alternative investments and risk management

advertisement

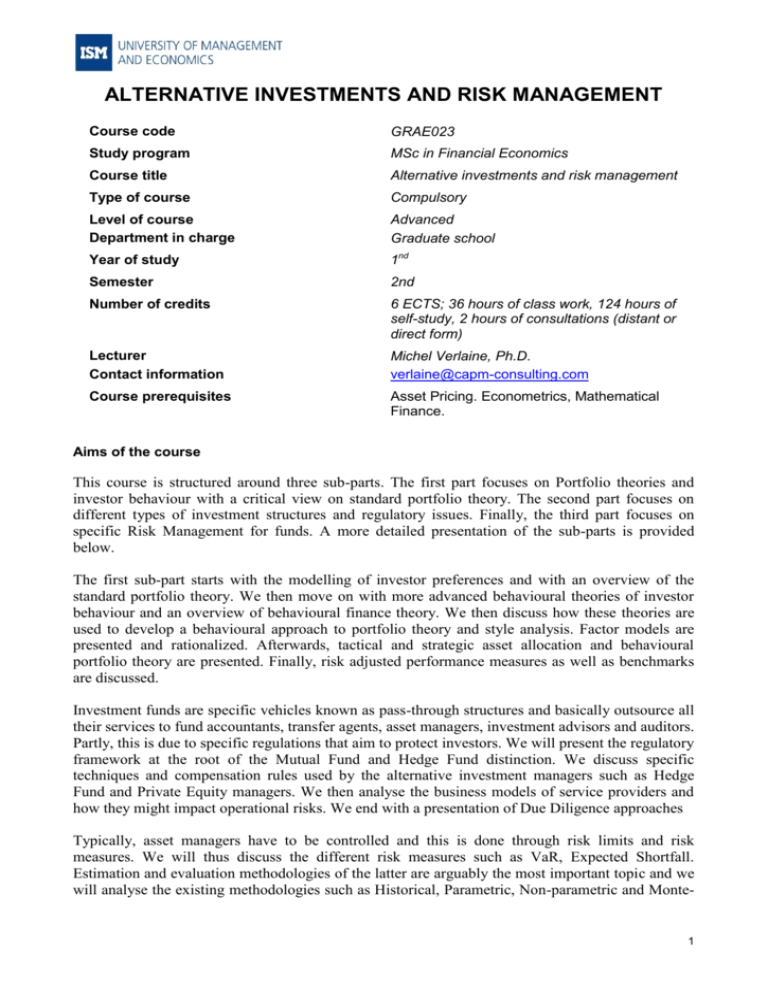

ALTERNATIVE INVESTMENTS AND RISK MANAGEMENT Course code GRAE023 Study program MSc in Financial Economics Course title Alternative investments and risk management Type of course Compulsory Level of course Department in charge Advanced Graduate school Year of study 1nd Semester 2nd Number of credits 6 ECTS; 36 hours of class work, 124 hours of self-study, 2 hours of consultations (distant or direct form) Lecturer Contact information Michel Verlaine, Ph.D. verlaine@capm-consulting.com Course prerequisites Asset Pricing. Econometrics, Mathematical Finance. Aims of the course This course is structured around three sub-parts. The first part focuses on Portfolio theories and investor behaviour with a critical view on standard portfolio theory. The second part focuses on different types of investment structures and regulatory issues. Finally, the third part focuses on specific Risk Management for funds. A more detailed presentation of the sub-parts is provided below. The first sub-part starts with the modelling of investor preferences and with an overview of the standard portfolio theory. We then move on with more advanced behavioural theories of investor behaviour and an overview of behavioural finance theory. We then discuss how these theories are used to develop a behavioural approach to portfolio theory and style analysis. Factor models are presented and rationalized. Afterwards, tactical and strategic asset allocation and behavioural portfolio theory are presented. Finally, risk adjusted performance measures as well as benchmarks are discussed. Investment funds are specific vehicles known as pass-through structures and basically outsource all their services to fund accountants, transfer agents, asset managers, investment advisors and auditors. Partly, this is due to specific regulations that aim to protect investors. We will present the regulatory framework at the root of the Mutual Fund and Hedge Fund distinction. We discuss specific techniques and compensation rules used by the alternative investment managers such as Hedge Fund and Private Equity managers. We then analyse the business models of service providers and how they might impact operational risks. We end with a presentation of Due Diligence approaches Typically, asset managers have to be controlled and this is done through risk limits and risk measures. We will thus discuss the different risk measures such as VaR, Expected Shortfall. Estimation and evaluation methodologies of the latter are arguably the most important topic and we will analyse the existing methodologies such as Historical, Parametric, Non-parametric and Monte- 1 Carlo simulations. Finally, we will analyse how the setting of risk limits impacts the behaviour of asset managers and might lead the letter to increase tail risk. Learning outcomes On completion of this course successful students should be aware of: Course learning outcomes (CLO) CLO1. The limits of standard portfolio theory and recent developments of behavioral models CLO2. Challenges facing the Asset Management industry. CLO3. Alternative Investment strategies CLO4. Risk Management implementations and specific risks involved with alternative investments CLO5. The different Investment structures and service providers CLO 6. Regulatory issues behind Fund strategies, Specific compensation rules Study methods Lectures, seminars, self study Lectures, seminars, self study Lectures, seminars, self study Lectures, seminars, self study Assessment methods Take home exam, data analysis report, final exam Take home exam, data analysis report, final exam Take home exam, data analysis report, final exam Take home exam, data analysis report, final exam Lectures, seminars, Take home exam, data self study analysis report, final exam Lectures, seminars, Take home exam, data self study analysis report, final exam Course Content Session 1 Topic Modelling Uncertainty and Preferences Portfolio Theory Reading Ch. 1+ 2 Lecture Notes MV (Part I) 2 Asset Allocation Puzzle Asset Pricing Ch. 3 + 4 Lecture notes MV (Part I) 3 Alternative Theories of Behavior under Uncertainty Behavioral Portfolio Theory Risk Adjusted Performance mesures More advanced performance measurement Chap. 5+6+7 Lecture notes MV (Part I) 5 Delegated Portfolio Management Architecture of the Fund Industry 6 Alternative Investment Funds : Operational, organizational and performance issues Chap I, 2 and 3 Lecture notes MV (Part IV) Chap 4 Lecture notes MV (Part IV) 7 Credit Risk Modelling and Structured Finance 8 Risk Management and Measurement Extreme Value Theory 4 9 An Integrated Risk Management process for Funds Chap. 8+9 Lecture notes MV (Part I) Chap 1, 3, 4, 5 Lecture notes MV Part III Book : Quantitative Risk Management Lecture notes MV Part III 2 Final Exam. Reading list: 1. Michel Verlaine, Lecture Notes “Asset Management: Risks and Products” 2. A W. LO “Hedge Funds: An Analytic Perspective” 3. McNeil, Frey and Embrechts “Quantitative Risk Management” Other papers will be mentioned in class. Teaching methods: The course will involve lectures over relevant material. Assessment methods: Students will be evaluated on the basis of homework assignments and their performance in final exam. TASK TYPE Take-home document in groups of two Final exam Total FINAL GRADE, % 40% 60% 100% ASSIGNMENT (40%): The Take-home document should be done in groups of two and consists of a kind of short research on the topic of Asset Management and the Fund Industry. Topics will be suggested in class. FINAL EXAM (60%): The final exam will test the understanding of the techniques presented throughout the course and the ability to apply them. The test is open book. Role of the subject in reaching learning outcomes of Financial Economics programme Special learning outcomes S1. Demonstrate knowledge and understanding of contemporary theories, their criticism and applications in the research field of financial economics; apply the modern theory of finance and economics in practice; S2. Integrate theoretical knowledge of financial economics to develop, apply and implement original research ideas in the fields of financial management, investment management, financial risk management and financial engineering S3. Analyse and critically evaluate the behaviour of national and international financial markets and institutions, investment environment of the company, financial engineering tools, the impact of fiscal and monetary policy to formation and management of organizations’ financial flows; S4. Analyse and assess both micro- and macroeconomic environment of private and public organizations in financial-decision making; S5. Evaluate, choose, and systemically apply advanced mathematical statistics methods and advanced econometric models and techniques in solving complex problems of corporate finance, the management of financial markets and financial CLO1, CLO2 CLO1, CLO2 CLO5, CLO6 CLO3, CLO4 CLO1, CLO4 3 economics; S6. Express independent opinion, formulate judgments and knowledge-based CLO1-CLO6 conclusions on relevant issues in financial economics, including international professional and academic literature S7. Conceptualize, research and write a state of the art review of a chosen area CLO1, CLO2 of financial economics and analyze empirical data on the phenomenon under investigation; be able to evaluate the appropriateness of the use of social science research methods, both qualitative and quantitative, including a number of different econometric tools, in a particular context. General learning outcomes G1. To apply modern information technologies in the data gathering, analysis and communication. G2. To apply a systematic, critical-analytical and constructive thinking in problem identification and solving. G3. Have abilities to communicate in English the knowledge to specialist and non-specialist audiences clearly and unambiguously. G3. Develop a range of personal skills including argumentation, evaluation, problem identification and solving, interactive and group skills, self-appraisal, cross-cultural teamwork. G4. To prepare research papers in English according to proper language, writing style and general bibliographic citation requirements. G5. To develop independent learning skills necessary to continue studies on a higher level. CLO4, CLO5 CLO3 – CLO6 CLO5, CLO6 CLO1, CLO2 CLO1 – CLO6 4