BLOX - University of Oregon Investment Group

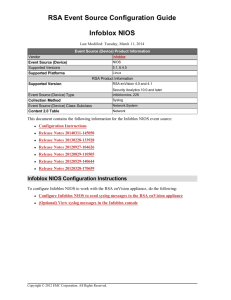

advertisement