sheet). Note: Tax returns are preferred to financial statements. Current interim business financial statements (if more than 6 months into the fiscal year). Copies of the personal tax returns for the past three years on each owner and/or guarantor. Accounts receivable aging (required for line of credit requests) Schedule of business debt (details the existing indebtedness of the business). Real Estate - For commercial mortgages (owner-occupied or investor), the following items are also needed. □ □ Copy of real estate purchase contract (if transaction involves a purchase of real estate). Copy of contractor’s bid or estimate for building improvements or renovations (if transaction involves improvements to an existing real estate property). CITADEL PERSONAL FINANCIAL STATEMENT Financial Condition as of: _____________, 20____ Complete this form for: (1) each proprietor, or (2) each owner, partner, or LLC member who owns 20% or more interest, or (3) any person providing a guaranty on the loan. Applicant Co-Applicant Social Security No. Birth Date Address Social Security No. Birth Date Mobile / Home Phone Business Name of Applicant/Borrower Business Phone Name, Address & phone number of nearest relative not living with applicant(s) Cash Accounts – Section 1 $________________ Accounts Payable $________________ IRA / Retirement Funds $________________ $________________ Accounts / Notes Receivable Cash Surrender Value of Life Insurance Marketable Securities / Brokerage Accts – Section 2 $________________ Notes Payable - Section 5 Installment Loan (Auto) Mthly. Payment $_________ Installment Loan (Other) Mthly. Payment $_________ Loan(s) on Life Insurance $________________ $________________ Value of Closely Held Businesses $________________ Real Estate Holdings – Section 3 $________________ $________________ $________________ $________________ Real Estate Mortgages Section 4 $________________ Unpaid Taxes $________________ Autos – Present Value $________________ Other Liabilities __________________ Personal Furnishings $________________ __________________ $________________ Other Assets (please define) $________________ Total Liabilities $________________ Total Assets $________________ Net Worth $________________ $________________ Sources of Income Contingent Liabilities (if any) Applicant Co-Applicant Salary Investment or Real Estate Income $____________ $____________ $____________ $____________ Other Income* $____________ $____________ As Guarantor or Co-Maker Any Legal Claims & Judgments Unpaid Federal Income Taxes $_____________ $_____________ $_____________ Please Provide Description of Other Income *Alimony or child support payments need not be disclosed in “Other Income” unless it is desired to have such payments counted toward total income. Please Provide Details of Contingent Liabilities Section 1 – Cash Accounts Account Title Financial Institution Section 2 – Marketable Securities / Brokerage Accounts # of Shares Name of Security Cost Section 3 – Real Estate Holdings Name in which Address Property is Titled Balance Market Value Exchange Homestead, Residential or Commercial Date Acquired Pledged Y/N Date of Value Original Cost Total Value Estimated Value 1. 2. 3. 4. Section 4 – Real Estate Loans Payable Mortgage Holder Original Mtg Amount Current Mtg Balance Monthly Payment 1. 2. 3. 4. Section 5 - Notes Payable Note Holder Original Balance Current Balance Monthly Payment Collateral Monthly Rental Income The following information is applicable to the person(s) signing this Personal Financial Statement Applicant (Yes/No) Co-Applicant (Yes/No) 1. Are you a U.S. Citizen? 2. Are you a defendant in any suits or legal actions? 3. Have you ever declared bankruptcy? 4. Have any judgments ever been entered against you? 5. Do you have ownership in or are you a partner in any other corporation or partnership? 6. Do you pay alimony, child support, or separate maintenance payments? If yes, amount $__________ If you answered yes to questions 2 – 6, please provide details: The financial statement and the information contained herein is given to the Citadel Federal Credit Union, hereafter called “Lender”, by the undersigned for the purpose of inducing Lender, from time to time, to extend credit to or otherwise become or remain the creditor of the undersigned, or persons, firms or corporations in whose behalf the undersigned may either individually or jointly with others, execute a guarantee in the Lender’s favor. The undersigned acknowledges that the Lender will rely on the information contained in this Financial Statement in making its credit decision, and under penalty of perjury, represents and warrants that such information is true and complete and that there are no material omissions. The undersigned agrees that the Lender may consider this Financial Statement as continuing to be true and complete until a written notice of a change is given to the Lender by the undersigned. The Lender and/or its affiliates is authorized to make all inquires that it deems necessary to verify the accuracy of the information contained herein and to determine the undersigned’s creditworthiness. The Lender is further authorized to respond to any inquiries from others concerning the Lender’s credit experience with the undersigned. Signature: Date: Signature: Date: Schedule of Business Debt Member Business Name (Borrower): __________________________________ Date: _________________ Please use this form to list in detail your current business indebtedness. This listing should include, but not be limited to, lines of credit, term (installment) loans, and mortgages. Please fill out this form as completely as possible. Financial Institution (i.e. name of credit union, bank, lender, etc.) Product Type* (i.e. line of credit, commercial mortgage, term loan, etc.) Current Balance $ Maturity Date Monthly Payment # of Remaining Payments $ Repayment Terms (i.e. interest only monthly, principal & interest monthly, etc.) * For Lines of Credit, please provide the principal balance as well as the full line commitment amount (i.e. $45,000 balance & $100,000 total line commitment)