accounting methods financial statements

advertisement

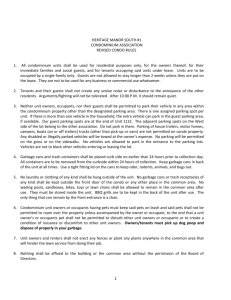

Chapter 57 Operation of Community Associations This chapter builds off of the previous chapters dealing with the organization, management and governance of community associations, and uses acronyms and terms defined in those previous chapters. For example, “GCA” means the Georgia Condominium Act, “POAA” means the Georgia Property Owners Association Act, “HOA” refers to a homeowners association, and “POA” refers to a property owners association (i.e., an HOA that has been submitted to the POAA). Please consult the previous chapters of this guide for more information and for assistance with interpreting and understanding this chapter. COMMUNITY ASSOCIATION FINANCES The money-side of a community association is just like any other business entity. The corporation brings in revenue. The corporation budgets for expenses. The board members and officers make decisions and adjustments throughout the year. The corporation files tax returns, evaluates investments, brainstorms creative ways to increase income and sometimes sues its debtors to collect funds owed to it. ACCOUNTING METHODS Cash Basis Accounting: Income recorded upon receipt; expenses recorded when paid Accrual Basis Accounting: Recognizes income and expenses when they are scheduled to take place, not when they actually do take place. For example, condominium assessments are due on the 1st day of each month. If a community employs cash basis accounting January assessments that get paid in February are report as income in February. Under an accrual method, this income would be reported for January (even though it was not actually received in January). In reality, most communities use a hybrid cash and accrual basis of accounting. Income and expenses are reported on a cash basis, but certain other items are entered on an accrual basis. FINANCIAL STATEMENTS Income Statement: Reflects corporation’s profitability for a specific period of time. Balance Sheet: Corporation’s assets, liabilities, and members’ equity at a specific moment in time. • Assets - things owned by the corporation • • Liabilities - debts of the corporation Members’ equity - value of assets that the corporation owns outright. Budgeting: • • • • • ZERO-BASED BUDGETING - the necessity and amount of each line item is evaluated each year. Historical data is not used. INCREMENTAL BUDGETING – each line item in previous budget is updated incrementally year after year. No evaluation or decision if each line item is needed for the following year. State law does not require the preparation of a budget (However, GCA requires one in the disclosure package from the declarant to the first purchaser of each new condominium unit) State law does not define what line items should be in a budget INCOME o General Assessments o Special Assessments o Specific Assessments and Fees o EXPENSES Operating Expenses Capital Improvement Expenses CAPITAL RESERVES - Acts as a savings account to pay for capital improvement expenses that will be necessary at some future date. Spreads out costs over time by “saving” each year so special assessments might not be necessary to pay for these expenses when the work needs to be done in the future. Georgia law does not require reserve funding for any type of community association, but FNMA and FHA guidelines do require adequate reserve funds in order to insure loans in a condominium. Reserve studies help determine: remaining useful life of each capital asset when each capital asset will need to be replaced how much it should cost to replace the asset in the future how much the corporation needs to “save” each year to meet the future financial needs Approving the Budget: • • • Follow process described in covenants and bylaws Some covenants require members to approve/adopt budget by specific vote at a meeting. If owners are happy with proposed budget they do not show up to the meeting. No quorum is obtained, no vote can be taken. Board then forced to use new budget that is not properly adopted. BETTER PROVISION – some covenants state that budget approved/adopted by the board unless disapproved by a certain percentage of members at annual or special meeting. Better because if owners do not like budget adopted by board they will show up at meeting, there will be a quorum and there can be a vote. QUESTION: Once approved, can the budget be changed? ANSWER: Yes, the budget is an active document. It should be evaluated on a monthly basis. Sometimes there will be unexpected expenses -- increases in utility charges, termite issues on the common property, broken pool pumps . . . The money needs to come from somewhere to address these issues. Other expense items need to be removed or lowered to create available funds for these expenses. It’s possible that the holiday party may not be as elaborate one year because that money was needed for some required expense during the year instead. Creating the General Assessment from the Budget The amount of the general assessment SHOULD BE calculated by determining the amount of money needed to pay the budgeted annual expenses less budgeted income from sources other than the general assessment and dividing the sum by the percentage of ownership income for each condominium unit or by the number of lots in an HOA/POA. NOT A GOOD IDEA -- Some boards of directors “back into” the budget by deciding what they want the general assessment to be, determining how much income that creates and then evaluating how to divide that income through the expense line items in the budget. QUESTION: What do we do if we need more money? ANSWER: The association may need to impose a special assessment, a specific assessment or obtain a loan. Special Assessment: The covenants hopefully include a provision allowing the board to impose a special assessment. If such a provision exists, then the board must comply with the described process or the special assessments could be challenged in the future. The GCA states that as long as the condominium legal instruments allow it, the board can impose a special assessment of not more than an average of $200 per unit per year without a vote of the association members. If the condominium documents do not include a provision that mirrors this one in the GCA or if the board needs to pass a special assessment for more than an average of $200 per unit, the board will need the consent of a majority of the condominium owners. Specific Assessment: A specific assessment is a “charge back” to a particular unit or lot owner for an expense that would be inequitable to pass on to all the owners. The GCA and POAA permit specific assessments as long as the covenants allow them. In an HOA, the covenants need to permit specific assessments. For example, an owner drives into the front entrance sign. Insurance might pay to rebuild it, but the association will have to fund the deductible. That amount should be passed on by specific assessment to the owner who caused the problem. In a condominium, expenses for limited common element repairs and maintenance can be specifically assessed to the owners of the units benefited by the limited common element so the association can recoup some of those funds. For example, if the patio or deck for one unit needs to be repaired, the association can charge back the repair costs to the owner of the unit attached to that deck. Doing this sets a precedent, so it’s important to determine whether the short term gain of funds from the specific assessment is the right route. Obtaining a Loan: Increasingly more common for community associations • • • • • • Real property no longer required as collateral (meaning no liens will be required on the common property or any individual lots or units) Personal guarantees by directors no longer required to qualify Association’s income stream is used as collateral now – lender takes lien on assessment income Loan Terms vary – usually between 3 and 10 years Lenders look at owner-occupancy ratios, delinquency rates, association reserves, impact of the debt service (loan payments) on the budget. Lenders need to see: o o o o o o o o o o o legal docs (declaration, bylaws, articles of incorporation, corporate certificate of organization) annual budget, balance sheet, income statement, reserve statements, banking financial statements accounts receivable listing corporate resolution authorizing borrowing minutes of board meeting and membership meeting (if required) approving the loan an attorney opinion letter regarding the association’s authority to borrow money title search results of association’s common property an environmental questionnaire copy of construction contracts/proposed contracts for the project (may need AIA form) payment and performance bonds from contractor, architect or engineer evidence of insurance naming the lender as an additional insured COLLECTING DELINQUENT ASSESSMENTS Georgia case law has established that owners have the legal obligation to pay lawfully imposed assessments. In Forest Villas Condominium Ass’n, Inc. v. Camerio, 205 Ga.App. 617, 619, 422 S.E.2d 884, 886 (1992), the Georgia Court of Appeals held that: There is no legal justification for a condominium owner to fail to pay valid condominium assessments. This reflects a clear choice by the legislature that the owner’s obligation to pay assessments be absolute…The obligation to pay the assessment is independent to the Association’s obligations to provide services. This is necessary because the communal business of the condominium association for the benefit in common of all condominium owners continues unabated during the pendency of any…individual dispute. The public policy expressed in the [GCA] assure that fulfillment of obligations and the functioning of a condominium association as a whole not be jeopardized or compromised by individual disputes, which may or may not be meritorious. Case applies to GCA, but it is used to support the assessment obligation in HOAs/POAs also. In Timberstone Homeowners Ass’n, Inc. v. Summerlin, 266 Ga. 322, 323, 467 S.E.2d 330, 332 (1996), the Georgia Supreme Court enforced an HOA’s right to impose a lien and file a lawsuit for past due assessments against an owner who claimed that he did not affirmatively agree to the fees and never used the common property. The Georgia Supreme Court held that the covenants created the lien right and since they were recorded in the county land records, the owner took title to the property with “constructive notice” of these obligations. The court stated: The purpose of mandatory assessments is to maintain the common property in the [community] for the use and enjoyment of all owners. The effects of invalidating mandatory payments of assessments for maintenance of amenities in a community without affirmative acceptance would render the provision of services or facilities in a community an impossibility because it would permit property owners to determine for themselves what portion of the amenities they would be willing to accept or to reject. Collections can be broken down into 5 steps: • • • • • Lien Lawsuit FiFa Association Foreclosure Finding Assets How Do We Know What To Do? Boards should establish a collection policy. • • • • • • • • • Due date of an assessment Date late fee can be charged (if permitted by docs) Amount of late fee to charge (if not specified in docs) Date interest can be charged (if permitted by docs) Amount of interest to charge (if not specified in docs) Date monthly assessments can be accelerated (if permitted by docs) Date notices will be sent to delinquent owners Amount of delinquency triggering the need to forward account to attorney Date attorney fees can be charged (GCA and POAA allow associations to charge delinquent owners the reasonable attorney fees actually incurred in collecting a past due balance. As of July 1, 2008, Georgia law also permits HOAs to collect reasonable attorney fees actually incurred from owners when the payment of assessments and fees arise from the covenants.) o Notice to the public that a creditor claims an interest in a debtor’s real property for payment of some debt. o Community association lien rights arise from GCA, POAA and covenants o Lien must be paid at sale of property or buyers and buyers’ lenders will not be able to obtain title insurance and lien will be ahead of buyer’s ownership interest and lender’s security deed. o Liens lapse after 4 years and cannot be the basis of collection litigation after that time LIENS GCA/POAA Liens • • • • • Associations benefit from GCA/POAA collection powers ONLY IF same collection powers are referenced in association’s legal docs. Written liens not required in county land records for unpaid assessments or other charges Automatic statutory lien against the delinquent owner’s unit or lot for all unpaid sums lawfully assessed by the association for common expenses, fines and other charges Lien principal automatically increases as additional amounts come due and remain unpaid As long as association covenants provide, lien also includes: o Late charges of the greater of $10.00 or ten percent (10%) of the amount due o Interest at the rate of ten percent (10%) per annum on unpaid assessments and charges o Association’s costs of collection of delinquent assessments, including reasonable attorney’s fees actually incurred o GCA and POAA state that association’s automatic, statutory lien is superior to all other liens on the condominium unit or lot except: A lien for ad valorem taxes on the condominium unit or lot The lien of any first priority mortgage on the condominium unit or lot; The lien of any mortgage recorded before the declaration was recorded A lessor’s lien The lien of any secondary purchase money mortgage on the condominium unit or lot if the secondary purchase money mortgage holder or his/her grantee was not the seller of the condominium unit or lot to the then owner What Options are Available if a GCA/POAA Lien is Wiped Out by a Tax or Lender Foreclosure? • • • • The association can find and sue the delinquent owner based on his/her personal obligation to have paid the past due amounts Special assessment to all the owners for the unpaid assessments (not the late fees, interests, court costs or attorney fees) The association can collect the excess proceeds, if any, from the foreclosure sale (NOT LIKELY) Usually the HOA writes off the lien amount as uncollected debt GCA/POAA Lien Payoffs: • Closing attorneys/title examiners – required to contact association for a statement of any amounts owed in connection with any sale or refinance of a unit or lot in that association • • • • Association is required to provide the statement of amount owed (payoff letter or closing letter), within five business days of the association’s receipt of a written request If association does not respond timely to a proper request association’s lien is extinguished Payoff/Closing letter is binding on association, so it is better be right (even though lien lapses after 4 years, payoff letter should include those amounts) If payoff/closing letter is submitted timely, but association is not paid from seller’s closing proceeds, lien remains on property ahead of buyer’s title interest and lender’s new security deed, buyer becomes personally liable (and can be sued) for the full amount owed by the previous seller HOA Liens: • • • • • No automatic, statutory lien rights Lien rights must exist in recorded covenants. If docs are silent about lien rights, HOA cannot file lien Must file written liens in county land records against delinquent owner’s property Recorded HOA liens only protect the amount of debt shown on the lien – so new liens must be filed as additional assessments remain unpaid As long as association covenants provide, lien also includes: o Late charges (in the amount specified by the covenants) o Interest (in the amount specified in the covenants, but not more than 18% per annum) o Association’s costs of collection of delinquent assessments, including reasonable attorney’s fees actually incurred o Other than tax liens (which trump everything) HOA liens have no special priority (like GCA/POAA liens) HOA lien priority is based on the date the lien is recorded in the county land records where the property is located (“first in time, first in line”) o The foreclosure of any lien with a higher priority than the HOA lien extinguishes the HOAs lien What Options are Available if an HOA Lien is Wiped Out by a Prior Liens Foreclosure? • • • The association can find and sue the delinquent owner based on his/her personal obligation to have paid the past due amounts. The association can collect the excess proceeds, if any, from the foreclosure sale (NOT LIKELY) Usually the HOA writes off the lien amount as uncollected debt LAWSUITS AND JUDGMENTS • • • • If association files collection lawsuit against delinquent owner and wins, association records a Writ of FieriFacias (“FiFa”) in the County’s General Execution Docket (not land records). FiFa is a judgment lien Judgment liens are enforceable for 7 years from date of judgment Judgment liens can be renewed after 7 years or they become dormant • Dormant judgment liens can be revived within 3 years after becoming dormant Post-Judgment Collections: • • • • • The best asset information is the association members and records Review/copy checks (not necessary if on lock box), correspondence and envelopes from owners Obtain banking, employment and off-site residence information Board members or manager might know where someone works Board members or manager might be able to obtain owner’s automobile license tag info Credit check/Skip Trace/Private Investigator: • • • Might find owner’s: bank accounts, employer, lenders, potential lenders Some people/entities listed may have taken a credit application or financial statement from the owner Subpoenas can be sent to get copies of these documents Garnishments • • Garnishee is a person or entity holding or controlling money belonging to the delinquent owner Types of garnishments: o Bank (holding money in owner’s bank accounts that can be obtained by association) o Wage (paying owner money, some of which can be sent to association) o Rent (tenant owes rent to owner, which can be paid to association instead) o Certain funds are exempt from garnishment: Some social security benefits Some life insurance benefits Non-IRA pensions Retirement plan benefits Suspension of Use Rights and Services • Suspend delinquent owners’ use rights and services to: o Vote o Use the recreational property o Park on the association common property o Suspend an owner’s cable, satellite, internet and trash service (if provided by the association) Suspension of Utilities: There are different requirements for condominiums, homeowner associations and property owner associations to suspend utility services provided by association (gas, electric, heat, air conditioning and water). Either way, this right is only available as a valuable remedy if there exist separate exterior cutoffs to individual units or lots. GCA: • • • Must have a judgment or judgments totaling at least $750.00 against the owner Must send notice of the suspension to the owner before suspension To restore service - owner required to pay judgment balance plus the costs of suspending and reconnecting service HOAs/POAs: • • • • Do not require a judgment Association’s docs control To restore services association docs. usually say owner must have zero balance Other services paid for as a common expense (cable, satellite, internet and trash service) Personal Property Levy • • • • Association notifies sheriff’s office of FiFa and requests sheriff collect owner’s personal property (TVs, appliances, cars, etc.) Association pays to transport and store the property and advertise the sale of the goods Sheriff’s office sells goods at judicial sale to satisfy FiFa Levy process can be costly for little return Post-Judgment Discovery • • • • Interrogatories. Questions about specific asset information. Requests for production of documents. Requests for specific asset documentation. Compliance is mandatory. If owner does not comply, motion to compel filed in court. If owner does not comply with court order, motion for contempt. Jail time and additional attorney fees. ASSOCIATION FORECLOSURE GCA/ POAA: • • • • • Association must provide 30-day notice to the delinquent owner prior to filing lawsuit seeking an order of foreclosure If the owner does not pay or work out payment arrangements during 30 day period AND if association’s lien is at least $2,000.00, association can file lawsuit for money judgment against owner and foreclosure of lien Results vary Best Result - third party purchases property at foreclosure sale for price high enough to pay off amounts owed to association by the delinquent owner Alternative Result - association buys property at foreclosure sale and becomes legal title holder, no money received by association but delinquent owner is gone • Worst Result - no one buys property at foreclosure sale and the preforeclosure status quo remains OBSTACLES TO COLLECTIONS Lender Foreclosure • • • • Non-judicial foreclosure (no lawsuit or court order necessary) Extremely fast process in Georgia First mortgage has priority so lender foreclosure extinguishes association lien If excess funds after foreclosure sale, association might get paid some money (unlikely in these economic times, properties are usually worth less than the loans) Bankruptcy • • Any and all collection action must stop immediately. Creditors can proceed with collection efforts if the bankruptcy is discharged, dismissed or the bankruptcy judge allows creditor to do so Pre-petition debt • • All debts owed by delinquent owner prior to filing bankruptcy petition. Addressed by bankruptcy court. Post-petition debt • • All debts arising after bankruptcy petition is filed. Must be paid by the delinquent owner as they accrue. Chapter 7 – Liquidation Complete relief from personal obligation of pre-petition debts – lenders typically foreclose after owner surrenders property. Chapter 13 – Reorganization Association receives partial or full payment of secured pre-petition amounts owed over a five year period - association secured by liens (GCA/POAA – automatically includes all principal owed upon petition. HOA – only includes amounts listed in recorded liens) Results of Bankruptcy • • Dismissal: Bankruptcy is concluded and owner remains responsible for prepetition debts Discharge: Creditors permanently prohibited from collecting pre-petition debt from owner (except if property is retained by debtor, liens remain on property) Audits/Financial Review: Often required by bylaws; prepared by an independent CPA • • Audit: More expensive and larger in scope – examines financial records, budgeting and accounting methods, checks operating accounts, reserve accounts, records of expenses. Financial review: Less expensive and smaller in scope – typically reviews the operating accounts QUESTION: What does the association do if the common property tax bill is really high? ANSWER: The board should file a real property tax return which will trigger a revaluation of the property and a new tax assessment notice. If the assessment notice continues to show a high fair market value for the common property, the board should appeal the taxes and explain why the common area property should be assigned a nominal fair market value. Most county tax assessors’ offices and boards of equalization will remedy the tax valuation of the common property without a hearing. Sometimes a hearing will be required though. QUESTION: Is there a problem if the HOA/POA is not getting a tax bill for the common property? ANSWER: Yes. This could mean that the common property was never properly conveyed from the developer to the association. Most likely, the developer is getting, but not paying, the tax bill. The association needs to obtain title to the common property and then pay the unpaid back taxes, penalties and interest to the county or the common property could be lost at a tax sale. TAXES Property Taxes Condominiums: Corporations rarely own property (common elements owned by all unit owners as tenants-in-common and taxed as part of the intrinsic value of the unit). No tax bill for common elements. HOAs and POAs: Corporations usually own common property/amenities – fair market value should be nominal because owner easements make it impossible to sell to third party for any real value. The FMV of each home in the HOA/POA is higher because the owners have the right to use and enjoy the common areas, so each lot is being taxed inherently for the value associated with the common property. Taxing both the lot owners and the association for the value of the common property creates double taxation. Income Taxes • • Community association are non-profit, but rarely tax exempt Federal and state tax return due on the 15th of March if the association’s fiscal year is the calendar year. If fiscal year is different from calendar year, tax returns must be filed on or before the 15th day of the third month following the close of the fiscal year • Associations have two methods for filing income taxes IRS Form 1120-H • • • • Association prohibited from carrying over losses from previous year Income received from member operations (i.e. membership dues, fees and assessments) is excluded from taxable income Subject to certain exceptions, association pays tax on gross taxable income (interest income, clubhouse rental income) Tax rate is a flat 30 percent IRS Form 1120. • • Corporation can carry over losses Corporation pays taxes on all income (including assessment income) • Association can choose what type to file each year (and change each year). Most CPAs do both computations each year and file the return that results in the least amount of taxes to the association. No matter which federal income tax form is used, all associations must file Georgia Form 600. Associations may have to pay personal property taxes to a city or county municipality • • For example, personal property taxes could be charged on playground equipment or pool furniture and equipment owned by the association. 1099 Forms • • • Used to report various types of income paid to others that would not be reported on a W-2 Required for payees receiving $600 or more during any calendar year Must be filed with IRS by the end of February for previous calendar year (copies must be sent to the payee by the end of January) TRUST ACCOUNTS • • • • • Brokers holding money for other people must hold the money in a trust account. Trust accounts - rarely used in the community association industry because the association’s money is not in an account under the broker’s name or broker’s EIN. The association’s money is in an account under its own name with its own EIN. The CAM/Broker usually has access to the association’s funds because they are listed as a signatory on the association’s accounts, but the funds are not being held by the broker for the association so they do not have to designate the account as a trust account. If funds are held by a broker for another party, the account the money is deposited into must be a trust account. These accounts must be federally insured, bank account designated as trust accounts. • • • • • • • • • Within one month of opening a trust account, the broker must register it with the Georgia Real Estate Commission (GREC). The broker must notify GREC in writing of the funds move to a different bank, a different trust account or if the broker closes a trust account. The broker must provide the GREC with the name of the bank and the account number and provide them with the authority to investigate and examine the records of that account at any time. This account may or may not be interest-bearing. If it is, there must be a written agreement between the parties giving direction as to who receives the interest. (In the community association industry, the association always keeps the interest on its money.) The qualifying broker must have signatory power on the trust account. The broker must maintain a journal of each trust account. The broker must reconcile their trust account balances at least once a month and make a written report comparing the broker’s total trust liability to the bank balance of the broker’s trust account. Each broker is responsible for establishing written policies about trust funds (especially cash) and making sure their licensees understand how trust funds will be received and acknowledged. The Commission may, upon reasonable request, examine a broker's trust account. The Commission may accept a certified report about the trust account from a CPA instead of examining a broker's account. MAINTENANCE AND REPAIR IN COMMUNITY ASSOCIATIONS General Rules for All Communities • • • • • • Whoever owns it, maintains it - unless the community documents state otherwise Community documents often state otherwise To figure out the association vs. owner responsibilities follow these three steps: STEP 1: Figure out what needs to be fixed and where it’s broken STEP 2: Check boundaries of lots/units in the documents to see who owns what STEP 3: Check maintenance section of documents to see if one party maintain something the other party owns Condominiums • If governing documents are silent, follow GCA, which states: o o unit owner maintains/repairs unit and limited common elements to the unit association maintains/repairs common elements of the condominium Example: Documents state that exterior walls are the unit boundaries in a townhome condominium. Unit owners are responsible for maintaining their unit, the driveway serving the unit, and the step or the patio serving the unit. There are no other maintenance responsibilities assigned to the unit owner. The association is responsible for maintaining all items outside of the unit boundaries unless otherwise assigned to the unit owner. An owner’s HVAC system is stolen from the ground outside her unit. STEP 1: HVAC system needs to be replaced STEP 2: Boundaries are exterior walls STEP 3: Maintenance Section of Declaration Maintenance Section of the Declaration says: Owner maintains: unit, driveway and steps/patio. Association maintains: all other areas outside the unit boundaries. Since the HVAC system was located outside the unit boundaries and the association is responsible for all areas outside the unit boundaries (except the driveway and the steps/patio), the association must replace HVAC system even though it serves only one unit. (The answer is the same even if the HVAC system is a limited common element – because docs are not silent, so you don’t follow the GCA.) Paying for Maintenance and Repairs General Rule -- whoever maintains it, pays for it • HOA/POA o Common Areas – association maintains – association pays* o Lots – owner maintains – owner pays • Condominiums o Common Elements: association maintains – association pays* o Units: owner maintains – owner pays o LCEs -- if Declaration is silent, GCA says owner maintains – owner pays o LCEs – if Declaration says owner maintains LCEs – owner pays o LCEs – If Declaration says association maintains o LCEs – association pays o THERE IS AN EXCEPTION! (See below.) *Unless an exception exists (see below), not only does the association pay to maintain the common areas/elements, but the GCA and POAA affirmatively prohibit an association from charging back costs to an owner for such maintenance/repair. IMPORTANT: The condominium declaration can state that the association does not have to charge the cost back to the owners, but if such language is not in the condominium declaration, the GCA REQUIRES the board to pass on such costs to the relevant unit owner(s). Example: If the declaration requires the association to maintain the roofs, the association cannot specifically assess a roof repair to a particular unit owner (even if the roof serves only one unit). Exceptions to the General Rule • If Association Maintains LCEs - GCA states that association is REQUIRED to charge LCE maintain/repair/replacement costs back to the relevant unit(s) unless declaration specifically states otherwise Example: The condominium declaration states that the driveways are limited common elements (“LCE”) to the townhomes. Another declaration for a different condominium states that the hallways are limited common elements to the units on the floors of a high-rise building. Both declarations require the association to maintain the LCEs. According to the GCA, the first association is REQUIRED to maintain the driveways as a common expense of the association, but also REQUIRED to charge back the cost of each driveway repair to the relevant unit owner (to reimburse the association for the work on the LCE). According to the GCA, the second association is REQUIRED to replace the hallway carpet as a common expense of the association, but also REQUIRED to charge the carpet replacement cost back to all the owners of the units on that hallway. • If Owner Damages Association-Maintained Property – GCA, POAA and most governing documents state that if an owner damages an area maintained by the association, the association must repair the damage, but the association can charge the costs of doing so back to the responsible owner as a specific assessment. Example: An owner crashes through the entrance gates of the community in her car. The association must fix the entrance gates. If permitted by the governing documents, the association can assess the costs of repairing the gate back against the owner as a specific assessment. • If Association Deliberately Damages Owner-Maintained Property – GCA and most governing documents state that if an association damages an area maintained by an owner in order to complete an association maintenance responsibility, the association is required to repair the damage it caused to the owner-maintained area. Example: If an association cuts a hole in the ceiling of a unit to fix a common element pipe, the association must repair the hole. The association must put the property back to the condition it was in when it was originally built – not when it was damaged. • Negligence - The negligent party is responsible for paying to repair any property or item that was damaged because of that party’s negligence. This applies both to the association and for unit owners. • Insurance – If the association maintains insurance covering the damages that need to be repaired, the carrier will pay for the repairs (less a deductible) even if the damaged area is supposed to be repaired by the owner. INSURANCE ISSUES IN COMMUNITY ASSOCIATIONS In general, however, there are 4 types of policies that an association carries: • • • • Directors’ and Officers’ Insurance Fidelity Insurance Liability Insurance Property Insurance Directors and Officers Insurance • Directors’ and Officers’ Insurance, known as (“D&O”), protects officers and directors of an association from liability resulting from their actions or inactions, where the claim is not a result of bodily injury, personal injury or property damage covered under the GCL • D&O typically covers wrongful acts on the part of an officer or director of the association. Be sure it also covers past (not just present) officers and directors. • A D&O policy also should cover any volunteers, committee members or other person acting on behalf of or as directed by the board of directors. • Typically any intentional, dishonest, fraudulent, criminal, or malicious acts are excluded from coverage. Example: If a director steals association funds, his actions will not be covered under D&O insurance. Likewise, if a director slanders another person, the claim will typically be excluded from coverage. Fidelity Insurance • Fidelity insurance protects associations from loss of money, securities, or inventory resulting from crime • Common fidelity claims allege employee dishonesty, embezzlement, forgery, robbery, safe burglary, computer fraud, wire transfer fraud, counterfeiting, and other criminal acts • An association is NOT REQUIRED BY LAW to have fidelity insurance, but most community association documents require it. Plus, most property insurance policies have some coverage for dishonest acts of a director, officer or an employee • Condominiums seeking FHA project approval and buyers seeking conventional loans to purchase condominiums compliant with FNMA guidelines must have fidelity insurance equal to AT LEAST three months of assessments plus the amount of reserves. • The Georgia License Law requires real estate brokers who have access to $60,000 or more of association funds to be covered by fidelity insurance or a fidelity bond in an amount equal to AT LEAST three months of assessments plus the reserves for all associations it manages. Each association must be listed as an additional insured on the broker’s fidelity insurance or bond Liability Insurance Coverage • • • Most community associations obtain commercial general liability insurance (“CGL”) CGLs cover claims of bodily injury or property damage occurring on the common property/elements caused by the negligence of the insured, unless the injury/damage is caused by something excluded by the policy, such as injury from mold or asbestos A typical CGL policy also includes coverage for indemnification and hold harmless provisions in association contracts. Example: A management contract requires the association to indemnify the manager and the management company from lawsuits brought during in the course of its work for the association. Someone slips and falls on the common property/elements and sues the association and the management company claiming the area was not properly maintained. The typical association CGL carrier will provide coverage for the defense of the association AND the management company in the lawsuit. Without the indemnification and hold harmless coverage in the CGL policy, the carrier would pay for a defense of the association but the association would have to come out of pocket to pay for the defense of the management company in the lawsuit. HOAs and POAs • • • NO GEORGIA LAW REQUIREMENT for HOAs and POAs to carry liability insurance, but if it OWNS COMMON PROPERTY, the HOA/POA SHOULD obtain a CGL covering the common areas Association legal documents might set the minimum amount of liability insurance When determining the amount of insurance, boards of directors should work with their insurance agents to evaluate the amount of common area owned, the number of owners and/or guests on the common areas and the uses of the common areas Condominiums • • GCA requires condominium associations to carry a CGL policy that covers bodily injury and property damage at the condominium in an amount not less than $1 million for a single occurrence and $2 million aggregate An association’s liability policy does not cover injuries incurred inside of a unit. Each unit owner should carry liability insurance covering themselves, the unit occupants and their guests inside of the unit. BEWARE: If a claim relates to any wrongdoing by the manager or management company, it is usually EXCLUDED from the CGL policy. If the association has not made a similar exception in the indemnification provision of the management contract and a claim is brought against the manager/management company for its wrongdoing, the association’s CGL carrier may deny the claim and the association will have to defend the manager/management company out of pocket. Property Insurance for HOAs and POAs • Property insurance is hazard or casualty insurance that protects the actual physical property and equipment of an association or owner against loss from theft, fire or other perils. • NO GEORGIA LAW REQUIREMENT for HOAs and POAs to carry property insurance, but most association legal documents require full replacement coverage for the common area damages occurring from standard perils such as fire, windstorm, hail, vehicles, etc. • TOWNHOME COMMUNITIES ARE TRICKY. o Some association documents require the owner to insure the entire townhome (even if the association maintains it) – just like a single family home owner insuring his/her house. o Some legal documents for townhome communities require the association to maintain insurance over all areas the association maintains/repairs in the community – which might include the exterior building surfaces and roofs. Essentially, this means the TOWNHOME ASSOCIATION might purchase a CONDOMINIUM PROPERTY INSURANCE POLICY. (Doing this does not make the townhome community a condominium, but it definitely confuses real estate agents and lenders.) Property Insurance for Condominiums • GCA REQUIRES condominium associations to carry hazard/casualty insurance (fire and extended coverage or basic perils insurance) covering the full replacement value of all the condominium building(s), less deductibles. • If a condominium association experienced a total loss of the building, there should be enough insurance coverage to rebuild back to the original condition. Without “guaranteed replacement cost coverage” in the policy, a condominium association must regularly obtain insurance appraisals of the entire property to ensure it is maintaining enough insurance for full replacement costs. • Fire and extended coverage will cover the damages caused by the following: o Fire o Windstorm o Hail o Explosion o Aircraft o Vehicles o Riot o Civil commotion • The GCA requires the association to cover the following building structures, including the common elements, the limited common elements and the units: o all common elements of a condominium, including all limited common elements; o the building foundation; o the building roof and roof structures; o o o • exterior walls of the building, including windows and doors and framing therefore; the HVAC systems serving a condominium unit; all drywall and plaster board comprising the walls and the ceilings of units; and the following items in a condominium unit in the like type and quality as originally installed: floors and subfloors; wall, ceiling and floor coverings; plumbing and electrical lines and fixtures; built-in cabinetry and fixtures; and appliances used for cooking, dishwashing and laundry. Personal belongings of an owner or occupant, and any betterments or improvements made by a unit owner are NOT required to be covered by an association’s insurance. Any upgrades or changes made by unit owners (even if the upgrades were part of the contract for the original purchase of the unit) are not required to be included in the association’s policy. Example: If an owner replaces the original tile in a unit with an upgraded tile or slate floor, the association’s insurance would not cover this upgrade. In the event of a fire, the association’s insurance carrier will replace the flooring that was originally installed in the unit. Application of Insurance Deductibles in Condominiums • • • • • A deductible is like a service charge taken from the insurance proceeds and kept by the insurance carrier. The loss is adjusted and the insurance proceeds determined. Then the deductible is reserved by the carrier and the remaining proceeds are sent to the association. Essentially, the insured “selfinsures” for the amount of the deductible. The condominium legal documents identify the party responsibility for the deductible. Usually it is allocated to person(s) responsible for the loss in the absence of insurance. For losses covered by an insurance policy required by the GCA, the association is permitted to allocate up to $2,500 of a deductible to a unit owner. For losses covered by an insurance policy that is not required by the GCA, there is no limited on the amount of deductible that can be allocated to a unit owner. Some insurance policies have a PER OCCURRENCE deductible. No matter how many units are damaged in one event, there is only one deductible allocated to the association or the entire event. Some insurance policies have a PER UNIT PER OCCURRENCE deductible. The same amount of deductible is allocated to each unit damaged in a single event. Important Notes about Condominium Insurance Deductibles • • Water damage is NOT covered by fire and extended coverage policies and the GCA does NOT REQUIRE a condominium association to carry water insurance covering losses from conditions like pipe bursts, washing machine overflows, toilet or tub overflows, etc. If the condominium association obtains a separate insurance policy covering water damages it will typically cover "accidental discharge or leakage of water • • or steam as the direct result of breaking or cracking of any part of a system or appliance containing water or steam." Specifically excluded from most water damage policies are any damages caused by the continuous or repeated seepage or leakage of water (such as a leak from a nail puncturing a pipe or a recurring window leaks), or the presence of condensation or humidity, moisture or vapor that occurs over a period of 14 days or more. Also, water insurance does NOT cover the costs of repair to the appliance, system, or pipe itself. It covers only the damages caused by the discharge of water. Example: If a water pipe serving a unit suddenly bursts causing damage to three units, the damage to the units will be covered, subject to any deductibles, but the repairs to the pipe itself will not be covered. Condominium Unit Owner Insurance Policies – HO-6 These policies have three types of coverage: • • • Coverage A - real property – coverage for damage to the parts of the unit not covered by the association’s policy. For example, owner betterments and improvements. **Be careful here -- most HO-6 policies cover named perils, not special perils.** Water damage typically is covered by special perils. Consequently, owners should confirm that they have special perils coverage to receive payment for water damage. Coverage B - liability – coverage for bodily injury and property damage inside a unit because of the owner’s negligence. Coverage C - personal property and association deductibles – coverage for personal property inside the unit, wall paper and carpeting, and betterments and improvements to the unit. Coverage C also reimburses a unit owner for deductibles under an association’s master policy that are passed along to the unit owners. **Be careful here -- deductible coverage in this part of the policy should match the amount of the association’s deductible.** *Most condominium documents require HO-6 policies for each owner. **Most residential lenders require HO-6 policies as a condition of loan approval (primarily because FHA and FNMA require HO-6 policies). COVENANT ENFORCEMENT Covenants • • • • An obligation to do or not do something with your real property required simply because you own that property. Use Restrictions (provisions that restrict an owner’s use of his/her real property) and Architectural Controls (provisions that control the architectural improvements that can be made to an owner’s real property) are, by definition, covenants affecting the use of land. To be enforceable from one owner to the next, they must be recorded in the county land records so they remain in the chain of title of the property. Once recorded, the new buyer “gets what they are given”… property with covenants recorded against it. The new owner does not need to be given a • • copy of the recorded documents for them to be enforceable. (The documents are public records and the new owner is on CONSTRUCTIVE NOTICE of them.) Must be clearly drafted so courts can strictly interpret them during enforcement actions Three-prong test for the interpretation of restrictive covenants: 1. Is covenant clear and unambiguous? If yes, it gets enforced. 2. If covenant is ambiguous, court applies rules of contract construction by looking at the entire document to resolve the ambiguity. 3. If the ambiguity still remains the question regarding what the ambiguous language means and what the parties intended must be resolved by a jury QUESTION: Who can enforce covenants? ANSWER: • • • Other owners who are also subject to the covenants can enforce them. Usually the association (through the board of directors) can enforce a covenant (as long as the covenants and the corporation are “married”) A committee of the corporation can sometimes enforce the covenants (for instance, the architectural control committee might be given such authority). QUESTION: Who can be sued for violating the covenants? ANSWER: Any owner subject to the covenants who violates the provisions is subject to enforcement mechanisms and can be sued to cease violating the covenants. QUESTION: What about an owner who purchased property that had a violation on it before the conveyance? ANSWER: Generally, the purchaser must have actual or constructive notice of the covenant violation for the association to enforce the covenant after the conveyance. QUESTION: How can we make sure that purchasers have actual or constructive notice of the violation? ANSWER: The association should record notices of violation in the county land records. The notice simply states that the real property is the subject of a covenant violation dispute. Doing so will put prospective purchasers on notice of existing violations. Once a notice of violation is recorded in the land records all potential purchasers have constructive notice of the violation. In order to avoid a potential claim for slander of title, it’s important to make sure the association legal documents affirmatively permit the recording of notices of violation as an enforcement mechanism. QUESTION: How can you enforce the covenants after filing notices of violation? ANSWER: • • The association can impose fines ($25 per day has been approved by the Georgia Court of Appeals) The association can use “self-help” – going onto the real property, fixing the violation and charging the costs back to the owner. (This can only be done peacefully. If the owner walk outside with a gun and threatens to shoot or call the police, the association representatives engaging in self-help should walk away.) QUESTION: If the association files suit to get a court order requiring the owner to fix the violation, is there anything the owner can say in defense that might make the association lose the case? ANSWER: Yes. The person can argue that he/she is not the owner of the property. Otherwise, there are 6 typical defenses to most covenant enforcement cases: • • • • • • Statute of Limitations Selective Enforcement Waiver Laches Estoppel Vague and Indefinite Statute of Limitations: • • Two years from the date of the covenant violation. Same statute of limitations for permanent violations and continuing violations. For instance, a covenant enforcement suit must be filed within 2 years after an owner installs an unapproved fence. Each day the unapproved fence remains in place does NOT start a new 2-year period. Selective Enforcement: • • Association does not enforce one of the covenants, but does enforce others (if the board is not going to enforce it, remove it) Association enforces a particular covenant differently (with no objective reasons) between and among owners Waiver: • • There is no test to determine how long the association can wait to enforce a covenant before the courts determine that the association waived its right to do so. Georgia courts have said that if the enforcing body does not know of the violation, they have not waived their right to enforce it. Laches: • If the association watches an owner spend money while committing a violation of the covenants, but the board does nothing about it, the • association will be barred by the defense of “laches” and will not be able to enforce the covenant against the violating owner. Georgia Supreme Court test to determine if laches exists. Look at the: • • • • • • length of the delay sufficiency of the defendant’s excuse for not acting sooner loss of evidence because of the delay opportunity for the plaintiff to have acted sooner whether the plaintiff or defendant possessed the property during the delay whether the defendant can show prejudice from the delay Estoppel: The association will not be permitted to successfully enforce the covenants if the violator was influenced by the conduct or representations of the association. For example, if a board member or ACC member tells an owner that the paint color he is about to use to repaint his siding looks nice, the association may be “estopped” from suing to make the owner repaint an approved color later. Vague and Indefinite: Georgia Supreme Court stated that if covenant clearly establishes the rights and obligations of the parties, the covenant will not be deemed void. For example, covenants prohibiting “noxious or offensive activity” and “anything which may be or may become an annoyance or nuisance” were deemed too vague, indefinite and uncertain for enforcement. Limitations on the Enforcement of Covenants Charter Club v. Walker The Charter Club community adopted an amendment to its Declaration of Covenants restricting the leasing of homes within the community. Prior to the amendment, leasing was permitted in the community. The community adopted the amendment following the amendment procedure specified in the Declaration. A homeowner named Constance Walker voted against the amendment and leased her home in violation of the new leasing restriction. Ms. Walker claimed that she was not subject to the amendment since she voted against it. The Association lost this case. The case revolved around a statute that has long existed in Georgia, O.C.G.A. § 445-60(d)(4). That statute provides, in relevant part, that "no change in the covenants which imposes a greater restriction in the use or development of the land will be enforced unless agreed to in writing by the owner of the affected property at the time such change is made." The Georgia courts for years have enforced community association amendments like the leasing amendment in this case. The courts have upheld amendments based on the understanding that, when covenants allow for amendments to those covenants with approval of less than all owners, buyers of property in the community have agreed to be bound by lawfully approved amendments, even if they vote against the amendments. In this case, however, the court ruled that the leasing restriction imposed a greater restriction on Ms. Walker's use of her property and, since she did not consent to this restriction, the amendment was not legally binding on her. The effect of this case, at a minimum, is that amendments already adopted by many homeowner associations may not be binding on any owner who did not agree in writing to those amendments, if the amendments impose a greater restriction on the use or development of the owner's property. This has broad application and could include everything from leasing restrictions to any provisions that regulate commercial vehicles and parking, pets, or architectural control and review procedures. In other words, any amendment which created a greater restriction on an owner's use or development of property can be challenged by any owner who did not vote in favor of that amendment. While the case suggests that amendments made by associations in the past may still be binding on those owners who voted in favor or agreed in writing to the amendments, the purpose of many of these amendments may be undermined if the restrictions are only binding on those homeowners who voted in favor of the amendment and not those who voted against the amendment or did not vote on the amendment. Additionally, to enforce these amendments against owners who voted in favor of the amendments, associations may be required to produce records to show that particular owners voted in favor of the amendments. This can be a challenge for many communities. QUESTION: Where does this leave community associations? ANSWER: First, this case does not apply to condominiums that were created under the GCA. This would cover all condominiums created after 1975. The reason for this is that the Condominium Act contains a provision that specifically states that O.C.G.A. Section 44-5-60 does not apply to condominiums. Amendments to condominium declarations, then, are not affected by this ruling. Next, the POAA contains a similar provision stating that O.C.G.A. Section 44-5-60 does not apply. For communities that are subject to the POAA, amendments adopted after submission to the POAA are not subject to this ruling. Certain amendments adopted BEFORE the submission to the POAA may not be binding on certain homeowners in the community. However, for all homeowner associations, certain amendments adopted by the community may be invalid and not binding on certain homeowners in the community. QUESTION: What should community associations do now? ANSWER: Any homeowner associations that have not yet adopted the Georgia Property Owners' Association Act should do so now. This often will require a vote of the association membership, but many community covenants allow the board of directors to adopt the POAA without a homeowner vote. If the community covenants require a homeowner vote for adoption of the POAA, the POAA itself permits that amendment by the percentage approval specified in the covenants. This case would not force associations to obtain 100% homeowner approval to adopt the POAA, if the covenants provide for a lesser amendment approval vote, as the POAA is not considered a use restriction. Adopting the POAA now probably will not fix the problem associated with amendments that were adopted prior to submission to the POAA, but adopting the POAA will give the community legal power to make future amendments and to ratify previous amendments. Additionally, the POAA greatly strengthens assessment collection powers, which we believe benefits all homeowner associations. If your community has adopted amendments in the past which impose a greater restriction on the use or development of homeowner properties, even if your community later adopted the POAA, the community should undertake an effort to ratify or readopt those amendments. The most efficient and cost effective way to validate amendments previously approved by the community is to first adopt the POAA and then ratify earlier amendments with a community amendment vote following the amendment procedure stated in the covenants. Unfortunately, this process cannot be accomplished without a community vote, but we believe that this process is the simplest and least costly approach to make existing covenant amendments binding on all homeowners in a community.