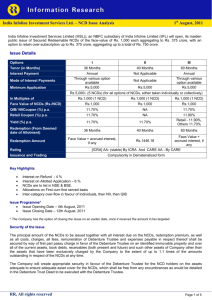

INDIA INFOLINE FINANCE LIMITED

advertisement

INDIA INFOLINE FINANCE LIMITED (Formerly known as India Infoline Investment Services Limited) Public Issue by our Company of Secured Redeemable NCDs aggregating up to ` 5,250 million with an option to retain over-subscription up to ` 5,250 million for issuance of additional Secured Redeemable NCDs aggregating to a total of up to ` 10,500 million. Issuer Lead Managers Co-Lead Managers Debenture Trustee Registrar to the Issue Type and nature of Instrument Face Value of NCDs(` / NCD) Issue Price (` / NCD) Minimum Application In Multiples of India Infoline Finance Limited Axis Capital Limited, Trust Investment Advisors Private Limited, India Infoline Limited and IDBI Capital Market Services Limited Karvy Investor Services Limited RR Investors Capital Services (P) Limited and SMC Capitals Limited IDBI Trusteeship Services Limited Link Intime India Private Limited Secured Redeemable Non-Convertible Debentures `1,000 `1,000 `5,000 (5 NCDs) (for all options of NCDs, namely Options I, II, III and IV either taken individually or collectively) One NCD after the minimum subscription Common Terms of NCDs Particulars Issuer Issue Stock Exchanges proposed for listing of the NCDs Issuance Trading Trading Lot Depositories Security Rating Issue Schedule* Pay-in date Deemed Date of Allotment Details India Infoline Finance Limited Public Issue by our Company of Secured Redeemable NCDs aggregating up to ` 5,250 million with an option to retain over-subscription up to ` 5,250 million for issuance of additional Secured Redeemable NCDs aggregating to a total of up to ` 10,500 million. BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”) In physical and dematerialised form for resident Investors and only in dematerialised form for non-resident Investors Compulsorily in dematerialised form 1 (one) NCD NSDL and CDSL Security for the purpose of this Issue will be created in accordance with the terms of the Debenture Trust Deed. The NCDs proposed to be issued under this Issue have been rated ‘CARE AA’[Double A] by CARE for an amount of up to `12,000 million vide its letter dated August 23, 2013 and ‘BWR AA (Outlook:Stable) by Brickwork for an amount of up to `10,500 million vide its letter dated August 27, 2013. The rating of NCDs by CARE indicates instruments with this rating are considered to have a high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk. The rating of NCDs by Brickwork indicates instruments with this rating are considered to have a high degree of safety regarding timely servicing of financial obligations. Su ch instruments carry very low credit risk. The ratings provided by CARE and/or Brickwork, may be suspended, withdrawn or revised at any time by the assigning rating agency and should be evaluated independently of any other rating. These ratings are not a recommendation to buy, sell or hold securities and investors should take their own decisions. Please refer to page 424 for the rationale for the above ratings. The Issue shall be open from September 17, 2013 to October 4, 2013. 3 (three) Business Days from the date of receipt of application or the date of realization of the cheques/demand drafts, whichever is later. The date on which the Board or a duly authorized committee approves the Allotment of NCDs. All benefits relating to the NCDs including interest on NCDs shall be available to Investors from the Deemed Date of Allotment. The actual allotment of NCDs may take place on a date other than the Deemed Date of Allotment. * The subscription list for the Issue shall remain open for subscription upto 5 pm, with an option for early closure or extension by such period, upto a period of 30 days from the date of opening of the Issue, as may be decided at the discretion of the duly authorised committee of Directors of our Company subject to necessary approvals. In the event of such early closure of the Issue or extension of the Issue, our Company shall ensure that notice of such early closure or extension of the Issue is given as the case may be on such date of closure through advertisement/s in a leading national The specific terms of each instrument are set out below: Options Tenure Frequency of Interest Payment Who can apply Options Tenure Frequency of Interest Payment Who can apply Minimum Application In Multiples of Face Value of NCDs(` / NCD) Issue Price (` / NCD) Mode of Interest Payment/Redemption Coupon (%) for NCD Holders in Category I and Category II Coupon (%) for NCD holders in the Category III (Unreserved Individual Portion) Coupon (%) for NCD holders in the Category III (Reserved Individual Portion) Effective Yield (per annum) Redemption Date Redemption Amount (`/NCD) Deemed Date of Allotment Nature of Indebtedness Credit Rating CARE Brickwork I II III IV 36 Months 60 Months Monthly Annually Monthly Annually Category I , II and III Investors described in the chapters “Issue Structure” I II III IV 36 Months 60 Months Monthly Annually Monthly Annually Category I , II and III Investors described in the chapters “Issue Structure” and “Issue Procedure” on page 258 and 278 respectively `5,000 (5 NCDs) (for all options of NCDs, namely Options I, II, III and IV either taken individually or collectively) 1 NCD after the minimum subscription `1,000 `1,000 Through Various options available 12% 12% 12% 12% 12% 12% 12% 12% 12% 12% 12% 12% 12.68% 12% 12.68% 12% 36 months from the Deemed Date of 60 months from the Deemed Date Allotment of Allotment Face Value of the NCDs plus any interest at the applicable Coupon that may have accrued at the Redemption Date The date on which the Board or a duly authorized committee approves the Allotment of NCDs. All benefits relating to the NCDs including interest on NCDs shall be available to Investors from the Deemed Date of Allotment. The actual allotment of NCDs may take place on a date other than the Deemed Date of Allotment. Pari passu with other secured creditors ‘CARE AA’ [Double A] BWR AA (Outlook:Stable) The key common terms and conditions of the NCDs are as follows: Particulars Terms and Conditions Minimum Application Size The minimum number of NCDs per application form will be calculated on the basis of the total number of NCDs applied for across all series of NCDs (i.e. Option I, Option II, Option III and/or Option IV) under each such Application Form and not on the basis of any specific option Mode of allotment Both in physical and dematerialised form to resident Investors and only in dematerialised form to non-resident Investors Terms of Payment Full amount on application Trading Lot 1 (one) NCD Who can Apply Category I • Foreign Institutional Investors and sub-accounts (other than a sub account which is a foreign corporate or foreign individual) registered with SEBI including Sovereign Wealth Funds, Pension and Gratuity Funds registered with SEBI as FIIs; • Public Financial Institutions, Statutory Corporations, Commercial Banks, • Co-operative Banks and Regional Rural Banks, which are authorised to invest in the NCDs; • Provident Funds, Pension Funds, Superannuation Funds and Gratuity Fund, which are authorised to invest in the NCDs; • Venture Capital funds and / or Alternative Investment Funds registered with SEBI; • Insurance Companies registered with the IRDA; • National Investment Fund; • Mutual Funds; Category II • Companies; bodies corporate and societies registered under the applicable laws in India and authorised to invest in the NCDs; • Public/private charitable/religious trusts which are authorised to invest in the NCDs; • QFIs not being an individual; • Scientific and/or industrial research organisations, which are authorised to invest in the NCDs; • Partnership firms in the name of the partners; and • Limited liability partnerships formed and registered under the provisions of the Limited Liability Partnership Act, 2008 (No. 6 of 2009); Category III* • Resident Indian individuals; • Non Resident Indians on repatriation as well as non-repatriation basis • Hindu undivided families through the Karta; And • QFI being an Individual; FIIs, QFIs and NRIs who intend to participate in the Issue must comply with the laws, rules and regulations of the jurisdiction they are resident in and laws, rules and regulations to which they are otherwise subject to in connection with the purchase and sale of NCDs. No offer or sale of NCDs, pursuant to this Prospectus or otherwise, is being made in the United States or any other jurisdiction where it is unlawful to do so. Accordingly these materials are not directed at or accessible by these investors. If any investor in any jurisdiction outside India receives this Prospectus, such investor may only subscribe to the NCDs if such subscription is in compliance with laws of all jurisdictions applicable to such investor. *With respect to applications received from Category III applicants, applications by applicants who apply for NCDs aggregating to a value not more than ` 1.00 million, across all series of NCDs, (Option I and/or Option II and/or Option III and/or Option IV) shall be grouped together, (“Reserved Individual Portion”) while applications by applicants who apply for NCDs aggregating to a value exceeding ` 1.00 million, across all series of NCDs, (Option I and/or Option II and/or Option III and/or Option IV), shall be separately grouped together, (“Unreserved Individual Portion”). Category – 1 (Institutional Portion) 40% Category-II (Non Institutional Portion) 10% Basis of Allotment First-Come First-serve basis, Category – III* (Unreserved Individual) 10% Category-III* (Reserved Individual Portion) 40%