PDF - George Weston Limited

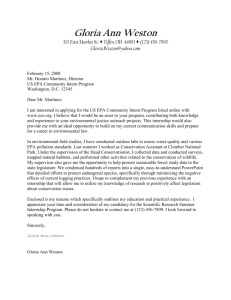

advertisement