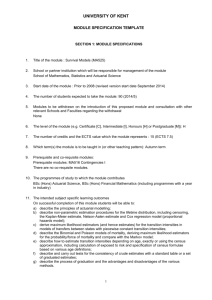

CV (, 170KB) - ANU College of Business and Economics

advertisement

Phone +61 2 6125 3580 (work) +61 (0)401 598 079 (mobile) Fax +61 2 6125 0087 (work) E-mail adam.butt@anu.edu.au Adam Butt Education Professional memberships Professional experience 1997 Graduated from Baulkham Hills High School – TER: 99.60 2002 Bachelor of Commerce (Actuarial Studies) at Macquarie University – GPA 3.691 2002 Completed Superannuation and other Employee Benefits Part III Exam of the Institute of Actuaries of Australia 2004 Completed Investment Management Part III Exam of the Institute of Actuaries of Australia 2011 PhD in Statistics at Australian National University 2013 Master in Higher Education at Australian National University 2005 Fellow of the Institute of Actuaries of Australia 2014 Fellow of the Higher Education Academy 1998 - 2004 Aon Consulting Pty Limited Actuarial Consultant - Superannuation I started at Aon during the winter break of my first year of university. From this point until the finish of my university career, I was employed on yearly cadetships, usually one day per week (three days during 2001) and then full-time during university breaks. I commenced full-time employment with Aon in December 2001 and completed my time at Aon Consulting working as an actuarial consultant, following a promotion from actuarial assistant in 2003. My duties included: – acting as consultant to a number of corporate superannuation funds; – running actuarial valuations for defined benefit superannuation funds; – completing other actuarial superannuation tasks; – preparation of quarterly investment reports; – analysis of benefit design including member investment choice; – review of group insurance arrangements; – preparation of annual reporting information to members; – calculation of interest rates and unit prices for superannuation funds; – answering complex member enquiries; and – completing miscellaneous actuarial tasks. 2005 - current Australian National University (ANU) Senior Lecturer – Research School of Finance, Actuarial Studies and Applied Statistics I commenced as a Lecturer in 2005 and was promoted to Senior Lecturer in 2014. My current responsibilities involve research, course co-ordination and teaching, administration and supervision of actuarial honours student research projects. Specific service roles I am currently responsible for are: – Convenor of the Bachelor of Actuarial Studies, Bachelor of Social Studies (Honours in Actuarial Studies and Economics – a joint program with the National University of Singapore) and related programs – Nominated Accreditation Actuary – College of Business and Economics Education Committee member – College of Business and Economics Teaching Awards Selection Panel I have previously been responsible for the following service roles: – Coordinator of the Actuarial Employment Seminar, where employers come to ANU to speak to students 2006 - current Professional Financial Solutions (PFS) Consultant During my time at ANU I have also worked as a consultant on an ad-hoc basis for PFS. I have completed consulting tasks in the following areas: – Valuation of executive share options; – Analysis of datasets for statistical trends; – Advising on the development of a stochastic investment model; and – Advice on the valuation of Commonwealth Superannuation Scheme benefits. September 2007 - February 2008 Mercer - United Kingdom Actuarial Consultant During a one year sabbatical / leave without pay from Australian National University I spent six months working in the Retirement Resources Group for Mercer in London. My main task during this time was to review the methodology being used to recommend discount rates for accounting and other statutory valuations of defined benefit pension schemes. My other duties included: – preparation and technical review of communications to Mercer staff giving information and best practice on numerous areas of pension consulting; and – research on the effect of potential changes to International Accounting Standards on pension expense and liability recognition. Other professional involvement and memberships Superannuation & Employee Benefits Research Sub-committee of the Institute of Actuaries of Australia (2009 – 2011) Marking of assignments and examination papers for Part III Courses 1, 4A, 4B and 10 of the Institute of Actuaries of Australia (2005 – 2013) Rewriting of the Institute of Actuaries of Australia Part III Courses 6A and 6B (2012 – 2014) Member of the Educational Development Group (EDG) of the Actuaries Institute (2015) Publications (with Scott Donald, Doug Foster, Susan Thorp and Geoff Warren) The Australian superannuation system post Stronger Super: views from fund executives. Law and Financial Markets Review, 2015, forthcoming. (with Scott Donald, Doug Foster, Susan Thorp and Geoff Warren) Design of MySuper Default Funds: Influences and Outcomes. Accounting and Finance, 2015, forthcoming. (with Fei Huang and Kin-Yip Ho) Stochastic economic models for actuarial use: an example from China. Annals of Actuarial Science, 8(2), 2014, pp 374-403. (with John Evans, David Pitt and Jim Farmer) A pilot survey of actuarial graduates’ views on their education. Australian Journal of Actuarial Practice, 1, 2014, pp 6375. Student views on the use of a flipped classroom approach: Evidence from Australia. Business Education & Accreditation, 6(1), 2014, pp 33-43. Effects of Scheme Default Insurance on Decisions and Financial Outcomes in Defined Benefit Pension Schemes. Annals of Actuarial Science, 7(2), 2013, pp 288-305. Causes of Defined Benefit Pension Scheme Funding Ratio Volatility and Average Contribution Rates. Annals of Actuarial Science, 6(1), 2012, pp 76-102. (with Ziyong Deng) Investment Strategies in Retirement: in the presence of a means-tested government pension. Journal of Pension Economics and Finance, 11(2), 2012, pp151-181. Management of Closed Defined Benefit Superannuation Schemes – An Investigation using Simulations. Australian Actuarial Journal, 17(1), 2011, pp 25-87. Effect of AASB 119 ‘Employee Benefits’ on Defined Benefit Superannuation Costs Recognised by Sponsoring Employers. Australian Actuarial Journal, 14(1), 2008, pp 97- 170. Submitted & Working Papers (with Jim Farmer, David Pitt and Michelle Salmona) A survey of actuarial graduates’ views on their education. Submitted to the Australian Journal of Actuarial Practice. (with Gaurav Khemka) The effect of objective formulation on retirement decision making. Being revised for Insurance: Mathematics & Economics. (with Scott Donald, Doug Foster, Susan Thorp and Geoff Warren) MySuper: A Stage in an Evolutionary Process. CIFR Research Working Paper, 048/2014. (with Scott Donald, Doug Foster, Susan Thorp and Geoff Warren) The Superannuation System and its Regulation: Views from Fund Executives. CIFR Research Working Paper, 030/2014. Selected conference presentations Graduate views on actuarial education and implications for educating actuaries of the future. Presented to the Actuaries Summit, 17-19 May 2015, Melbourne. Graduate views on actuarial education. Presented to the International Congress of Actuaries, 31 March – 4 April 2014, Washington D.C. Alternative use of lecture time – towards an active student experience. Presented to the Australiasian Actuarial Education & Research Symposium, 6-7 December 2012, Monash University. Feedback effects of default insurance for defined benefit schemes. Presented to the Pensions, Benefits and Social Security Colloquium, 25-27 September 2011, Edinburgh. (with Brian Chu and John Shepherd) Actuarial Education: Theory into Practice. Presented to the 46th Actuarial Research Conference, 11-13 August 2011, University of Connecticut. The Universities’ Role in Improving Actuarial Education. Presented to the Australiasian Actuarial Education & Research Symposium, 25-26 November 2010, University of Melbourne. Funding obtained (with Anthony Asher, Ujwal Kayande and Gaurav Khemka) Developing Coherent and Usable Decision Support Systems to Improve Financial Wellbeing over an Individual’s Lifecycle. Centre for International Finance and Regulation Research Grant, 2014/15, $56,498. (with Jim Farmer and David Pitt) Graduate Views on Their Actuarial Education in Australia, 2014/15, Actuaries Institute Research Grant, $18,000. (with Gaurav Khemka) Decision Making in Retirement using Dynamic Programming Techniques, 2013/14, Research School Internal Grant, $10,000. (with Geoff Warren, Scott Donald, Doug Foster and Susan Thorp) Structure and Responsibilities in Default Superannuation Funds: Influences and Effectiveness. Centre for International Finance and Regulation Research Grant, 2013/15, $40,000. (with Yin Liao) Does the Financial Market Fully Price Unfunded Pension Liabilities in Australia: Evidence from Corporate Defined-benefit Superannuation. AFAANZ Research Fund Grant 2011/12, $10,000. Teaching experience I have taught in the following courses for at least one semester during my time at ANU: – – – – – – – Actuarial Control Cycle II; Actuarial Techniques (part of CT5 of the U.K. exams); Advanced Global Retirement Income Systems; Financial Mathematics (equivalent to CT1 of the U.K. exams); Generalised Linear Models; Introduction to Actuarial Studies; and Statistical Techniques. In 2013 I won the College of Business & Economics Award for Teaching Excellence. In 2014 I received a Special Commendation in the Vice Chancellor’s Award for Teaching Excellence at ANU. I am currently developing a Massive Open Online Course for the edX platform titled “An Introduction to Actuarial Science”, which is due for release in October 2015. Referees Can be provided upon request.