Capital Financing For Independent Schools

advertisement

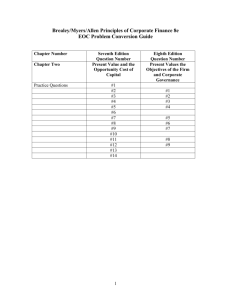

Capital Financing For Independent Schools A Primer for School Boards and Management INTRODUCTION The continued growth in demand for private school education is a result of a number of factors. The most significant have been (1) the persistent growth in population of grammar and high school age children relative to the number and capacity of private schools, (2) widespread dissatisfaction with public school education, (3) need or desire for specialized education in the curriculum, (4) need or desire for better quality teachers, a lower student-to-teacher ratio and increased one-on-one attention between teachers and students and (5) conviction that a particular private school offers a better combination of academics, athletics, extracurricular activities and values building than the alternatives. Public elementary and secondary schools in the United States are largely supported by tax dollars collected by states and local governments or school districts and the planning, development and financing of public school facilities tend to be done on a highly centralized basis. In contrast, private schools rely primarily on tuition revenue, charitable donations and endowment and investment portfolio income to support their operations, and each school is on its own to address its facility and financing needs. To address new or evolving facility requirements, private schools lacking all of the required funds to address such needs have turned increasingly to debt financing over the past decade. Moreover, following the lead of colleges and universities, private schools have been using tax-exempt financing in recent years with greater frequency. This paper seeks to provide a basic overview of the key issues, considerations and options associated with the use of debt by private schools to address facility financing needs. In addition, for a school which has decided to pursue debt financing, it provides basic guidelines for the choice of debt modality and structure depending on that school’s finances, type and amount of financing sought and the financial environment at the time of the planned borrowing. FUNDING ALTERNATIVES Private schools require working capital to fund routine operating costs such as teacher and administrator salaries and benefits, academic and athletic programs, utilities, repair and maintenance, printing, copying and office supplies, IT supplies, software and services, student transportation and the like. The sources of such working capital are typically tuition, auxiliary fees and revenues, development dollars and investment income. When private schools face the need for a major new facility, renovations to an existing facility or other major capital expenditures, some schools, but not many, have the option to fund such costs from cash reserves, endowment funds or contemporaneous gifts. More frequently, in lieu of deferring the project, schools turn to debt financing. Debt financing offers the borrower the opportunity to fund a project on a near term basis while spreading the cost of that capital over time in order to meet budgetary and affordability constraints. In addition, long term debt enables the school to effectively pass the cost of the capital investment to the users of the associated project over its useful life. Traditionally, independent schools had avoided debt financing, electing to defer facility acquisitions or improvements until the requisite funds were raised through a capital campaign and gifts. To the extent that such schools borrowed at all, their debt financings were structured as conventional commercial loans from a bank. However, in recent years, there has been a convergence of trends and events which has resulted in increased and more aggressive borrowing activity by private schools: Demographics1: Over the past 10 years, the number of private schools operating in the U.S. has increased by nearly 3,300 from 25,998 in the 1991-92 school year to 29,273 in the fall of 2001. Total private school enrollment at the end of 2001 was over 5.3 million, representing approximately 10% of total (public and private) elementary and secondary enrollment in the United States. Since the 1991-92 school year, private school enrollment has increased by over 450,000 students or 9.24% from 4,889,545 in 1991-92 to 5,341,513 in the fall of 2001. The following table provides summary statistics on the number of private schools operating in the U.S. and private school enrollment between 1991 and 2001. Schools Total % Growth Elementary Secondary Combined 1991 1993 1995 1997 1999 2001 25,998 -2.67% 15,716 2.475 7,807 26,093 0.37% 15,571 2,506 8,016 27,686 6.11% 16,744 2,533 8,409 27,402 -1.03% 16,623 2,487 8,292 27,223 -0.65% 16,530 2,538 8,155 29,273 7.53% 17,427 2,704 9,142 1 All statistical data provided by the National Center for Education Statistics; 2002-2003 data will be available in Q3, 2005. 2 Enrollment Total % Growth Elementary Secondary Combined 1991 1993 1995 1997 1999 2001 4,889,545 1.06% 2,766,059 818,570 1,304,917 4,836,442 -1.09% 2,759,771 791,235 1,285,437 5,032,200 4.05% 2,835,247 811,422 1,385,531 5,076,119 0.87% 2,824,844 798,339 1,452,937 5,162,684 1.71% 2,831,372 806,639 1,524,673 5,341,513 3.46% 2,883,010 835,328 1,623,175 The National Center for Education Statistics projects a cumulative increase in private elementary and secondary enrollment of 7% between 2001 and 2013. No information is available as to the projected number of private schools in the U.S. over that same timeframe, but recent rends suggest that there will be significant net growth. Facility Expectations: Parents and students have become more “consumer-driven” when it comes to the facilities and resources of their private schools. The result has been increased demand for, among others, modern athletic and multi-purpose facilities; stateof-the-art science labs; higher quality residential and dining facilities and sophisticated information technology infrastructures. Capital Markets Flexibility: Over the past 20 years, the debt markets have expanded appreciably and undergone a revolution of creativity. Today, they offer a broad array of financing techniques and options to the institutional borrower. Over the same timeframe, major underwriters and lenders have developed “industry expertise” in the educational sector and now can offer highly customized and affordable solutions to the financing needs of each borrower. More Sophisticated Management: The boards and management of private schools have likewise become more sophisticated with regard to financial matters. Dynamic analytical tools, reference private school financing activity, readily available statistical data and practical business experience have enabled school boards and management to take a more scientific approach to weighing the costs and benefits of a financing and a proposed financing structure. For instance, a number of schools with considerable cash reserves and endowments have never the less undertaken debt convinced that they can realize investment returns on their endowment capital at meaningfully higher levels than the interest cost of such debt financing, particularly if the debt is tax-exempt. There is limited data available on private debt financing by independent schools. However, the data regarding public financings (that is, bond issues sold in the public capital markets) indicates that private schools have embraced debt financing as an important tool for advancing their missions. Approximately 70 private schools in the U.S. have issued bonds with published credit ratings2. In addition, one of the major rating agencies estimates that for every one school that has issued bonds based on its own credit rating, five more have conducted bond financings supported by a direct-pay letter of credit from a bank or bond insurance provided by a U.S. based bond insurance company. 2 Moody’s Investors Service; Fitch Investors Service; Standard & Poor’s Corporation 3 The continued growth in demand for private school education, the growing and evolving facility needs of private schools and their students and increasingly accommodating capital markets indicate that the number and amount of such debt financing will likely continue to increase. 4 TYPES OF DEBT Debt can be categorized in a number of ways based upon its term, interest rate modality, security structure and manner of placement or sale. The traditional bank loan now must compete with a number of more sophisticated and often less expensive types of debt. Perhaps the two most important developments in the debt marketplace for private schools over the past twenty years have been “tax-exempt” financing and variable interest rate structures. Both have served to lower significantly the cost of capital to private schools versus the traditional fixed rate bank loan. In addition, such techniques are being augmented with increased frequency with derivative financial products (interest rate swaps, caps, collars) to design highly customized solutions to the needs and judgments of particular borrowers. In fact, the “creative financing” structures have become so prevalent and risk profiles and funding techniques at banks have so evolved that some banks no longer even offer the “traditional” long term fixed rate loan structure. The table below attempts to organize and categorize the types of debt available to private schools today by defining features: Manner of Placement or Sale Private Placement Bank or single institutional investor Typically styled as a “loan” Investor owns loan to maturity or repayment Public Offering Loan is securitized into publicly traded bonds Multiple individual and/or institutional investors Secondary market for bonds enables investors to sell investment before maturity. In contrast to privately placed debt, investors will accept a lower rate in exchange for secondary market liquidity. Taxability of Interest Income to Investor Taxable Investor liable for income tax on interest Taxable debt interest rates driven by yields on U.S. Treasury securities Tax-Exempt Interest income is exempt from federal and sometimes state and local income taxation Investors will accept a lower rate based upon effective “after-tax” yield on comparable taxable debt Result: Borrowers are able to reduce interest cost from 1 to 2.5% by borrowing tax-exempt versus taxable 5 Interest Rate Modality Fixed Rate(s) based upon positively sloped yield curve (ie. rates typically increase as term of debt lengthens) Rate is fixed for a specific duration usually to the maturity date of the obligation Rate is based on credit quality of borrower Variable Rate based upon short end of yield curve (ie. tend to be lower than long term fixed rates, although subject to vagaries of economy over time) Rate adjusts daily, weekly, monthly and based upon an index or reset based upon general market conditions If a variable rate bond, rate is also based on credit quality of letter of credit bank Term Short Term Usually five years or less Typically, no principal amortization. Entire principal amount repayable at maturity Usually styled as “Notes” if sold publicly Long Term Typically ten years or longer Principal generally amortizes fully over term of debt Usually styled as “Bonds” if sold publicly Credit Structure General Obligation Unsecured unconditional guaranty based upon overall financial strength of borrower Revenue Bond Debt secured by combination of net revenues of school and security interest in select or all tangible assets and funds Typically augmented by the school’s general obligation 6 KEY DEBT FINANCING CONSIDERATIONS The private school faces a number of considerations in deciding to borrow and then determining the type and amount of debt financing that best meets its needs and constraints. Major considerations, along with some relevant commentary, include the following: Amount and Purpose of Borrowing: Small borrowings for projects or general working capital needs are best structured as bank loans or revolving lines of credit. As discussed at greater length in forthcoming sections, working capital is generally not a qualified purpose for tax-exempt financings. In addition, the transaction costs for tax-exempt transactions tend to be higher than those of comparably sized taxable financings. Consequently, for smaller transactions, any interest cost benefit of a tax-exempt financing is often negated by such higher transaction costs. As a general rule, a school undertaking a direct borrowing of $3 million or less is best served going to a bank rather than the capital markets. Banks are the best resource for such financings and such transactions can be integrated readily with other services (depository, checking, cash investment management) provided by the bank. The advantages of borrowing in the capital markets in terms of lower interest cost and structuring flexibility become significant for transactions of $5 million or more, particularly if the debt is tax-exempt. Larger borrowings tend to be for “hard” assets such as land, buildings and equipment which qualify for such debt. School’s Financial Resources: Debt capacity and the structure and cost of specific debt will be defined and limited to a large extent by the historic financial performance and current financial resources of the school. The primary evidence of such performance and resources is the school’s financial statements. Such factors as balance sheet strength, debt service coverage ratios, fundraising success and investment portfolio performance are significant. For borrowers undertaking relatively large financings, the more accommodating lenders and investors will give weight to (1) financial projections depicting future levels of net income adequate to service the proposed debt and (2) a large capital campaign which is meeting its milestones in terms of pledge amounts and collections. Market Demographics and School Market Position: Strong demographics and demonstrated sustained demand for private school education in the borrower’s “market area” is a major lending and investing consideration. Of equal importance is the school’s success in its market at consistently attracting students at its tuition “price points” and maintaining respectable matriculation and college admissions statistics. Quality of Management and Education: The collective level of engagement by parents, board members and senior management in the school’s finances and borrowing activity is a key indicator of financial and operational stability and breadth of community and “stakeholder” support. Decision making processes which reflect robust planning and analysis, vigilant monitoring and well-coordinated communications among the various stakeholders is important. Equally important is management depth in numbers and in relevant expertise and experience. The relative success of the school in addressing its 7 mission can be readily measured by considering matriculation rates, student turnover rates, and in the case of high schools, SAT scores and percentage of graduates progressing to college. 8 TAX-EXEMPT FINANCING The tax-exempt bond market is unique to the United States. Its creation was and the combined result of the U.S. Constitution which recognizes certain special rights of each of the United States and the U.S. tax laws which, pursuant to the Constitution, exempt from income taxation the interest income on obligations issued by state and local governments or governmental entities. Until the mid-1960s, the tax-exempt bond market was almost entirely the province of governmental borrowers. However, amendments to, and more liberal interpretations of, the Internal Revenue Code combined with the ingenuity and drive of capital market intermediaries and bond attorneys have expanded access to tax-exempt financing to other types of borrowers than governments. One such type of borrower is the non-profit institution qualified under IRS Section 501(c)(3). As a result of the growth in the national economy and the broader deployment of tax-exempt financing, total annual dollar volume of public tax-exempt debt has grown from $55 billion in 1980 to over $350 billion in 2004.3 Relative to the taxable debt market, the tax-exempt bond market has proven to be not only a source of lower cost capital but a provider of capital on more favorable terms. Tax-exempt debt can be issued readily on a long term (20 to 30 years) fixed rate basis. In contrast, most taxable debt financings, other than very large issues for investment grade rated borrowers, are more typically structured with a floating rate and a shorter term. In addition, the financial covenants of tax-exempt debt tend to be less restrictive than those of taxable debt. Such covenants relate to liquidity requirements, minimum acceptable debt service coverage levels, issuance of additional debt and the disposition of surplus capital and assets. The tax-exempt market’s legacy of more lenient terms is in no small part due to the prudent and conservative nature of its most prevalent borrowers – governments, agencies, authorities and non-profit institutions. There is some price to be paid by the borrower in exchange for access to lower cost financing on more favorable terms. That price comes in the form of transaction costs which are often higher than those of taxable transactions. However, generally, the long term cost savings from a tax-exempt issue significantly exceed the incremental transaction costs. Moreover, a significant amount of the transaction costs can be funded with tax-exempt proceeds and thereby amortized over the term of the financing. The majority of transaction costs relate to the services of the financial intermediaries and professional services firms (various legal counsel, financial advisor) involved in the transaction. The complexities of the tax laws and certain financing techniques generally require more legal research and documentation, quantitative analysis and evaluation and financial structuring in order to achieve an optimal financing solution. The description that follows regarding “eligible” borrowers, eligible uses of tax-exempt bond proceeds and the unique issues associated with religiously affiliated schools will provide a flavor of the complexities to be navigated by the private school borrower in a tax-exempt transaction. 1. Eligible Borrowers Generally, only state and local governments, agencies or authorities can issue tax-exempt bonds. However, a non-profit corporation can access the tax-exempt market by having 3 Sources: The Bond Market Association and The Bond Buyer, January 3, 2005. 9 such a governmental entity issue bonds “on behalf of” the non-profit and then lend the proceeds to the non-profit as borrower. In such cases, the entity issuing the bonds is said to be serving in a “conduit” capacity and has no direct repayment obligation with respect to the bonds. To qualify for tax-exempt financing, the non-profit borrower must be a “501(c)(3) corporation”. In order to be a “501(c)(3)”, the institution must be organized and operated for a religious, charitable, scientific, educational or related purpose. That assessment is made by the Internal Revenue Service pursuant to an application and review process. If that process is favorable, the IRS issues a “determination letter” that the borrower qualifies. Examples of non-profit educational organizations include private colleges and universities, private elementary and high schools, research institutions and special purpose foundations supporting such organizations. Colleges and universities were among the earliest type of non-profit to source capital in the tax-exempt markets. It was not until the early 1990s that private K-12 schools began to follow suit. Tax-exempt bond issues by independent schools cover a broad spectrum of size, credit quality and location From AAA-Rated (St. Paul’s School – New Hampshire) to Baa3-Rated (Oakwood School – California) From $4.46 million (Green Acres School – Maryland) to $44.635 million (Brunswick School – Connecticut) Private school bond issues have been completed in virtually every state in the U.S. The states in which the largest number of rated bond issues have been completed are4: 3 Massachusetts 3 New Hampshire 3 Connecticut 3 Virginia 3 New York 3 New Jersey 2. Eligible Uses of Tax-Exempt Bond Proceeds There are five basic categories of expenditures eligible for tax-exempt debt, each with its own unique limitations under the tax laws: 4 “Project” Costs: The primary costs associated with any financing are, of course, those of the “project” itself. The project can include the acquisition or construction of land, buildings, equipment and related infrastructure. Such assets must be owned directly by the borrower (or an affiliated non-profit entity such as a foundation or alumni association) and used primarily for the non-profit’s mission as opposed to an unrelated business activity. The cost of the assets can include certain soft costs such as engineering, architectural, legal and brokerage fees. As is almost consistently the case with any general limitation in the laws applicable to tax-exempt finance, there are “de-minimis” exceptions. For instance, up to five percent of the proceeds of a tax-exempt financing can be used for otherwise prohibited purposes (characterized by bond attorneys as the “bad Moody’s Investors Service. 10 money” exception) such as working capital, certain facilities used for profit making enterprises and financing costs in excess of two percent. Prior Debt: As long as the proceeds of outstanding taxable debt were spent on eligible project costs, proceeds of a tax-exempt issue may be used to refinance such debt. Likewise, a tax-exempt issue can be used to refinance a prior taxexempt issue. However, it can often be the case that the prior tax-exempt issue is a fixed rate transaction which is “call protected”, that is, not subject to immediate repayment. In such instances, the tax-exempt refinancing must be structured as an “advance refunding” of the prior issue. The tax laws allow non-profits only one advance refunding for the specific projects earlier financed. Reimbursement: It is not uncommon for a private school to spend capital on the initial or preliminary costs of a project with the expectation of financing the majority, if not all, of that project’s cost with tax-exempt bonds. Federal tax regulations impose a general prohibition on reimbursement to the school of such expenditures from bond proceeds. However, they also provide a series of exceptions which in most instances should enable a school in a properly organized financing effort to secure reimbursement. Those exceptions are as follows: – If prior expenditures were funded with proceeds of a loan still outstanding at the time of the tax-exempt issue, such expenditures may be repaid, as described above in “Prior Debt”. – Select “soft costs” paid prior to the commencement of acquisition or construction of a project may be reimbursed to the extent of 20% of the issue price of the bonds. Soft costs could include, for instance, architectural, engineering, and similar professional services, but not the actual costs of land acquisition or construction. – Any other capital expenditures including costs of issuance paid before issuance of the tax-exempt bonds may be reimbursed, but only if “Official Intent”, typically through the adoption of a “Reimbursement Resolution”, has been established by the school’s board. Any such costs incurred more than 60 days before adoption of such a resolution will not qualify. This rule is an unfortunate trap for unwary and uninformed schools which advanced funds in anticipation of an eventual tax-exempt issue. Compliance through adoption of a properly crafted Reimbursement Resolution is a simple and inexpensive undertaking which in no way binds the school to the project or bond financing unless it determines subsequently to proceed with the project. There is one additional limitation on reimbursement of this category of capital expenditure. The reimbursement must occur no later than 18 months after the later of (1) the date the original expense is incurred or (2) the date that the project is placed in service, but in no event more than three years after 11 the expense is incurred. Interestingly, for schools involved in major facility developments and incurring considerable costs in advance of a planned tax-exempt financing, the best way to assure that early costs can be reimbursed may be by borrowing such costs under a line of credit facility, then repaying the borrowed funds with the proceeds of the tax-exempt bond issue. Because reimbursed funds are considered “spent”, the school may apply or invest such funds however it sees fit without further limitation under the tax code provisions governing bond proceeds. Working Capital: The practical effect of federal tax regulations on the use of tax-exempt bond proceeds for working capital is to limit the amount of such working capital to 5% of the principal amount of the bonds less any reserves, provided that such working capital is to be used in connection with the project being financed. Select Other Costs: The nature and complexity of most school financings are such that various other costs must be incurred. Those include costs of issuance, capitalized interest and a debt service reserve fund. Costs of Issuance typically include all costs incurred directly to facilitate the financing including underwriting and bank fees, rating agency fees, and legal and financial advisory fees (but not the cost of credit enhancement). Up to two percent of the principal amount of the bond issue may be spent on costs of issuance. Any additional costs must be funded with borrower cash or the proceeds of a separate taxable financing. Capitalized Interest is eligible for tax-exempt financing in an amount necessary to fund interest during the period of construction and for up to one year thereafter. Most private school tax-exempt bond issues are structured as revenue bonds and the underwriters or banks require that the bond issue have a Debt Service Reserve Fund as a first source of money in the event of the school’s failure to make a timely payment of debt service. The federal tax laws limit the amount of the Debt Service Reserve Fund to the lesser of 10% of the bond issue amounts, 125% of average annual debt service of the bonds or maximum annual debt service. 3. Restrictions on Investment As a general rule, the non-profit school may not profit by investing the proceeds of its tax-exempt bonds at yields higher than the interest cost of such debt. Such profit, often called “arbitrage income”, must be rebated to the U.S. Treasury Department or otherwise avoided through yield restricted investments. There are several exceptions to this rule which for the most part are of no or limited benefit to a private school transaction other than the “reimbursement” exception noted above. 12 4. “Replacement” Proceeds There is a corollary concept to the general prohibition of arbitrage of tax-exempt proceeds. That rule applies to funds which are effectively “replaced” by tax-exempt proceeds. Such funds comprise money that has been raised, segregated or earmarked specifically to finance the same project to which the tax-exempt issue applies. In such an instance, any income earned on such funds in excess of the borrowing cost of the associated bond issue is likewise subject to rebate or yield restriction. This rule may represent a significant imposition on such money. However, with proper advance planning by a financial advisor and legal counsel, the problem of “replacement” proceeds can be avoided or minimized. Part of such planning entails review of capital campaign literature before publication and proposed Board resolutions and initiatives in each instance to assure that existing or future collected funds are not so restricted in their application as to give rise to the restriction. 5. Pledges, Fund Balance Requirements, Collateral Often, to assure the feasibility of a transaction or to lower its cost of capital, a private school will consider some or all of the following techniques to further secure proposed debt: Pledging a portion of its endowment Agreeing to maintain fund balances above a minimum required level Securing collateral from a third party (eg. a donor or foundation) such as securities or bank accounts Without appropriate structuring of such terms, the yield on such funds will be effectively restricted to the school’s associated borrowing cost. Again, creative advance planning with the assistance of knowledgeable professionals can help a school navigate such tax law pitfalls while achieving its desired objectives. 6. Special Rules – “For Profit Activities” The IRS has crafted a series of complex rules designed to curtail, and define the permissible scope of, involvement by private enterprise in tax-exempt borrowings as well as the operations by non-profits of “for-profit” endeavors in tax-exempt financed facilities. Still, there are various legitimate circumstances under which private enterprise can or must become involved with a private school in connection with the development or management of a school or certain elements of its operations. Examples include the following: A developer undertaking a design-finance-build agreement with a non-profit school for the development of school facilities. 13 A for-profit education services company providing turnkey management of a non-profit private or charter school. Private companies operating the private school cafeteria, bookstore, parking lot or other on-campus enterprises, and in that connection, possibly leasing school facilities and space. The operation in a tax-exempt financed facility of a summer camp, private social functions or other for-profit ventures not directly related to the school’s nonprofit mission. The following is a brief summary of applicable rules. However, each school is advised to consult with experienced legal counsel regarding the application of relevant tax laws to its proposed endeavor to assure compliance and avoid compromising the tax-exempt status of an outstanding or forthcoming bond issue. Private Use Rules: In general, federal tax law disallows the use of tax-exempt bonds to finance facilities which are unrelated to the school’s mission or which are reasonably expected to be used consistently for “for-profit” endeavors. Consequently, a private school can not, for instance, develop a shopping center or commercial office building on school land with the proceeds of a tax-exempt financing. In addition, a school must be vigilant not to engage in excessive forprofit enterprise in traditional school facilities already financed with tax-exempt bonds. There are “de minimis” exceptions to the rule which generally enable schools to conduct legitimate ancillary activities on campus such as a cafeteria, bookstore or convenience store. Management Contracts: There are specific rules which govern the legal and financial relationship between private management companies and non-profit taxexempt borrowers. Those rules specifically limit the term of, and compensation structure under, such agreements. 7. Special Considerations – Religiously Affiliated Schools Private schools which are religiously affiliated must navigate some additional laws in connection with a tax-exempt borrowing. Those laws comprise the First Amendment of the U.S. Constitution relating to the establishment of religion, similar provisions in the constitutions of the state in which the school is located and the evolving body of case law interpreting those constitutional provisions. As a general matter, the relevant case law in recent years has taken a decidedly liberal turn with the result that most religiously affiliated schools have little difficulty using tax-exempt debt in the same manner as their non-sectarian counterparts. The following are general factors upon which bond counsel rely in evaluating a candidate school and the purpose of its financing: the neutrality of the law or program (ie. does the law treat all borrowers the same regardless of religious affiliation?) 14 the nature of the aid (ie. are the bonds being used for secular as opposed to primarily religiously oriented facilities, such as a chapel?) the nature of the activities conducted on campus and the recipients of the assistance (schools which conduct primarily religious activities, as opposed to an academic program, for students of uniformly one faith are likely not going to be eligible for a tax-exempt financing) the nature of the borrower (schools which discriminate in their admissions policy based upon religious affiliation likewise will probably not qualify) the extent to which there are other fundamental rights which must be reconciled. Provided that a religiously affiliated school and its policies, programs and activities pass bond counsel analysis, the only practical limitations on tax-exempt bonds is that the proceeds cannot be spent on a building used for religious worship or primarily for religious training. 8. Creative Applications of Tax-Exempt Finance The combination of relatively lower interest rates available in the tax-exempt bond market and a wealth of financing structures and techniques offer private schools opportunity to craft highly customized transactions. Those transactions can be designed with reference to such considerations as: attempting to achieve the lowest possible interest cost over a specific timeframe, tailoring debt service to specific near term budgetary constraints or longer term financial projections and objectives, enabling the school to maintain higher degrees of liquidity by conserving cash that might otherwise have to be spent on project costs, and likewise enabling the school to maintain investments in endowments or reserves that might otherwise have to be liquidated to fund project costs. With respect to both short term and long term investments in the school’s portfolio, there are a number of interesting strategies to deploy fixed income investments as (1) “hedges” against adverse interest rate movement or (2) effectively as a resource to subsidize the payment of debt service while invested at yields higher than the interest cost of the borrowing. Generally, any calculation of the compounded return available from long term investments in balanced accounts versus the cost over a similar term of a taxexempt transaction serves as a compelling argument for a school to leverage its balance sheet and hedge the debt with its financial assets. There are significant benefits associated with both fixed rate borrowing and variable rate financing with tax-exempt obligations. Fixed rates, particularly in recent times, have been available at low or near low 30 year levels. The combination of rates which are as much 15 as 200 basis points lower than taxable rates and the ability to amortize such debt over as much as 30 years offers schools the opportunity to secure significant amounts of debt in the capital markets (much more than available from banks) on an affordable basis. Many schools have opted for variable rate demand bond (VRDB) financing over fixed rate obligations out of conviction that VRDBs offer the potential for a lower average cost of borrowing and greater future financial flexibility (ability to repay debt at par, to refinance more readily or to borrow additional funds more easily). 9. Financing Process and Structures The timetable for a project and its tax-exempt bond issue can be as short as 90 days or run over several years depending upon the size and complexity of the project and financing and the school’s finances. The following sample timetable is indicative of the various elements, timing and required coordination in a bond issue. 16 Sample Financing Timetable Month: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Preliminary Planning Phase Project Scope Development Reimbursement Resolution and Board Approval for Project Preliminary Design/Engineering/Land Use Planning Internal Feasibility and Debt Capacity Analysis Development Phase Final Design (Plans & Specs) Bid Package Development Construction Bid/Contract Negotiations Permitting – Land/Environment/ Bldg. Finance Plan Determination Financial Model/Financial Projections Assessment of Financing Options Competitive Financing Selection Process Bond Issuing Authority Approval Process TEFRA Hearing Inducement Resolution Other Local Government Approvals Transaction Structuring Determination of Security Structure Transaction Documentation and Development of Preliminary Official Statement Credit Rating Process Transaction Execution Marketing and Pricing of Securities Competitive Bidding of Investment of Proceeds Derivative Products Closing and Delivery of Securities A. Preliminary Planning A thorough analysis of a private school’s operating and facility needs and constraints as well as its financial resources is a key first step in establishing the feasibility and utility of debt financing for the school. The extent of that exercise can vary widely depending upon numerous factors including the age and size of the school, the size and condition of its grounds and facilities, specific facility needs and the school’s financial condition and capital fundraising program. The school is well served to develop and maintain a Strategic Plan, a Facilities Plan and a Financial Plan. 17 18 The Strategic Plan relates to the school’s operations, finances, facility requirements and mission and goals. It addresses the school’s objectives in multiple respects – organizational, academic, extracurricular, financial, facility-wise, community-wise – and lays out a plan of action for achieving those objectives. It also helps to assure consensus among the school’s key stakeholders with respect to the strategic direction of the school. The Facilities Plan (or capital improvement program) describes the existing facilities of the school; identifies maintenance, expansion and new facility needs and projects and prioritizes those projects based upon such factors as health, safety, regulations, academic importance, cost and competing schools. The school’s Finance Plan details the manner in which the school intends to fund planned facility development, acquisition, renovation or expansion. It describes the estimated timing and cost of the projects and the proposed sources of capital to fund those costs. Generally, debt financing is a major form of such capital. The Finance Plan should relate the school’s current and projected finances to such debt in order to demonstrate the key conditions to continued financial stability. This can be done most effectively through the development of a financial model which reflects historical and projected revenues, operating expenses and debt service and which depicts key financial ratios on prospective financing. In short, the financial model can help the school’s management and board determine the school’s debt capacity, future debt affordability and important conditions underlying continued financial stability. An independent financial advisor can help a school’s management and board to organize and analyze financial data, projections, project priorities and costs and then develop a coherent and feasible Finance Plan. For a real estate project, the financial analysis and planning process can be conducted in tandem with other elements of the overall project development process such as preliminary design and engineering, legal and capital campaign program. As with the school’s Strategic Plan, the process associated with the development of the Finance Plan, if conducted properly, is an ideal way to help assure stakeholder consensus and for approved projects, support for the forthcoming financing effort. B. Transaction Planning Once specific projects have been identified, a finance plan for those projects has been developed, and the project timetable indicates the upcoming need for funding, the next step for a school is to launch a transaction planning process. In light of the multitude of potential sources of capital, and capital financing structures and techniques, a financial advisor can play a helpful role in developing 18 and conducting a process for helping the school to evaluate and choose among alternatives. Specific elements of such a process should including the following: Finance Plan: The Finance Plan should be finalized. It should identify a specific preferred financing amount, structure and timetable or financing scenarios under consideration. It should include analysis from the school’s financial model which demonstrates the school’s ability to service the proposed debt. The model should include a breakdown of revenues by sources and expenses by component with a narrative that explains the underlying assumptions and basis for those assumptions. A financial advisor can plan a particularly helpful role in developing the financial model, running various financing scenarios and helping to assure realism in the development of the school’s “Base Case” financial projections. Legal Consultation: The private school is well served involving qualified legal counsel in its project planning process at an early stage. Counsel can play an integral role in addressing the array of real estate, contract, regulatory and tax issues that typically arise with a new capital project. Of particular importance will be those issues unique to taxexempt bond financing which must be navigated – the school’s eligibility, the eligibility of the project and the governmental issuer approval process. Although the school’s counsel can play a helpful role in preliminarily analyzing such matters, those matters will ultimately have to be addressed by “Bond Counsel”, an independent law firm which will provide a legal opinion that the bonds are enforceable obligations of the school and that their interest is exempt from income taxation. Early consultation by the school with its legal counsel (“Borrower’s Counsel”) and the bond counsel firm of the issuing government or authority for the school’s prospective bond issue can help assure that the school does not run afoul of important rules (eg. reimbursement, eligible cost) to its financial detriment. Assessment of Financing Options: In concert with the development of financial projections and a Finance Plan, the school should undertake an assessment of its financing options. Under most circumstances for a transaction of $5 million or more, tax-exempt financing will be the superior financing alternative in terms of capital cost and legal provisions. Other aspects of the transaction should be considered during this phase including the debt’s term, interest rate modality, amortization structure and security structure. The judgment and practical business experience of management and the board should be brought to bear in determining a structure or alternate structures which best address the school’s needs and constraints. Competitive Selection Process: Once the school has determined its preferred financing approach, it is well served conducting a competitive procurement of the financing. Such an exercise will provide the basis for 19 an open and fair evaluation of financing candidates (investment banking firms and/or commercial banks), their qualifications and capabilities and any creative techniques or structures which may serve to optimize the outcome of the financing. At the same time, such a process will engender competitive pricing proposals for services and assurance of the basic terms and provisions of the proposed transaction from the financing candidates. Typically, such a process is initiated through the distribution of a written request for proposals which requires a written response to specific questions relevant to both the candidate’s qualifications as well as the financing. Often the board or management will designate a finance committee or chief financial officer to shepherd the procurement process. The written proposals, often followed by interviews of those candidates with the most favorable proposals, should provide the committee or finance staff with the information reasonably necessary to make an informed selection of both its financing source and type of financing. The culmination of the transaction planning process should be the following: selection of a financing team, determination of a basic financing structure (fixed rate, variable rate or combination), and verification of financing feasibility, cost and major terms. With that, the school should be well prepared and positioned to proceed with the actual development and execution of its financing. The illustration below lists the key participants in a bond financing: BORROWER Attorneys Bond Counsel Borrower’s Counsel Underwriter’s Counsel Trustee’s Counsel Bank Counsel (Lender, Letter of Credit Provider) Financial Intermediary Issuer Underwriter (Public or Private Sale) Bank (Loan) Remarketing Agent (VRDBs) Others Accountants Bond Trustee Credit Enhancers – Bond Insurer – Bank (Letter of Credit Provider) Financial Advisor Rating Agencies 20 C. Financing Structures and Options The phrases “financing structure” and “structuring a financing” relate to the various elements of a transaction described earlier, namely: (i) (ii) (iii) (iv) (v) manner of placement or sale taxability of interest income interest rate modality term and amortization structure, and credit structure Because the majority of debt financings undertaken by independent private schools for facilities over the past decade have been (1) long term, (2) tax-exempt and (3) revenue bonds, the discussion below focuses primarily on the basic framework and structuring options for financings which combine those elements. Credit Structure: Only the most extraordinarily wealthy private schools can look forward to a “general obligation” credit structure for large, facility based financings. General obligation debt is backed only by the school’s unconditional guaranty to pay. Investors’ and lenders’ willingness to accept such an unsecured guaranty would be based upon the substantial financial resources of the school, as possibly further evidenced by very high investment grade credit ratings. There are instances in which financial institutions and capital markets investors will accept a credit structure pursuant to which their security is limited to (1) the project being financed and/or (2) other specific collateral such as land, equipment, or financial investments. However, such transactions tend only to be viable in cases when there is a very low “loan to value” ratio and where the collateral is a crucial asset of the school. The most frequently used credit structure underlying a debt issue has come to be characterized as the “revenue bond”. Typically, regardless of the project(s) being financed, the school will pledge the following to secure a revenue bond: à à à all of its “net revenues” all of its real estate comprising its campus (secured by a mortgage or dead of trust) some or all of its personal property (furniture, fixtures and equipment) Depending on the school’s financial strength and the amount of the transaction, banks and underwriters may seek the inclusion of one or more of the following to additionally secure the financing: 21 à à à the school’s general guaranty a pledge of some or all of its financial assets (working capital, reserves, endowment) third party collateral or guarantees The basic security structure of a revenue bond issue is typically augmented by a series of covenants, all articulated in the major bond documents (indenture, loan agreement, etc.). Those covenants are designed to foster prudent management and financial performance and to establish minimum acceptable standards in that regard. Examples of such covenants include the following: à à à à à à à rate (or revenue) covenant liquidity covenant maintenance of reserves and endowment above certain minimum levels delivery of financial information on a timely basis limitations on additional encumbrances limitations on additional debt limitations on the sale or disposition of major assets For a school with outstanding debt, crafting the security structure can be particularly challenging. Sometimes the terms of the outstanding debt expressly allow additional debt, but on terms which are not feasible or acceptable. In such instances, it is not uncommon for the school to refinance or “defease” such earlier debt in order to secure covenant relief or to release the security of that debt in favor of the transaction at hand. Interest Rate Modality: The two basic options for a borrower with respect to interest rate are (1) fixed and (2) variable. The level of fixed rates available to a tax-exempt borrower will be a function of (1) the term of the debt and (2) the credit ratings of the transaction, or in the absence of credit ratings, the perceived credit quality of the borrower versus others in the non-rated sector of the market. Fixed rates in the tax-exempt market are in turn driven by such factors as (1) taxable yields, particularly those for U.S. Treasury obligations, (2) the marginal income tax rates for individual and institutional investors and (3) the relative levels of supply and investor demand for tax-exempt obligations. A period of sustained economic difficulty and large U.S. government deficits from the late 1960s through the early 1980s caused interest rates in all domestic markets to rise to double digit levels. The period from 1982 to early 2000 witnessed a general decline in interest rates, punctuated by periodic increases. By June, 2003, interest rates in the domestic debt markets had reached a nearly 40 year low point. In the 22 early 1980s, in response to unaffordably high fixed interest rates, the investment banking community developed a variable rate financing technique called variously “low floaters”, “floating rate bonds” and most commonly, variable rate demand bonds (“VRDBs”). Overview of VRDBs Low Rate – In exchange for highly secure credit quality and liquidity, and a put right supported by a bank letter of credit, investors in VRDBs are willing to accept yields which are usually significantly lower than long term fixed rates. Interest rate – Reset daily, weekly, monthly, semiannually, annually (in some cases a commercial paper structure is possible). Liquidity Facility – At a minimum, VRDBs must be secured by a highly rated bank letter of credit which provides “liquidity” that guarantees investors repayment of their investment on an interest rate reset date if they “put” their bonds. Credit Enhancement – More often, a letter of credit provides long term credit enhancement as well as short term liquidity. With credit enhancement, a bank unconditionally guarantees repayment of a defaulted bond. Remarketing – On each interest rate reset date, a remarketing agent renegotiates the interest rate on VRDBs on behalf of the borrower. The Market – VRDB interest rates are first and foremost driven by supply and demand in their own market and secondarily by conditions in the economy and taxable debt capital markets. The “BMA Index” is an industry average, published daily, of the interest rates on outstanding VRDBs. Interestingly, despite the relatively low fixed interest rates available to tax-exempt borrowers in recent years, many governmental and nonprofit borrowers, including private schools, have continued to opt for variable rate financing. The reasons for using VRDBs have been and continue to include the following: à potential to realize significant interest cost savings versus the fixed rate alternative, thereby making a project more affordable or increasing the school’s borrowing capacity, à “flexibility” in the respect that VRDBs can be repaid partially or fully at any time without the type of early redemption protection or prepayment penalties typically associated with fixed rate bonds, à potential for lower costs of issuance, although in recent years, the relative costs of issuance for fixed rate bond issues have declined appreciably. Credit Enhancement: The two types of credit enhancement used most commonly in the tax-exempt bond market are letters of credit and bond insurance. Bond insurance and an “unconditional” letter of credit 23 are used to assure investors the repayment of principal and any unpaid interest due on a bond issue which has defaulted. The practical effects of deploying credit enhancement are to give the borrower access to a segment of the bond market otherwise unavailable (eg. the VRDB market, investment grade only mutual funds) or to lower the borrower’s overall interest cost. Generally, banks will offer letters of credit only for fixed periods of three to seven years. Consequently, they are only available for use with VRDBs. Bond insurance can be used both for VRDBs (although a line of credit would also be required for the liquidity requirement) and fixed rate bonds. The cost of credit enhancement can be fully capitalized in a tax-exempt bond issue. However, there must be a demonstrated “net savings” in debt service as a result of its use. Calculations demonstrating such savings net of the cost of the credit enhancement can be provided by a financial advisor. Although the credit ratings of banks which provide credit facilities for VRDBs range widely within the investment grade rated sector, the credit ratings of most of the major bond insurance companies (MBIA, FGIC, AMBAC) are “AAA”. For the most part, bond insurance companies seek to enhance private schools already capable of securing an investment grade credit rating. Consequently, bond insurance would not be available to most private schools. Notably, one lower rated (“A”) bond insurance company (FSA) has provided bond insurance for non-investment grade quality schools in limited instances. In recent years, bank letter of credit providers have been decidedly more lenient than the major bond insurance companies in their credit criteria for private schools, particularly schools located in the bank’s service area. Unlike bond insurance companies which provide a one-time service for a one-time premium, banks in most instances seek a broader relationship with their customers and will look to marry a credit facility with bond underwriting and remarketing services, a checking and depository relationship and investment management support. Derivative Products: “Derivatives” are versatile financial instruments which can be used in asset or debt management or with respect to a debt financing to achieve a specific financial objective or to limit the user’s financial risk. Examples of derivative products include: à à à à interest rate swaps interest rate caps interest rate collars swaptions 24 Overview of Swaps What is a Swap? An interest rate swap is an agreement to: 3 Exchange a floating interest payment for a fixed interest payment 3 Based upon a specific notional principal amount 3 For a defined time period 3 Tax-exempt floating rate is driven by variable rate bond market (usually BMA Index) How can a swap be used? 3 Interest Rate Management Adjust the duration of assets or liabilities to reflect the borrower’s interest rate management strategy 3 Enhance Asset Yield Create synthetic fixed or floating rate assets with higher yields 3 Arbitrage Capitalize on relative inefficiencies between two markets 3 Lock Interest Cost Create “synthetic” fixed rate debt for a specific period Eliminate interest rate risk for future floating rate debt Structure a synthetic advance refunding 3 Asset/Liability Management Achieve the desired balance sheet match of fixed rate or variable rate assets and liabilities Interest Rate Swap Example Borrower has an outstanding long term variable rate bond issues and desires to fix interest cost on its borrowing for the next five years. Borrower enters into a five year Interest Rate Exchange Agreement with a highly rated financial institution under which the Borrower pays a five year fixed rate (eg. 3.5%) and receives a variable rate payment. Borrower continues to pay the weekly floating rate, annual letter of credit and remarketing fees on its outstanding variable rate bond, and either pays or receives the net difference between the fixed rate and BMA. Total approximate annual interest cost = 4.75% (assumes 1.25% for remarketing and letter of credit fees). Fixed L.C. & Remarketing Fees (1.25%) L.C. Bank Swap Client Swap Counterparty Variable (1.5%) (BMA) Variable (1.5%) Variable Rate Bondholders Floating Rate Received on Swap Floating Rate Paid on Bond Issue Letter of Credit Fee on Bond Issue (estimate for next 5 years) Remarketing and other Fees on Bond Issue Fixed Rate Paid on Swap Total Effective Cost + 1.500% (BMA) - 1.500% (assumes current weekly rate is 1.5%) - 1.125% - .125% - 3.500% 4.750% 25 Derivatives have a provocative reputation because of well publicized episodes in which they were deployed by major borrowers that either did not understand or ignored the financial risks associated with these financial instruments. Used properly and on a fully informed basis, derivative products can help a school tailor the debt service of a bond transaction to its budgetary constraints and within its tolerance of risk. It has not been uncommon for banks to encourage or require the use of an interest rate swap to “hedge” a school against interest rate risk in a VRDB issue. A school considering such a proposal is well advised to consider (1) the necessity of such a hedge, (2) the term and risks of the proposed swap and (3) whether it is an absolute condition of the issuance by a bank of the letter of credit. In any case, securing an interest rate swap or any other derivate product should be done through an open, competitive bidding process. The interest rate swap market is complex and inefficient and schools should not enter it without the benefit of a thorough understanding of its risks, mechanics and costs. D. Financing – Structuring Phase The outcome of a school’s financing in terms of timeliness, transaction cost and cost of capital will be driven in large part by the quality and thoroughness of planning throughout the financing process. At the structuring phase, the school will focus on the following details working closely with its legal counsel, financial advisor and underwriting/banking professionals: Financing Timetable Bond Issuance Process – Issuer application – Issuer review and approval – Required hearings Bond Issue Structure – Term – Interest Rate Modality – Credit/Security Structure – Credit Enhancement – Credit Ratings Key Information Requirements – Audited Financial Statements – Financial Projections – Material Information About School, Management and Project Bond Marketing Process – Private Placement 26 – Public Offering Credit Rating/Credit Enhancement Process – Presentations – Confidential Consultations – Bond Insurance Companies (Fixed Rate Bonds) à Bond Insurance à Reserve Fund Surety – Letter of Credit Banks (VRDBs) à Term Sheet à Commitment Letter Transaction Documents – Bond Indenture or Trust Agreement – Financing (Loan) Agreement – Bond Offering Document/Disclosure Matters à Private Placement Memorandum à Official Statement – Bond Purchase Agreement – Issuer and Borrower Certifications – Real Estate Legal Documents Typically, the professionals representing the underwriter or bank in a transaction take the lead in managing and orchestrating the structuring process for a financing. Borrower’s counsel and financial advisor should play an active role in representing the school to assure generally that the school’s legal and financial interests are protected and specifically that the transaction is being structured and implemented on terms and at a cost consistent with the underwriter’s or bank’s proposal. A “working group” comprising the school’s chief representative(s) (president, chief financial officer, business manager), school legal counsel and financial advisor, bank/underwriter and counsel and bond counsel will collaborate in the development and review of the transaction documents until they conform optimally with the school’s finance plan and preferred financing structure. Generally, the documentation process will occur over a six to twelve week timeframe depending on such factors as the complexity of the transaction, bond issuer requirements and number of individuals involved in generating and revising the documents. For any capital markets-oriented transaction, the culmination of all of the efforts of the working group during the structuring phase will be final drafts of all of the basic transaction documents and either a Private Placement Memorandum (PPM) or a Preliminary Official Statement (POS) to be used in the offering and sale of the bonds. E. Financing – Execution Phase The process for marketing bonds and finalizing pricing (interest rate and fees) varies depending on the type of financing (fixed vs. variable rate) and if a fixed rate public offering, whether the bonds have investment grade credit ratings. 27 Accordingly, the following is a brief overview and comparison of the process for each of those scenarios. Variable Rate Demand Bonds: The initial offering and sale of VRDBs has become a highly mechanical process. The vast majority of VRDB investors are institutions, primarily mutual funds and insurance companies. The marketplace is deep and efficient. The interest rate on the bonds is driven primarily by (1) the short and long term credit ratings of the letter of credit provider and (2) the interest rate adjustment period, and secondarily by (3) the efforts, reputation and expertise of the underwriter/placement agent. Typically, the offering document for VRDBs is distributed three to ten days before pricing, and the VRDBs are all priced and sold within one day with closing scheduled within a week after sale. Fixed Rate Bonds – Rated: Over the past decade, information and telecommunications technology has streamlined and compressed significantly the offering and pricing process for credit rated fixed rate tax-exempt bonds. Although underwriters will still make a POS available in printed form, the market is migrating to a primarily electronic based system of information dissemination, with the POS, for example, being distributed via email to prospective, qualified investors. The overarching factor impacting the interest rate or rates ultimately established for the debt is the credit rating level of the bonds. Still, the efforts of individual professionals interacting with the investment community are important and integral to that rate setting process. The bankers, underwriters, traders and investment sales representatives of the school’s underwriting team play an important role in educating candidate investors about the school and its transaction and securing orders from such investors. Ultimately, the final rates on the bonds are established when the underwriting firm has adjusted the rates on the bonds to a level which achieves a reasonable but not excessive level of investor subscription. At that point, the underwriter will present a formal offer to the school to purchase all of its bonds at specific rates, reoffered yields and prices. During the execution phase of the financing, the school’s financial advisor should be playing an active role monitoring the underwriter’s efforts to assure high quality and focused service and “on the market” (ie. competitive) pricing of the bonds. Once the school and underwriter have executed a Bond Purchase Agreement, the school has “locked” in its interest cost on its debt. Typically, fixed rate bonds settle within two to three weeks of execution of the Bond Purchase Agreement. Fixed Rate Bonds – Non-Rated: Of approximately 30,000 independent schools in the United States, approximately 70 currently have investment grade credit ratings5. Although more could secure such ratings based 5 Based on credit ratings provided by one or more of the major rating agencies as of January, 2005. Does not include ratings issued for transactions which included a bank letter of credit or bond insurance. 28 upon their financial statements and the rating agencies’ rating criteria, the vast majority of independent schools in the U.S. are not of investment grade quality. In past times, absent a credit rating or credit enhancement, a school would likely not have access to the fixed rate capital markets. However, as the intermediaries and investors in the tax-exempt bond market have become increasingly familiar with the independent school sector, they have become more receptive to school transactions which are non-investment grade but still “good stories”. The market’s relative enthusiasm for non-rated private school bonds is in no small part driven by the fact that there has never been a reported, uncured financial default of a private school bond issue in the United States. This interesting statistic is testament to the quality of stewardship and stakeholder support which private schools enjoy. 29 CREDIT QUALITY AND RATINGS Credit quality can be measured both on an absolute basis and on a relative basis. On an absolute basis, credit analysts look at the school and its market area to form a judgment about creditworthiness. Key areas of inquiry are summarized below. Key School Performance Factors Market Position 3 Historical enrollment trends and target size 3 Selectivity and yield (matriculation) rates 3 Geographic diversity 3 SAT/ACT scores of graduating students 3 Secondary school and college placement of graduating students 3 Retention Rates 3 Trend of net tuition per student, and future pricing plans 3 Cross-admission (win/loss) data versus primary competitors Financial Resources 3 Balance Sheet strength 3 Liquidity/Capital Reserves 3 Fundraising Operating Performance 3 Operating Margin 3 Annual Debt Service Coverage 3 Revenue Diversity Debt 3 Debt Capacity 3 Outstanding Debt 3 Term of Proposed Debt Management 3 Budgetary/Monitoring Practices 3 Board Composition/Involvement It is the rare school whose circumstances are so distressed that it cannot incur and support some level of debt. Many schools have no practical alternative to debt in order to address mission critical facility needs on a timely basis. The challenge for each school is to determine how much debt it can afford and on what terms. An application of typical credit rating agency financial and operating ratios to the school’s LTM (last 12 month) financial statements and next three to five year financial projections is a proven and effective way to begin to triangulate a debt capacity range. A financial advisor can also play a helpful role in such analysis and provide a formal opinion and supporting debt capacity analysis to help a school’s board and management assess the school’s financing prospects and to determine prudent limits on the amount and type of debt. Many schools develop a Debt Policy to use as a device to maintain a stable financial position and remain in good standing with their investors and lenders. 30 All schools are well served familiarizing themselves with the key credit rating criteria and integrating such criteria into their strategic planning, budgetary and financial management processes. Moreover, those schools with strong performance metrics considering debt financing should consider pursuing credit ratings in connection with such financing regardless of whether fixed or variable rate financing is contemplated. In the case of a VRDB financing, either a published or “shadow” rating can be an effective tool in negotiating the most favorable terms and price for a letter of credit and any type of interest rate hedge. For a fixed rate financing, the credit rating will be the single most significant determinant of the interest cost on the debt. Despite the variability of income taxation on a state by state basis, the tax-exempt bond market is very efficient in correlating yield to maturity and investment grade quality. Consequently, through a preliminary, confidential assessment of a school’s likely credit rating level, and an analysis of the pricing of recent comparably rated transactions, a school should be able to determine what its cost of capital in a fixed rate issue would be at the time within 10 to 15 basis points (.1 to .15%). A school whose finances and proposed transaction appear to qualify for an investment grade credit rating should concurrently explore the availability and cost of bond insurance. If bond insurance is available at a sufficiently low price, the bonds’ credit ratings can be raised to “AAA” rated quality. At the present time, there are three nationally recognized credit rating agencies which provide rating assessments of tax-exempt bond issues: Moody’s Investors Service, Standard & Poor’s Corporation and Fitch Investors Service. Each of these agencies maintain relatively similar criteria, conduct comparable credit assessment reviews and publish credit ratings which attempt to relate on an absolute and relative basis the financial security of a particular transaction. The following rating scale of Moody’s Investors Service is representative of the categories of credit quality: Rating Aaa* Aa1,2,3* A1,2,3* Baa1,2,3* Ba1,2,3 B1,2,3 Caa to C Financial Security Exceptional Excellent Good Adequate Moderate Weak Default * Investment Grade Source: Moody’s Investors Service 31 The following are select median financial and operational ratios and benchmarks for high investment-grade through low and non-investment grade independent school credits6. (Note: Each of the three rating agencies referenced above has slightly different rating guidelines and criteria. Current and detailed rating criteria for each of these rating agencies are available upon request.) Median Aaa Aa A Baa Below Baa Capital Ratios: Unrestricted financial resources-to-direct debt (x) Expendable financial resources-to-direct debt (x) Total financial resources-to-direct debt (x) Total cash & investments-to-direct debt (x) 3.49 6.62 8.87 8.67 2.69 3.10 5.18 4.91 1.33 2.04 2.79 2.66 0.76 1.00 1.20 1.64 0.30 0.34 0.99 1.01 Balance Sheet Ratios: Unrestricted financial resources-to-operations (x) Expendable financial resources-to-operations (x) 2.53 7.71 2.48 3.07 1.62 2.08 0.63 0.73 0.32 0.43 7.8 22,348 9.4 0.9 10,290 2.3 0.9 4,958 1.8 1.0 3,454 2.3 -4.5 4,918 1.5 Contribution Ratios (% of Total Operating Rev.): Net tuition and fees (%) Auxiliary enterprises (%) Investment income (%) Gifts (%) Other (%) 26.3 10.8 44.7 11.9 3.0 40.8 12.6 29.3 7.7 2.3 52.2 9.1 12.8 9.6 1.7 73.2 5.6 5.9 10.2 2.8 62.3 2.9 5.5 6.4 1.1 Market Data and Ratios: Selectivity (%) Matriculation (%) 27.2 66.8 30.4 63.9 45.3 70.6 54.4 59.9 78.0 67.1 Operating Ratios: Annual operating margin (%) Total gifts per student ($) Actual debt service coverage (x) 6 Source: Moody’s ‘Independent School Outlook & Medians 2004-05’ dated August, 2004. Data based on fiscal year 2003 reported financial data and fall 2003 reported enrollment data. 32 HOW AN INDEPENDENT FINANCIAL ADVISOR CAN HELP A knowledgeable and experienced financial advisor can play a crucial role in assisting a private school to secure the most favorable financing, and to maintain its financial integrity on an ongoing basis. Wye River Group is a specialty financial advisory firm focused on providing advisory services to not-for-profit institutions and state and local governments and agencies. Our range of capability includes the following: 3 Capital Analysis and Planning Financial Modeling Financial Projections Debt Affordability Analysis Credit and Credit Rating Assessment Debt Policy Development 3 Debt Financing Support Evaluation of Financing Options Finance Plan Development Competitive Solicitation of Debt Financing Rating Agency/Credit Enhancement Presentations Debt Structuring & Implementation Arbitrage Calculations & Reports NRMSIRs Reports/Annual Reports 3 Investment Counsel Structured Investment of Debt Proceeds Cash Management Reserve/Endowment Asset Allocation Services To serve the needs of our clients, our Firm’s professionals draw on more than 100 years of combined experience as financial advisors, investment bankers, attorneys, educators and federal government executives. Wye River Group’s professionals have completed more than 250 debt, lease and related transactions totaling over $10 billion during their collective careers. Because many of our not-for-profit clients have not previously issued debt or have modest financial statements, our professionals’ credit expertise can be integral to a successful financing effort. With backgrounds in bond finance and law and credit rating analysis, Wye River Group’s professionals have considerable experience in assessing the creditworthiness of non-profit organizations and then assisting such organizations to best position themselves for a debt financing. Our fixed and variable rate financing solutions are designed to meet the unique needs of each not-for-profit borrower. Many non-profit institutions receive gifts and grants that help to insure their long-term viability. These funds can be structured to help support a bond financing, often without any direct security pledge by the institution. 33 Some financings for non-profits require discrete private placement or limited institutional underwritings because investment grade credit ratings may not be achievable. With its extensive experience in low and non-investment grade credits, Wye River Group is well equipped to structure financings for institutions with limited market access. Good planning and strong, independent financial advice are musts for any school contemplating or undertaking a capital financing. 7 King Charles Place Annapolis, Maryland 21401 Ph: 410.267.8811 Fx: 410-267-8235 www.wyeriver.net Kevin G. Quinn Robert F. Doherty Thomas J. Street Christopher O. Wienk 34