Business Aircraft Market Forecast 2015

advertisement

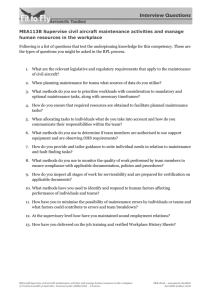

MARKET FORECAST 2015-2024 BOMBARDIER BUSINESS AIRCRAFT BUSINESSAIRCRAFT.BOMBARDIER.COM FORWARD LOOKING STATEMENTS This presentation includes forward-looking statements, which may involve, but are not limited to: statements with respect to our objectives, guidance, targets, goals, priorities, our market and strategies, financial position, beliefs, prospects, plans, expectations, anticipations, estimates and intentions; general economic and business outlook, prospects and trends of an industry; expected growth in demand for products and services; product development, including projected design, characteristics, capacity or performance; expected or scheduled entry-into-service of products and services, orders, deliveries, testing, lead times, certifications and project execution in general; our competitive position; and the expected impact of the legislative and regulatory environment and legal proceedings on our business and operations. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “anticipate”, “plan”, “foresee”, “believe”, “continue”, “maintain” or “align”, the negative of these terms, variations of them or similar terminology. By their nature, forward-looking statements require us to make assumptions and are subject to important known and unknown risks and uncertainties, which may cause our actual results in future periods to differ materially from forecasted results. While we consider our assumptions to be reasonable and appropriate based on information currently available, there is a risk that they may not be accurate. For additional information with respect to the assumptions underlying the forward-looking statements made in this presentation refer to the respective Guidance and forwardlooking statements sections in Overview, Bombardier Aerospace and Bombardier Transportation sections in the Management’s Discussion and Analysis (“MD&A”) in the Corporation’s financial report for the fiscal year ended December 31, 2014. Certain factors that could cause actual results to differ materially from those anticipated in the forward-looking statements include risks associated with general economic conditions, risks associated with our business environment (such as risks associated with the financial condition of the airline industry and rail industry, political instability and force majeure), operational risks (such as risks related to developing new products and services; fixed-price commitments and production and project execution; doing business with partners; product performance warranty and casualty claim losses; regulatory and legal proceedings; the environment; dependence on certain customers and suppliers; human resources), financing risks (such as risks related to liquidity and access to capital markets, retirement benefit plan risk, exposure to credit risk, certain restrictive debt covenants, financing support provided for the benefit of certain customers and reliance on government support) and market risks (such as risks related to foreign currency fluctuations, changing interest rates, decreases in residual values and increases in commodity prices). For more details, see the Risks and uncertainties section in Other in the MD&A the Corporation’s financial report for the fiscal year ended December 31, 2014. Readers are cautioned that the foregoing list of factors that may affect future growth, results and performance is not exhaustive and undue reliance should not be placed on forward-looking statements. The forward-looking statement set forth herein reflect our expectations as at the date of this presentation and are subject to change after such date. Unless otherwise required by applicable securities laws, we expressly disclaim any intention, and assume no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this presentation are expressly qualified by this cautionary statement. All amounts in this presentation are expressed in 2014 U.S. dollars unless otherwise indicated. Global 5000, Global 6000, Global 7000, Global 8000, Learjet 40, Learjet 45, Learjet 70, Learjet 75, Learjet 85, Challenger 350, Challenger 650, Bombardier, Bombardier Business Aircraft, Bombardier Vision and The Evolution of Mobility are either Unregistered or Registered Trade-Mark(s) of Bombardier Inc. or its subsidiaries. BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 2 TABLE OF CONTENTS 1. INTRODUCTION AND EXECUTIVE SUMMARY 2. BOMBARDIER BUSINESS AIRCRAFT OVERVIEW 3. BUSINESS AIRCRAFT MARKET DRIVERS 4. BUSINESS AIRCRAFT MARKET FORECAST 5. FORECAST BY REGION 6. CONCLUSION 3 EXECUTIVE SUMMARY INTRODUCTION Bombardier Business Aircraft is pleased to present its 2015 edition of the Business Aircraft Market Forecast, debuting at the European Business Aviation Convention and Exhibition in Geneva. The forecast provides an in-depth look at how six primary market drivers (wealth creation, globalization of trade, emerging markets, new aircraft programs, replacement demand and accessibility) will shape the future of business aviation over the next 10 years. This analysis focuses specifically on aircraft categories in which Bombardier competes: Light, Medium and Large, as well as major world regions. THE BUSINESS JET MARKET IN 2014 In 2014, the business jet industry continued its path towards recovery, led by the strengthening North American economy. North American business jet orders and deliveries in the markets where Bombardier competes were strong in 2014, driven by solid domestic business investment, a thriving stock market and sustained consumer spending. However, orders and deliveries lagged in other regions as a result of several challenges which held back a broader recovery in the world economy. European GDP growth remained sluggish overall but gained some momentum in the later part of 2014. China’s growth decelerated while Russia ended the year on the brink of recession due to falling oil prices and significant economic restrictions imposed by the western world. Last year the industry reached 601 aircraft deliveries, a 6% increase from 2013. Demand for long range business travel continued to grow, though at a slower pace, which resulted in a total of 200 deliveries for Large category aircraft. Medium category aircraft had 212 total deliveries, a modest recovery expected to accelerate as world GDP growth improves in upcoming years. Light category deliveries amounted to 189 aircraft, less than half the level of deliveries seen when the market peaked in 2008. Having secured more aircraft orders and deliveries since the downturn in 2009 than any other manufacturer, Bombardier Business Aircraft continues to hold its position as industry leader. In 2014, Bombardier Business Aircraft delivered 204 business aircraft, amounting to 34% delivery market share. BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 4 EXECUTIVE SUMMARY BUSINESS JET VALUE PROPOSITION AND LONG-TERM VISION FOR THE INDUSTRY Business jets have proven to be a cost-effective, fast, and safe method of travel1. The benefits of business travel include on-demand flight scheduling, the ability to conduct business privately during flights, direct access to company sites and reduced travel time. While we acknowledge the slow growth facing the industry today, we believe the strong value proposition for business jets remains uncontested. In the long term, with continued wealth creation in mature markets and increased penetration of business jets in emerging markets, the overall market for business jets will show strong growth. As a result, our long-term forecast remains relatively unchanged from the forecast published last year. Our 10-year delivery forecast predicts 9,000 business aircraft deliveries valued at $267 billion. In the following sections, we present our detailed forecast and analysis of the business jet industry for key regions across the world. In a series of studies conducted between 2009 and 2013, NEXA Advisors evaluated the impact of business jet ownership on small to large companies, as well as government agencies. Its most recent study on business aviation and the world’s top performing companies concluded that companies using business jets were likely to outperform non-users on revenue growth, innovation, employee satisfaction and market share. 1 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 5 BOMBARDIER BUSINESS AIRCRAFT Strength in numbers 2014 ACHIEVEMENTS 204 13% DELIVERIES INCREASE VERSUS 2013 34% 10 TH DELIVERY MARKET SHARE CONSECUTIVE YEAR AS A LEADER1 PROGRAM MILESTONES LEARJET CHALLENGER GLOBAL DELIVERED DELIVERED DELIVERED AND COUNTING AND COUNTING AND COUNTING 40/45/70/75 SERIES 600 1 Delivery unit leader in those segments where Bombardier competes. 300 SERIES 500 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 SERIES 600 6 BUSINESS AIRCRAFT MARKET DRIVERS Drivers have a positive relationship with the business aircraft market WEALTH CREATION GLOBALIZATION OF TRADE EMERGING MARKETS NEW AIRCRAFT PROGRAMS REPLACEMENT DEMAND ACCESSIBILITY Expansion of economic activity in the world, measured by Gross Domestic Product Expansion of trade from interregional partners to a globally connected economy Growth of the world’s developing markets and the convergence of business jet adoption towards mature market levels Introduction of new and technologically advanced aircraft models into the industry Demand generated from the retirement of aircraft Alternatives to full business jet ownership The evolution of these drivers will shape the outlook of the industry BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 7 ECONOMIC DRIVERS BUSINESS JET FLEET AND WORLDWIDE ECONOMIC GROWTH 1970 1980 1990 2000 2010 2014 FLEET (# aircraft) 830 2,000 4,650 8,650 14,150 15,735 WORLD ECONOMY ($ trillion) 18.5 27.3 37.4 49.3 65.2 72.3 Growth in the business jet fleet has followed growth of the world economy BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 8 15 ,7 35 ECONOMIC DRIVERS EMERGING EMERGENCE ECONOMIES 5 % POCKETS OF GROWTH OF NEW GDP GROWTH 15 ,7 35 EXPANDING GLOBALIZATION OF TRADE EMERGING ECONOMIES 3% AVERAGE WORLD GDP 5% GDP GROWTH 72 .3 2% GDP GROWTH 3% AVERAGE WORLD GDP 2014 72 .3 MATURE ECONOMIES trillion) 2% GDP GROWTH 2014 MATURE ECONOMIES ($ trillion) Expanding globalization of trade is driving the need for direct city-to-city access High growth economies are accounting for a greater share of world wealth BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 9 BUSINESS JET MARKET SEGMENTATION In production: 34 In development: 14 VERY LIGHT BOMBARDIER* LIGHT MEDIUM LARGE Learjet 70 Challenger 350 Global 5000 Learjet 75 Challenger 650 Global 6000 LARGE CORPORATE AIRLINERS Global 7000 Global 8000 CESSNA Mustang CJ4 Citation X+ M2 XLS+ Longitude CJ2+ Latitude CJ3+ Sovereign+ DASSAULT EMBRAER Phenom 100 GULFSTREAM F2000S F7X F2000LXS F5X F900LX F8X Phenom 300 Legacy 500 Legacy 450 Legacy 650 G150 Lineage 1000E G280 G500 G450 G550 G600 G650/G650ER OTHER INDUSTRY DRIVERS Hondajet PC-24 ACJ 318/319 SJ30-2 BBJ 1/2/3 Eclipse 550 BBJ Max 8/9 Introduction of several new and more capable models stimulates demand and replacement purchase decisions * Learjet 85 program on pause BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 10 INDUSTRY DRIVERS 2,050 REPLACEMENT DEMAND 2,050 Full ownership Full ownership mulative siness jet tirements 0 ACCESSIBILITY 14 1980 Cumulative business jet 699 retirements 342 1960 1990 14 1970 2000 1980 699 342 2014 1990 2000 Branded charter Branded charter Air taxis Air taxis Fractional Fractional ownership ownership Jet card Jet card programsprograms 2014 Increased pace of retirements drives demand for replacement aircraft Several alternatives to full business aircraft ownership exist that extend the benefits of private jet travel to many users BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 11 MARKET DRIVERS OUTLOOK Future projections of key market drivers WEALTH CREATION The global economy is expected to continue improving. GDP growth is forecasted to cross the 3% threshold by 2016-2017. NEW AIRCRAFT PROGRAMS Several new models will enter service between 2015-2024 which will attract new buyers and stimulate replacement activity. GLOBALIZATION OF TRADE Trade globalization will continue, particularly with and between emerging markets, increasing the need for direct city-to-city access. REPLACEMENT DEMAND 1,825 worldwide business aircraft retirements forecasted over the next 10 years will drive increased replacements. EMERGING MARKETS Fleet size in these regions is expected to continue growing as business jet adoption approaches mature market levels. ACCESSIBILITY Operators in the charter and fractional market are renewing their fleets. International expansion will drive future growth. The outlook for the long-term drivers of business jet demand remains strong BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 12 2015-2024 10 TOTAL YEARS LIGHT MEDIUM LARGE $137B 3,400 $91B 3,100 38% $39B 51% 34% 34% 2,500 28% 15% FORECAST BY AIRCRAFT SIZE CATEGORY $267 9,000 Billion Deliveries BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 13 FORECAST BY AIRCRAFT SIZE CATEGORY Light category KEY CHARACTERISTICS 10-YEAR FORECAST 3,400 TYPICAL PURCHASE PRICE $9-20 M 3,100 8,770 CABIN VOLUME1 3 300 ft to 700 ft3 - + + - 11,085 1,085 7,755 690 5,345 = CAGR = 2.4% CAGR 3.8% RANGE 2,000 to 3,000 NM 2014 Fleet 2014 Fleet Light category aircraft offer intraregional range at an entry-level cost 1 Cabin volume of 8.5 m3 to 19.8 m3 Deliveries Deliveries + + Retirements Retirements - - 2024 Fleet 2024 Fleet = = Light category will generate a total of 3,400 deliveries from 2015 to 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 14 FORECAST BY AIRCRAFT SIZE CATEGORY Medium category KEY CHARACTERISTICS 10-YEAR FORECAST TYPICAL PURCHASE PRICE 3,100 $20-42 M 3,100 5,345 CABIN VOLUME1 3 700 ft to 1,500 ft3 - + + - 7,755 690 7,755 690 5,345 = CAGR = 3.8% CAGR 3.8% RANGE 3,100 to 5,000 NM 2014 Fleet 2014 Fleet Medium category aircraft offer greater cabin comfort, range and speed 1 Cabin volume of 19.8 m3 to 42.5 m3 Deliveries Deliveries + + Retirements Retirements - - 2024 Fleet 2024 Fleet = = Medium category will generate a total of 3,100 deliveries from 2015 to 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 15 FORECAST BY AIRCRAFT SIZE CATEGORY Large category KEY CHARACTERISTICS 10-YEAR FORECAST TYPICAL PURCHASE PRICE $50-72 M 3,100 + CABIN VOLUME 3 1 5,345 >1,500 ft 1,620 - 2,500 + - 7,755 50 690 = CAGR 9.6% CAGR 4,070 = 3.8% RANGE >5,000 NM 2014 Fleet 2014 Fleet Large category aircraft offer the greatest cabin comfort, range and speed 1 Cabin volume > 42.5 m3 Deliveries Deliveries + + Retirements Retirements - - 2024 Fleet 2024 Fleet = = Large category will generate a total of 2,500 deliveries from 2015 to 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 16 FORECAST BY REGION TOTAL 2015-2024: 9,000 DELIVERIES NORTH AMERICA 3,900 EUROPE 1,525 CIS 510 LATIN AMERICA 850 AFRICA MIDDLE EAST 275 400 SOUTH ASIA 310 GREATER CHINA 875 ASIA PACIFIC 355 North America, Europe, China and Latin America will be the largest markets for business aircraft over the next 10 years BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 17 2.6% FORECAST BY REGION NORTH AMERICA $23.3 $18.1 2014 2015-2024 INDUSTRY DELIVERIES ECONOMIC GROWTH 3,900 $96 Units CAGR 2.6% 2024 FLEET GROWTH CAGR CAGR 2.6% 2% Billion in revenue 12,715 10,090 KEY FACTS $23.3aviation •Birthplace of business $23.3 $18.1 $18.1 •Largest market for business aircraft 2015-2024 OUTLOOK 2014 2024 2014 $ U.S. trillion (2010) •Average economic growth of 2.6% per year 2% 12,715 •Light and Medium category aircraft account for over 80% of deliveries 2014 2024 For the purposes of this forecast, North America includes the United States and Canada. Units LIGHT 2% •Will remain the largest market for business aircraft MEDIUM LARGE LIGHT 12,715 2,060 2,060 10,090 53% $33B 34% $24B 1,140 53% $39B 29% 25% 2014 2024 FORECAST BY CATEGORY CAGR •Fleet compound CAGR annual growth rate of 2% •Forecasted to receive 3,900 deliveries 10,090 valued at $96 billion 2014 2024 41% 700 18% $ $24B 25% 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 18 1.8% FORECAST BY REGION EUROPE $22.3 $18.6 2014 2015-2024 INDUSTRY DELIVERIES 1,525 Units CAGR 1.8% $50 FLEET GROWTH CAGR CAGR 1.8% 7% Billion in revenue 2,850 1,435 KEY FACTS •Second largest$22.3 market for$18.6 business jet deliveries 2015-2024 OUTLOOK 2014 ECONOMIC GROWTH 2024 2024 •Average economic growth of 1.8% per year 2014 2024 Units FORECAST BY CATEGORY CAGR LIGHT 7% % •Will remain 7the second largest market for business jet deliveries •Medium and Large category aircraft account for almost 70% of deliveries 2014 2024 $ U.S. trillion (2010) •Fleet compound annual CAGR growth rate of 7% 2,850 •Forecasted to receive 1,525 deliveries 1,435 valued at $50 billion $22.3 $18.6 MEDIUM 500 62% $14B 465 33% 28% 2024 For the purposes of this forecast, Europe includes the EU27 plus Albania, Andorra, Bosnia, Croatia, Iceland, Kosovo, Liechtenstein, Macedonia, Montenegro, Norway, Serbia, and Switzerland. European fleet and deliveries are adjusted to exclude deliveries to CIS-based owners that register their aircraft in Europe. 500 37% $ 33% $5B $5B 2014 560 30% 10% 2014 LIGHT $31B 2,850 1,435 LARGE 10% 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 19 6.5% FORECAST BY REGION GREATER CHINA $16.7 $8.9 2014 2015-2024 INDUSTRY DELIVERIES 875 Units CAGR 6.5% ECONOMIC GROWTH $33 FLEET GROWTH CAGR CAGR 6.5% 13% Billion in revenue 1,255 385 KEY FACTS $16.7 •Exceedingly fast fleet growth over the$8.9 last 10 years at more than 20% per year 2014 •Medium and Large category aircraft account for 90% of deliveries For the purposes of this forecast, Greater China includes China, Hong Kong, Macau and Taiwan. Units LIGHT 13% MEDIUM 1,255 385 $14B 475 55% LARGE LIGHT $18B $ 55% 42% 310 35% $1B 2024 2024 FORECAST BY CATEGORY CAGR CAGR annual •Fleet compound growth rate13of 13% % 385 2014 2024 $ U.S. trillion (2010) •Average economic growth of 6.5% per year •Forecasted to receive 875 deliveries valued at $33 billion1,255 $16.7 $8.9 2014 2024 2015-2024 OUTLOOK 2014 2024 2014 3% 90 $1B 10% 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 3% 90 10% 20 3.3% FORECAST BY REGION LATIN AMERICA $7.9 $5.7 2014 2015-2024 INDUSTRY DELIVERIES 850 Units CAGR 3.3% ECONOMIC GROWTH $24 2024 FLEET GROWTH CAGR CAGR 3.3% 3% Billion in revenue 2,505 1,925 KEY FACTS $7.9 •Relatively mature market for$5.7 business aviation •Brazil and Mexico account for 60% fleet 2014 of the regional 2024 2014 2024 Units FORECAST BY CATEGORY CAGR •A verage economic growth CAGR of 3.3% per year LIGHT 3% 3% •Fleet compound annual growth rate of 3% •Light and Medium category aircraft account for 75% of deliveries 2014 2024 $ U.S. trillion (2010) 2015-2024 OUTLOOK 2,505 •Forecasted to receive 850 deliveries 1,925 valued at $24 billion $7.9 $5.7 MEDIUM LARGE 2,505 1,925 $11B 350 $9B 290 37% 41% 2024 34% For the purposes of this forecast, Latin America includes all countries between the Rio Grande and Cape Horn. 41% 210 25% $4B 2014 350 46% 17% 2014 LIGHT $4B 17% 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 21 2.4% FORECAST BY REGION CIS $2.8 $2.2 2014 2015-2024 INDUSTRY DELIVERIES 510 Units CAGR 2.4% ECONOMIC GROWTH $16 FLEET GROWTH CAGR CAGR 2.4% 6% Billion in revenue 1,035 555 KEY FACTS $2.8 •Business aviation in CIS began $2.2 in the early 1990s 2014 Units LIGHT 6% 6% •Fleet compound annual growth rate of 6% MEDIUM 1,035 555 $9B 56% LARGE $1B 57% $6B 90 130 25% 18% $1B 6% 2014 LIGHT 290 38% •Medium and Large category aircraft account for over 80% of deliveries For the purposes of this forecast, the Commonwealth of Independent States (CIS) includes Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine and Uzbekistan. 2024 FORECAST BY CATEGORY CAGR •Average economic growth CAGR of 2.4% per year 2024 2014 2024 $ U.S. trillion (2010) 2015-2024 OUTLOOK 1,035 •Forecasted to receive 510 deliveries 555 valued at $16 billion $2.8 $2.2 •Fleet has grown by nearly 7% per year early 1990s 2014 since the 2024 2014 2024 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 90 18% 6% 22 4% FORECAST BY REGION MIDDLE EAST $4.9 $3.3 2014 2015-2024 INDUSTRY DELIVERIES 400 Units CAGR 4% ECONOMIC GROWTH $15 FLEET GROWTH CAGR CAGR 4% 7% Billion in revenue 780 410 KEY FACTS $4.9market •Remains a promising for$3.3 business aviation $4.9 $3.3 2014 •Long distances between cities and difficult justify 2014 ground transportation 2024 the need for business aviation CAGR •Average economic growth of 4.0% per7year % LIGHT 7% 410 •Forecasted to receive 400 deliveries valued at $15 billion For the purposes of this forecast, the Middle East region also includes Turkey. Units FORECAST BY CATEGORY MEDIUM LARGE $5B 180 60% 45% 33% $1B 60 160 40% $1B 15% 7% 2014 LIGHT $9B 780 410 •Medium and Large category aircraft remain the aircraft of choice 2024 2024 $ U.S. trillion (2010) CAGR •Fleet compound annual growth rate of 7% 780 2014 2024 2015-2024 OUTLOOK 2014 2024 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 60 15% 7% 23 2.5% FORECAST BY REGION ASIA PACIFIC $13.8 $10.8 2014 2015-2024 INDUSTRY DELIVERIES 355 Units CAGR 2.5% $14 FLEET GROWTH CAGR CAGR 2.5% 6% Billion in revenue $13.8 •Geographic position necessitates $10.8 the need for long range aircraft 2015-2024 OUTLOOK 2014 FORECAST BY CATEGORY LIGHT 6% % •Forecasted 6to receive 355 deliveries valued at $14 billion MEDIUM For the purposes of this forecast, Asia Pacific excludes Greater China and South Asia. LIGHT 205 58% $1B $2B 22% 14% 7% 2014 79% 720 405 LARGE $11B 80 2024 2024 Units CAGR •Fleet compound annual CAGR growth rate of 6% for close to 60% of deliveries 2014 2024 $ U.S. trillion (2010) 2024 720account •Large category aircraft 405 $13.8 $10.8 •Average economic growth of 2.5% per year 2014 720 405 KEY FACTS 2014 ECONOMIC GROWTH 2024 80 70 20% 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 $1B 22% 7% 24 7% FORECAST BY REGION SOUTH ASIA $5.1 $2.6 2014 2015-2024 INDUSTRY DELIVERIES 310 Units CAGR 7% ECONOMIC GROWTH $12 FLEET GROWTH CAGR CAGR 7% 12% Billion in revenue 455 150 KEY FACTS $5.1 its regional •Continues to develop $2.6aviation market business $5.1 $2.6 2014 •Infrastructure and regulatory environment continue 2014 2024 to slowly improve CAGR •Average economic growth of 7% per year 12% LIGHT 12% 150 •Forecasted to receive 310 deliveries valued at $12 billion For the purposes of this forecast, Asia Pacific includes Afghanistan, Pakistan, Bhutan, India, Bangladesh, Sri Lanka, Maldives, and Nepal. Units FORECAST BY CATEGORY MEDIUM 150 LARGE LIGHT $9B 75% 455 160 52% 70 •Large category aircraft account for over 50% of deliveries 2024 2024 $ U.S. trillion (2010) CAGR •Fleet compound annual growth rate of 12% 455 2014 2024 2015-2024 OUTLOOK 2014 2024 $1B $2B 23% 25% 17% 8% 2014 70 80 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 $1B 23% 8% 25 4.8% FORECAST BY REGION AFRICA $3.5 $2.2 2014 2015-2024 INDUSTRY DELIVERIES 275 Units CAGR 4.8% ECONOMIC GROWTH $7 2024 FLEET GROWTH CAGR CAGR 4.8% 5% Billion in revenue 595 380 KEY FACTS $3.5 •Important market for business aircraft $2.2 deliveries •Fleet size has more than doubled in the past 10 years 2014 2024 2014 2014 2024 2024 $ U.S. trillion (2010) 2015-2024 OUTLOOK Units FORECAST BY CATEGORY CAGR •Average economic growth CAGR of 4.8% per year LIGHT 5% 5% •Fleet compound annual growth rate of 5% 595 •Forecasted to receive 275 deliveries 380 valued at $7 billion $3.5 $2.2 MEDIUM $3B 110 43% 100 40% 36% $3B 2024 $1B 2014 100 43% 65 24% 14% 2014 LIGHT 595 380 •Light and Medium category aircraft account for over 75% of deliveries LARGE 36% $1B 14% 2024 BOMBARDIER BUSINESS AIRCRAFT | MARKET FORECAST 2015-2024 26 CONCLUSION In 2014, business aviation continued on its path towards recovery. Though industry orders lagged, deliveries increased by 6% compared to the previous year. Over the next 10 years, we expect Large category aircraft will represent half of overall revenues at $137 billion while Medium and Light category aircraft will represent $91 billion and $39 billion respectively. Emerging markets like China, Russia, and Latin America will once again be key drivers to future growth as current challenges in these markets subside. Our 2015 edition of the Business Aircraft Market Forecast predicts a promising future for business aviation in the years ahead. With the most extensive product portfolio of any manufacturer, Bombardier is well positioned to lead the industry forward. RESOURCES Ascend Asian Sky Group B&CA – Business & Commercial Aviation Magazine GAMA – General Aviation Manufacturers Association IBAC – International Business Aviation Council IHS Global Insight World Economic Outlook, January 2015 JETNET NEXA Advisors This presentation can be found on BUSINESSAIRCRAFT.BOMBARDIER.COM 27