Annual Report - Jubilee General Insurance

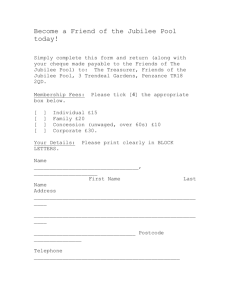

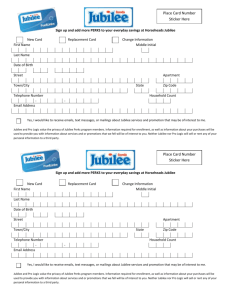

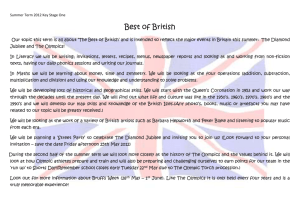

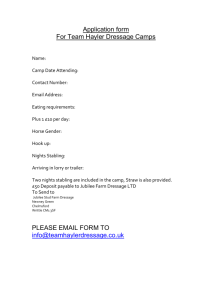

advertisement