Economics 3030 Chapter 6 Overview Manager's Role Methods of

advertisement

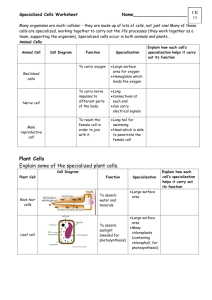

Overview Economics 3030 I. Methods of Procuring Inputs n Chapter 6 n n The Organization of the Firm Spot Exchange Contracts Vertical Integration II. Transaction Costs n Specialized Investments III. Optimal Procurement Input IV. Principal-Agent Problem n n Owners-Managers Managers-Workers 1 Methods of Procuring Inputs Manager’s Role • Procure inputs in the least cost manner • Provide incentives for workers to put forth effort • Failure to accomplish this results in a point like A 2 • Spot Exchange n Costs C(Q) A $100 80 When the buyer and seller of an input meet, exchange, and then go their separate ways. • Contracts B n A legal document that creates an extended relationship between a buyer and a seller. • Vertical Integration Output 0 n $10 When a firm shuns other suppliers and chooses to produce an input internally. 3 4 Pros and Cons of Each Method Transaction Costs • Spot Exchange n n Specialization, avoids contracting costs, avoids costs of vertical integration. Possible supply problems (i.e.,“hold-up problem”) • Contracting n n Specialization, reduces opportunism, avoids skimping on specialized investments Costly in complex environments, incomplete contracts n n • Vertical Integration n n • Costs of acquiring an input over and above the amount paid to the input supplier. • These must also be included in a cost calculation: n Reduces opportunism, avoids contracting costs Lost specialization, organizational costs 5 Search costs Negotiation costs Other required investments or expenditures to facilitate exchange (e.g., transportation costs) 6 1 Specialized Investments Optimal Input Procurement • Investments made to allow two parties to exchange but has little or no value outside of the exchange relationship Site specificity Physical-asset specificity Dedicated assets Human capital n n n n • Cost minimization depends on the extent of relationship-specific exchange • Spot Exchange n • Contracts n • Implications of specialized investments Higher transactions costs because of bargaining Underinvestment Opportunism and the problem of “hold-up” n n n Higher transactions costs (due to underinvestment, opportunism and bargaining) if specialized investment. Costly but reduces the above problems of underinvestment and opportunism. • Vertical Integration n When contracts are just too costly, but reduces specialization of the firm. Method of last choice. 7 Specialized Investments, Contract Complexity, and Contract Length 8 Optimal Input Procurement MC1 $ Substantial specialized investments relative to contracting costs? MC0 MB1 No Yes Due to greater need for specialized investments Spot Exchange Complex contracting environment relative to costs of integration? MB0 No Due to increased complexity of contract Shorter Contract 0 L2 Longer Contract L0 L1 Contract Length 9 The Principal-Agent Problem • Occurs when the principal cannot observe the effort of the agent n n Example: Shareholders (principal) cannot observe the effort of the manager (agent) Example: Manager (principal) cannot observe the effort of workers (agents) • The Problem: Principal cannot determine whether a bad outcome was the result of the agent’s low effort or due to bad luck Contract Vertical Integration 10 Solving the Problem Between Owners and Managers • Internal incentives n n Incentive (or performance-based) contracts Stock options, year-end bonuses • External incentives n n 11 Yes Personal reputation Potential for takeover 12 2 Solving the Problem Between Managers and Workers • • • • Summary • A manager must decide which inputs to procure and how to get the most from these inputs. • Spot markets, contracts, and vertical integration are all ways to obtain inputs depending on the nature of the input. • Solving the principle-agent problem is essential to getting the most from managers and employees. Profit sharing Revenue sharing Piece rates Time clocks and spot checks 13 14 3