FINANCIAL FITNESS

Physically Speaking

September 2005

Planning and saving money for your retirement or life after tennis may seem like a goal that is

far in the future. It’s not! Saving and investing should start as early as possible in your career

and continue through your lifetime. Investment choices you make now will impact upon your

lifestyle tomorrow. They can determine whether you:

•

Buy Haute Couture or High Street;

•

Own your home outright or pay rent; or

• Need to work extended years or can retire.

A basic understanding of your financial situation is necessary to help you decide what financial

choices to make; even when you have someone helping you manage your assets.

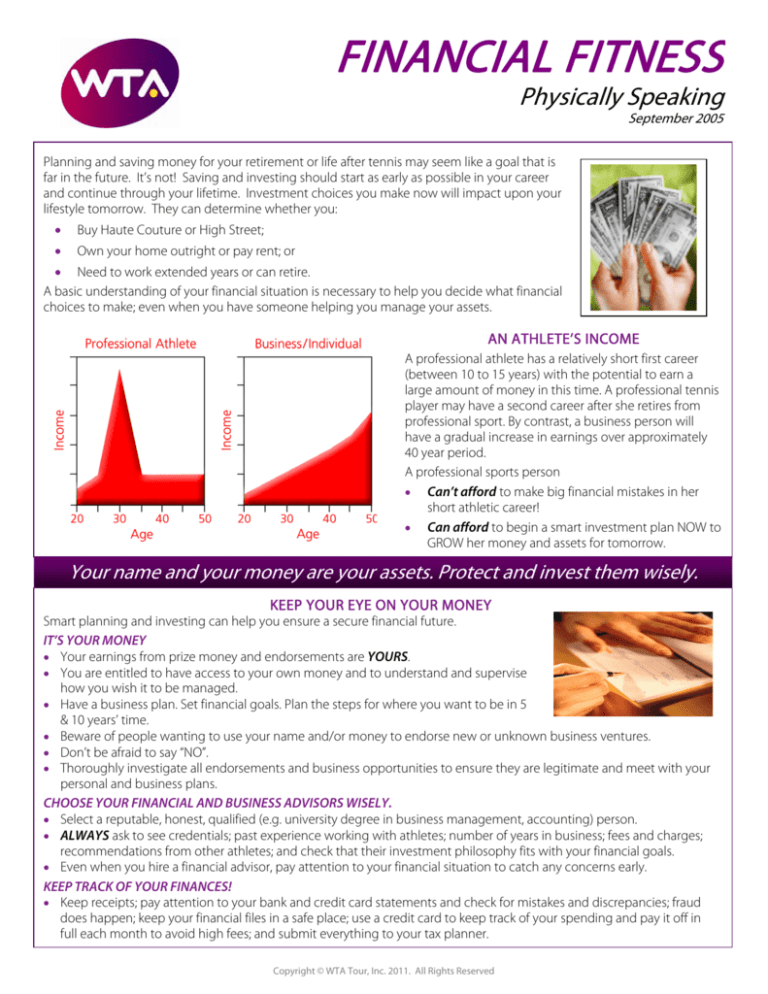

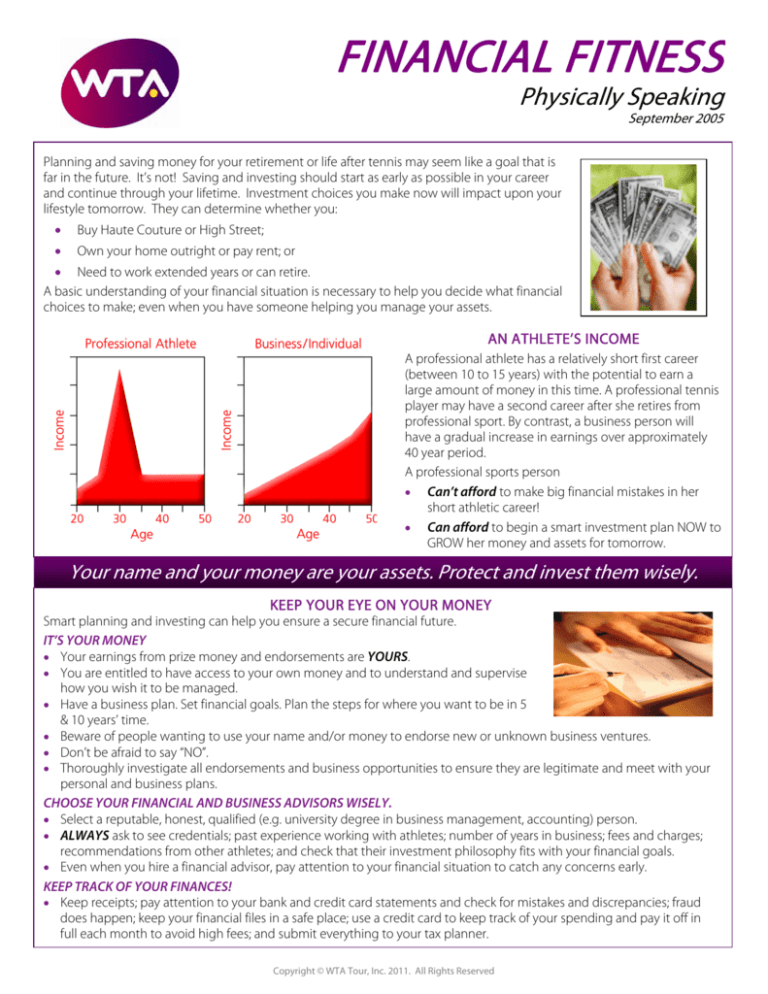

AN ATHLETE’S INCOME

A professional athlete has a relatively short first career

(between 10 to 15 years) with the potential to earn a

large amount of money in this time. A professional tennis

player may have a second career after she retires from

professional sport. By contrast, a business person will

have a gradual increase in earnings over approximately

40 year period.

A professional sports person

• Can’t afford to make big financial mistakes in her

short athletic career!

• Can afford to begin a smart investment plan NOW to

GROW her money and assets for tomorrow.

Your name and your money are your assets. Protect and invest them wisely.

KEEP YOUR EYE ON YOUR MONEY

Smart planning and investing can help you ensure a secure financial future.

IT’S YOUR MONEY

• Your earnings from prize money and endorsements are YOURS.

• You are entitled to have access to your own money and to understand and supervise

how you wish it to be managed.

• Have a business plan. Set financial goals. Plan the steps for where you want to be in 5

& 10 years’ time.

• Beware of people wanting to use your name and/or money to endorse new or unknown business ventures.

• Don’t be afraid to say “NO”.

• Thoroughly investigate all endorsements and business opportunities to ensure they are legitimate and meet with your

personal and business plans.

CHOOSE YOUR FINANCIAL AND BUSINESS ADVISORS WISELY.

• Select a reputable, honest, qualified (e.g. university degree in business management, accounting) person.

• ALWAYS ask to see credentials; past experience working with athletes; number of years in business; fees and charges;

recommendations from other athletes; and check that their investment philosophy fits with your financial goals.

• Even when you hire a financial advisor, pay attention to your financial situation to catch any concerns early.

KEEP TRACK OF YOUR FINANCES!

• Keep receipts; pay attention to your bank and credit card statements and check for mistakes and discrepancies; fraud

does happen; keep your financial files in a safe place; use a credit card to keep track of your spending and pay it off in

full each month to avoid high fees; and submit everything to your tax planner.

Copyright © WTA Tour, Inc. 2011. All Rights Reserved

FINANCIAL FITNESS

Physically Speaking

SHOW ME THE MONEY!

ACE YOUR INVESTMENT PLAN

There are many different types of investment products. What you choose to include in your portfolio (group

of investments) will depend upon a number of factors, including what your short, medium and long-term

goals are and what type of investor you are and how comfortable you are with risk.

APPRECIATION

Start investing early. You will reap bigger financial rewards. For example, if you invest $25,000 a year from 20

to 30 years of age, (a total investment of $250,000) in a moderate investment mix earning 8%, leave it there

for 20 years, by age 50 you will have $1, 688,031.17!

SAVINGS PRODUCTS

Allow you to access your money at any time and are generally low risk and earn low interest. Examples

include saving accounts, checking accounts and certificates of deposit. It is smart to have enough money

(about 6 months’ income) in a savings product to cover an emergency that affects your ability to earn

All tennis photos:

money, like an injury or illness.

Getty Images

INVESTMENT PRODUCTS

Investing means you may earn much more money than by relying upon no-risk savings. Investors are not usually guaranteed of a return,

but they do get the opportunity of making money that more than offsets the cost of inflation. These products include: stocks and bonds,

real estate and mutual funds.

RISK TOLERANCE

What are the best saving and investing products for you? The answer depends on when you will need the money, your goals, and if you

will be able to sleep at night with the level of risk you have selected. For example, if you are saving for a short-term goal, you don't want

to choose risky investments, because when it's time to sell, you may have to take a loss. For a long-term goal, you may choose to invest in

riskier products, knowing that you have time and can wait and plan to sell at the best possible time.

DIVERSIFY

Diversification is spreading out your investments between different types of products. It helps protect your money because if one

product does not perform well, it is unlikely that your whole portfolio does not perform well.

Spread out your money across different products to lower your risk and balance your

portfolio. A reputable financial advisor can help you make wise choices.

GET A GRIP ON YOUR PENSION PLAN

Do you plan on making a living from professional tennis when you are 60 years old? Probably not, so get a grip on your future;

understand your pension plan now.

• The Players’ Pension Plan is a large pool of money that is invested for eligible players. The money is invested in funds that you

choose, and grows over the years. When a player turns 50, she will receive a monthly payout of the money that continues for the

next 20 years.

• This money is fully funded by a percentage from the overall pool of prize money, so your investment costs you nothing additional.

• An independent committee with experience in the areas of investments and pensions selected by the Board of Directors of the

Women’s Tennis Benefit Association, Inc. (WTBA) runs the Plan.

TO BE ELIGIBLE YOU MUST:

• Be a Full Member.

• Play (not win) 12 singles or10 doubles WTA tournaments in a calendar year.

• Have 5 years of service (year of service = 6 singles or 5 doubles tournaments) before you qualify for payment.

WATCH IT GROW

• A $4,000 payment per year between age 23 and 28, at 8% growth per year, by age 50 you could have

$127,576 ($900 a month).

• For a $7,000 contribution for same time, with same growth rate, by age 50 you could have $223, 258

($1,600 per month).

• Access your Vanguard account records at any time, with your Social Security Number or Member Access Number and your PIN at

www.vanguard.com. If you have questions, contact a Vanguard Participant Services associate at 1-800-523-1188. If you call from

outside the USA and cannot access a 1-800 number, Vanguard will accept a collect call at 1-610-669-1000 between 8:30 am and

5:30 pm Eastern Standard Time. Player Relations staff can also provide more information.

QUESTIONS? Need more information? Contact a member of the WTA Sport Sciences &

Medicine, Player Development or Athlete Assistance Departments and check out the

Athlete Assistance website: www.achievesolutions.net/tennis

Copyright © WTA Tour, Inc. 2011, All Rights Reserved.

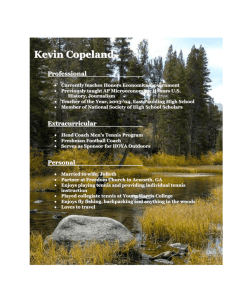

Thanks to Jan Plewes, Senior Vice

President Financial Services, Octagon; &

The Vanguard Group, Inc. for their

assistance with this topic.