Global MES in Food & Beverage

advertisement

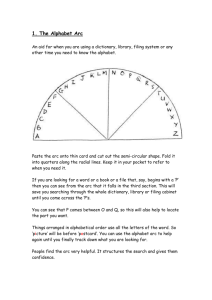

“Global MES in Food & Beverage New Trends, New Opportunities, New Approaches & Successes” ARC Twelfth India Forum, Bangalore 10-11 July, 2014 Industry in Transition: The Information Driven Enterprise in a Connected World Narasimha B T Senior Director Photograph of Speaker Schneider Electric Narasimha.bt@schneider-electric.com 1 © ARC Advisory Group Agenda Global food and beverage companies are shifting their Manufacturing IT focus from within the four walls of the plant to across the plant network. This trend calls for a different approach to engaging, developing and coordinating on these enterprise-wide initiatives. In this session, we share our experiences and the methodology we have adopted. 2 © ARC Advisory Group “What is Different ?” Single Site (what’s typical) Multi-Site (what’s different) Trends & Triggers Why are companies doing these initiatives? Value & ROI How are they looking to justify the investment? Stakeholders Who is involved in the evaluation & decision process? Software & Technology What are (or should) they be looking for? Deployment & Support How do you manage the delivery and transformation? 3 3 © ARC Advisory Group Multi-site reshapes the MES conversation Manufacturing Execution System vs. Manufacturing Execution Standards Standardization is not a business goal – it is a means to an end. The goal of business is to make a profit. In F&B, variety is necessary. But variety (or variability) also creates waste and inhibits velocity, and thus standardization is about separating necessary variety from unnecessary variety to maximize profit.” - Continuous Improvement Leader 4 © ARC Advisory Group It (always) starts with the customer Customer influence Product portfolio Asset portfolio More choices… All taste is local… Preferences change… (Nestle: 33% of portfolio introduced/ renovated in the last 3 years) 5 5 © ARC Advisory Group Impact of M & A Customer influence Product portfolio Nestle acquisition 2012 Acquisition of Pfizer Nutrition Beverage Partners Worldwide JV 2011 Partnership with Hsu Fu Chi in China SKU variety… (candy) Partnership with Yinlu (food) 2007 2006 Asset portfolio Financial Entity Consumer Brands Year 2010 Brand promise… Acquisition of dog snacks Entry into clinical nutrition products Kraft Foods frozen pizza business Partnership with Pierre Marcolini (chocolate) Acquisition of Henniez (bottled water) Acquisition of RKF in Russia (candy) Acquisition of Gerber Acquisition of Novartis Medical Nutrition Partnership with Barry Callebaut (bulk chocolate) Investment in brain research with EPFL BPW JV to refocus on black tea Acquisition of Jenny Craig Acquisition of Uncle Toby’s in Australia Acquisition of Dreyers SKUs Recipes Procured Items Equipment diversity… Core Processes Plants Lines Plant-level Recipes Unique Equipment Controllers/Sensors I/O points Ernst & Young Consumer Products (M&A) Deals Quarterly, Issue 15, Q2 2013 6 6 © ARC Advisory Group Connecting the dots between functional silos Different stakeholders R&D: • Product variety • First-time quality C-Suite: • Margins • Market Share Lean/Six Sigma/CI: • Waste Reduction • Cycle Times Supply Chain: • Inventory velocity • Service levels Manufacturing: • Throughput • Utilization Different triggers & agendas Corporate IT: • Standards • Security Many KPIs are interdependent with Manufacturing Engineering: • Equipment Uptime • Energy Use Marketing • Brand Loyalty • Promotions Procurement • Master Agreement • Compliance Finance • Budgeting Growth / M&A Supply Chain velocity Margin pressure Multi-site MES (Global Standards) Standards maturity Limited Visibility Shadow IT 7 7 © ARC Advisory Group Connecting MES to strategic value Stakeholders [ Customers, Investors, Employees ] Business Goals Supply Chain Goals Manufacturing Goals / Initiatives Manufacturing IT Platform Market share Margins Agility “Making & keeping the right brand promise…” “Continuously taking waste out of the system” “Seizing opportunities & managing risk…” Right Right Right Right Right Right Product Customer Location Quality Quantity Time Quality/Genealogy Product Mix (Variety) On-Time Delivery Reliability/Maintena nce Contextualize Processes Structure (M&A) Innovation Culture Technology Right Cost Right Partners Waste reduction / CI Standard processes Cycle Times (Velocity) Compliance Hardware-agnostic PLM-to-MES integration Empowering the frontline Open & Interoperable [ MES] Capture & Control [ HMI/SCADA ] & Response Multiple options to build a business case that is strategic. Optimize Manufacturing Real-Time Sense 8 8 © ARC Advisory Group Telling the (F&B) story… Brand Promise Operational Challenges Right Customer • Rising customer influence • Changing tastes & preferences Right Product • More choices, more SKUs • More product innovation Right Quality • Raw material variability • Regulatory compliance Right Quantity • Smaller batch sizes • Frequent changeovers Right Time • Frequent replenishment / freshness • Supply chain (production) velocity Right Location • M&A (right growth markets) • More DSD networks Right Price (Cost) • Higher utilization • Very little room for errors Is product moving faster than information on your factory floor? 9 9 © ARC Advisory Group “Thinking big. Thinking different.” Single Site (what’s typical) Multi-Site (what’s different) Trends & Triggers Why are companies doing these initiatives? Value & ROI • How are they prioritizing product portfolio & regional initiatives for growth & profitability? How are they looking to justify the investment? • Are there other considerations they have not fully thought through that strengthens our value proposition? Stakeholders • Who are the various stakeholders outside the plant who stand to benefit – directly or indirectly? Who is involved in the evaluation & decision process? Software & Technology What are (or should) they be looking for? Deployment & Support How do you manage the delivery and transformation? 10 10 © ARC Advisory Group It requires a process perspective [Example: Brewery] LEVEL FUNCTIONAL REQUIREMENTS FERMENTATI BREWING Enterprise Integration (ERP, PLM, etc.) Wonderware Enterprise Integrator/SCC Advanced Analytics/BI Wonderware Intelligence Plant-level Reporting & Visibility Wonderware Information Server Paperless Operations (People) Wonderware Workflow Order Execution/Track & Trace Avantis CM Wonderware MES/Performance Wonderware IntelaTrac ON FINISHING FILL/PAC MALTING KING UTILITIES ENABLED BY PRODUCT ERP & Supply Chain Apps L4 L3 Asset Condition Monitoring Asset Optimization/OEE Mobile Asset Management Batch Process Management/Genealogy L2 Wonderware InBatch Quality Management Wonderware Quality Utilities Management Wonderware CEM Supervisory Control Historian HMI DCS/PLC L1 Wonderware MES/Operations Process Equipment Wonderware System Platform 11 11 © ARC Advisory Group Client Perspective: Success Factors of Multi-site Executive Sponsorship Program Organization & Planning Clear Strategy Bus. Drivers-based Scope & Requirements Business + Operational Alignment Rational/Achievable Timelines Strategy & Structure Operational Champion Comm. & Stakeholder Management People Customer Readiness MES Center of Excellence Program Governance Process Technology Bus. Process Alignment & Improvements Infrastructure Readiness Solution Lifecycle Mgmt. & Governance How do you perceive the MES vendor ? Partner in transformation journey vs. technology vendor? 12 12 © ARC Advisory Group MES vendor perspective: Articulating value proposition Enabling Multi-site MES at Global F&B Company (through higher value, faster ROI, and lower risk) Thought Leadership Integration Strategy Local Presence Client Success Multi-site Scalability Proven Project Execution Methodology Beverage Expertise Platform Maturity “Glocal” Implementation RIGHT EXPERTISE RIGHT PRODUCT RIGHT SERVICES 13 13 © ARC Advisory Group How are clients selecting MES vendors ? Engage Develop Propose Close Consultative approach + Cumulative industry experience Listening from the customer point-of-view Designing a solution (products + services) Built on a differentiated value proposition 14 © ARC Advisory Group “Thinking big. Thinking different.” Single Site (what’s typical) Trends & Triggers Why are companies doing these initiatives? Value & ROI How are they looking to justify the investment? Stakeholders Who is involved in the evaluation & decision process? Software & Technology What are (or should) they be looking for? Deployment & Support How do you manage the delivery and transformation? Multi-Site (what’s different) • How are they prioritizing product portfolio & regional initiatives for growth & profitability? • Are there other considerations they have not fully thought through that strengthens value proposition? • Who are the various stakeholders outside the plant who stand to benefit – directly or indirectly? • What are the lifecycle / TCO considerations like reusability and maintenance that must be designed up front? • What is required beyond delivering a project – and being able to manage a global transformation program? • How can clients leverage a global pool of talent and resources but still get a single point of accountability? • How do you structure support? 15 15 © ARC Advisory Group Global Food & Beverage clients who are actively shaping this vision 16 16 © ARC Advisory Group “State-of-the-art” Full MES Suite Expansion (Lines 3-10?) Phased & sustainable path to manufacturing execution standards Reusability at Other sites Limited scope Functionality For multi-site MES standardization to succeed, the economics have to work… Single site FOR EACH SITE ADDED TO MES ROLLOUT… Incremental cost to deploy declines… …while cumulative value increases! Site #1 #2 #3 #4 #5 #6 #7 … Multi-site/plant portfolio Scalability …and we have proven it can be done! • 10+ projects in Europe, Asia, and Latin America • 11 core MES processes being standardized • 50+ sites already completed including SI deployments • Dedicated Program Team via Center of Excellence 17 17 © ARC Advisory Group Extracting the maximum captive value. What to improve Energy & Water Use Effectiveness Filling & Packaging Area Efficiency What to measure What results to expect Electricity (intensity) 10-25% reduction Water (intensity) 10-15% reduction Fossil Fuel 10-20% reduction Chemicals Waste 5-15% reduction Line Efficiency Sugar (HFCS) Waste Material Losses from Finished Syrup Waste Receiving to Final Packaging CO2 Waste Bottle Waste Labor Cost Reduction Production Line Labor Warehouse Labor 10% increase Who has done it • Baltika Breweries (Carlsberg) • Coca Cola Swaziland • Princes Foods • Pepsi Bottling Ventures • Baltika Beverages 10-25% reduction 10-25% reduction • New Belgium Breweries 10-25% reduction 10-15% reduction 30-50% increase in labor efficiency • Princes Foods • New Belgium Breweries Indirect Labor 18 18 © ARC Advisory Group Thank You 19 © ARC Advisory Group