entreprendre No 55 • Spring-Summer 2010

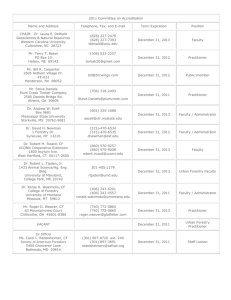

advertisement