Convertible Bonds

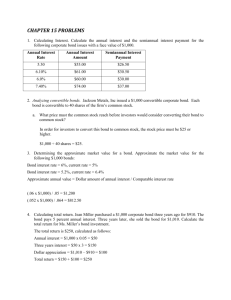

advertisement

Convertible Bonds Topics Covered Bond Terminology The Bond Contract Convertible Bonds The Value of a Convertible at Maturity Forcing Conversion Why Do companies Issue Convertibles? Valuing Convertible Bonds Bond Terminology Foreign bonds - bonds that are sold to local investors in another country's bond market Yankee bond- a bond sold publicly by a foreign company in the United States Samurai - a bond sold by a foreign firm in Japan Eurobond market - when European and American multinationals are forced to tap into international markets for capital Global Bonds - very large bond issues that are marketed both internationally (that is, in the eurobond market) and in individual domestic markets Bond Terminology Indenture or trust deed - the bond agreement between the borrower and a trust company Registered bond - a bond in which the Company's records show ownership and interest and principal are paid directly to each owner Bearer bonds - the bond holder must send in coupons to claim interest and must send a certificate to claim the final payment of principal Accrued interest - the amount of accumulated interest since the last coupon payment Coupon – the annual or semiannual interest paid on a bond Bond Terminology Debentures - long-term unsecured issues on debt Mortgage bonds - long-term secured debt often containing a claim against a specific building or property Collateral trust bonds - Bonds secured by common stocks or other securities that are owned by the borrower Equipment trust certificate - Form of secured debt generally used to finance railroad equipment. The trustee retains ownership of the equipment until the debt is repaid. Bond Terminology Sinking fund - a fund established to retired debt before maturity Callable bond - a bond that may be repurchased by the firm before maturity at a specified call price Puttable bond – A provision that allows the bondholder to demand immediate payment. This is the central feature in loan guarantees issued by the government. Defeasance - a method of retiring corporate debt involving the creation of a trust funded with treasury bonds Bond Terminology Restrictive covenants - Limitations set by bondholders on the actions of the Corporation Negative Pledge Clause - the processing of giving unsecured debentures equal protection and when assets are mortgaged Poison Put - a clause that obliges the borrower to repay the bond if a large quantity of stock is bought by single investor, which causes the firms bonds to beat down rated Pay in kind (PIK) - a bond that makes regular interest payments, but in the early years of the bonds life the issuer can choose to pay interest in the form of either cash or more bonds with an equivalent face value Bond Contract Issued by J.C. Penney Trustee Rights of default Registered Denomination Amount issued Issue Date Offered Interest Seniority Security Maturity Sinking fund Callable Moody's rating Bank of America National Trust and Savings Association The trustee or 25% of debenture holders may declare the principle due and payable Fully registered $1,000 $250 million 26-Aug-1992 Issued at a price of 99.489% plus accrued interest (proceeds to company 98.614%) through First Boston Corporation At a rate of 8.25% per annum, payable February 15 and August 15 Ranks pari passu with other unsecured unsubordinated debt Not secured. Company will not permit to have any lien on its property or assets without equally and ratably securing the debt securities 15-Aug-2022 Annually from August 15, 2003, sufficient to redeem $12.5 million principal amount, plus an optional sinking fund of up to $25 million At whole or in part on or after August 15, 2002, at the option of the company with at least 30 days, but not more than 60 days notice to each August 14 as follows: schedule inserted here B Straight Bond vs. Callable Bond What is a Convertible Bond? Convertible bond is a bond that may be converted into another security at the holder’s option. You can think of a convertible bond as equivalent to a straight bond plus an option to acquire common stock. When convertible bondholders exercise this option, they do not pay cash; instead they give up their bonds in exchange for shares. Conversion ratio = the number of shares into which each bond can be converted. Conversion price = the face value of the bond divided by the conversion ratio Conversion value = conversion ratio x share price Example: Chiquita Brands February 2008 issued $200M 4.25% Convertible 2016 Convertible into 44.5524 shares Conversion ratio 44.5524 Conversion price = 1000/44.5524 = $22.45 Market price of shares = $16.85 Lower bound of value Bond value Conversion value = 44.5524 x $16.85 = $750.71 How bond value varies with firm value at maturity Bond value ($ thousands) 3 2 bond repaid in full default 1 0 0 1 2 3 Value of firm ($ million) 4 5 How conversion value at maturity varies with firm value Conversion value ($ thousands) 3 2 1 0 0 0.5 1 1.5 2 2.5 Value of firm ($ million) 3 3.5 4 How value of convertible at maturity varies with firm value Value of convertible ($ thousands) 3 convert 2 bond repaid in full default 1 0 0 1 2 Value of firm ($ million) 3 4 What we do and do not know about convertible bond financing (please see, Dutordoir, Lewis, Seward and Veld (2014) JCF) The article reviews the literature on: The issuance motives (why firms issue convertible bonds), The shareholder wealth effects (both in the short-run and the long-run), and The design of convertible bonds (the determinants of convertible securities design) Why do companies issue convertible bonds? There are two dominant group of studies The first group of studies perceive convertibles as a tool to reduce agency problems The second group of studies perceive convertibles as a tool to reduce adverse selection costs Convertible debt as a financing mechanism to reduce agency costs Risk-shifting model of Green (1984): This model focuses on potential bondholders and shareholders conflicts of interest, arguing that a convertible bond mitigates shareholders’ incentives to engage in high-risk, negative NPV projects. The idea behind this model is that shareholders will have to share any cash flows resulting from high-risk strategies with convertible bondholders. Sequential-financing model of Mayers (1998): This model considers convertibles as a tool to reduce agency problems between managers and shareholders in the special case where the company has a sequence of investment opportunities. The model suggests that convertibles are more useful in reducing security issue costs and controlling the overinvestment problem. Convertible debt as a tool to reduce adverse selection costs Risk-uncertainty model of Brennan and Kraus (1987) and Brennan and Schwartz (1988): This model assumes that managers and stock market investors disagree on the risk of the firm. The high levels of risk result in the firm having to pay a higher interest rate on straight debt. This problem is mitigated, however, by issuing convertible bonds, because higher perceived risk translates into a higher value of the conversion option. Thus, while the credit portion is undervalued, the conversion option is overvalued, resulting in a fairly priced security. Signaling or backdoor-equity model of Stein (1992) This model considers that there is asymmetric information about firm value, an equity offering announcement might signal to the market that the firm is overvalued. Since convertible issuance is less likely to be perceived as a signal of firm overvaluation, thereby reducing adverse selection costs. Empirical studies on shareholder wealth effects of convertible bond issues Empirical studies in this area fall into two broad categories: Short-term stock price impact of convertible bond announcements and issuance Long-term stock price impact of convertible bond offering Short-term stock price impact of convertible bond announcements and issuance Negative announcement effect (the stock price effects of convertible debt announcements are intermediate in size between those of straight bond and common equity announcements). For example, Eckbo et al. (2007) report that the announcement average ARs: Convertible bonds is -1.82% (4 event studies), Seasoned equity offerings is -2.22% (7 event studies), Straight bond offerings is -0.22% (non-significant) Negative announcement effect does not hold for all countries (i.e. Japanese and Taiwanese convertible announcements) Convertible arbitrage activities induce downward stock price pressure around convertible bond issue dates (Loncarski et al. (2009)). Long-term stock price impact of convertible bond offering Convertible bond issuers’ stock price significantly underperforms that of matching non-issuers over the years following issuance (see, Lee and Loughran (1998), Spiess and Affleck-Graves (1999), and Lewis et al. (2001)). Recent empirical evidence shows that controlling for changes (declines) in systematic risk leads to less pessimistic conclusions on stock return performance following convertible bond issuance (see, Zeidler et al. (2012)). Empirical studies on the design of convertible securities Empirical studies in this area fall in two categories: A first group of articles relies on the assumption that convertible bond design choices may be indicative of underlying issuer motives (debt-like, hedge-like, and equitylike offerings). A second group of studies examines the determinants of innovations in the design of convertible securities. Accounting regulations allowing issuers to obtain favorable reported diluted EPS on security design decisions (contingent convertibles (COCOs) are convertible bonds that can only be converted into shares of common stock if a prespecified stock price is reached). See, Marquardt and Wiedman (2005). Large presence of convertible arbitrageurs as investors in convertible bond issues. Web Resources www.investinginbonds.com/ www.hbs.edu/projfinportal