January 30, 2015

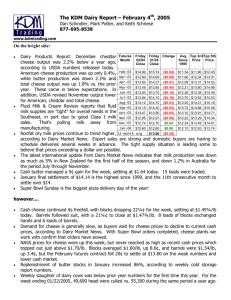

advertisement