International Structured Finance

Pre-Sale Report

Australia

RAMS Mortgage Securities Trust in respect of

Series 2006-1

RMBS / Australia

This pre-sale report addresses the structure

and characteristics of the proposed transaction

based on the information provided to Moody’s

as of 30 August 2006. Investors should be

aware that certain issues concerning this

transaction have yet to be finalised. Upon

conclusive review of all documents and legal

information as wel las any subsequent changes

in information, Moody’s will endeavour to

assign definitive ratings to this transaction. The

definitive ratings may differ from the

provisional ratings set forth in this report.

Moody’s will disseminate the assignment of

definitive ratings through its Client Service

Desk. This report does not constitute an offer

to sell or a solicitation of an offer to buy any

securities, and it may not be used or circulated

in connection with any such offer or

solicitation.

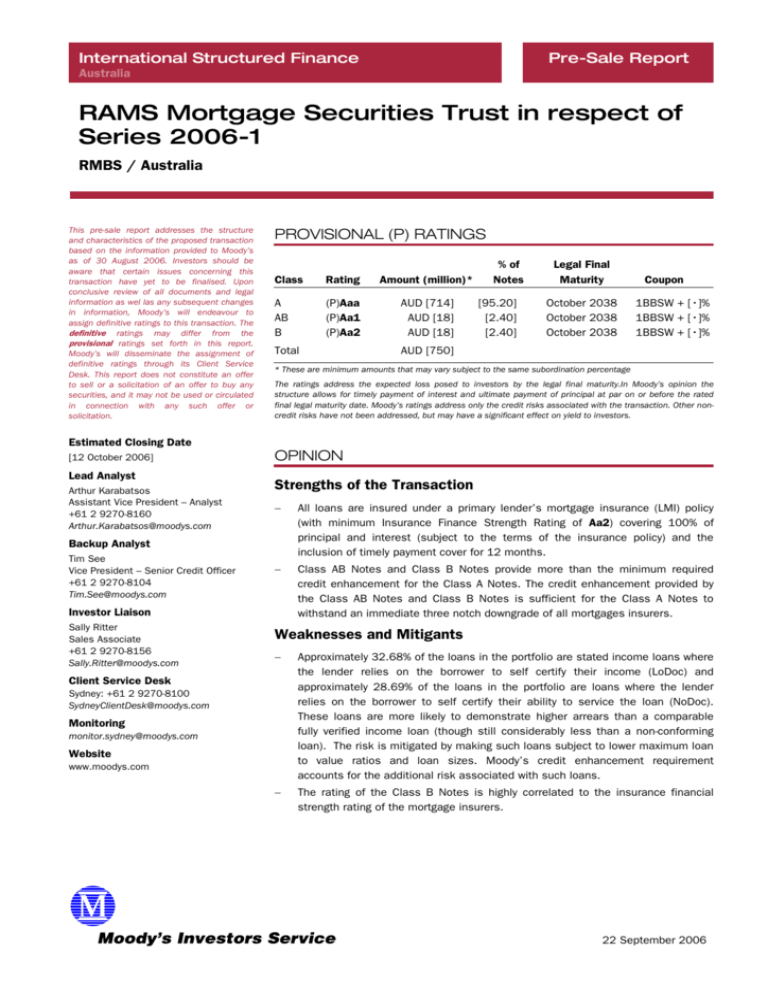

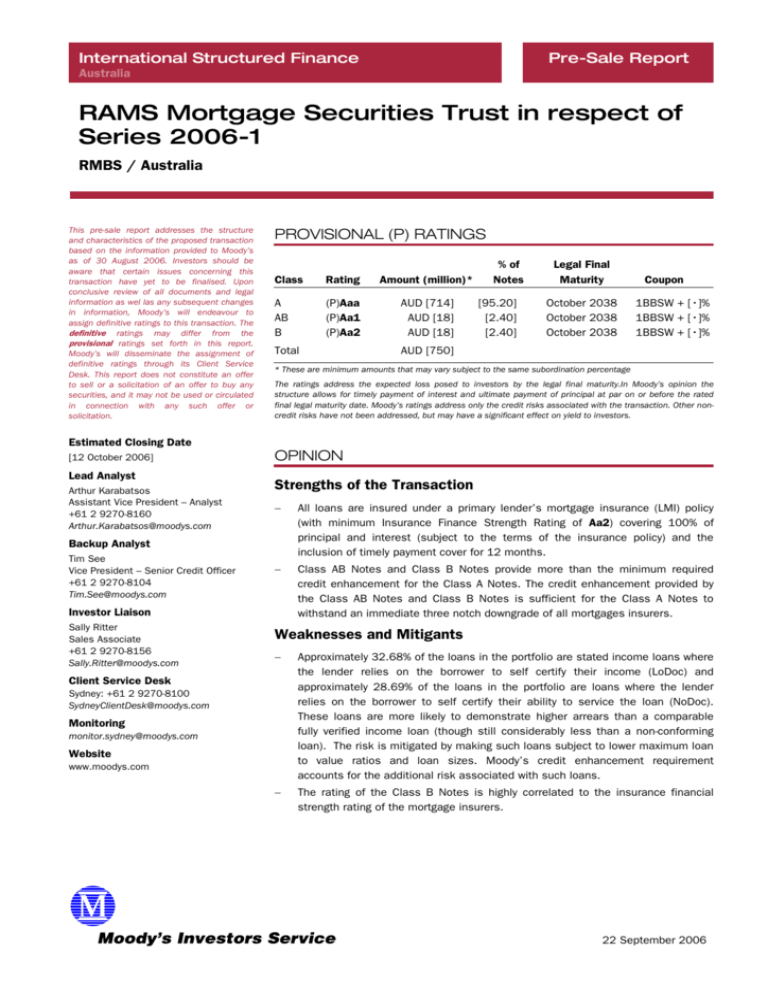

PROVISIONAL (P) RATINGS

Class

Rating

Amount (million)*

A

AB

B

(P)Aaa

(P)Aa1

(P)Aa2

AUD [714]

AUD [18]

AUD [18]

Total

% of

Notes

[95.20]

[2.40]

[2.40]

Legal Final

Maturity

October 2038

October 2038

October 2038

Coupon

1BBSW + [•]%

1BBSW + [•]%

1BBSW + [•]%

AUD [750]

* These are minimum amounts that may vary subject to the same subordination percentage

The ratings address the expected loss posed to investors by the legal final maturity.In Moody’s opinion the

structure allows for timely payment of interest and ultimate payment of principal at par on or before the rated

final legal maturity date. Moody’s ratings address only the credit risks associated with the transaction. Other noncredit risks have not been addressed, but may have a significant effect on yield to investors.

Estimated Closing Date

[12 October 2006]

Lead Analyst

Arthur Karabatsos

Assistant Vice President – Analyst

+61 2 9270-8160

Arthur.Karabatsos@moodys.com

OPINION

Strengths of the Transaction

−

All loans are insured under a primary lender’s mortgage insurance (LMI) policy

(with minimum Insurance Finance Strength Rating of Aa2) covering 100% of

principal and interest (subject to the terms of the insurance policy) and the

inclusion of timely payment cover for 12 months.

−

Class AB Notes and Class B Notes provide more than the minimum required

credit enhancement for the Class A Notes. The credit enhancement provided by

the Class AB Notes and Class B Notes is sufficient for the Class A Notes to

withstand an immediate three notch downgrade of all mortgages insurers.

Backup Analyst

Tim See

Vice President – Senior Credit Officer

+61 2 9270-8104

Tim.See@moodys.com

Investor Liaison

Sally Ritter

Sales Associate

+61 2 9270-8156

Sally.Ritter@moodys.com

Weaknesses and Mitigants

−

Approximately 32.68% of the loans in the portfolio are stated income loans where

the lender relies on the borrower to self certify their income (LoDoc) and

approximately 28.69% of the loans in the portfolio are loans where the lender

relies on the borrower to self certify their ability to service the loan (NoDoc).

These loans are more likely to demonstrate higher arrears than a comparable

fully verified income loan (though still considerably less than a non-conforming

loan). The risk is mitigated by making such loans subject to lower maximum loan

to value ratios and loan sizes. Moody’s credit enhancement requirement

accounts for the additional risk associated with such loans.

−

The rating of the Class B Notes is highly correlated to the insurance financial

strength rating of the mortgage insurers.

Client Service Desk

Sydney: +61 2 9270-8100

SydneyClientDesk@moodys.com

Monitoring

monitor.sydney@moodys.com

Website

www.moodys.com

22 September 2006

STRUCTURE SUMMARY

Issuer:

Structure Type:

Seller:

Originator:

Servicer:

Delegated Servicer:

Document Custodian:

Trust Manager:

Standby Manager:

Security Trustee:

Interest Payments:

Principal Payments:

Fixed Swap Providers:

Mortgage Insurers:

Credit Enhancement/Reserves:

Liquidity Support:

Registered Note Registrar:

Registered Note Paying Agent:

Joint Lead Managers:

RAMS Mortgage Securities Pty Limited as trustee of RAMS Mortgage Securities Trust in

respect of Series 2006-1

Notes backed by a pool of mortgage receivables which have been sold to a special

purpose vehicle incorporated in Australia.

RAMS Mortgage Corporation Limited

RAMS Home Loans Pty Limited

Receivables Servicing Pty Ltd

Unisys Credit Services Pty Ltd

JP Morgan Services Pty Limited

RAMS Home Loans Pty Limited

JP Morgan Trust Australia Ltd

JP Morgan Trust Australia Ltd

Monthly in arrears on the 14th (or next banking day) of each month.

On the 14th (or next banking day) of each month.

National Australia Bank Limited (Aa3/P-1)

Housing Loans Insurance Corporation (HLIC) (IFSR Aaa)

Genworth Financial Mortgage Insurance Pty Limited (Genworth) (IFSR Aa2)

PMI Mortgage Insurance Limited (PMI) (IFSR Aa2)

Note Subordination, Mortgage Insurance, Excess Spread.

0.50% Cash Deposit

JP Morgan Trust Australia Ltd

JP Morgan Trust Australia Ltd

Royal Bank of Scotland PLC

National Australia Bank Limited

COLLATERAL SUMMARY (see Tables 1 & 2for more details)

Underwriting Type

Portfolio Size:

Loans Count:

WA Original LTV:

WA Scheduled LTV:

WA Current LTV:

WA Seasoning (months):

Mortgage Insurance:

Loan Repayment Schedule:

Geographic Diversity:

Pool Cut-off Date:

2 • Moody’s Investors Service

38.64% fully verified loans, 32.68% LowDoc loans, 28.69% NoDoc loans

743,733,958

3,393

72.14%

71.98%

69.70%

4.7

HLIC (IFSR Aaa)

0.14%

Genworth (IFSR Aa2)

31.41%

PMI (IFSR Aa2)

68.45%

Principal & Interest

46.54%

Interest Only ≤ 5 Years

45.14%

Interest Only > 5 Years

8.32%

Australian Capital Territory

1.73%

New South Wales

28.28%

Northern Territory

0.32%

Queensland

21.49%

South Australia

1.69%

Tasmania

0.49%

Victoria

18.44%

Western Australia

27.56%

30 August 2006

RAMS Mortgage Securities Trust in respect of Series 2006-1

TRANSACTION SUMMARY

Rating Opinion

(P)Aaa Class A

Moody's (P)Aaa rating on the Class A Notes is based on several factors:

−

The level of subordination provided for the Class A Notes by the Class AB Notes

and Class B Notes is equal to approximately 4.80% of the total notes issued;

−

All loans are covered by a mortgage insurance policy covering default losses equal

to 100% of the principal and accrued interest of each loan and reasonable expenses

involved in enforcing the mortgage. The policies are issued by Housing Loan

Insurance Corporation (IFSR Aaa), Genworth Financial Mortgage Insurance Pty

Limited (IFSR Aa2) and PMI Mortgage Insurance Limited (IFSR Aa2);

−

The availability of excess interest income to meet principal chargeoffs (if any);

−

The liquidity protection made available to meet interest shortfalls through a

combination of the ability of the Trustee to use principal collections, the Cash

Deposit equal to 0.50% of Notes outstanding and the 12 months timely payment

cover provided respectively by each mortgage insurer.

−

The interest rate swap contract the Trustee enters into with National Australia Bank

Limited (Aa3/P-1) to hedge the interest rate mismatch between the Trustee's

floating rate obligations to noteholders and the interest rates on the fixed rate

mortgage loans, together with the threshold rate mechanism that requires the

Trustee to ensure that interest rates on the underlying mortgages are set at a rate

sufficient to meet the Trust’s obligations (taking into account swap payments);

−

The protection offered to noteholders by a charge over the Trust assets granted to a

Security Trustee on their behalf; and

−

The ability of RAMS Home Loans Pty Ltd and Receivables Servicing Pty Ltd to

perform their obligations relating to the management and servicing of Series

2006 1.

(P)Aa1 Class AB

The (P) Aa1 rating of the Class AB Notes is primarily based on the factors above, the

level of subordination provided to the Class AB Notes by the Class B Notes (2.40%) and

Moody’s analysis of the expected loss relative to the size of the tranche of Class AB

Notes. The rating of the Class AB Notes is correlated to the rating of the mortgage

insurers.

(P)Aa2 Class B

The (P)Aa2 rating of the Class B subordinated Notes is also based on the same factors

above and Moody's analysis of the expected loss of the Class B Notes. The rating of the

Class B Notes is highly correlated to the ratings of the mortgage insurers.

The ratings address the expected loss posed to investors by the legal final maturity. The

structure allows for timely payment of interest and ultimate payment of principal with

respect to the Class A Notes, Class AB Notes and the Class B Notes by the legal final

maturity.

Moody’s issues provisional ratings in advance of the final sale of securities and these

ratings reflect Moody’s preliminary credit opinion regarding the transaction. Upon a

conclusive review of the final versions of all the documents and legal opinions,

Moody’s will endeavour to assign a definitive rating to the transaction. A definitive

rating may differ from a provisional rating.

RAMS Mortgage Securities Trust in respect of Series 2006-1

Moody’s Investors Service • 3

STRUCTURAL AND LEGAL ASPECTS

Chart 1:

Structure diagram, Trust Level

Trustee

RAMS Mortgage Securities Pty Limited (RMS)

as trustee of

RAMS Mortgage Securities Trust

Group 1

Group 2

Group 3

Group 4

Group 5

Series 2006-1

Excess Spread

Future

Groups

Future Series

Chart 2:

Structure diagram, Series Level

Delegated Servicer

Unisys Credit Services

Pty Ltd

Standby Manager

JP Morgan Trust

Australia Ltd

Trust Manager

RAMS Home Loans Pty

Limited (RHL)

Servicer

Receivables Servicing

Pty Ltd

Document Custodian

JP Morgan Trust

Australia Ltd

Standby Trustee

Security Trustee

JP Morgan Trust

Australia Ltd

JP Morgan Trust

Australia Ltd

Floating Charge

Trustee

RAMS Mortgage Securities

Pty Limited (RMS)

Reallocation of beneficial interest

Various warehouse series

Note proceeds used to

acquire loans

Notes

Issuer & Trustee

RAMS Mortgage Securities Pty Limited (RMS)

as trustee of

RAMS Mortgage Securities Trust

in respect of Series 2006-1

Investors

Note proceeds

Loans. Originated in the name of

RAMS Mortgage Corporation

Limited (RMC)

Originator

RAMS Home Loans Pty

Limited (RHL)

Liquidity

0.50% Cash Deposit

Mortgage Insurance

Genworth, PMI & HLIC

Interest Rate Swap

NAB

Structural Overview

Single trust

RAMS Mortgage Securities Trust is a single trust that has been established under the

Trust Deed entered into between the Security Trustee, RAMS Mortgage Securities Pty

Limited, Registered Note Registrar and Registered Note Paying Agent on December 8,

2004.

Multiple series

An unlimited number of separate “series” may be established within the RAMS Mortgage

Securities Trust by the execution of a Deed of Charge and Series Supplement for each

series. Each series is a separate and distinct security structure enabling it to issue notes

secured by the specific assets allocated to the series. With the exception of excess

spread the assets of one series are not available to meet the obligations of any other

series. Legal opinion has been provided to support the segregation of the assets of each

series from creditors of other series.

Groups

When established, each a series of the trust is designated to a particular group. The only

purpose of the group is to allow for the reallocation of excess spread from one series to

another within the group to reinstate losses. Currently Series 2006-1 is the only series in

Group 5.

4 • Moody’s Investors Service

RAMS Mortgage Securities Trust in respect of Series 2006-1

Sale Mechanism / Title Perfection / Document Custody

Warehouses

All loans have been originated by RAMS Home Loans Pty Limited (RHL) and written in the

name of RAMS Mortgage Corporation Limited (RMC). Post origination loans are equitably

assigned by RMC (lender of record) to one of various series within the RAMS Mortgage

Securities Trust of which RAMS Mortgage Securities Pty Limited (RMS) is trustee.

Equitable assignment

At closing, RMC may either equitably assign such loans to RMS in respect of Series

2006-1 or, if the loans are held in respect of another Series, RMS will reallocate its

beneficial interest in the loans to Series 2006-1.

Title perfection

RMC is a bankruptcy remote special purpose vehicle and not a subsidiary of any RAMS

company. RMC will continue to maintain legal ownership of the loans until the occurrence of a

title perfection event which amongst other things includes the insolvency of RMC, upon which

RMS is required to take the necessary steps to obtain legal title of the loans from RMC

(perfecting its legal title). The Security Trustee will hold irrevocable powers of attorney (granted

by RMC the lender of record), entitling it to perfect legal title following a title perfection event.

Independent document custodian

The Security Trustee also acts as custodian of all mortgage security documents (which

facilitates the ability to perfect title if necessary).

Based on these factors Moody’s believes title perfection risk is adequately mitigated

Security Trust Deed

Security Arrangement

The Trustee will grant to the Security Trustee, for the benefit of the noteholders and

other secured creditors including the providers of support facilities, a first ranking

floating charge over all of the Series 2006-1 assets. The floating charge will become a

fixed charge if certain events occur, including the insolvency of the Trustee in its capacity

as Trustee of the Trust in respect of Series 2006-1, and a failure to pay secured

creditors in full within a specified period. The transaction documents also set out the

enforcement procedures of the charge that the Security Trustee is required to follow and

the applicable priorities in relation to the enforcement proceeds.

Payment Structure Of The Notes

RAMS Mortgage Services Pty Limited as Trustee of RAMS Mortgage Securities Trust in

respect of Series 2006-1 will issue three classes of Notes:

−

Class A Notes;

−

Class AB Notes; and

−

Class B Notes.

All notes are denominated in Australian Dollars.

Liquidity Notes

To assist in funding principal redraws and further advances on mortgages, Series 2006-1

may, as needed, issue Liquidity Notes (denominated in Australian Dollars), provided

Moody’s confirms that the existing ratings of the Notes outstanding will not be adversely

affected.

On each monthly payment date the Class A Notes, Class AB Notes and Class B Notes

will receive a floating rate of interest at a respective margin over one month AUD-BBSW.

Margin step up

The notes may be redeemed at the earlier of the Call Date (October 2011) or when the

principal outstanding on all notes is less than 20% of there initial balance. If the notes

are not redeemed the margin on the Class A Notes will increase by a further 0.25% and

the margins on the Class AB Notes and Class B Notes will double.

Excess spread shared between

series within a group

Distributions of excess spread occur on a monthly payment date and may be made

available to other series in the group (if any) to meet charge off and carry over charge

offs (if any).

Principal Payments

On each monthly payment date total available principal collections from the mortgage

pool will be allocated in the following priority:

1.

Repayment of Liquidity Notes (if required);

2.

Retain in collection account anticipated Redraws and Further Advances;

3.

Repayment of Class A Notes;

4.

Repayment of Class AB Notes; and

5.

Repayment of Class B Notes.

RAMS Mortgage Securities Trust in respect of Series 2006-1

Moody’s Investors Service • 5

No step down

Class AB Notes will receive principal payments only after the Class A Notes have been

redeemed in full. Class B Notes will receive principal payments only after the Class AB

Notes have been redeemed in full. The Class A Notes are therefore protected from credit

losses to the full extent of the initial value of the Class AB Notes and Class B Notes.

Likewise, the Class AB Notes are protected from credit losses to the full extent of the

initial value of the Class B Notes.

Pre Funding

If on the Closing Date, the purchase price of the loans is less than the bond proceeds,

then the surplus bond proceeds will be retained in a pre-funding account held with a P-1

rated bank, and used to purchase further eligible loans during the pre-funding period

(from Closing Date till the first payment date). The purchase of further loans is subject to

ratings affirmation by Moody’s.

The amount of surplus bond proceeds held in the pre-funding account may not exceed

25% of initial amount of notes issued.

Any monies held in the pre-funding account not used to purchase mortgages will be

distributed as principal collections at the end of the pre-funding period (first payment

date).

Credit Support

Lenders Mortgage Insurance

Lender’s Mortgage Insurance

provides first layer of external

support

Upon default of a borrower, if there is unpaid principal and interest outstanding - after

applying proceeds from the realisation of the underlying residential property security - the

first layer of external protection is Lenders Mortgage Insurance (LMI).

Mortgage insurance policies insure the Trustee against default losses equal to 100% of

the principal amount of each mortgage loan, together with loss of interest and

reasonable expenses involved in enforcing the mortgage. The insurers and the respective

proportion of loans insured are as follows:

−

0.14% Housing Loan Insurance Corporation (IFSR Aaa);

−

31.41% Genworth Financial Mortgage Insurance Pty Limited (IFSR Aa2); and

−

68.45% PMI Mortgage Insurance Ltd (IFSR Aa2).

Mortgage insurance policies are not guarantees and claims are subject to the terms of

the policy. Exclusions under the LMI policies include damage to the security property not

covered by building insurance.

Application of Excess Spread

Threshold Rate

The threshold rate mechanism requires the Servicer to set the weighted average interest

rate not less than the Threshold Rate. The Threshold Rate is the rate required to cover

the Trust’s obligations including interest on the notes, fees and expenses.

On each monthly payment date, the Trustee must apply any excess income available to

all principal charge-offs related to Series 2006-1, to the extent that excess income is

available.

Subordination

The rights of the Class B Notes to receive principal payments are subordinated to the

Class AB Notes, which are subordinated to the Class A Notes.

To the extent that there are losses not covered by mortgage insurance or excess spread,

these losses are first allocated to the Class B Notes. To the extent that the Class B

Notes are fully charged off, any further losses are applied to the Class AB Notes.

To the extent the Class AB Notes are fully charged off, any further losses are allocated to

the Class A Notes.

6 • Moody’s Investors Service

RAMS Mortgage Securities Trust in respect of Series 2006-1

Hedging

Fixed Rate Swap

Hedging strategy supports ability

to generate excess spread

The Trustee will enter into a fixed interest rate swap with National Australia Bank

Limited (NAB) (Aa3/P-1) to hedge any mismatch between the rates of interest received

on any fixed rate loans and the floating rate obligations of the trust including interest

paid on the Notes.

If NAB is downgraded to below A2 or P-1, then it must either be replaced by a suitably

rated swap provider, or post collateral in an amount sufficient to preclude a ratings

downgrade of the Notes.

Threshold Rate

The Trustee is also required to ensure that the weighted average interest rate on the

mortgage pool is not less than the amount required to meet the payment obligations of

the Trust.

Liquidity Support

There are three sources of liquidity available to cover income shortfalls. These are the

use of principal collections, the Cash Deposit and Timely Payment Cover under the LMI.

Use of principal

In the first instance the Trustee is able to use mortgage principal receipts (Principal

Draw) to fund any income shortfalls.

0.50% Cash Deposit

At closing 0.50% of the proceeds of the notes will be invested in liquid authorised

investments (the Cash Deposit) to be used to meet any shortfall where the Interest

Collections, together with any Principal Draw, are not sufficient to meet the Required

Payments in full on a Payment Date.

Any drawing from the Cash Deposit must be subsequently replenished from excess

income and principal collections. The Cash Deposit must be maintained at 0.50% of

principal outstanding of the notes, any amounts released will be included in total

available principal.

Timely payment cover

The series also has the benefit of timely interest cover on all loans for a minimum of 12

months provided by the respective mortgage insurers.

COLLATERAL

RAMS Home Loans Pty Limited (RHL) underwrites all loans originated and makes certain

representations and warranties about the housing loans sold into the series. All housing

loans must conform with RAMS’ underwriting procedures and must meet the eligibility

criteria under the transaction documents before being sold into the series.

The eligibility criteria include the following:

61% limited documentation loans

−

The mortgage is secured by a first mortgage over Australian residential property; and

−

No loans are currently more than 30 days in arrears.

RAMS provides limited documentation loan products (approximately 61% of the portfolio)

for self employed borrowers where the normal requirements of income verification is

relaxed subject to lower loan to value ratio and maximum loan size tests being met.

Credit checks are conducted on all borrowers.

RHL uses two methods of assessing borrowers’ serviceability for its limited

documentation loan products, as set out below:

LoDoc

The loan applicants self-certify their income. RHL then applies normal serviceability tests

to determine whether this income supports the proposed loan payments and also checks

that the applicant’s assets and liabilities statement supports the income disclosed by

the applicant. Approximately 32.68% of the portfolio are originated using this

underwriting approach. Non self employed borrowers may also qualify for a LoDoc loan

subject to maximum LTV of 70%.

NoDoc

The loan applicants self certify their ability to service the proposed debt. There is no

income verification in relation to these loans (though different maximum loans sizes and

LTV limits apply). Approximately 28.69% of the portfolio are originated according to this

underwriting approach.

RAMS Mortgage Securities Trust in respect of Series 2006-1

Moody’s Investors Service • 7

The maximum loan to value ratios and loan size tests which apply to the various loan

types are set out below:

Eligibility Criteria

Fully Verified

Loans

LoDoc

NoDoc

Maximum Loan to Value ratio

Maximum Loan Size*

95%

$2,000,000

80%

$1,000,000

80%

$800,000

(or $1,000,000

subject to max LTV 70%)

* Maximum loan size is further subject to geographical limitations.

The pool of eligible mortgages sold to the Trust includes the following loan features:

−

fixed rate and variable rate amortising mortgage loans, where the borrower can

choose to fix mortgage rates for a term of no more than five years at a time; and

−

loans with an interest only period of up to ten years, after which the loan must

convert into a principal and interest amortising loan.

Further Advances

The trustee may subject to certain conditions, use principal collections to fund further

advances to borrowers which represents an increase in the original loan amount.

Further advances are subject to the normal credit assessment including a revaluation of

security property and must meet the following conditions:

−

borrower must not have been in arrears in the previous 6 months;

−

the further weighted average Loan to Value Ratio of the pool must not increase by

more than 2% from the previous distribution date;

−

the aggregate of all further advances made in any year is limited to 3% of the

invested amount of the bonds as at the most recent anniversary of the closing date;

−

total arrears greater than 60 days must not exceed 2%; and

−

there must be no unreimbursed charge-offs on the notes.

Moody’s conducted its preliminary credit analysis on the loan pool as of August 30,

2006. Further details are set out in Table 1 (Mortgage Pool Summary) and Table 2

(Detailed Mortgage Pool Summary).

Characteristics of the securitised

pool

Moody’s believes that the pool has a number of positive and negative characteristics,

which impacts on Moody’s credit enhancement requirements.

Positive characteristics include the following:

−

approximately 68% of the portfolio properties are located in metropolitan areas,

based on Moody’s classification; and

−

approximately 85% of the security properties are detached houses.

Negative characteristics include the following:

−

approximately 32.68% and 28.69% of the portfolio comprises of LoDoc and No Doc

loans respectively; and

−

Approximately 27.5% of the mortgage pool balance represents loans which are in

Western Australia. Whilst the Western Australian economy is currently experiencing

strong growth and strong house price appreciation on the back of strong commodity

prices, the regional economy is less diverse and is therefore also at risk of boom/bust

cycles

ORIGINATOR, SERVICER AND OPERATIONS REVIEW

Program Servicing and management

RAMS Background

In September 1991 RAMS Home Loans Pty Limited (“RHL”) was incorporated and

commenced operations acting as a third party funder, sourcing its residential mortgage

loans through a network of up to 20 originators.

In 1994, RHL established its own origination business and established its corporate

funding vehicle, RAMS Mortgage Corporation Limited (“RMC”) which executed its

inaugural securitisation issue in 1994.

8 • Moody’s Investors Service

RAMS Mortgage Securities Trust in respect of Series 2006-1

In November 2002, RHL established another funding vehicle, RAMS Mortgage Securities

Pty Limited, which acts as the trustee of separate trusts established from time to time.

RHL commenced two major outsourcing projects in 2002. RHL is private company.

Issuance to date

To date, the RAMS issuance program has issued 14 prime RMBS transactions (A$12.4

billion).

The Trust Manager (RAMS Home Loans Pty Limited) provides the administrative support

and automated systems required to perform the administration, supervision and

management of the trust. The responsibilities involved include the coordination of

funding requirements for the RAMS program and the establishment of guidelines

governing mortgages approved for the program.

Servicing

Receivables Servicing Pty Limited (a company within the RAMS group companies) is

responsible for performing the day to day duties of servicing the loans including amongst

other things administering collections for loans, compliance with applicable laws, setting

interest rates and generating periodic reports.

Delegated servicer

Under the terms of the Master Servicer Deed, the Servicer may delegate some of its

servicing functions to a third-party provider. Since November 2002 the Servicer has

delegated all of its servicing functions to Unisys Credit Services Pty Limited. The Servicer

will remain liable for servicing the Loan Portfolio and the acts and omissions of any

delegate, including Unisys Credit Services Pty Limited.

Backup servicer

The Security Trustee acts as Backup Servicer in the event the Servicer is no longer able

to perform its obligations.

Collection Account

From closing, the Servicer will collect all monies due under the mortgage loans and is

required to be deposit these monies into Series 2006-1 collection account within 1

business day of receipt. The collection account must be held with a P-1 rated bank.

MOODY’S ANALYSIS

Rating Analysis

LTV is the prime determinant of

mortgage loan default

Moody’s applies an expected loss analysis when quantifying the credit risks for this loan

portfolio. Moody's approach is based on historical evidence that the prime determinant

of mortgage loan default in the Australian market is LTV. Historical data indicates that

the incidence of default rises sharply and disproportionately to relative incremental

increases in LTV.

A similar relationship between LTV and severity of loss exists with the substantially

higher average severity of loss experienced at higher LTV levels.

Moody’s has derived benchmark credit enhancement levels to reflect differences in LTV.

Using the weighted average LTV for any particular pool (calculated on a loan by loan

basis), Moody’s then makes further adjustments for specific risk attributes including

Limited Income Verification, High Value Security Properties, Non-owner Occupied

Properties, etc.

The total gross credit enhancement provided to the senior notes therefore derives from

the credit enhancement requirements of the benchmark pool as well as the penalties

and benefits assigned by Moody’s for deviations from this benchmark. Moody’s

methodology for rating Australian RMBS can be found in “AU-MILAN, The Scoring Model

Revisited,” August 2003. To provide for concentration risk given that the portfolio

comprises 61% limited documentation loans, Moody’s has allowed for additional positive

default correlation in a stress scenario.

Net Credit Enhancement is More Than Sufficient to Support (P)Aaa Ratings

When analysing the adequacy of the net credit enhancement available to the rated notes,

Moody's assesses the loan characteristics, the origination and underwriting practices,

and the insurance financial strength ratings of the mortgage insurers.

(P)Aaa Class A

The gross level of subordination to support the (P)Aaa ratings assigned to the senior

notes would be approximately 9.25%, assuming the pool was not insured.

After mortgage insurance the 4.80% credit enhancement provided to support the (P)Aaa

ratings assigned to the Class A senior notes is higher than the Moody’s required credit

enhancement of 1.85%.

RAMS Mortgage Securities Trust in respect of Series 2006-1

Moody’s Investors Service • 9

3 notch downgrade

The extra credit enhancement provided would be sufficient to withstand an immediate

three notch downgrade for all mortgage insurers supporting the transaction.

(For details of Moody's assessment of the impact of mortgage insurance on the level of

subordination, please refer to Moody's Special Report, "The impact of Mortgage

Insurance on the Subordination Level Of Australian MBS, May 2000").

The difference between the minimum required subordination 1.85% and the total subordination

provided to the Class A Notes of 4.80%, of which 2.40% is represented by the Class AB Notes.

These Notes effectively bear mortgage insurance downgrade risk that would otherwise be

borne by the Class A Notes as well as the risk of any credit losses not covered by mortgage

insurance policies once the Class B Notes have been charged off in full

(P)Aa2 Class AB

The (P)Aa1 rating of the Class AB Notes reflects the higher expected loss of this tranche

relative to the Class A Notes, taking into consideration the subordination to the Class A

Notes, together with the benefit of the 2.40% subordination provided by the Class B

Notes, the mortgage insurance policies and excess spread. The rating of the Class AB

Notes is more correlated to the rating of the mortgage insurers than the Class A Notes,

but less so than the Class B Notes.

(P)Aa2 Class B

The (P)Aa2 ratings of the Class B Notes reflects Moody’s view of the expected loss of

this tranche, taking into consideration the benefit of mortgage insurance policies and

excess spread. The rating of the Class B Notes is highly correlated to the ratings of the

mortgage insurers.

Rated to legal final

The ratings address the expected loss posed to investors by legal final maturity. The

structure allows for timely payment of interest and ultimate payment of principal by the

final legal maturity.

RATING SENSITIVITIES AND MONITORING

Ongoing monitoring

Moody’s will monitor the transaction on an ongoing basis to ensure that its transaction

continues to perform in the manner expected, including checking all supporting ratings

and reviewing periodic servicing reports. Any subsequent changes in the rating will be

publicly announced and disseminated through Moody’s Client Service Desk.

RELATED RESEARCH

Visit www.moodys.com for more

details

For a more detailed explanation of Moody’s approach to this type of transaction as well

as similar transactions please refer to the following reports:

Performance Review

−

Australian RMBS Performance Review: Q2 2006, September 2006 (SF81717)

Rating Methodology

−

AU-MILAN - The Scoring Formula Revisited - Moody's Individual Loan Analysis for

Australian RMBS, August 2003 (SF25565)

−

The Impact of Mortgage Insurance on the Subordination Level of Australian MBS,

July 2003 (SF8895)

To access any of these reports, click on the entry above. Note that these references are current as of the date of

publication of this report and that more recent reports may be available. All research may not be available to all clients.

10 • Moody’s Investors Service

RAMS Mortgage Securities Trust in respect of Series 2006-1

APPENDIX

Chart 3:

RAMS Delinquency Performance

(Arrears as a percentage of current balance)

2.00%

1.80%

1.60%

1.40%

1.20%

1.00%

0.80%

0.60%

0.40%

0.20%

0.00%

Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan- Jul- Jan98

98 99

99 00

00 01

01 02

02 03

03 04

04 05

05 06

RAMS 30-60 days Delinquency

RAMS 60+ days Delinquency

Australian RMBS Market 30+ days Delinquency

Chart 4:

Geographical Distribution

Tasmania

0.49%

South Australia

1.69%

Australian Capital

Territory

1.73%

Northern Territory

0.32%

New South Wales

28.28%

Victoria

18.44%

Queensland

21.49%

Western Australia

27.56%

Chart 5:

Scheduled LTV Distribution

45.00%

40.00%

35.00%

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

>0%

and

≤50%

>50%

and

≤55%

>55%

and

≤60%

RAMS Mortgage Securities Trust in respect of Series 2006-1

>60%

and

≤65%

>65%

and

≤70%

>70%

and

≤75%

>75%

and

≤80%

>80%

and

≤85%

>85%

and

≤90%

>90% >95%

and

and

≤95% ≤100%

Moody’s Investors Service • 11

Table 1:

Mortgage Pool Summary as at August 30, 2006

Mortgage Pool Summary

Pool Size (A$)

Percentage of Total

Number of Loans

W.A. Original LTV

W.A. Scheduled LTV

W.A. Current LTV

W.A. Seasoning (months)

Average Loan Balance (A$)

Maximum Loan Balance (A$)

Scheduled LTV

>0% and ≤50%

>50% and ≤55%

>55% and ≤60%

>60% and ≤65%

>65% and ≤70%

>70% and ≤75%

>75% and ≤80%

>80% and ≤85%

>85% and ≤90%

>90% and ≤95%

>95% and ≤100%

Seasoning

>0 months and ≤6 months

>6 months and ≤12 months

>12 months and ≤18 months

>18 months and ≤24 months

>24 months

Property Value

>A$0 and ≤A$300,000

>A$300,000 and ≤A$500,000

>A$500,000 and ≤A$1,000,000

>A$1,000,000

Property Type

Detached

Units/Townhouses

Land

Occupancy

Owner Occupied

Investment

Loan Purpose

Purchase

Refinance

Amortisation Schedule

Principal & Interest

Interest Only ≤ 5 Years

Interest Only > 5 Years

Fixed/Var

Fixed

Var

Income Verification

Verified Income

Low Doc

No Doc

State Distribution

Australian Capital Territory

New South Wales

Northern Territory

Queensland

South Australia

Tasmania

Victoria

Western Australia

Metro/Non Metro

Metro

Non-Metro

Mortgage Insurance Cover

HLIC (Aaa)

Genworth (Aa2)

PMI (Aa2)

12 • Moody’s Investors Service

TOTAL

743,733,958

100%

3,393

72.14%

71.98%

69.70%

4.7

219,197

1,000,000

10.14%

3.50%

5.16%

5.22%

14.33%

5.77%

41.45%

2.54%

6.79%

5.10%

0.00%

90.35%

6.48%

1.11%

0.25%

1.80%

28.31%

39.31%

28.67%

3.72%

84.83%

14.66%

0.50%

64.66%

35.34%

53.09%

46.91%

46.54%

45.14%

8.32%

0.52%

99.48%

38.64%

32.68%

28.69%

1.73%

28.33%

0.32%

21.49%

1.69%

0.49%

18.39%

27.56%

68.30%

31.70%

0.14%

31.41%

68.45%

RAMS Mortgage Securities Trust in respect of Series 2006-1

Table 2:

Detailed Mortgage Pool Summary as at August 30, 2006

Scheduled LTV

RAMS 2006-1

LTV ≤80%

TOTAL

Property Value

LTV >80%

≤A$500,000

Property Type

>A$500,000

Occupancy

Detached

Units

Amortisation

Owner Occ

Investment

P&I

Fixed/Var

IO

Fixed

Income Verification

Var

Verified

Low Doc

No Doc

213,351,780

Mortgage Pool Summary

Pool Size (A$)

Percentage of Total

Number of Loans

743,733,958

502,866,137

240,867,821

630,943,071

112,790,887

480,862,244

262,871,714

346,132,841

397,601,118

3,836,697

739,897,261

287,362,587

243,019,591

100%

636,390,215 107,343,744

86%

14%

68%

32%

85%

15%

65%

35%

47%

53%

1%

99%

39%

33%

3,393

2,967

426

2,776

617

2,891

502

2,309

1,084

1,605

1,788

19

3,374

1,258

1,020

29%

1,115

W.A. Original LTV

72.14%

69.19%

89.63%

74.22%

67.79%

71.54%

75.45%

70.72%

74.73%

71.47%

72.72%

77.58%

72.11%

75.90%

73.44%

65.58%

W.A. Scheduled LTV

71.98%

69.03%

89.49%

74.05%

67.66%

71.39%

75.27%

70.53%

74.64%

71.19%

72.67%

77.46%

71.95%

75.61%

73.33%

65.56%

W.A. Current LTV

69.70%

66.50%

88.67%

71.78%

65.36%

69.09%

73.11%

68.05%

72.72%

69.65%

69.75%

77.30%

69.66%

73.68%

71.25%

62.58%

4.7

4.6

5.0

4.8

4.4

4.7

4.9

4.6

4.9

5.4

4.1

7.1

4.7

5.9

4.4

3.5

219,197

214,489

251,981

181,148

390,385

218,244

224,683

208,256

242,502

215,659

222,372

201,931

219,294

228,428

238,255

191,347

1,000,000

1,000,000

842,140

469,469

1,000,000

1,000,000

1,000,000

1,000,000

1,000,000

868,951

1,000,000

405,800

1,000,000

900,000

1,000,000

1,000,000

W.A. Seasoning (months)

Average Loan Balance (A$)

Maximum Loan Balance (A$)

Scheduled LTV

>0% and ≤50%

10.14%

10.14%

0.00%

5.06%

5.08%

9.27%

0.87%

8.29%

1.85%

5.78%

4.35%

0.02%

10.12%

3.66%

1.88%

4.60%

>50% and ≤55%

3.50%

3.50%

0.00%

2.21%

1.29%

3.02%

0.48%

2.84%

0.66%

2.23%

1.27%

0.04%

3.46%

1.50%

0.78%

1.22%

>55% and ≤60%

5.16%

5.16%

0.00%

2.63%

2.53%

4.47%

0.69%

3.89%

1.27%

2.69%

2.47%

0.04%

5.13%

1.91%

1.32%

1.93%

>60% and ≤65%

5.22%

5.22%

0.00%

3.21%

2.01%

4.81%

0.40%

4.03%

1.19%

2.57%

2.64%

0.00%

5.22%

1.31%

1.46%

2.45%

>65% and ≤70%

14.33%

14.33%

0.00%

9.38%

4.95%

12.45%

1.88%

9.32%

5.01%

6.33%

8.00%

0.00%

14.33%

2.21%

2.93%

9.18%

>70% and ≤75%

5.77%

5.77%

0.00%

3.49%

2.28%

4.78%

0.99%

3.81%

1.97%

3.05%

2.73%

0.03%

5.74%

2.50%

2.95%

0.32%

>75% and ≤80%

41.45%

41.45%

0.00%

28.97%

12.48%

34.46%

6.99%

21.56%

19.89%

14.72%

26.73%

0.23%

41.22%

11.33%

21.24%

8.89%

>80% and ≤85%

2.54%

0.00%

2.54%

2.06%

0.48%

2.17%

0.37%

1.78%

0.76%

1.32%

1.22%

0.04%

2.49%

2.36%

0.12%

0.06%

>85% and ≤90%

6.79%

0.00%

6.79%

5.91%

0.88%

5.60%

1.19%

4.96%

1.83%

4.13%

2.66%

0.07%

6.72%

6.75%

0.00%

0.04%

>90% and ≤95%

5.10%

0.00%

5.10%

4.71%

0.40%

3.79%

1.31%

4.18%

0.92%

3.72%

1.39%

0.06%

5.05%

5.10%

0.00%

0.00%

>95% and ≤100%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

27.43%

Seasoning

>0 months and ≤6 months

90.35%

77.81%

12.54%

60.81%

29.54%

76.88%

13.47%

58.41%

31.95%

41.60%

48.76%

0.44%

89.92%

33.92%

29.01%

>6 months and ≤12 months

6.48%

5.13%

1.35%

4.61%

1.88%

5.56%

0.93%

4.77%

1.71%

3.08%

3.40%

0.02%

6.46%

3.03%

2.27%

1.19%

>12 months and ≤18 months

1.11%

0.97%

0.14%

0.79%

0.33%

0.74%

0.38%

0.51%

0.60%

0.45%

0.66%

0.00%

1.11%

0.26%

0.78%

0.08%

>18 months and ≤24 months

0.25%

0.25%

0.00%

0.20%

0.05%

0.25%

0.00%

0.09%

0.16%

0.13%

0.12%

0.00%

0.25%

0.09%

0.16%

0.00%

>24 months

1.80%

1.40%

0.40%

1.21%

0.59%

1.41%

0.38%

0.87%

0.93%

1.28%

0.52%

0.06%

1.74%

1.34%

0.46%

0.00%

Property Value

>A$0 and ≤A$300,000

28.31%

21.51%

6.80%

28.31%

0.00%

23.51%

4.80%

18.77%

9.54%

15.26%

13.05%

0.22%

28.09%

12.10%

8.55%

7.66%

>A$300,000 and ≤A$500,000

39.31%

33.43%

5.88%

39.31%

0.00%

33.86%

5.45%

26.57%

12.74%

19.94%

19.37%

0.26%

39.05%

16.39%

11.44%

11.47%

>A$500,000 and ≤A$1,000,000

28.67%

27.02%

1.65%

0.00%

28.67%

24.09%

4.57%

17.12%

11.54%

10.21%

18.46%

0.04%

28.63%

9.27%

11.18%

8.21%

3.72%

3.61%

0.11%

0.00%

3.72%

3.38%

0.35%

2.20%

1.53%

1.13%

2.59%

0.00%

3.72%

0.87%

1.50%

1.34%

>A$1,000,000

RAMS Mortgage Securities Trust in respect of Series 2006-1

Moody’s Investors Service • 13

Table 2 – continued:

Detailed Mortgage Pool Summary as at August 30, 2006

Scheduled LTV

RAMS 2006-1

TOTAL

LTV ≤80%

Property Value

LTV >80%

≤A$500,000

Property Type

>A$500,000

Detached

Occupancy

Units

Owner Occ

Amortisation

Investment

P&I

Fixed/Var

IO

Fixed

Income Verification

Var

Verified

Low Doc

No Doc

Property Type

Detached

84.83%

73.28%

11.56%

57.37%

27.47%

84.83%

0.00%

59.02%

25.81%

41.63%

43.20%

0.44%

84.39%

32.15%

28.05%

Units/Townhouses

14.66%

12.02%

2.65%

9.79%

4.87%

0.00%

14.66%

5.57%

9.10%

4.60%

10.06%

0.08%

14.59%

6.16%

4.48%

4.02%

0.50%

0.27%

0.23%

0.45%

0.05%

0.00%

0.50%

0.06%

0.44%

0.30%

0.20%

0.00%

0.50%

0.33%

0.15%

0.03%

Owner Occupied

64.66%

53.73%

10.92%

45.34%

19.32%

59.02%

5.63%

64.66%

0.00%

38.71%

25.95%

0.44%

64.22%

28.26%

21.32%

15.07%

Investment

35.34%

31.83%

3.51%

22.28%

13.07%

25.81%

9.54%

0.00%

35.34%

7.83%

27.51%

0.08%

35.27%

10.38%

11.35%

13.61%

Land

24.64%

Occupancy

Loan Purpose

Purchase

53.09%

43.43%

9.66%

34.07%

19.02%

43.66%

9.43%

32.31%

20.78%

26.80%

26.29%

0.22%

52.86%

23.93%

15.96%

13.21%

Refinance

46.91%

42.14%

4.77%

33.54%

13.37%

41.18%

5.73%

32.34%

14.57%

19.74%

27.17%

0.29%

46.62%

14.71%

16.72%

15.48%

Amortisation Schedule

Principal & Interest

46.54%

37.38%

9.16%

35.20%

11.34%

41.63%

4.91%

38.71%

7.83%

46.54%

0.00%

0.35%

46.19%

23.58%

13.37%

9.59%

Interest Only ≤ 5 Years

45.14%

40.41%

4.73%

26.92%

18.21%

35.75%

9.39%

20.04%

25.10%

0.00%

45.14%

0.17%

44.97%

12.15%

17.09%

15.90%

Line of Credit > 5 Years

8.32%

7.78%

0.54%

5.49%

2.83%

7.45%

0.87%

5.91%

2.41%

0.00%

8.32%

0.00%

8.32%

2.91%

2.22%

3.20%

Fixed/Var

Fixed

0.52%

0.35%

0.16%

0.48%

0.04%

0.44%

0.08%

0.44%

0.08%

0.35%

0.17%

0.52%

0.00%

0.34%

0.12%

0.06%

99.48%

85.22%

14.27%

67.14%

32.35%

84.39%

15.09%

64.22%

35.27%

46.19%

53.29%

0.00%

99.48%

38.30%

32.56%

28.63%

Verified Income

38.64%

24.42%

14.22%

28.49%

10.15%

32.15%

6.48%

28.26%

10.38%

23.58%

15.05%

0.34%

38.30%

38.64%

0.00%

0.00%

Low Doc

32.68%

32.56%

0.12%

19.99%

12.69%

28.05%

4.63%

21.32%

11.35%

13.37%

19.31%

0.12%

32.56%

0.00%

32.68%

0.00%

No Doc

28.69%

28.59%

0.09%

19.13%

9.55%

24.64%

4.05%

15.07%

13.61%

9.59%

19.10%

0.06%

28.63%

0.00%

0.00%

28.69%

Var

Income Verification

State Distribution

Australian Capital Territory

New South Wales

Northern Territory

1.73%

1.37%

0.35%

1.34%

0.39%

1.65%

0.08%

1.26%

0.47%

1.01%

0.72%

0.00%

1.73%

1.01%

0.55%

0.17%

28.33%

23.63%

4.70%

16.64%

11.69%

23.86%

4.47%

19.71%

8.62%

14.33%

14.00%

0.18%

28.15%

13.97%

8.83%

5.53%

0.32%

0.28%

0.05%

0.21%

0.11%

0.24%

0.09%

0.08%

0.24%

0.08%

0.24%

0.00%

0.32%

0.10%

0.09%

0.13%

21.49%

18.74%

2.75%

15.39%

6.10%

18.39%

3.10%

12.98%

8.51%

8.32%

13.17%

0.04%

21.45%

6.94%

8.14%

6.41%

South Australia

1.69%

1.47%

0.22%

1.52%

0.17%

1.66%

0.02%

1.10%

0.59%

0.91%

0.78%

0.00%

1.69%

0.41%

0.66%

0.61%

Tasmania

0.49%

0.46%

0.03%

0.27%

0.22%

0.36%

0.13%

0.28%

0.21%

0.20%

0.29%

0.00%

0.49%

0.30%

0.09%

0.11%

Queensland

Victoria

18.39%

14.48%

3.91%

14.07%

4.33%

15.15%

3.25%

13.24%

5.15%

10.81%

7.58%

0.07%

18.32%

8.90%

5.62%

3.87%

Western Australia

27.56%

25.13%

2.43%

18.18%

9.38%

23.53%

4.02%

16.01%

11.55%

10.88%

16.67%

0.22%

27.34%

7.01%

8.70%

11.85%

Metro/Non Metro

Metro

68.30%

59.14%

9.15%

43.11%

25.19%

56.40%

11.90%

44.25%

24.04%

31.85%

36.45%

0.37%

67.92%

26.15%

22.67%

19.47%

Non-Metro

31.70%

26.43%

5.28%

24.51%

7.20%

28.44%

3.27%

20.40%

11.30%

14.69%

17.01%

0.14%

31.56%

12.48%

10.00%

9.22%

Mortgage Insurance Cover

HLIC (Aaa)

0.14%

0.14%

0.00%

0.09%

0.05%

0.14%

0.00%

0.10%

0.04%

0.14%

0.00%

0.00%

0.14%

0.14%

0.00%

0.00%

Genworth (Aa2)

31.41%

27.68%

3.73%

21.36%

10.06%

26.54%

4.88%

22.18%

9.24%

14.70%

16.72%

0.13%

31.29%

8.76%

12.26%

10.39%

PMI (Aa2)

68.45%

57.75%

10.70%

46.16%

22.28%

58.16%

10.29%

42.37%

26.07%

31.70%

36.74%

0.39%

68.05%

29.73%

20.42%

18.30%

14 • Moody’s Investors Service

RAMS Mortgage Securities Trust in respect of Series 2006-1

RESIMAC Premier Euro 2006-1E Trust

Moody’s Investors Service • 15

SF81870isf

© Copyright 2006, Moody’s Investors Service, Inc. and/or its licensors and affiliates including Moody’s Assurance Company, Inc. (together, “MOODY’S”). All rights

reserved. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY COPYRIGHT LAW AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE

REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR

ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR

WRITTEN CONSENT. All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of

human or mechanical error as well as other factors, however, such information is provided “as is” without warranty of any kind and MOODY’S, in particular, makes no

representation or warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability or fitness for any particular purpose of any such

information. Under no circumstances shall MOODY’S have any liability to any person or entity for (a) any loss or damage in whole or in part caused by, resulting from,

or relating to, any error (negligent or otherwise) or other circumstance or contingency within or outside the control of MOODY’S or any of its directors, officers,

employees or agents in connection with the procurement, collection, compilation, analysis, interpretation, communication, publication or delivery of any such

information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if

MOODY’S is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The credit ratings and financial

reporting analysis observations, if any, constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not

statements of fact or recommendations to purchase, sell or hold any securities. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS,

COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR

MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER. Each rating or other opinion must be weighed solely as one factor in any investment decision made

by or on behalf of any user of the information contained herein, and each such user must accordingly make its own study and evaluation of each security and of each

issuer and guarantor of, and each provider of credit support for, each security that it may consider purchasing, holding or selling.

MOODY’S hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and

preferred stock rated by MOODY’S have, prior to assignment of any rating, agreed to pay to MOODY’S for appraisal and rating services rendered by it fees ranging

from $1,500 to $2,400,000. Moody’s Corporation (MCO) and its wholly-owned credit rating agency subsidiary, Moody’s Investors Service (MIS), also maintain policies

and procedures to address the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO

and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is

posted annually on Moody’s website at www.moodys.com under the heading “Shareholder Relations — Corporate Governance — Director and Shareholder Affiliation

Policy.”

This credit rating opinion has been prepared without taking into account any of your objectives, financial situation or needs. You should, before acting on the

opinion, consider the appropriateness of the opinion having regard to your own objectives, financial situation and needs.

16 • Moody’s Investors Service

RAMS Mortgage Securities Trust in respect of Series 2006-1