Management's Discussion and Analysis

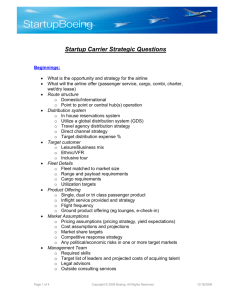

advertisement