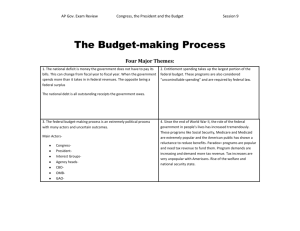

getting back - Peterson-Pew Commission on Budget Reform

advertisement