Clearthought Snacks 6pp V6

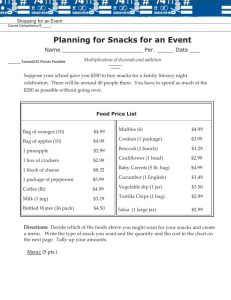

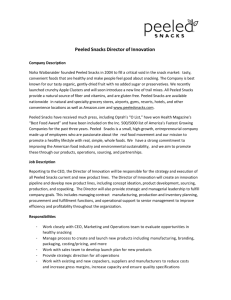

advertisement

Food & Beverage Insights from Clearwater International Autumn 2015 clearthought Snacks The global snacks market is seeing major consolidation as industry players capitalise on fast-changing consumer trends. A treat in store The consumer drive towards healthy, nutritional and high-protein products is having a huge impact on the food and beverage industry, and especially the snacks market. Together with faster-paced lifestyles and the emergent global middle class, snacking players are facing an abundance of growth opportunities but also new competitors and the need to get the right focus. In this publication, we analyse these trends, discuss the moves of the leading industry players, and provide an overview of recent M&A activity. Healthy living diet. This is driving demand for healthier and more nutritious snacks, particularly among millennials and parents of young children. Both groups tend to be very health conscious, preferring snacks that they consider to be ‘guilt-free’. Snackification Most people snack between meals and many snack multiple times each day. What’s new is that close to half of consumers now regularly consume snacks as a meal alternative too. This ‘snackification’ of meals is one of the big opportunities for snack brands. Most snacks are designed to satisfy a hunger craving but those who snack in place of traditional meals could be leaving a gap in their This growing demand for healthier snacks is causing upheaval throughout the global food and drink industry. It has led to a flurry of activity in new product development, caused incumbent players to reassess their existing recipes, and created spaces for new brands to emerge. DEAL ACTIVITY SNACKS SECTOR 2012-2015 4 3 2 Deal Volume 1 13 12 6 4 10 10 1 10 12 10 7 5 3 4 Q1 9 10 7 2 5 16 11 1 3 3 1 Q2 Q3 2012 9 7 1 1 2 Q4 Q1 Q2 8 5 8 Q4 6 3 3 Q1 Q2 Q3 2013 9 8 6 1 Q3 6 5 3 Q1 Q2 1 Q4 2014 2015 Processing & preserving of potatoes Manufacture of rusks, biscuits, pastry & cakes Manufacture of cocoa, chocolate and sugar confectionery Wholesale of sugar, chocolate & sugar confectionery ‘Big Food’ goes shopping These trends have coincided with mounting consumer distrust of so-called ‘Big Food’ - the term used to define large food companies and legacy brands. The problem is the questionable ability of Big Food, known for its heavily processed products, to deliver authentic and genuine food experiences. Big Food has thus found it very challenging to develop ‘betterfor-you’ businesses organically. By contrast, consumers perceive speciality players in the natural space to be much more credible, and their better-for-you propositions have found a strong market. It is no surprise then that Big Food has started hunting for speciality players to buy, and in doing so hopes to acquire some authenticity in the natural space. Campbell Soup Company was one of the first Big Food companies to recognise the challenge. Since becoming CEO in 2011, Denise Morrison has been repositioning the business more within the realm of ‘small’ food, pitching itself as “the biggest small company”. To achieve this, Morrison has made a number of acquisitions in the healthy food space, such as Bolthouse Farms, a maker of organic juices and smoothies. clearthought | Autumn 2015 Clean label - the new industry standard There is a connection in the consumer mind between healthy living and knowing exactly what they are eating, and thus ‘clean label’ is fast becoming a commercial necessity in the food industry. Many consumers already purchase ‘low in’ or ‘free from’ products, whether due to intolerances (to gluten, nuts, dairy, eggs, etc) or general well-being (avoiding GMOs, artificial additives, pesticide residues, trans fats, etc). However, clean label is fast moving beyond ‘free from’ and consumers are now demanding shorter and more recognisable ingredient lists. As clean eating is regarded as a lifestyle choice by consumers, it is likely to have much more staying power than a fad diet. The movement is not limited to healthy foods but applies to the whole shopping basket, including snacks. While consumers may not be demanding ‘farm-to-table’ when it comes to sweet treats, those that can marry health, sensory pleasure and convenience will be the winners. Food & Beverage Insights from Clearwater International Manufacturers are responding. Research from Innova Market Insights has found that more than 20% of newly launched products in the US feature clean label positioning. There has been a significant rise in the use of clean label ingredients such as stevia and monk fruit natural sweeteners, and natural colours such as those based on spirulina, elderberry and beetroot. Protein goes mainstream In Big Food, Kellogg Co. and General Mills have committed to eliminating artificial ingredients over the coming years; Nestlé is removing all artificial flavours and colours from more than 250 types of chocolate sold in America; PepsiCo is removing the artificial sweetener aspartame from Diet Pepsi while Coca-Cola is promoting its use of the natural sweetener stevia in Coke Life. Nearly 4% of global product launches recorded by Innova Market Insights in the past 12 months used a ‘high in’ or ‘source of’ protein positioning. The dairy sector has responded particularly fast, and the trend for high protein dairy products has moved from sports nutrition into the mainstream. High protein claims are now widespread in milk drinks, yoghurts and dairy-based desserts. Meanwhile, research from Ingredion has shown that clean label is also on the radar of consumers in the Far East. It found that a short and simple ingredient list was increasingly important, with Chinese consumers among the most likely to read ingredient lists out of 17 countries surveyed around the world. Recent deal highlights • General Mills acquired Annie’s for ¤725m to further build its presence in the branded natural and organic food markets. Annie’s is particularly strong in convenience meals and snacks, two of General Mills’ priority platforms. • Back to Nature Foods (BNF), one of the original natural food brands in the US, acquired SnackWell from Mondelēz. SnackWell was originally launched by Nabisco in 1992 as a line of reduced-fat and fat-free cookies and crackers, and will significantly increase BNF’s scale in these categories. • Natural Balance Foods (NBF), the British maker of Nakd and Trek snack bars, was acquired by Belgian biscuits and cakes maker Lotus Bakeries for ¤83m. NBF was founded a decade High protein foods have also been feeding the healthy living trend. Government advice is generally that 10~35% of daily calorie intake should come from protein, and many consumers now recognise that protein helps to boost energy levels, strengthen muscle growth and bone maintenance, and improve satiety. Dairy brands have been striving to find unique points of differentiation. Arla’s Breaker HighProtein is a drinkable yoghurt packed in a pouch, appealing to males as a functional and convenient post-exercise snack. Danone’s Greek-style yoghurt, Danio, is positioned as a more permissible indulgence than chocolate and crisps, being protein enriched yet full of fruity flavours and thick textures. ago, with the aim of creating a ‘wholefood revolution’ where natural and affordable snacks would become mainstream. Lotus will help NBF with international expansion. • US private label food producer Hearthside Food Solutions bought Dutch healthy bar producer VSI. VSI makes speciality private label protein, sports and health bars, producing around 250 million bars a year. The transaction will enable the rapid scaling of VSI’s product development, formulations, manufacturing and sales in North America. • Coca-Cola has increased its share to take full control of Innocent, a British maker of fruit smoothies. Coca-Cola has invested heavily in the brand to increase European sales, while committing to uphold Innocent’s ethical values and donating 10% of profits to charity. Recent large snack deals Target United Biscuits (Holdings) Wild Flavors Russell Stover Candies Target country UK Switzerland Acquirer Yildiz Holding Archer Daniels Midland Acquirer country Deal value (¤m) Turkey 2,488 US 2,300 US Lindt & Spruengli Switzerland 1,102 Archer Daniels Midland cocoa distribution business US Olam International Singapore 1,060 Annie's US General Mills NZ Snack Food Holdings Shanghai Golden Monkey Food Joint Stock Co. US 736 New Zealand URC International Co. Philippines 442 China Hershey Netherlands Netherlands 361 Archer Daniels Midland chocolate business US Cargill US 335 Vista Bakery Inc US Shearer's Foods US 315 Switzerland 280 Klemme Germany Aryzta clearthought | Autumn 2015 Faster lifestyle Faster-paced lifestyles continue to create strong demand for pre-packaged, readyto-eat and on-the-go snacks. However, the rising tide will not lift all boats. The winners will need to have a very clear focus, both on where their growth opportunities lie, and how they will pursue them. Occasions, e.g. breakfast on-the-go The ‘snackification’ of meal occasion has been most apparent at breakfast time, as time-pressed consumers want to make a quicker start to their day. In Western markets, sales of breakfast snacks such as granola and yoghurt bars have risen sharply in recent years while the market for readyto-eat cereals has been stagnating or even shrinking. Food & Beverage Insights from Clearwater International Emerging market consumers are becoming just as time-poor as their Western counterparts. Since China’s Bright Food launched its Momchilovtsi ambient yoghurt in 2010, the category has rocketed and is expected to be worth ¤5bn in China in 2017. The product doesn’t need to be refrigerated and is thus readily consumed on-the-go, often for breakfast. Convergence, e.g. out of home The trend for ‘out of home’ consumption is encouraging a convergence between food service and packaged snacks. Some segments of the food service industry such as coffee shops and retail bakeries are developing and packaging snacks for take-away. Such offerings are often perceived to be fresher and healthier, and can be consumed warm back in the office or on-the-go. Recent deal highlights • Cereal maker Post Holdings acquired MOM Brands for ¤1bn and tapped into the growth trends in the breakfast cereal space. MOM has focused on a healthy, quality proposition at good prices and found strong demand. Of note: 90% of its portfolio is bagged, thus reducing packaging costs and appealing to the consumer’s ecological sensitivities. • Unilever sold its meat snacks division, including the Peperami and BiFi brands, to Jack Link’s, a US-based player in protein snacks. Unilever intends to concentrate on brands that can stretch across many markets, while the deal gives Jack Link’s an expanded portfolio and stronger consumer base across Europe. • Shearer’s Foods, a maker of private label sweet and savoury snacks, acquired the private brands business of Snyder’sLance. The deal doubled the size of Shearer’s Foods and At the same time, there are also packaged snacks players that are developing products that mimic food service. In China, for example, milk tea cups - powder sachets in paper cups that can be reconstituted onthe-go with hot water - have driven the instant tea category to a penetration rate five times higher than instant coffee. Finding a focus, e.g. M&A Many of the deals in the snacking space have been driven by the need to focus. Big Food are divesting snack brands that are poorly suited to their global sales and distribution platforms. Snacking players with both branded and private label businesses are deciding between one or the other. And those snack brands that have found the right position are now seeking partnerships to reach new consumers either nationally or internationally. Such focus is needed in a time of so much change. leaves Snyder’s-Lance free to focus on its branded business. Snyder’s-Lance now intends to invest in growth opportunities such as better-for-you, nutritional and premium snacks. • UK private equity firm LDC backed a ¤48m management buyout of British crisp manufacturer Seabrook. The company is famed for its bold flavours such as pickled onion and Worcester sauce. In recent years, it has launched a number of innovative products, including a lattice range, and has also tapped into healthy living with its products becoming totally gluten-free. • Bahrain-listed PE group Investcorp bought gourmet UK crisp maker Tyrrells from Langholm Capital in a ¤138m deal. Tyrrells is developing an international footprint, recently acquiring Australian crisp manufacturer Yarra Valley Snack Foods, and Investcorp will help accelerate the snack maker’s overseas expansion. clearthought | Autumn 2015 Food & Beverage Insights from Clearwater International Hot topic: Hot chocolate The chocolate market has been a particularly active M&A sector this year. • A notable deal saw Swiss Lindt & Sprüngli Group, the world’s largest producer of premium chocolate, make its biggest ever acquisition when it purchased Russell Stover Candies. Lindt is now the third largest chocolate producer in North America, behind Hershey and Mars, and says it is looking to increase its share of the US chocolate market to 10% within the next three years. • Over in Europe, Ferrero International which makes Nutella and Tic Tacs as well as its famous foil-wrapped Ferrero Rocher chocolates - acquired British manufacturer Thorntons to expand its business in the UK. The deal was notable for marking the loss of one of Britain’s last remaining home-grown chocolate brands to an overseas buyer, after Cadbury and Green & Black’s were sold to Kraft Foods in 2009. • Another deal saw Cargill acquire Archer Daniels Midland’s (ADM) chocolate manufacturing business for ¤386m. Meanwhile, Olam International, the Singaporean coffee-to-cashews trader, is seeking to acquire ADM’s cocoa business for ¤1.1bn. The deal would make Olam one of the leading cocoa processors alongside Barry Callebaut of Switzerland and Cargill of the US. Singapore’s state investment company Temasek holds a majority stake in Olam. The China opportunity China’s snacking market is one of the most dynamic worldwide, fast adopting global trends and proving itself to be a source of innovations with global potential. Imported snacks Since 2009, the imported food sector has grown at a compound annual growth rate of 27% - much faster than the market average. Following milk powder, snacks is the second largest category of imported packaged food. The underlying driver has been the growing middle class, with its stronger spending power, but it is more nuanced than that. Chinese snacks have been very traditional and consumers, who are keen to indulge themselves, now look for greater variety and novelty. distribution, they cannot rest there. Now the pressure is on to better understand and meet the evolving needs of the Chinese consumer, and stay competitive against fast-moving local competition. Mondelēz, for example, has seen growth slowing and is therefore innovating around its major product platforms to tap into new consumer needs. As the healthy living drive is changing the face of treats in China, Mondelēz recently introduced a new Oreo ‘thin’. The diameter of the cookies is the same but they’re only about half as thick. The concept was so successful that Mondelēz then launched the product in the US. Moreover, many Chinese are now travelling overseas and there is a desire to bring their experiences back to China with them, in order to consume and gift the snacks that they found and enjoyed on their travels. The rapid increase in availability of imported snacks, especially on cross-border e-commerce platforms, has made this more possible. Chinese outbound Exporting to China has become an interesting opportunity for international snack brands, especially heritage or established brands with a premium positioning and an offering that suits the Chinese palate. For example: the largest Chinese snacks player - Hefei Huatai Group, which owns the QiaQia nut and seed brand - has its eye on baked snacks and chocolate players in Europe and the US, focusing on established brands positioned in the mid to high end. Their intention, as with other Chinese buyers, is to bring international snack brands to China. In China for China There are more than 5,000 companies operating in China’s snacking space, and thus categories such as biscuits, salty snacks and sweet breads are fragmented. Although Western Big Food may have established sizeable businesses in China through broad and deep We expect to see both inbound and outbound activity in the snacks space over the coming years, with a ramp up in the number of Chinese acquisitions of Western snack brands. clearthought | Autumn 2015 Recent deal highlights • Hershey acquired an 80% stake in Shanghai Golden Monkey, a privately held confectionery company. The deal gives Hershey a presence in China’s sugar confectionery and snacking markets and complements its existing portfolio in the region. • Campbell Soup Company acquired the Danish Kelsen Group which produces baked snacks including the Kjeldsens and Royal Dansk brands. Kelsen has been exporting Danish butter cookies to China for many years and has become a leading player in the assortment segment of the fast-growing sweet biscuits category in China. The acquisition provides Campbell with a platform for additional growth in key emerging markets. • Nestlé acquired Hsu Fu Chi, the Chinese sweets company which also plays in cakes and cereal bars. The deal makes Nestlé a significant player in China’s confectionery space, complementing its existing confectionery brands in the country: Kit Kat, Wafer, Polo and Fruittips. • Shanghai-based Bright Food Group’s acquisition of Weetabix in 2012 remains a landmark outbound deal. Weetabix has portfolio brands in cereals and cereal bars. In September 2015, Baring Private Equity Asia took a 40% stake in Weetabix and will work in partnership with Bright Food to help execute the cross-border growth strategy. Food & Beverage Insights from Clearwater International Hot Topic: Deals with Emerging Markets In addition to China, deal activity involving other emerging markets is heating up. The internationalisation of snacking companies is morphing from a Western to a global phenomenon. •K ellogg Co. acquired a majority stake in Egyptian snack maker Bisco Misr, which makes Minto-brand candies and Bisco Wafers cookies. The deal is part of a drive by Kellogg’s to increase exposure to snack trends and emerging markets, both of which offer better growth prospects than breakfast cereals. • United Biscuits, the British snack manufacturer, was sold to Yildiz Holding of Turkey by Blackstone and PAI Partners. The deal reflects the rise of emerging markets and their appetite for Western brands. Yildiz’s international sales have now doubled as a proportion of revenues, up to 70%, and further international expansion is planned. • Universal Robina from the Philippines acquired NZ Snack Food Holdings - the holding company of Griffin’s Foods, New Zealand’s leading biscuit and snack food company. Griffin’s has a growing presence in Australia and provides Universal Robina with a strong platform for Asian expansion. M&A BY TARGET REGION 2 2 1 7 2015 9 2 5 Balkan States Baltic States Eastern Europe Far East & Central Asia Middle East Nordic States North America Oceania South & Central America Western Europe 11 5 29 2014 11 5 6 24 Balkan States Baltic States Eastern Europe Far East & Central Asia Middle East Nordic States North America Oceania South & Central America Western Europe M&A BY ACQUIRER REGION 1 1 1 6 8 2015 5 2 Balkan States Baltic States Eastern Europe Far East & Central Asia Middle East Nordic States North America Oceania South & Central America Western Europe 11 2 30 9 2014 6 2 3 22 Balkan States Baltic States Eastern Europe Far East & Central Asia Middle East Nordic States North America Oceania South & Central America Western Europe Conclusion The heady mix of healthy living and faster lifestyles, combined with growing demand for Western brands and innovative new products from emerging markets, is fundamentally reshaping the global snacks sector. This is creating a unique M&A environment, as both Big Food and new upstarts seek to tap into these trends and gain market share. Our research suggests strong M&A activity in the years ahead. clearthought | Autumn 2015 Food & Beverage Insights from Clearwater International Meet the team Deal highlights Some of our recent food and beverage deals Gareth James Iley Sinclair Largo Foods Cutting’s Leading manufacturer and distributor of snack foods Distributor of fresh food to the hospitality industry Clearwater International advised the shareholders of Largo Foods on the sale to Intersnack Group Clearwater International advised Miura Private Equity on the acquisition of Cutting’s The J. M. Smucker Co Pastisart Leading American food and drinks group Spanish frozen pastries and bakery manufacturer Clearwater International advised on the acquisition of Chinese oat brand Seamild Clearwater International advised the company on raising capital from a group of banks Partner Partner, China 052808 0367 +44 (0)845 7704 113 gareth.iley@cwicf.com james.sinclair@cwicf.com Marc Gillespie Søren Nørbjerg Partner Denmark Partner, +45 40 21 45 190302 +44 (0)845 052 soren.norbjerg@cwicf.com marc.gillespie@cwicf.com John Sheridan Sarah Charman Partner, Ireland Consumer Analyst +353 1 517 5841 +44 (0)845 052 0393 john.sheridan@cwicf.com sarah.charman@cwicf.com Miguel Marti Senior Advisor, Spain Jackie Naghten +34 917 812 890 Consumer Consultant miguel.marti@cwicf.com +44 (0)845 052 0300 jackie.naghten@cwicf.com John Clarke Director, UK Alex Patey +44 845 052 0358 Manager john.clarke@cwicf.com +44 (0)845 052 0398 alex.patey@cwicf.com Lars Rau Jacobsen System Frugt A/S Frutarom Danish market leader for packaged dried fruit and nuts Israeli flavours and speciality fine ingredients company Clearwater International advised System Frugt on the sale of 80% of its shares to Odin Equity Partners Clearwater International advised Frutarom on acquiring a 79% stake in Nutrafur, a Spanish manufacturer of speciality natural plant extracts Director, Denmark Perri +45 25Blakey 39 45 71 Deal Originaton lars.rau.jacobsen@cwicf.com +44 (0)845 052 0390 perri.blakey@cwicf.com José Couto Senior Analyst, Portugal +351 912 044 468 jose.couto@cwicf.com James Marshall Deal Origination, UK +44 845 052 0391 james.marshall@cwicf.com www.clearwaterinternational.com AARHUS • BARCELONA • BEIJING • BIRMINGHAM • COPENHAGEN • DUBLIN LISBON • LONDON • MADRID • MANCHESTER • NOTTINGHAM • PORTO • SHANGHAI