Forecasting interest rates - Risk Policy and Regulation

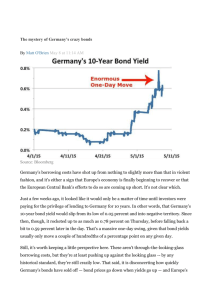

advertisement