Leader in online banking : one new customer every 5 minutes in

advertisement

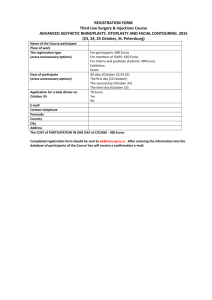

PRESS RELEASE Boulogne-Billancourt, 30 July 2014 Leader in online banking : one new customer every 5 minutes in France during H1 2014 France : one new customer every 5 minutes Close to 55,000 new customers acquired in the first half (+50%) 554,603 customers at the end of June 2014, +21% Strong growth in balance sheet deposits +16% at 4.2 billion euros Very good performance of Life Insurance, net inflows +83% during H1 2014 Success of the Simplified Public Tender Offer of Société Générale on the Boursorama shares and mandatory squeeze out United Kingdom : sale of assets to the Equiniti Group “With a simple, clear and kept customer promise, online banking meets a genuine expectation and that is why one of out five French people considers moving in the near future to a fully online bank. The first half of 2014 demonstrates the attractiveness of Boursorama and the current rate of customer acquisition will allow us to meet the target of 600,000 customers in France by the end of the year,” declared Marie Cheval, CEO of Boursorama. France Banking activity - One new customer every 5 minutes since January 2014 With 52,251 current accounts opened in the 1st half 2014, or +47%, and 24,432 new savings accounts, Boursorama Banque counted 554,603 customers at the end of June 2014. 70% of new current accounts were opened fully online. The growth in the customer base (54,872 new customers, or +21%) came with a 16% increase in customer deposits to 4.2 billion euros. The online marketing was intensified thanks to partnership operations such as the one developed in June with vente-privee for an exclusive offer to vente-privee members. The scheme’s success was due to the complementary nature of vente-privee members expectations with Boursorama’s relationship-driven model (fully online), its products and quality of service. - One in five French people considers moving in the near future to an online bank According to a study conducted by OpinionWay for Boursorama, 46% of French people declare having at least two banks and 5% of them already use an online bank as their main banking institution. The digitalisation of customer relations means that the remote banking offered by online banks meets customer’s needs perfectly (91% feel that these means of communication are sufficient) and leads to a powerful word-of-mouth effect with a 91% recommendation rate. One in five French people considers moving in the near future to online banking, which demonstrates significant scope for growth. - A complete and attractive offering of savings products The strong growth in the level of net inflows to 202 million euros, +83%, shows the attractiveness of Boursorama’s Life Insurance offering. Total outstandings grew +15% to 3.1 billion euros and the unitlinked/euros mix increased to 26%. 70% of new contracts were opened fully online in the 1st half 2014 against 53% in 2013. Mutual fund outstandings increased +14 % to 872 million euros. Total assets administered by Boursorama in France reached 11.7 billion euros. 1 PRESS RELEASE Boulogne-Billancourt, 30 July 2014 - A well-positioned credit offering In the 1st half 2014, the production of housing loans was stable at 331 million euros, which brings total outstanding loans to more than 2.4 billion euros, or a 25% increase against the 1st half 2013. More than 1,700 customers took out a housing loan in H1 2014. The pricing policy of the Boursorama housing loan offering remains attractive. The success of this offering is also due to the application process : easy, quick, online from every digital media, it allows customers to apply anytime and to receive an immediate answer in principle. Brokerage activity The online brokerage activity was characterised by a pick-up in the number of orders executed during the 1st half 2014 with 14% growth in France, despite a rather weak 2nd quarter. Internet Portal In the 2nd quarter 2014, monthly visits on the boursorama.com site amounted to 29 million and more than 276 million pages per month were viewed, confirming boursorama.com as the leader of financial and economic news sites in France. Additional news flow and news items related to the PEA-PME, warrants, SCPI were added to the website. Other highlights of the semester Simplified Public Tender Offer of Société Générale and mandatory squeeze out Following the successful Simplified Public Tender Offer on the Boursorama shares, Societe Generale proceeded with the mandatory squeeze out of the Boursorama shares on 28 May 2014 at a price of €12 per share. Further to the mandatory squeeze out procedure, the breakdown of the Boursorama capital is as follows: Societe Generale, 79.5% / La Caixa, 20.5%. The increase in Société Générale’s share of Boursorama’s capital demonstrates its willingness to strengthen its presence in the online banking sector, of which Boursorama is the leader in France, and to pursue its development in this market. Signature of a contract with IBM Softlayer to host the web part of its IT Boursorama decided to partner with IBM in order to meet the growth challenges of its activity under optimal availability conditions for its customer websites. By developing its services on SoftLayer, Boursorama will improve the management of its IT resources by activating servers as soon as possible in line with the specific needs and uses of its customers. Boursorama will continue to propose new, innovative offerings at the lowest possible cost thanks to the flexibility brought by IBM’s Cloud solution, while at the same time strengthening the resilience of its websites. International In the United Kingdom, following the exclusivity letter signed on May 1st 2014 with Equiniti, Selftrade – Boursorama’s UK subsidiary – entered into an agreement on June 2nd 2014 for the sale of its assets to Equiniti. The two entities worked together for several years, Equiniti being the account holder and supplier of the technological platform on which Selftrade operates. Equiniti will provide continuity of the services offered at similar prices. The transfer of Selftrade’s customer portfolio to Equiniti should take place in the 4th quarter 2014. Selftrade currently has about 130,000 customers and assets worth 6 billion euros. In Germany, activity is driven by the strong performance of brokerage with an 18% increase in the number of orders over the 1st half 2014. In Spain, the 1st half 2014 delivered an excellent performance. The number of orders increased by 54% between January and June 2014. The number of customers rose by 14% to 47,694 and AUA reached 1.1 billion euros, or +63%. The banking activity is due to be developed in the fourth quarter. 2 About Boursorama Boursorama, part of the Société Générale Group, is a major player in online banking in Europe with 733,536 customers, 1,179,110 direct accounts and total assets under management of 18.6bn euros at end of December 2013. In France, Boursorama is the online bank of reference: more than 555,000 customers, at end of June 2014, rely on its innovative, simple, inexpensive and secure bank offering. Its portal, www.boursorama.com, is the leading financial and economic online information website. Boursorama is also active in the United Kingdom and in Spain, under the respective brands Selftrade and Self Bank. In Germany, Boursorama is a major player in brokerage and in financial and economic online information, through its brand OnVista. Press Contacts : Boursorama Communication Department Tél.: +331 46 09 53 21 diane-charlotte.kermorgant@boursorama.fr Publicis Consultants Stéphanie Tabouis Tél.: +336 03 84 05 03 stephanie.tabouis@consultants.publicis 3