Structure of international division of labor in East Asia and its change

Section 2 Structure of international division of labor in East Asia and its change

In this section, we discuss the international division of labor surrounding Japan and analyze its recent change. We begin with the analysis of the trade structure in East Asia and overview the trend of trade flows in the world. In particular, we observe the characteristics of East Asia and discuss their change before and after the failure of Lehman Brothers. Next we understand the trend of overseas development of Japanese affiliated companies behind such a trade structure, specifically the trend of sales and procurement activities associated with production. In addition, we estimate the competitiveness of East Asian economies and discuss their competitive and complementary relationships by using trade statistics.

1. Trade structure in East Asia

(1) East Asia in world trade

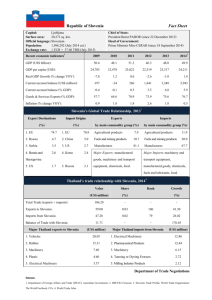

We start with an overview of the trends in world trade. Figure 2-2-1-1 is a bird’s eye view of trade flow in the world. It shows trade flow at three time points (1990, 2000 and 2010) considering the categories of goods by production process (intermediary/final goods) to discuss the structure of international division of labor. In the figure, the arrow’s size and color represents a trade flow, trade amount and share of intermediary goods respectively (a colder color indicating the share of intermediary goods is higher). First it shows the trade amount in East Asian economies

28

, including

China, has significantly increased over the past two decades. In particular, the trade amount in China increased significantly. For example, China's exports to NAFTA even exceeded the total exports from

EU 27 countries to NAFTA in 2010. Next, as for the trend of trades by goods, the share of intermediary goods is high in both the trade within East Asia to China and ASEAN and the trade within ASEAN. In contrast, the share of final goods is high in the trade from East Asia to EU and

NAFTA. In particular, figures in 2010 show China imports intermediary goods from Japan and

ASEAN and exports final goods to NAFTA and EU.

28 Here, due to a statistical technicality, the data are compiled assuming East Asia consists of Japan,

China, South Korea, Hong Kong, Taiwan, Brunei, Cambodia, Indonesia, Malaysia, Philippine,

Singapore, Thailand and Vietnam. ASEAN is assumed to consist of eight countries: Brunei, Cambodia,

Indonesia, Malaysia, Philippine, Singapore, Thailand and Vietnam. However, statistics may not be available for some countries or years due to data restrictions.

295

Figure 2-2-1-1 (a)

Flow of trade between major regions worldwide (1990)

(1990)

East Asia

290.9

China

20.7

23.5

9.8

17.9

14.0

38.1

Japan

29.3

62.4

8.0

36.8

ASEAN

25.8

24.9

24.4

* The size of an arrow and its color represent a trade amount (billion dollars) and the share of intermediary goods, respectively.

24.4

992.3

Source: RIETI-TID 2011 .

EU

67.4

23.4

125.1

101.5

29.6

28.3

119.1

NAFTA

210.6

Figure 2-2-1-1 (b)

Flow of trade between major regions worldwide (2000)

(2000)

East Asia

800.7

China

50.3

67.1

42.6

56.1

44.2

47.0

Japan

58.0

82.1

69.4

86.3

27.1

39.9

ASEAN

53.0

* The size of an arrow and its color represent a trade amount (billion dollars) and the share of intermediary goods, respectively.

163.9

82.4

1,391.3

Source: RIETI-TID 2011 .

EU

90.0

66.7

211.9

129.4

262.1

96.8

NAFTA

635.8

Figure 2-2-1-1 (c)

Flow of trade between major regions worldwide (2010)

(2010)

East Asia

1,971.5

197.2

China

208.4

145.3

143.5

Japan

94.1

65.0

208.5

80.5

104.9

193.7

113.0

80.8

ASEAN

84.2

* The size of an arrow and its color represent a trade amount (billion dollars) and the share of intermediary goods, respectively.

140.5

384.7

93.9

115.9

432.0

119.5

NAFTA

2,791.7

Source: RIETI-TID 2011 .

EU

278.5

380.8

839.1

It is inferred from this point that the international division of production has developed in East Asia,

296

where intermediary goods are transferred as necessary through trades among production bases. It is suggested a so-called “triangular trade” has been conducted as a basic structure, in which intermediary goods, including key parts and components, are exported from Japan, are assembled in China and other countries where labor costs are relatively low, and are exported to Europe and the U.S. as final demand areas. Next we take a closer look at the trade structure in East Asia.

(2) Characteristics and change of the trade structure in East Asia

(A) Inter-regional trade in East Asia

Figure 2-2-1-2 shows the long-term trend in shares by goods

29

to grasp the characteristics of inter-regional trade in East Asia. First it shows the share of materials (primary products) declined dramatically in the 1980s. It seems this is because the industrialization has shifted the main trade items from primary products to industrial products. Next it is notable that the share of parts and components, which are intermediary goods, has risen almost consistently. In addition, the share of consumption goods in final goods started to decline after peaking in the early 1990s. Although there is a gradual increase or decrease, the share of capital goods, which are also final goods, remained relatively stable.

Figure 2-2-1-2

Trend in composition by goods in East Asian inter-regional trade

(%)

45

40

35

30

25

20

15

10

Processed products

Parts and components

Materials

Processed products

Parts and components

Capital goods

Consumption goods

Capital goods

Consumption goods

5

Materials

0

1980 1982 1984

Source: RIETI-TID 2011 .

1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010

In East Asia, there are many different countries such as those with technical advantages and those with abundant and cheap labor forces. With the characteristics being utilized, production processes were divided in the machinery manufacturing industry, and the international division of labor has developed. Accordingly, it is suggested parts and components have been needed to be exchanged among manufacturing bases across borders in the region, the trade of parts and components has expanded among production bases, and at the same time, capital goods such as industrial machinery necessary for the production activities have been actively traded. Meanwhile, exports of consumption goods within the region have relatively decreased.

Behind such an international division of production is overseas development of companies,

29 Goods are classified into five categories: “materials,” which are primary products, “processed products” and “parts and components,” which belong to intermediary goods, “capital goods” and

“consumption goods,” which belong to final goods. Refer to notes for details.

297

including Japanese manufacturers. This will be discussed in the next paragraph “2. Division of production developed in East Asia.”

(B) Differences in inter-regional trades in East Asia, EU and NAFTA

Is this trade structure in East Asia common to other regions (such as EU and NAFTA)? Figure

2-2-1-3 compares the composition by goods in inter-regional trade among three regions. East Asia has a much higher share of parts and components than NAFTA and EU (East Asia: 32.5%, NAFTA: 17.2%,

EU: 16.2% as of 2010) and conversely has a much lower share of consumption goods than NAFTA and EU (East Asia: 11.4%, NAFTA: 22.6%, EU: 30.1% as of 2010). This suggest the division of production has developed more actively in East Asia than in EU and NAFTA, and the entire region serves as a “factory of the world.”

Figure 2-2-1-3

Composition by goods in inter-regional trade

(%)

50

40

(Within East Asia) (Within NAFTA)

As the characteristics of East Asia,

• The share of trades of parts and components has rapidly increased.

• The share of consumption goods is low and has been declining.

Consumption goods

Processed products

32.5

30

Parts and components

Capital goods

20

22.6

17.2

10

Consumption goods

11.4

(Within EU)

Materials

Processed products

Parts and components

Capital goods

Consumption goods

30.1

16.2

0

1990 1995 2000

East Asia

Source: RIETI-TID 2011 .

2005

Materials

20101990

Parts and components

1995 2000

NAFTA

2005 20101990 1995 2000

EU

2005 2010

(C) Export destinations of East Asia

Then where are the final consumption goods produced exported to? Figure 2-2-1-4 shows East

Asian exports by region. As was described previously, the share of intermediary goods is high in exports within the region. Meanwhile, the share of final goods is high, and especially that of consumption goods is the highest in exports to NAFTA and EU. Exports of consumption goods within the East Asian region were greater than those to NAFTA as of 2010.

Figure 2-2-1-4

Trend in the export amount in East Asia by region/goods

(Billion dollars)

700

(To East Asia) (To NAFTA) (To EU)

600

500

400

Processed products

Parts and components

Capital goods

As the characteristics of East Asia

by export destination,

• Exports within the East Asian region are centered

on those of intermediary goods.

• Exports to NAFTA and EU are predominantly

those of final goods, especially consumption

goods.

Consumption goods

300

200

Consumption goods

100

0

1990 1995 2000

East Asia

Source: RIETI-TID 2011 .

2005

Materials

20101990 1995 2000

NAFTA

2005

Capital goods

Parts and components

Materials

Processed products

20101990 1995 2000

EU

2005

Materials

Processed products

Parts and components

Capital goods

Consumption goods

Consumption goods

Capital goods

Materials

Parts and components

Processed products

2010

298

(D) Change of the trade structure before and after the failure of Lehman Brothers

The trade structure described above is susceptible to a demand shock from outside the region because it has relied on the markets in Europe and the U.S. for final demands such as consumption goods. In fact, countries highly dependent on exports in particular were greatly affected by the failure of Lehman Brothers. This led to increasing calls for a departure from dependence on Europe and the

U.S. and growth as self-reliant economic zones based on inter-regional demand within East Asia after the failure of Lehman Brothers.

Then did such a trade structure actually change? We look at the trend in the amount and share of final consumption goods in East Asia by export destination as one consideration. First, before the failure of Lehman Brothers, exports of consumption goods to Europe and the U.S. increased, while those to East Asia temporarily decreased after the Asian currency crisis in 1997 (Figure 2-2-1-5 (a)). It is probably because countries affected by the currency crisis in particular expanded exports to Europe and the U.S. due to the lower exchange rate. After that, although exports to East Asia have been recovering, their growth is slow. Looking at shares by export destination, exports to East Asia continued to decrease (Figure 2-2-1-5 (b)). The share of exports to Japan is high among East Asian economies. Meanwhile, exports to EU have greatly increased in amount and share since 2003 in exports of consumption goods to Europe and the U.S.

Figure 2-2-1-5 (a)

Trend in the export amount of consumption goods in East Asia by counterpart country

(Billion dollars)

300

250

200

East Asia

EU27

U.S.

Japan

ASEAN

China

Hong Kong

Taiwan

South Korea

150

Asian currency crisis

(1997)

U.S.

Failure of Lehman Brothers

(2008)

East Asia

100

Japan

EU27

Hong Kong

50

0

ASEAN

China

South

Korea

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Note: East Asia consists of Japan, China, South Korea, Hong Kong, Taiwan, Brunei, Cambodia, Indonesia, Malaysia, Philippines, Singapore,

Thailand and Vietnam.

Source: RIETI-TID 2011 .

Taiwan

Figure 2-2-1-5 (b)

Trend in the share of East Asian exports of consumption goods by counterpart country

(%)

60

50

40

East Asia

EU27

U.S.

Japan

ASEAN

China

Hong Kong

Taiwan

South Korea

Asian currency crisis

(1997)

U.S.

Failure of Lehman Brothers

(2008)

The share of East Asia has increased, while the share of the U.S. and EU has decreased.

East Asia

30

20

10

0

EU27

Japan

Hong

Kong

ASEAN

China

South

Korea

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Taiwan

Note: East Asia consists of Japan, China, South Korea, Hong Kong, Taiwan, Brunei, Cambodia, Indonesia, Malaysia, Philippines, Singapore,

Thailand and Vietnam.

Source: RIETI-TID 2011 .

299

Next, after the failure of Lehman Brothers, exports of consumption goods to East Asia, the U.S. and

EU significantly decreased in 2009 and were recovering in 2010. Comparing shares by export destination in 2008 with those in 2010, the share of exports to the U.S. and EU declined (the U.S.: from 28.6% to 27.5%, EU: from 25.7% to 23.5%), while the share of exports to East Asia reversed the downward trend until then (from 23.4% to 25.5%). In East Asia, the share of exports to Japan, which had been originally high, expanded (from 8.0% to 9.2%, by 1.2 percentage points), and the share of exports to China also increased (from 1.7% to 2.4%). Thus, there is a trend of exports shifting to final demand within the East Asian region

30

. However, the trend is considered to have been influenced by the slowdown in the U.S. and EU economy. It is necessary to keep a close watch on whether the shift to demand within the East Asian region will continue. In this regard, exports within the region will be encouraged by China's policy to boost consumption, for example, as described in Section 4 of the preceding chapter

31

.

We also look at the change in exports of capital goods

32

of final goods

33

. Exports of capital goods within the East Asian region have long been much greater than those to the U.S. and EU (Figure

2-2-1-6 (a)). This is thought to be influenced mainly by strong demand for industrial machinery such as machine tools and construction machinery associated with capital investment and infrastructure construction. After the failure of Lehman Brothers, exports to East Asia, though temporarily decreased in amount, started to increase and also expanded in shares. In particular, it is noteworthy the share of exports to China, which had implemented the four trillion yuan economic stimulus measures, expanded (Figure 2-2-1-6 (b)).

30 Here we focused the change in export destinations of consumption goods. Exports of intermediary goods are also regarded as trades based on inter-regional demand when final goods produced with the intermediary goods are consumed in the region.

31 We included exports from East Asia in the analysis because in this section we discuss the structure of division of labor in East Asia. Rather, China is highly expected to expand imports as an importer from the world.

32 Goods are classified using Broad Economic Categories (BEC). Some goods used by general consumers may be classified as capital goods. Examples include PCs, a type of automatic data-processing machine, and mobile phones, a type of communications equipment.

33 Note that consumption goods and capital goods are different in character though they both are final goods. Consumption goods are closely associated with consumption by definition, and are considered to be influenced by the improvement in living standards and the growth of middle class. Meanwhile, capital goods are associated with investment such as capital investment and infrastructure construction.

Although imports of capital goods mean the buildup of the domestic production base, excessive expansion of productivity involves risks of low operating rate, overproduction and intensifying competition.

300

Figure 2-2-1-6 (a)

Trend in the export amount of capital goods in East Asia by counterpart country

(Billion dollars)

400

350

300

250

East Asia

EU27

U.S.

Japan

ASEAN

China

Hong Kong

Taiwan

South Korea

200

Asian currency crisis

(1997)

East Asia

Failure of Lehman Brothers

(2008)

U.S.

150

100

50

0

China

EU27

ASEAN

Hong

Kong

Japan

South

Korea

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Note: East Asia consists of Japan, China, South Korea, Hong Kong, Taiwan, Brunei, Cambodia, Indonesia, Malaysia, Philippines, Singapore,

Taiwan

Thailand and Vietnam.

Source: RIETI-TID 2011 .

Figure 2-2-1-6 (b)

Trend in the share of East Asian exports of capital goods by counterpart country

(%)

60

50

40

East Asia

EU27

U.S.

Japan

ASEAN

China

Hong Kong

Taiwan

South Korea

Asian currency crisis

(1997)

East Asia

Failure of Lehman Brothers

(2008)

The share of East Asia has increased, while the share of the U.S. and EU has decreased.

U.S.

30

20

10

0

EU27

China

ASEAN

Hong

Kong

Japan

South

Korea

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Note: East Asia consists of Japan, China, South Korea, Hong Kong, Taiwan, Brunei, Cambodia, Indonesia, Malaysia, Philippines, Singapore,

Taiwan

Thailand and Vietnam.

Source: RIETI-TID 2011 .

2. Division of production developed in East Asia

Behind the trade structure in East Asia is overseas development through direct investment of

Japanese affiliated companies, especially manufacturers. In this paragraph, we look at the trend of production, sales and procurement of these overseas subsidiaries. At the same time, we also pay attention to the trend of goods (locally sold and procured) within a country, which is impossible to understand by trade statistics.

(1) Overseas development of Japanese manufacturers

Companies from Europe and the U.S., South Korea and Taiwan, in addition to Japanese affiliated companies, establish overseas subsidiaries through direct investment and operate in East Asia. Here we look at activities focusing Japanese manufacturers. Japanese manufacturers started to transfer production bases overseas, particularly to Asia, following the yen appreciation after the Plaza Accord.

The number of overseas subsidiaries of manufacturers has more than doubled worldwide over the past two decades. In particular, the number has more than tripled in Asia, and the share of Asia has been increasing (Figure 2-2-2-1). According to Basic Survey of Overseas Business Activities (METI), about

18,600 Japanese overseas subsidiaries operate worldwide as of the end of FY2010. Among them, about 8,400 companies are manufacturers, of which about 6,200 companies (more than 70 percent) operate in Asia (Table 2-2-2-2). Many companies operate in China and ASEAN in particular. Asia accounts for a majority (55.0%; 49 trillion yen) of 89 trillion yen total sales of overseas subsidiaries of

301

manufacturers worldwide. Asia is thus an important region for Japanese manufacturers, and links

34 are formed within the region through their production activities, sales and procurement.

Figure 2-2-2-1

Trend in the number of overseas subsidiaries of Japanese manufacturers

(Thousand companies)

10

8

World

Asia

Share of Asia

(%)

100

80

6

4

2

60

40

20

0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Source: Basic Survey of Overseas Business Activities (METI).

0

Table 2-2-2-2

Number of Japanese overseas subsidiaries (2010)

(Unit: Companies, %)

Total

Manufacturing industry

All regions

18,599

(100.0)

8,412

(100.0)

North

America

2,860

(15.4)

1,063

(12.6)

Asia

11,497

(61.8)

6,189

(73.6)

China

5,565

(29.9)

3,078

(36.6)

ASEAN

4,247

(22.8)

2,326

(27.7)

Europe

2,536

(13.6)

762

(9.1)

Chemicals

Production machinery

Electric machinery

Information and communication electrics equipment

1,020

530

526

985

149

75

53

76

703

387

414

801

283

190

246

389

267

127

124

315

123

54

43

85

Transport machinery 1,659

10,187

312

1,797

1,058

5,308

425

2,487

470

1,921

Non-manufacturing industry

(100.0) (17.6) (52.1) (24.4) (18.9)

Notes: 1. North America refers to the U.S. and Canada. China includes Hong Kong. Calculation is made assuming ASEAN consists of six countries:

175

1,774

(17.4)

Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam.

2. As of the end of FY2010.

Source: Basic Survey of Overseas Business Activities (METI).

(2) Sales and procurement activities of Japanese manufacturers

Figure 2-2-2-3 illustrates the patterns of sales and procurement activities of overseas subsidiaries by applying the “sales-sourcing box diagram” proposed by Baldwin and Okubo (2012) to consider the characteristics of Japanese manufacturers in East Asia. A horizontal axis, a vertical axis and the size of a circle represent the local procurement ratio, the local sales ratio to total sales and the total amount of sales and purchases, respectively. As suggested by Baldwin and Okubo (2012), when a circle is located in the upper right, the procurement and sales are likely to conclude within a local country. In contrast, when a circle is located in the lower left, it is thought that the procurement and sales are conducted outside the country, and that the country takes on only the assembly function. When a circle is located in the upper left, the intermediary goods tend to be procured from outside the country and sold within

34 They are referred to as production networks, supply chains and value chains, etc..

302

the country, and the possibility of so-called “tariff jumping” is suggested.

In Asia, except that foods are located in the upper-right corner with a high local sales ratio and a high local procurement ratio, many industries such as transport machinery are distributed near the center of the diagram. This shows the supply chain is developed in a local country but is not closed within the country. However, this means the sales and procurement relationship with Japan and third countries within the Asian region, and suggests the existence of the production network in East Asia.

For manufacturers as a whole, local procurement accounts for about 60% and procurement from overseas for the remaining 40%. The procurement ratio from Japan is as high as about 30%, and the procurement ratio from third countries within the Asian region is about 10%. This shows the supply chain is being developed within the Asian region centering around Japan. By industry, in the information and communication electrics equipment industry, the local procurement ratio and local sales ratio are 40% or less, which shows the supply chain with foreign countries is strong. In contrast, in the transport machinery industry, these ratios are more than 60%, which indicates a growing localization. It is also inferred the transport machinery industry sells and procures goods in great amounts, and has a significant impact on the economy of countries where overseas subsidiaries are located.

Figure 2-2-2-3 (a)

Local sales/purchase ratio for overseas subsidiaries of Japanese manufacturers (Asia/2010)

(%)

100

80

Iron and steel

Petroleum and coal products

Transport machinery

Foods

Ceramic, stone and clay products

Chemicals

Metal products

60

40

20

Production machinery

Others

Lumber, paper and pulp

Non-ferrous metals

Information and communication electrics equipment

Sales and purchases

(local countries) Sales and purchases

(third countries within the region)

Sales and purchases

(Japan)

Business oriented machinery

General-purpose machinery

Electric machinery

Textiles

0

0 20 40 60

The local purchase ratio to total purchases (%)

80

Notes: 1. Purchases refer to purchases of raw materials, parts and components, and semi-finished products.

2. The size of a circle represents the total amount of local procurement and local sales.

3. A red crystal represents the sales and purchase ratio of the entire manufacturing industry to/from the local countries, Japan and third countries within the region.

Source: Basic Survey of Overseas Business Activities (METI).

100

Figure 2-2-2-3 (b)

Local sales/purchase ratio for overseas subsidiaries of Japanese manufacturers (Europe/2010)

(%)

100

80

Electric machinery

Information and communication electrics equipment

Others

Chemicals

Iron and steel

Metal products

General-purpose machinery

Lumber, paper and pulp

60

Foods

Production machinery

Business oriented machinery

40

20 Sales and purchases

(third countries within the region)

Sales and purchases

(local countries)

Sales and purchases

(Japan)

Transport Non-ferrous metals

0

0 20 40 60

The local purchase ratio to total purchases (%)

80

Notes: 1. Purchases refer to purchases of raw materials, parts and components, and semi-finished products.

2. The size of a circle represents the total amount of local procurement and local sales.

3. A red crystal represents the sales and purchase ratio of the entire manufacturing industry to/from the local countries, Japan and third countries within the region.

Source: Basic Survey of Overseas Business Activities (METI).

100

303

Figure 2-2-2-3 (c)

Local sales/purchase ratio for overseas subsidiaries of Japanese manufacturers (North America/2010)

(%)

100

80

60

40

20

Textiles

Production machinery

Information and communication electrics equipment

Business oriented machinery

Metal products

Others

Petroleum and coal products

Non-ferrous metals

Ceramic, stone and clay products

Iron and steel

Chemicals

General-purpose machinery

Electric machinery

Sales and purchases

(local countries)

Foods

Lumber, paper and pulp

Sales and purchases

(third countries within the region) Transport machinery

Sales and purchases

(Japan)

0

0 20 40 60 80 100

The local purchase ratio to total purchases (%)

Notes: 1. Purchases refer to purchases of raw materials, parts and components, and semi-finished products.

2. The size of a circle represents the total amount of local procurement and local sales.

3. A red crystal represents the sales and purchase ratio of the entire manufacturing industry to/from the local countries, Japan and third countries within the region.

Source: Basic Survey of Overseas Business Activities (METI).

As with Asia, industries in Europe are distributed near the center of the diagram. For manufacturers as a whole, goods are actively procured from Japan and third countries within the region. As for sale destinations, the export ratio to Japan is lower than that of Asia, and instead the export ratio to third countries within the region is higher. In North America, it is notable the local sales ratio is high in many industries since the region includes the U.S., a huge consumer market

35

.

Regardless of region, it is said Japanese manufacturers are dependent to some extent on the supply from foreign countries such as Japan for procurement. However, the dependency rate differs greatly according to industries. In general, the information and communication electrics equipment industry has strong links with foreign countries, and the transport machinery industry has relatively close relationships with the local country. As for sale destinations, the sales ratio to the local country

(especially North America) and third countries within the region is high, and the export ratio to Japan is high particularly in Asia

36

.

Analysis of the Asian inter-regional trade above shows the share of trade of parts and components has been increasing within the region. Chronologically looking at the trend of the procurement and sales of Japanese overseas subsidiaries in the machinery manufacturing industry, the local procurement ratio is increasing in the transport machinery, electric machinery and general and precision machinery industries (Figure 2-2-2-4). This is probably because Japanese parts and components suppliers have increased supply of parts and components from local companies due to spillovers through discovery of and trades with promising local companies in addition to doing so by advancing into the local country.

This is the case with parts and components suppliers as well as final assemblers, and it is assumed

35 “North America” here refers only to the U.S. and Canada, and Mexico is not included in the region.

36 When industries are plotted in the same way by replacing “local” in the horizontal and vertical axes with “regional” (which refers to within the Asian, European or North American region), many industries are located in the upper right for all regions. Accordingly, for the entire region, procurement and sales tend to conclude within the region. However, the export ratio to Europe and the U.S.

(triangular trade) may be undervalued as a sale destination of final goods of Japanese overseas subsidiaries in Asia. This is because, in this statistics, products of overseas subsidiaries are not divided into those input in the production network as intermediary goods and those sold as final goods.

304

business relationships and industrial clusters have been developed based on the production network in

Asia.

Figure 2-2-2-4

Trend in the local sales/purchase ratio for overseas subsidiaries of Japanese manufacturers

(Asia/1996 M 2000 M 2005 M 2010)

(%)

100

Transport machinery

80

60

40

20

Electric machinery

General and precision machinery

0

0 20 40 60

The local purchase ratio to total purchases (%)

80

Notes: 1. Purchases refer to purchases of raw materials, parts and components, and semi-finished products.

2. The size of a circle represents the total amount of local procurement and local sales.

3. Although there were changes in the industry categories in the applicable period, broad categories were used to ensure a continuity of the statistics.

Source: Basic Survey of Overseas Business Activities (METI).

100

(3) Increase in the procurement amount and change in suppliers

Here, chronologically looking at the trend of the procurement amount of overseas subsidiaries of

Japanese manufacturers in Asia, these companies have increased the procurement of parts and components such as key parts and components from Japan and third countries in the Asian region with increasing production scale in the local country. It is thought this has led to increasing intermediary goods trade such as parts and components in Asia (Figure 2-2-2-5).

Figure 2-2-2-5

Trend in the procurement amount of overseas subsidiaries of Japanese manufacturers in Asia

(Trillion yen)

45

40

35

30

25

20

Europe

Asia

North America

Within the local countries

Japan

Asian currency crisis

(1997)

15

10

Asia

North America

Europe

Failure of Lehman Brothers

(2008)

Within the local countries

5 Japan

0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Source: Basic Survey of Overseas Business Activities (METI).

At the same time, however, since the procurement amount within the local country, which does not appear in the trade statistics, has also increased, the share of procurement from Japan in the total procurement of overseas subsidiaries has gradually decreased (Figure 2-2-2-6). As described above, this trend differs according to industries. In the electric machinery industry, the local procurement and the procurement from Japan are balanced, and goods are actively procured from third countries in the

Asian region. It is suggested the supply chain has spread around the region (Figure 2-2-2-7). In

305

contrast to the electric machinery industry, in the transport machinery industry, most parts and components are procured from the local country or Japan, and the local procurement ratio has rapidly increased. This difference is thought to reflect differences in the degree of standardization of parts and components for each product categories and in transportation costs. In the information and communication electrics equipment industry, goods are actively procured from Japan and Asian countries since parts and components are being standardized worldwide, are relatively light, and are transported at low costs. In contrast, it is said the automobile industry tends to form clusters of related companies since parts and components differ in standards according to car models, are relatively heavy, and are transported at high costs.

Figure 2-2-2-6

Trend in the share by supplier of overseas subsidiaries of Japanese manufacturers in Asia

40

30

20

70

(%)

60

50

Within the local countries

Japan

Asia

10

North America

0

1990 1992 1994 1996 1998

Source: Basic Survey of Overseas Business Activities (METI).

2000 2002

Europe

2004 2006 2008 2010

Figure 2-2-2-7

Trend in the share by supplier of overseas subsidiaries of Japanese manufacturers in Asia (electronic machinery/transport machinery)

80

(%)

70

(Electric machinery) (Transport machinery)

Within the local countries

60

Within the local countries

50

40

30

Japan Japan

20

Asia Asia

10

North America

Europe

North America

Europe

0

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010

Note: Although there were changes in the industry categories in 2001, in order to ensure a continuity of the statistics, “electric machinery” is calculated as the sum of the “electric machinery” and “information and communication electrics equipment” under the new industry categories.

Source: Basic Survey of Overseas Business Activities (METI).

Which is greater in terms of local procurement, Japanese suppliers advancing into a country or local companies? Figure 2-2-2-8 illustrates suppliers of overseas subsidiaries of Japanese manufacturers by nationality. The great majority of the procurement from Japan is from parent companies. In contrast, one-third of the local procurement is from Japanese affiliated companies advancing into a country, while the other two-thirds is from local companies, enabling open procurement not limited to Japanese

306

affiliated companies (Figure 2-2-2-8). Looking at characteristics by industry, the procurement amount of the transport machinery industry is remarkably high, followed by that of the information and communication electrics equipment industry (Figure 2-2-2-9). In the transport machinery industry, the local procurement ratio is high, and goods are actively procured from local companies as well as

Japanese suppliers.

Figure 2-2-2-8

Share by supplier to overseas subsidiaries of Japanese manufacturers in Asia (2010)

Local countries

(other companies)

2.3%

Procurement from third countries

Europe

0.7%

North America

0.5%

Others

0.8%

Asia

10.6%

Procurement from

Japan

Japan (parent companies)

24.6%

Japan (other companies)

4.0%

Local countries

(local companies)

38.9%

Procurement from the local countries

Source: Basic Survey of Overseas Business Activities (METI).

Local countries

(Japanese affiliated companies)

17.5%

Figure 2-2-2-9

Share of suppliers to overseas subsidiaries of Japanese manufacturers in Asia (2010)

40

(Trillion yen)

Europe

Asia

North America

30

20

Others

Local companies

(Trillion yen)

20

Other regions

Europe

Asia

North America

Local countries (other companies)

Local countries (local companies)

Local countries (Japanese affiliated companies)

Japan (other companies)

Japan (parent companies)

15

10

5 10

Japanese

Others

Parent

0

M an uf ac tu rin g in du st ry co m

Tr an sp or t m ac hi at io n m un ic ne ry el ec tri cs eq ui pm en t

Ch em

El ec ic al tri c s m ac hi ne ry

Iro n el la an d ste el

N on

-f er ro us m et al s m an uf ac tu

B us in ne ou s rin g in du str ie s ed m es s o rie nt

M isc

In fo rm at io n an d

Note: The right-hand scale is for the graph by industry.

ac hi ne ry

Fo od s n m ac hi

Pr od uc tio

G en er al

-p

C er ur po am ne ic ry se

, s m ac hi to ne an d ne ry ay pr od uc ts cl

M et al pr od uc ts

Lu m be r, ile s

Te xt pa pe r a nd an d pu lp um co al

Pe tro le pr od uc ts

Source: Basic Survey of Overseas Business Activities (METI).

0

3. Competition and complementation in East Asian economies

(1) Characteristics by major countries

We have looked so far at the East Asian region as a whole, and from here we analyze the competitive and complementary relationships among countries/regions by industry and goods.

For this purpose, we discuss competitiveness for intermediary and final goods. We use a trade specialization coefficient as an indicator, assuming competitiveness is reflected to the ratio of trade surplus to total imports and exports. The trade specialization coefficient is calculated as the ratio of trade surplus (exports - imports) to the total trade (exports + imports), and takes the value between -1 and +1. A number closer to +1 represents higher competitiveness (in the graph, numbers are shown in terms of percentage and take the value between -100 and +100).

When the competitiveness as of 2010 is illustrated under this framework, many industries in Japan have competitiveness in intermediary goods, and industries are distributed almost vertically on the right side of the origin (Figure 2-2-3-1 (a)). The machinery industry such as the transport machinery

307

industry imports and exports on a large scale and has competitiveness in both intermediary and final goods, while some industries have lost competitiveness in final goods. In contrast, many industries in

China have competitiveness in final goods, and industries are plotted above the origin (Figure 2-2-3-1

(b)). As shown on the ceiling of the graph, the home appliance, toys and miscellaneous goods, ceramic, stone and clay products, textiles and other industries have strong competitiveness in final goods.

Figure 2-2-3-1 (a)

Trade specialization coefficient (Japan/2010)

100

80

Transport machinery

60

General machinery

40

Precision machinery

Electric machinery

20

Household electric appliances

0

-100 -80 -60 -40 -20 0 20 40 60 80 100

-20

Chemical products

Iron and steel, and metal products

Foods

Pulp, paper and wooden products

-40

-60 Miscellaneous goods and toys Ceramic, stone and clay products

-80

Textile products

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

Figure 2-2-3-1 (b)

Trade specialization coefficient (China/2010)

Pulp, paper and wooden products

Foods

100

80

Iron and steel, and metal products

Textile products

Electric machinery

60

40 General machinery

Ceramic, stone and clay products

Miscellaneous goods and toys

Household electric appliances

Chemical products

20

0

-100 -80 -60 -40 -20 0 20 40 60 80 100

-20

Transport machinery

-40

Precision machinery

-60

-80

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

Although Japan having strong competitiveness in intermediary goods bears a complementary relationship with China having competitiveness in final goods, China started to compete with Japan in an increasing number of areas as it has enhanced technical capabilities and increased the production of intermediary goods. Next we will look chronologically at the changes in both countries.

Reviewing the changes in competitiveness chronologically, in Japan, the machinery industry has competitiveness in both intermediary and final goods, but its level has been declining (Figure 2-2-3-2

(a)). Meanwhile, in China, in light industries such as toys and miscellaneous goods, ceramics, stone and clay products, and textiles industries, competitiveness in final goods has already been shown on the ceiling of the graph, and competitiveness in intermediary goods has increased. In addition, in the general machinery and transport machinery industries, competitiveness in both intermediary and final

308

goods are increasing after overcoming delays (Figure 2-2-3-2 (b)).

Figure 2-2-3-2 (a)

Trade specialization coefficient (Japan/1990

M

2000

M

2010)

-100

Foods

-80

100

80

General machinery

60

Transport machinery

40

Iron and steel, and metal products

Ceramic, stone and clay products

-60

20

Household electric appliances

0

-40 -20

-20

0 20

Electric machinery

40

Chemical products

60

-40

Precision machinery

80 100

Pulp, paper and wooden products

-60

-80

Textile products

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

Figure 2-2-3-2 (b)

Trade specialization coefficient (China/1990 M 2000 M 2010)

-100

Industries whose competitiveness in final goods was shown on the ceiling of the graph, have increased their competitiveness in intermediary goods as well.

Pulp, paper and wooden products

Foods

Chemical products

100

Textile products Ceramic, stone and clay products

Miscellaneous goods and toys

60

Electric machinery

Household electric appliances

-80 -60 -40 -20

40

20

Precision machinery

0

-20

0 20

Transport machinery

-40

General machinery

40 60 80 100

-60

-80

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

In other Asian countries, e.g., South Korea, the electronic machinery and transport machinery industries have remarkably strong competitiveness, and many industries are located in the lower right of the origin (Figure 2-2-3-3 (a)). This shows industries with high competitiveness are concentrated in some machinery manufacturing industry. Other industries do not have such strong competitiveness in intermediary goods, and rather have weak competitiveness in final goods, causing a trade deficit.

Thailand, a member of ASEAN, may be similar to China in that many industries are competitive in final goods and focus on assembly works. In particular, the transport machinery industry has high competitiveness in final goods (Figure 2-2-3-3 (b)).

309

Figure 2-2-3-3 (a)

Trade specialization coefficient (South Korea/2010)

-100 -80

Foods

100

80

Household electric appliances

Precision machinery

Transport machinery

60

40

Iron and steel, and metal products 20

Electric machinery

General machinery

-60 -40

Ceramic, stone and clay products

-20

0

-20

0 20 40

Chemical products

-40

Pulp, paper and wooden products

-60

Textile products

Miscellaneous goods and toys

-80

60 80 100

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

Figure 2-2-3-3 (b)

Trade specialization coefficient (Thailand/2010)

-100 -80

Iron and steel, and metal products

Transport machinery

Foods

100

80

Textile products

Ceramic, stone and clay products

Household electric appliances

60

40

General machinery

Miscellaneous goods and toys

20

Pulp, paper and wooden d t

-60 -40 -20

Chemical products

-20

0

0

Electric machinery

20

-40

40

Precision machinery

-60

60 80 100

-80

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

In India, which is in the spotlight of Asian emerging economies, industries are distributed vertically on the left side of the origin except that the textiles and foods industries, etc. have competitiveness in both intermediary and final goods (Figure 2-2-3-3 (c)). The machinery manufacturing industry is plotted in the lower left of the origin, which indicates the industry has weak competitiveness in both intermediary and final goods. Instead, chemical products have high competitiveness in final goods, which suggests the existence of the pharmaceutical industry such as generic drugs.

310

Figure 2-2-3-3 (c)

Trade specialization coefficient (India/2010)

100

Pulp, paper and wooden products

80

Textile products

60

Iron and steel, and metal products 40

Chemical products

20

Transport machinery

Miscellaneous goods and toys

Foods

Ceramic, stone and clay products

0

-100 -80 -60 -40 -20 0 20 40 60 80 100

-20

Electric machinery

-40

Household electric appliances

General machinery

-60

Precision machinery -80

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

(2) Electric machinery and transport machinery

Figure 2-2-3-4 plots the trade specialization coefficients of intermediary and final goods in the horizontal and vertical axes, respectively in the electric machinery and transport machinery industries as major industries in East Asia. The size of circle represents the scale of imports and exports.

In many countries, including Japan, South Korea, Taiwan, Malaysia and Philippines, the electric machinery industry has competitiveness in both intermediary and final goods, and there may be competition

37

(Figure 2-2-3-4 (a)). China has overwhelming competitiveness in final goods though it does not have an advantage in intermediary goods.

Meanwhile, in the transport machinery industry, Japan has strong competitiveness in both intermediary and final goods, and the trade volume is great (Figure 2-2-3-4 (b)). It is followed by

South Korea

38

. China has weak competitiveness even with great trade volume, and shows an excess of imports particularly in final goods. In contrast to China, Thailand has strong competitiveness in final goods though it does not have competitiveness in intermediary goods. This shows Thailand serves as a base for assembly and exports of automobiles in ASEAN.

37 Note that the proximity on this figure can hardly be considered to directly indicate competitiveness since the electric machinery industry includes a wide variety of items and there is a mutual complementary relationship through the system of international division of labor in the industry.

38 Transport machinery includes automobiles, rail vehicles, ships and aircrafts, and in South Korea, the transport machinery industry is thought to be strongly influenced by ships as well as automobiles.

311

Figure 2-2-3-4 (a)

Trade specialization coefficient (electric machinery/2010)

China

100

80

60

40

Taiwan

Philippines

South Korea

-100 -80 -60 -40

Indonesia

India

-20

20

0

-20

0

Malaysia

20

Thailand

-40

Singapore -60

-80

40

Japan

60 80 100

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports

+

Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

Figure 2-2-3-4 (b)

Trade specialization coefficient (transport machinery/2010)

Thailand

100

80

60

40

South Korea

Japan

20

India

-100 -40 -20

0

-20

0 20 40

Taiwan

60 80 100 -80 -60

Singapore

China

-40

Indonesia

-60

-80

Philippines

Malaysia

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

4. Transport machinery includes automobiles, rail vehicles, aircrafts and ships.

Source: RIETI-TID 2011 .

Looking at the trend in major countries from 1990 to 2010, in the electric machinery industry, Japan has weakened its competitiveness in both intermediary and final goods, while South Korea and Taiwan have enhanced competitiveness mainly in intermediary goods, and the degree of competition might have been increased (Figure 2-2-3-5 (a)). China has greatly enhanced its competitiveness in final goods as a base for assembly, but still has weak competitiveness in intermediary goods and is a net importer. If it enhances competitiveness in intermediary goods in the future, however, the competition with Japan, South Korea and Taiwan may increase.

In the transport machinery industry, Japan maintains strong competitiveness in both intermediary and final goods (Figure 2-2-3-5 (b)). Meanwhile, South Korea has enhanced its competitiveness.

Particularly since the beginning of the 2000s, the competitiveness in intermediary goods has improved.

China has increased its competitiveness though it remains a net importer of both intermediary and consumption goods. In ASEAN, Thailand has greatly enhanced competitiveness in final goods.

312

Figure 2-2-3-5 (a)

Trade specialization coefficient (electric machinery/1990 M 2000 M 2010)

China

(Orange)

100

80

60

40

Japan

(Blue)

-100 -80 -60 -40 -20

20

0

-20

0

-40

Taiwan

(Yellow)

South Korea

(Green)

20 40

-60

-80

60 80 100

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

Source: RIETI-TID 2011 .

Figure 2-2-3-5 (b)

Trade specialization coefficient (transportation machinery/1990 M 2000 M 2010)

100

Thailand

(Brown)

80

60

40

South Korea

(Green)

Japan

(Blue)

-100 -80 -60 -40

China

(Orange)

-20

-40

-60

-80

20

0

-20

0 20 40 60 80 100

-100

Intermediary goods (%)

Notes: 1. Calculated by a formula: Trade specialization coefficients = (Exports - Imports)/(Exports + Imports) * 100.

Calculated using the total amount of imports and exports.

2. A horizontal axis represents the trade specialization coefficients of intermediary goods, and a vertical axis those of final goods.

The size of a circle reflects the trade amount (exports + imports) of intermediary and final goods.

3. Considering the nature of the database, the export amount of the country was regarded as the same as the import amount of its counterpart country.

4. Transport machinery includes automobiles, rail vehicles, aircrafts and ships.

Source: RIETI-TID 2011 .

(3) Qualitative differences in goods exported

The analysis of competitiveness above shows each country in East Asia has rapidly approached

Japan in competitiveness. China in particular has rapidly expanded trade amounts as well as competitiveness, and seems to become competitive with Japan. However, we have so far not considered product quality. Taking product quality into consideration, these countries are thought to successfully share markets to some extent with each other.

Although evaluating product quality is difficult, here we will try to analyze quality through unit price (customs-cleared basis), assuming the quality of a product is reflected in its price as long as the product is traded in the market.

39

That is, we assume the higher unit price a product of the same item is exported (or imported) at, the higher its quality.

39 It is essentially difficult to determine whether a product with higher unit price is better or otherwise.

For example, companies may actively bring low-priced products since being low-priced is an important requirement for competition in a market with low income consumers. Here we focus on the

U.S. market with high income consumers, and assume the higher the unit price of a product, the higher its added-value and quality are. In addition, also in other market, when there is a big difference in unit price (e.g., the unit price of a product is more than twice of that of another product), they are likely to differ in quality.

313

We focused on machinery with presumably intense competition as a subject item, and compared unit prices for each six-digit category, the smallest unit in HS codes common in all countries

40

. The export destinations with possible competitive relationship is thought to be third countries markets and within each country. Here we (A) compared the U.S. import unit price from Japan and China using

U.S. import statistics, and (B) compared Japanese and Chinese export unit prices to their counterpart countries using export statistics of Japan and China.

First we compared U.S. import unit prices. By calculating shares according to how many times higher the import unit prices of Japanese products are than those of Chinese products (four categories: less than 1 time, 1-2 times, 2-5 times and more than 5 times), the unit prices of many Japanese products are higher though they vary from year to year (Figure 2-2-3-6 (a)). Especially in capital goods, there are more than five-fold differences in unit prices of a majority of items. This shows a certain level of differentiation is made in products exported from Japan and those from China.

Figure 2-2-3-6 (a)

Comparison of Japanese and Chinese unit price of items imported by the U.S. (share by multiple of import unit price/number of items basis)

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

0 10 20 30 40 50 60 70 80 90 100

More than 5 times 2-5 times 1-2 times Less than 1 time (%)

Notes: 1. Multiple of unit prices = Import unit price from Japan / Import unit price from China.

2. Shares are calculated using the number of HS six-digits code.

3. Based on HS six-digits, items are compared with each other when there is no extreme difference (10 times or less, if any) in import amounts from Japan and China, and data are available for the same numerical unit (such as piece, Kg).

4. Calculation is made for between HS84 and HS91 categories as machinery.

Source: Global Trade Atlas.

However, the share of an item with a more than five-fold unit price in Japan is often lower in terms of value than in terms of item (Figure 2-2-3-6 (b)). Japanese products may be high in quality and unit price, but it seems their import volume slows and their import amount is not so great. It is also considered that the export amount of specific items with high quality is great in China.

40 When there is an extreme difference between the import amount from Japan and that from China, they were excluded because they deviate from the purpose of the analysis of competition and give rise to a distortion in the calculation of unit prices. Here, when there is a more than ten-fold difference in import amounts, we excluded them from the comparison. In an extreme case, the U.S. imported from

Japan about a million of 1500-3000cc automobiles (HS870323) at 16.5 billion dollars, while it imported from China about only 100 automobiles at 3 million dollars. By simply calculating unit prices, however, the conclusion is that the import unit price from China is higher.

314

Figure 2-2-3-6 (b)

Comparison of Japanese and Chinese unit price of items imported by the U.S. (share by multiple of import unit price/import amount basis)

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

0 10 20 30

More than 5 times

40

2-5 times

50 60

1-2 times

70

Less than 1 time

80 90

Notes: 1. Multiple of unit prices = Import unit price from Japan / Import unit price from China.

2. Shares are calculated using the total import amounts from Japan and China.

3. Based on HS six-digits, items are compared with each other when there is no extreme difference (10 times or less, if any) in import amounts from Japan and China, and data are available for the same numerical unit (such as piece, Kg).

4. Calculation is made for between HS84 and HS91 categories as machinery.

Source: Global Trade Atlas .

100

(%)

Next we calculated shares according to how many times higher Japanese export unit price to China is than Chinese export unit price to Japan (four categories: less than 1 time, 1-2 times, 2-5 times and more than 5 times). The unit prices of Japanese exports are higher in many items though they vary from year to year as in the consideration of the U.S. market (Figure 2-2-3-7 (a)). They are also the same in that there are more than five-fold differences in unit prices of many items, especially in capital goods. In trades between Japan and China, many exports from Japan are high in quality, and a certain level of differentiation seems to be made. However, the share of an item with a more than five-fold difference in unit prices is lower in terms of amount than in terms of item, and the relationship is breaking down (Figure 2-2-3-7 (b)).

Figure 2-2-3-7 (a)

Comparison of unit price of export goods in Japan-China trade (share by multiple of export unit price for Japan’s exports to China/number of items basis)

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

0 10 20 30 40 50 60 70 80 90 100

More than 5 times 2-5 times 1-2 times Less than 1 time (%)

Notes: 1. Multiple of unit prices = Unit price of Japan's exports to China / Unit price of China's exports to Japan.

2. Shares are calculated using the number of HS six-digits code.

3. Items are compared with each other when there is no extreme difference (10 times or less, if any) in export amounts based on

HS six-digits categories in the export statistics of Japan and China, and data are available for the same numerical unit (such as piece, Kg).

However, items not exported in the year are excluded.

4. Calculation is made for between HS84 and HS91 categories as machinery.

Source: Global Trade Atlas .

315

Figure 2-2-3-7 (b)

Comparison of unit price of export goods in Japan-China trade (share by multiple of export unit price for Japan’s exports to China/export amount basis)

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

1995

2000

2005

2010

0 10 20 30

More than 5 times

40

2-5 times

50 60

1-2 times

70

Less than 1 time

80 90 100

(%)

Notes: 1. Multiple of unit prices = Unit price of Japan's exports to China / Unit price of China's exports to Japan.

2. Shares are calculated using the total exports by item to the counterpart countries of Japan and China.

3. Items are compared with each other when there is no extreme difference (10 times or less, if any) in export amounts based on HS six-digits categories in the export statistics of Japan and China, and data are available for the same numerical unit (such as piece, Kg).

However, items not exported in the year are excluded.

4. Calculation is made for between HS84 and HS91 categories as machinery.

Source: Global Trade Atlas .

We have looked at the structure of division of labor in East Asia. In East Asia, the international division of production has developed, and there is a trade structure where intermediary goods are exported within the region and final goods to outside the region. Behind such an international division of labor is overseas development, and active sales and procurement activities of companies, including

Japanese manufacturers. Meanwhile, procurement is being localized mainly in the transport machinery industry. In addition, the importance of inter-regional demand has been further recognized following the failure of Lehman Brothers. There has actually been a shift in export destinations of final consumption goods towards within regions such as Japan and China.

In terms of the competitive and complementary relationship between countries, the entire East Asian region has grown, building complementary relationships of division of production between, for example, Japan with advantages mainly in production of intermediary goods and China with assembly bases and advantages in final goods. These countries, however, have gradually enhanced competitiveness, including that in intermediary goods. Especially in the electric machinery industry, many countries in East Asia have become more competitive in both intermediary and final goods, and competition has also intensified.

As seen above, regarding the recent international division of labor in East Asia, demand areas for final goods have shifted towards within the region, the suppliers of companies have increasingly been localized, and the competitive relationship has gradually strengthened while the complementary relationship of supplying parts and components is maintained.

316