AICPA Clarity Project Redrafts AU Sections

advertisement

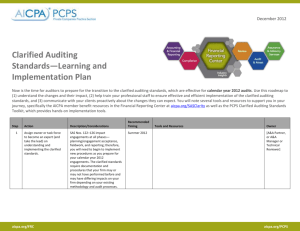

AICPA Clarity Project Redrafts AU Sections In 2004, the Auditing Standards Board (ASB) began an effort to clarify Generally Accepted Auditing Standards (GAAS). This effort has come to fruition nearly a decade later in the form of the American Institute of CPAs (AICPA) Clarity Project. As part of this project, the ASB has redrafted almost all of the auditing sections in Codification of Statements on Auditing Standards (contained in the AICPA Professional Standards). These sections now reflect the ASB’s newly established clarity drafting conventions, which are designed to make the standards easier to read, understand and apply. All AU sections of currently effective Statements on Auditing Standards (SASs) in AICPA Professional Standards are being clarified. As of early 2013, the ASB has completed clarity redrafting of all AU sections except AU section 322, which it expects to redraft and issue as a separate SAS later in 2013. As it redrafted GAAS for clarity, the ASB also converged the standards with the International Auditing and Assurance Standards Board’s (IAASB) International Standards on Auditing (ISAs), which were similarly clarified in 2009. Among other improvements, GAAS now more clearly states the objectives of the auditor and the requirements auditors must comply with when conducting an audit in accordance with GAAS. The newly clarified GAAS are effective for 2012 calendar year audits. Therefore, you will probably begin seeing qualified and unqualified opinions presented differently in your borrowers’ financial statements during the first quarter. Be aware that the reason for the new opinion format is to comply with the ASB’s clarity drafting conventions. For example, the new clarity standards have eliminated the AU section 508 concept of an explanatory paragraph. Instead, AU-C section 706 utilizes the concepts of emphasis-of-matter and other-matter paragraphs. These paragraphs must be included in a separate section with a heading after the opinion paragraph. Winter 2013 Edition ©2013 Reynolds, Bone & Griesbeck PLC