First Metro's ETF Primer - First Metro Philippine Equity

advertisement

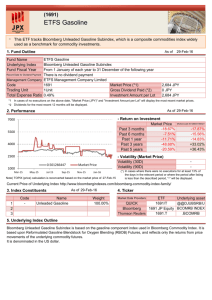

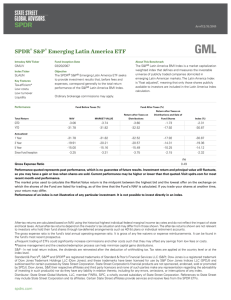

What is the history and global performance of ETFS? Exchange Traded Funds debuted in 1993 when State Street launched the SPDR S&P 500, an equity index fund tracking the S&P 500. Shortly after, ETFs gained popularity and other forms of ETFs were developed, such as bond index and commodity ETFs. In 1999, the first ETF in Asia was introduced when the Hong Kong Tracker Fund was launched. Europe’s first ETF started two years later, in 2001, with its Euro STOXX 50. As of March 2013, there are about 4,964 ETFs worldwide with assets amounting to approximately USD2,059.6Bn. What are ETFs? Mutual funds or collective investment schemes whose shares can be traded in a stock exchange Provide investors with diversification and lower expense ratios compared to other actively managed funds Feature the tradability of other ordinary stocks with more transparent pricing Assets Under Management (AUM) of ETFs: 2001 – Q12013 USDMn CAGR Asia Pacific Global GLOBAL Number of ETFs: 4,964 ETF Assets: USD2,059.6Bn 2 24.93% 28.17% ASIA PACIFIC Number of ETFs: 554 ETF Assets: USD144.6Bn UNITED STATES Number of ETFs: 1,822 ETF Assets: USD1,533.5Bn What are Exchange Traded Funds? What are the different kinds of ETFs? The most basic ETF type is the index ETF, which aims to track a benchmark index. For discussion and illustration purposes in this document, equity index ETFs will be used. What is an index? An index measures the value of a section of the stock market. The most commonly used index is the market-value/market-capitalization weighted which uses the highest weighted stocks in the index to measure the total value of the listed stocks in an exchange. In the Philippines, the main stock market index is the PSEi composed of stocks from different sectors. It is comprised of 30 fixed stocks, reviewed and rebalanced twice a year. 45/F GT Tower International Ayala Avenue cor. H.V. Dela Costa St., Makati City 3 How do ETFs differ from Mutual Funds and UITFs? Issue ETFs Mutual Funds UITFs Minimum Investment If bought through the exchange, minimum investment would be dependent on price and board lot Dependent on fund manager (by law, the minimum investment is PHP5,000) Dependent on fund manager Intraday Trading Can be traded intraday at market price; price guidance through iNAV disclosure every minute Purchase at NAV which is calculated at end-ofday Purchase at NAV which is calculated at end-of-day Fund Management Generally passive Usually active Can be both Entry and Exit Costs Similar to trading a stock – brokers commission, transaction fees, etc. Front-end load, backend load, redemption fee Early redemption fee Management fees Lower management fees Higher management fees Higher trustee fee Redemption Cash and/or in kind Cash Cash Who are the parties to an ETF? PARTY RESPONSIBILITY Issuer ETF company; continuously issues and redeems shares of stocks Fund Manager Manages the fund, oversees day-to-day operations Market Maker Provides bid and ask quotes to ensure liquidity Authorized Participant Accepts and collates orders from brokers and institutions for creation and redemption of new ETF shares iNAV Calculator Calculates and supplies the intraday NAV of the fund Custodian Takes physical custody of the shares comprising the underlying basket Index Provider Source of the index; entity whose index is used by the ETF 4 Why invest in ETFs? What are the advantages of ETFs? Diversification Transparency Liquidity Diversification An ETF share gives you exposure to all the component shares that make up the ETF basket at a lower cost. Broad Asset Allocation Investing in various ETFs allows you to address any gap in your portfolio in terms of industry or asset exposure. Effective Short-term Flexibility ETFs can be traded like a listed share during trading hours. Transparency Information on component securities are publicly available. You can easily access the information from the website of either the PSE or the listed companies. What do I consider when choosing ETFs? ETF Structure What body regulates the ETF company? How is the index designed? Are derivatives used? Index Methodology What index is the ETF tracking? How does this index fit your portfolio? What underlying shares are covered by this index? Total Costs What are the relevant fees, charges and taxes? Tracking Error How precisely does the ETF track the index? ETF Fund Manager What is the fund manager’s track record and history? How do I invest in ETFs? Investing in ETFs is easy. First, you need to allocate funds that you want to invest. REMEMBER: Your minimum investment will depend on the price of the ETF and the PSE board lot. Second, register with any of the 134 PSE brokers. Third, start buying and selling the ETF shares, just like any listed stock! 45/F GT Tower International Ayala Avenue cor. H.V. Dela Costa St., Makati City 5 Q: What’s good about investing in ETFs? A: Investing in ETFs has numerous pros which include immediate exposure to the broad market without having to choose a single stock, automatic diversification of your portfolio, lower management fees, flexibility, no minimum entry fee and transparent pricing. Q: Why would I buy an ETF when I can get an index mutual fund without a broker? A: As they are passively managed, ETFs will allow you to invest in a diversified portfolio with lower management fees versus mutual funds. In addition, ETFs can be bought and sold any time of the day using prevailing market prices through an exchange, whereas mutual funds can only be bought and sold using end-of-day NAV. Q: What will happen to the dividends declared by the constituent stocks of an equity index ETF? A: The dividends may either be paid out by the ETF or reinvested. Q: Will I be able to beat the index if I invest in ETFs? A: The main goal of ETFs is to track the index and not beat it. Q: Why will I want to match the market using an index fund when I can beat it with an outperforming mutual fund? A: Although mutual funds may outperform the market, beating the index, however, is not certain and always has associated risks. Also, actively managed funds, by nature, have higher management fees than passively managed ones. 6 Q: If the ETF is tracking an index, will all the stocks in that index be included? A: Not necessarily. There are three options to create a portfolio. One of which is full replication, wherein the basket will be composed of all assets in the index. The other option is sampling or optimizing, wherein the basket will only be comprised of a portion of the index. The last option is the synthetic index which makes use of derivatives. In the Philippines, synthetic index is not allowed yet. Q: What are the risks? A: As with regular stock investing, your ETF investment will also be dependent on favorable market conditions and subject to market volatility. Q: Are ETFs only for stocks? A: You must be asking if ETFs can only use stocks as its component securities. The answer is no. Component securities of ETFs may include any asset class which has a published index and which is liquid. Nowadays, bonds, real estate and even gold ETFs are already available. Q: Where can I buy ETFs? A: Just like other listed stocks you may buy ETFs at any brokerage firm. For block orders, you can go to any authorized participant. Q: How much is the minimum investment for ETFs? A: When you buy ETF shares in the exchange, there will be no minimum investment required. You will, however, be bound by the minimum board lot size which is prescribed by the PSE. Minimum board lots depend on the price of the ETF shares. 45/F GT Tower International Ayala Avenue cor. H.V. Dela Costa St., Makati City 7 This material is intended only to provide information regarding the First Metro Philippine Equity Exchange Traded Fund. IT IS NOT TO SOLICIT INVESTMENTS IN THE FUND. Each person contemplating investment in the fund must make his own investigation and analysis of the risks in investing in a listed mutual fund.