Detroit Water and Sewerage Department

735 Randolph Street

Detroit, Michigan 48226

(313) 224-4704 Office

www.dwsd.legistar.com

Meeting Agenda

Wednesday, December 9, 2015

7:30 AM

Finance Committee Meeting

5th Floor Board Room, Water Board Building

Finance Committee

Finance Committee

Meeting Agenda

1.

CALL TO ORDER

2.

ROLL CALL

3.

APPROVAL OF AGENDA

4.

APPROVAL OF MINUTES

November 12, 2015

December 9, 2015

(Page 2)

5.

PUBLIC PARTICIPATION

6.

OLD BUSINESS

A. Preliminary Official Statement (Bond Refunding) and Bondholder Consent

(Page 5)

Update

7.

NEW BUSINESS

A. Resolutions Adopting Amendment to Ordinance and Authorizing Execution of

Supplement to Indenture for Both the Water Supply System and the Sewage

Disposal System

8.

(Page 14)

REPORTS

A. Customer Service Division Report

-

Customer Payments- Policy Decision

B. CFO Report

(Page 46)

C. Technology Update (verbal)

D. Monthly Information Reports

- Transition Budget

9.

OTHER MATTERS

Future Meeting Date(s)

10.

ADJOURNMENT

Detroit Water and Sewerage Department

Page 2

Printed on 12/4/2015

PAGE 1

AGENDA ITEM #4

Detroit Water and Sewerage

Department

735 Randolph Street

Detroit, Michigan 48226

(313) 224-4704 Office

www.dwsd.legistar.com

Meeting Minutes - Draft

Finance Committee

Thursday, November 12, 2015

7:30 AM

5th Floor Board Room, Water Board Building

Finance Committee Meeting

1.

CALL TO ORDER

Co-Chairperson Forte called the meeting to order at 7:30 A.M.

2.

ROLL CALL

Present:

3.

3 - Linda Forte, Michael Einheuser and Jody Caldwell

APPROVAL OF AGENDA

Co-Chairperson Forte requested approval of the agenda.

A motion was made by Co-Chairperson Jody Caldwell, seconded by

Co-Chairperson Michael Einheuser that the agenda be approved. The motion

carried by the following vote:

approved

Aye:

4.

3-

Co-Chairperson Forte, Co-Chairperson Einheuser and Co-Chairperson

Caldwell

APPROVAL OF MINUTES

Co-Chairperson Forte requested approval of the minutes of November 2, 2015.

A motion was made by Co-Chairperson Einheuser, seconded by

Co-Chairperson Caldwell that the minutes be approved. The motion carried by

the following vote:

approved

Aye:

5.

3-

Co-Chairperson Forte, Co-Chairperson Einheuser and Co-Chairperson

Caldwell

PUBLIC PARTICIPATION

This was none.

6.

OLD BUSINESS

Please view the Finance binder of November 12, 2015 for supplemental details.

Detroit Water and Sewerage Department

Page 1

PAGE 2

Finance Committee

Meeting Minutes - Draft

November 12, 2015

A. Preliminary Official Statement/Bondholder Consent Update (Page 5)

Presenters: Nicolette Bateson, CFO and Lee Donner of First Southwest

Lee Donner, First Southwest stated that Standard & Poors (S&P) took action and

upgraded senior lien bonds. He recommends reading the rating report. S&P gave

good report for the standup of Great Lakes Water Authority (GLWA) and legal

separation from the City. Moody's rating expected by Monday or Tuesday. Deadline

of November 24 for beneficial holders to submit consent solicitation documents to

trustee of DWSD and Citibank. Price the refunding on or about November 24. Create

a one week optional pricing date of November 23/24 or as late as November

30/December 1. Finalized the official statements and the closing for the refunding by

December 15 or 17. By the November 18 BOWC meeting will have a handling on the

voluntary consent process and an idea whether it necessitate a Plan B for advance

refunding.

7.

NEW BUSINESS

15-1188

Finance Committee binder of Nov. 12, 2015

Sponsors:

Attachments:

Bateson

FC Binder 11.12.2015

This Communication or Report was received and filed.

A. Actuarial Report for the CIty of Detroit General Retirement System (Page 6)

Presenter: Nicolette Bateson, CFO

B. Proposed Procurement of Asset Management Services (Page 46)

Presenter: Nicolette Bateson, CFO

8.

REPORTS

A. Customer Service Division Report (Page 55)

Darryl Latimer, Chief Customer Service Officer, reported shutoff activity continues;

news coverage regarding shut offs; payment plan customers have missed payments;

issued door tags to customers who fell off payment plans; 43 thousand customers in

payment plans; 5-6 thousand in delinquent status attached with workorders; water

fund asistance availability; general counsel continued work with Highland Park and

Melvindale; online payment system has 15 percent activity; challenges of check

process.

Detroit Water and Sewerage Department

Page 2

PAGE 3

Finance Committee

Meeting Minutes - Draft

November 12, 2015

B. CFO Report (Page 65)

Presenter: Nicolette Bateson, CFO

Project Implementation Plan ( Page 67)

Presenter: Michael Huber, Finance Director

C. Monthly Information Reports

- State Revolving Fund Loans and Status (Page 72)

Presenter: Jon Wheatley

9.

OTHER MATTERS

Future Meeting Date(s)

Dec. 9, 2015, 7:30 AM.

10.

ADJOURNMENT

Co-Chairperson Forte requested a motion to adjourn.

A motion was made by Co-Chairperson Caldwell, seconded by Co-Chairperson

Einheuser that this meeting be adjourned. The motion carried by the following

vote:

adjourned

Aye:

3-

Co-Chairperson Forte, Co-Chairperson Einheuser and Co-Chairperson

Caldwell

There being no further business, the meeting adjourned at 9:00 AM.

Detroit Water and Sewerage Department

Page 3

PAGE 4

AGENDA ITEM #6A

City of Detroit

Water & Sewerage Department

Financial Services Division

DT: December 9, 2015

TO: Board of Water Commissioners Finance Committee

FM: Nicolette Bateson, CPA, Chief Financial Officer

RE: Preliminary Official Statement (Bond Refunding) and Bondholder Consent Update

In the past two weeks, the City of Detroit Water & Sewerage Department successfully executed

two financial activities. Both of these transactions support that stand-up of the Great Lakes

Water Authority while also recognizing the significant financial improvements that the Board of

Water Commissioners (BOWC) has established as the foundation for the transition.

On Wednesday, November 25, 2015, the "Notice of 51% Consent Date" for the water and sewer

systems was posted to EMMA (the Electronic Municipal Market Access system provided by the

Municipal Securities Rulemaking Board). This notice was the outcome of a public voluntary

consent solicitation process that had a deadline of November 24, 2015. The consent sought was

for the purpose of pivoting the obligor of outstanding bonds from the City of Detroit Water &

Sewerage system to the Great Lakes Water Authority on the effective date (presumed to be

January 1, 2016). As of that date, approximately 67% consent had been achieved – surpassing

the goal of 51%.

On Wednesday, December 2, 2015, the bond refunding transaction of $324.4 million resulted in

cashflow savings of $38.2 million and net present value savings of $29.3 million. Like the 2014

refunding, many series were significantly oversubscribed (over $4.4 billion in orders were

received) which led to a re-pricing and further reduced debt service cost. The refunding bonds

also carry the pivot language which increases the percentage of outstanding bonds that carry the

bondholder consent language. Closing on this transaction is scheduled for Monday, December

14, 2015.

These activities have been underway since the Memorandum of Understanding was executed in

September 2014 to form the regional authority. The timing has been driven by the coordination

and completion of significant conditions precedent documents leading to the stand-up of the

Great Lakes Water Authority. The financing team supporting this transaction has worked

tirelessly to get us to this point. Many thanks to First SouthWest (Lee Donner and Ann BurgerEnterkin), Dykema (Ann Fillingham and Jim Kiefer), Citi (an extensive team led by Tom Green,

including Dave Houston, George Leung, Daniel Siegel, and Marjorie Henning), Kutack Rock

(Debbie Ruskin and Lisa Sturzenberger), Foster Group, LLC (Bart Foster), Michigan Finance

Authority (John Barton, Valerie Khoury, and Kester So of Dickinson Wright), Attorney

PAGE 5

General’s Office (William Petit), Dykema’s Advisor to the BOWC (Rick McDonald), Ramirez

& Co. (Ted Sobel), and US Bank (Susan Brown) as well as DWSD’s Public Finance Manager

Jon Wheatley.

Members of the financing team will be in attendance at the Finance Committee meeting to

provide a recap of the transactions. Their presentation is attached.

PAGE 6

December 9, 2015

Detroit Water & Sewerage Department

Review of the 2015 Consent Solicitation / Refunding Transactions

Presentation to the Board of Water Commissioners

PAGE 7

Review of Multi-Year, Multi-Step Strategy to Create GLWA

The 2014 tender and restructuring laid the groundwork for “standing up” the Great Lakes Water Authority

(“GLWA”). Via the 2015 transaction, GLWA will become effective by January 1, 2016.

To effectuate GLWA, the holders of at least 51% of outstanding DWSD Water bonds and DWSD Sewer bonds

must consent to the transfer of such debt obligations to GLWA

The 2014 transaction, which generated $249 million of gross cash flow savings and $113 million of present

value savings, included language that constituted consent of the purchasers of the 2014 Bonds to such

transfer

– These purchasers provided consent for approximately 35% of outstanding Water Bonds and 32% of

outstanding Sewer Bonds

– As consent solicitation manager, Citi canvassed the largest bondholders of DWSD Bonds, other than the

2014 holders in hand, and asked for formal consent by November 24, 2015

Needing approximately $870 million of consents to reach the 51% threshold, Citi was able to bring in

approximately $1.5 billion consents

– In total, the holders of over 2/3 of DWSD’s outstanding bonds consented to the transfer of obligor

DWSD posted a formal EMMA notice on November 25, 2015 to announce that over 51% of bondholders had

consented to the change in obligor from DWSD to the GLWA of all DWSD Bonds

– This posting precluded the withdrawal of any provided consents

On December 2, 2015, DWSD priced “in-the-money” current refunding candidates for savings

– Over $38 million in gross cash flow savings and $29 million in present value savings was realized

– As only current refunding candidates were selected, future refunding opportunities will remain in 2016 and

2017

1

PAGE 8

Rating Upgrades (And More to Come)

All three rating agencies upgraded the DWSD Bonds since the 2014 transaction, with Moody’s expected to

upgrade the rating “several notches higher” upon formal GLWA conversion in January 2016.

Leaner operations, improving financial metrics, and a proactive DWSD management team were the basis for

continued upgrades in 2015, with DWSD returning to the “A” rating category

Moody’s, which currently has the lowest rating on the DWSD Bonds, took the unusual step of stating in its

report that upon GLWA stand up, “the rating could be several notches higher”

2

Pre 2014

Tender /

Restructuring

2014

Refunding

Bonds

2015

Refunding

Bonds

Senior / Sub

Senior / Sub

Senior / Sub

CCC / CCC

BBB+ / BBB+

A- / BBB+

B1 / B2

Ba2 / Ba3

Baa3 / Ba1

BB+ / BB

BBB- / BB+

BBB / BBB-

PAGE 9

Extensive Marketing Outreach to Bondholders and Insurers

Citi and FirstSouthwest planned and executed an unprecedented marketing campaign to educate investors and

insurers on the pivot to GLWA.

Approach

1. Electronic Investor Roadshow for MFA Bonds

– 51 unique institutional investors viewed the recorded roadshow available online

2. Electronic Investor Roadshow Targeting Largest Bondholders for Voluntary Consent

3. One-on-One Calls with Institutional Accounts to Discuss GLWA Consent and Series 2015C&D Bonds

– DWSD management participated in 20+ one-on-one investor calls to discuss GLWA consent and improving financial and operating

metrics of DWSD

4. Internal Citi Salesforce Teach-In to educate Sales and assist in canvassing accounts

Results

Over $4.4 billion of orders were received for the Series 2015C&D refunding bonds, including $1.1 billion of Senior Lien orders and $3.3

billion of Second Lien orders

72 distinct institutional investors placed orders

– Existing holders added to positions

– New investors came in to buy DWSD bonds for the 1st time

– Variety of account types participated including asset managers, mutual funds, insurance companies, SMAs, and relative value funds

“Top Tier” accounts such as Vanguard, PIMCO, Fidelity, Goldman Sachs Asset Management, Nuveen, Franklin, Cap Re, Wamco,

BlackRock, and T. Rowe came in for significant orders

– Vanguard placed orders for the entire deal ($325 million of orders)

Assured Guaranty offered to insure the entire deal and added to its DWSD exposure by insuring over $13 million

3

PAGE 10

Tightened Spreads, Enhancing Savings

Over $38 million in gross cash flow savings and $29 million in present value savings was captured. As only

current refunding candidates were selected, future refunding opportunities will remain in 2016 and 2017.

On the Senior Lien Bonds, the underwriting syndicate tightened spreads 32 basis points from price views and 17 basis points from premarketing levels

– The lower interest rates saved DWSD approximately $1.1 million on the Senior Lien Bonds

On the Second Lien Bonds, the underwriting syndicate tightened spreads 37 basis points from price views and 22 basis points from premarketing levels

– The lower interest rates saved DWSD approximately $3.5 million on the Second Lien Bonds

Senior Lien Spreads

Maturity

Sewer

Par

7/1/2017

Water

Par

505

7/1/2018

Pre

Marketing

Spread

40

Second Lien Spreads

Final

Pricing

Spread

33

50

Pre Marketing

Vs. Final

Pricing Benefit

-7

7/1/2017

N/A

7/1/2018

Maturity

7/1/2019

4,600

60

49

-11

7/1/2019

7/1/2020

2,005

70

58

-12

7/1/2020

7/1/2021

7,120

80

65

-15

7/1/2021

7/1/2022

5,925

90

75

-15

7/1/2022

Sewer

Par

500

Water

Par

Pre

Marketing

Spread

Final

Pricing

Spread

55

Pre Marketing

Vs. Final

Pricing Benefit

N/A

7/1/2023

7/1/2023

7/1/2024

7/1/2024

7/1/2025

7/1/2025

7/1/2026

7/1/2026

3,620

120

105

-15

115

N/A

7/1/2027

3,175

100

85

-15

7/1/2027

7,065

125

110

-15

7/1/2028*

8,250

100

65

-35

7/1/2028

7,415

125

110

-15

7/1/2029

9,270

100

85

-15

7/1/2029

7/1/2030

5,085

100

87

-13

7/1/2030

7/1/2031

5,660

100

86

-14

7/1/2031

7/1/2032

5,985

100

85

-15

7/1/2032

5,955

110

N/A

7/1/2033

6,405

100

85

-15

7/1/2033

21,165

7/1/2034

18,915

100

83

-17

7/1/2034

74,125

7/1/2035

6,530

100

83

-17

Total

89,430

7/1/2035**

77,815

Total

197,660

37,235

125

107

-18

125

103

-22

125

103

-22

37,235

* Insured by AGM

4

** $5 million insured by AGM (only uninsured spread is displayed)

PAGE 11

Over $38 Million in Savings to DWSD

Over $38 million in gross cash flow savings and $29 million in present value savings was captured, with positive

savings generated in every fiscal year.

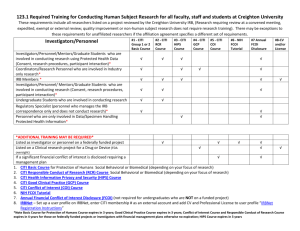

Refunding Statistics

Delivery Date

Refunding Savings

Fiscal Year

Water Savings

By Year

Sewer Savings

By Year

Total Savings

By Year

Water System

Sewer System

12/15/2015

12/15/2015

2016

$3,078,891

$863,826

$3,942,717

Refunding Par

$126,665,000

$197,660,000

2017

1,698,550

838,370

2,536,920

Refunded Par

$142,065,000

$215,245,000

2018

3,023,100

872,370

3,895,470

2003A, 2003B,

2005A, 2005C

2001D,

2005A, 2005C

2019

232,000

1,231,370

1,463,370

2020

158,500

1,065,570

1,224,070

2021

158,500

2,950,370

3,108,870

Series Refunded

Gross Savings

$16,389,941

$21,883,689

2022

158,500

1,166,575

1,325,075

PV Savings ($)

$13,003,173

$16,347,772

2023

158,500

1,051,050

1,209,550

9.2%

7.8%

2024

158,500

833,213

991,713

$357,691

$584,135

2025

928,500

6,593,450

7,521,950

97.3%

96.6%

2026

2,120,000

756,200

2,876,200

2027

220,000

200

220,200

PV Savings (%)

Negative Arbitrage

Escrow Efficiency

True Interest Cost

3.87%

4.17%

2028

160,000

200

160,200

All-In TIC

3.96%

4.24%

2029

162,500

200

162,700

Avg. Life

15.1 yrs

18.1 yrs

2030

161,875

200

162,075

2031

162,875

200

163,075

2032

162,275

200

162,475

2033

159,050

3,655,200

3,814,250

2034

3,323,900

1,425

3,325,325

2035

3,925

3,500

7,425

$16,389,941

$21,883,689

$38,273,629

Savings, Negative Arbitrage, and Escrow Efficiency calculations for the Sewer system do not include the defeasance of the Sewer Series 2001D Auction Rate Security.

5

PAGE 12

In any instance where distribution of this communication is subject to the rules of the US Commodity Futures Trading Commission (“CFTC”), this communication constitutes an invitation to consider

entering into a derivatives transaction under U.S. CFTC Regulations §§ 1.71 and 23.605, where applicable, but is not a binding offer to buy/sell any financial instrument.

This presentation has been prepared by individual personnel of Citigroup Global Markets Inc., Citigroup Global Markets Limited or their subsidiaries or affiliates (collectively, “Citi”). Such employees are not research

analysts and are not subject to SEC or FSA rules designed to promote the independence of research and research analysts and accordingly may receive compensation related to securities or products to which these

materials relate. These materials may contain general market commentary and excerpts of research; however they are not intended to constitute investment research, a research recommendation, research analysis or a

research report for purposes of such rules.

In connection with any proposed transaction, Citi will be acting solely as a principal and not as your agent, advisor, account manager or fiduciary. Citi has not assumed a fiduciary responsibility with

respect to the proposed transaction, and nothing in this or in any prior relationship between you and Citi will be deemed to create an advisory, fiduciary or agency relationship between us in respect of a

proposed transaction. You should consider carefully whether you would like to engage an independent advisor to represent or otherwise advise you in connection with any proposed transaction, if you

have not already done so.

Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This presentation is not a commitment to lend, syndicate a

financing, underwrite or purchase securities, or commit capital nor does it obligate us to enter into such a commitment. By accepting this presentation, subject to applicable law or regulation, you agree to keep confidential

the existence of and proposed terms for any contemplated transaction.

The provision of information in this presentation is not based on your individual circumstances and should not be relied upon as an assessment of suitability for you of a particular product or transaction. Even if Citi

possesses information as to your objectives in relation to any transaction, series of transactions or trading strategy, this will not be deemed sufficient for any assessment of suitability for you of any transaction, series of

transactions or trading strategy.

This presentation is provided for information purposes and is intended for your use only. Except in those jurisdictions where it is impermissible to make such a statement, Citi hereby informs you that this presentation

should not be considered as an offer to sell or the solicitation of an offer to purchase any securities or other financial products. This presentation does not constitute investment advice and does not purport to identify all

risks or material considerations which should be considered when undertaking a transaction. Citi makes no recommendation as to the suitability of any of the products or transactions mentioned. Any trading or investment

decisions you take are in reliance on your own analysis and judgment and/or that of your advisors and not in reliance on us.

Certain transactions, including those involving swaps and options, give rise to substantial risk including the potential loss of the principal amount invested, and are not suitable for all investors. Citi does not provide

investment, accounting, tax, financial or legal advice; however, you should be aware that any proposed indicative transaction could have accounting, tax, legal or other implications that should be discussed with your

independent advisors. Therefore, prior to entering into any transaction, you should determine, without reliance on Citi, the economic risks or merits, as well as the legal, tax and accounting characteristics and

consequences of the transaction and that you are able to assume these risks. By acceptance of these materials, you and Citi hereby agree that from the commencement of discussions with respect to any transaction,

and notwithstanding any other provision in this presentation, Citi hereby confirms that no participant in any transaction shall be limited from disclosing the U.S. tax treatment or U.S. tax structure of such transaction.

This presentation is not intended to forecast or predict future events. Past performance is not a guarantee or indication of future results. Any estimates and opinions included herein constitute Citi’s judgment as of the date

hereof and are subject to change without any notice.

This presentation may contain "forward-looking" information. Such information may include, but not be limited to, projections, forecasts or estimates of cash flows, yields or return, scenario analyses and proposed or

expected portfolio composition. Any forward-looking information is based upon certain assumptions about future events or conditions and is intended only to illustrate hypothetical results under those assumptions (not all

of which are specified herein or can be ascertained at this time). It does not represent actual termination or unwind prices that may be available to you. Actual events or conditions are unlikely to be consistent with, and

may differ significantly from, those assumed. Illustrative performance results may be based on mathematical models that calculate those results by using inputs that are based on assumptions about a variety of future

conditions and events and not all relevant events or conditions may have been considered in developing such assumptions. Accordingly, actual results may vary and the variations may be substantial. The products or

securities identified in any of the illustrative calculations presented herein may therefore not perform as described and actual performance may differ, and may differ substantially, from those illustrated in this material.

When evaluating any forward looking information you should understand the assumptions used and, together with your independent advisors, consider whether they are appropriate for your purposes.

Any securities or other financial products described herein may be subject to fluctuations of their mark-to market price or value. Such fluctuations may be substantial, depending on the type of securities or other financial

products and the financial environment. In addition certain securities described in the presentation may provide for payments linked to or derived from prices or yields of one or more securities or other instruments or

foreign currencies, and such provisions may result in negative fluctuations in the value of and the amounts payable with respect to such securities prior to or at redemption. You should consider the implication of such

fluctuation with your independent accounting, tax and risk advisors.

Citi shall have no liability to you, the user or to third parties, for the quality, accuracy, timeliness, continued availability or completeness of the data nor for any special, direct, indirect, incidental or consequential loss or

damage which may be experienced because of the use of the information in this presentation or otherwise arising in connection with this presentation, provided that this exclusion of liability shall not exclude or limit any

liability under any law or regulation applicable to Citi that may not be excluded or restricted. These materials are intended for distribution solely to customers of Citi in jurisdictions where such distribution is permitted. The

information contained herein is proprietary information of Citi and may not be reproduced or otherwise disseminated in whole or in part without Citi’s prior written consent.

Citi often acts as (i) a market maker; (ii) an issuer of financial instruments and other products; and (iii) trades as principal in many different financial instruments and other products, and can be expected to perform or

seek to perform investment banking and other services for the issuer of such financial instruments or other products. The author of this presentation may have discussed the information contained herein with others within

or outside Citi and the author and/or such other Citi personnel may have already acted on the basis of this information (including by trading for Citi's proprietary accounts or communicating the information contained

herein to other customers of Citi). Citi, Citi's personnel (including those with whom the author may have consulted in the preparation of this presentation), and other customers of Citi may be long or short the financial

instruments or other products referred to in this presentation, may have acquired such positions at prices and market conditions that are no longer available, and may have interests different from or adverse to your

interests.

Citi is required to obtain, verify and record certain information that identifies each entity that enters into a formal business relationship with Citi. Citi will ask for your complete name, street address, and taxpayer ID

number. Citi may also request corporate formation documents, or other forms of identification, to verify information provided.

Although Citibank, N.A. (together with its subsidiaries and branches worldwide, "Citibank") is an affiliate of Citi, you should be aware that none of the financial instruments or other products mentioned in this presentation

(unless expressly stated otherwise) are (i) insured by the Federal Deposit Insurance Corporation or any other governmental authority, or (ii) deposits or other obligations of, or guaranteed by, Citibank or any other insured

depository institution.

IRS Circular 230 Disclosure: Citi and its employees are not in the business of providing, and do not provide, tax or legal advice to any taxpayer outside of Citi. Any statements in this presentation regarding tax matters

were not intended or written to be used, and cannot be used or relied upon, by any taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular

circumstances from an independent tax advisor.

© 2011 Citigroup Global Markets Inc. Member SIPC. All rights reserved. Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

PAGE 13

AGENDA ITEM #7A

City of Detroit

Water & Sewerage Department

Financial Services Division

DT: December 9, 2015

TO: Board of Water Commissioners Finance Committee

FM: Nicolette Bateson, CPA, Chief Financial Officer

RE: Resolutions Adopting Amendment to Ordinance and Authorizing Execution of

Supplement to Indenture for Both the Water Supply System and the Sewage Disposal

System

Background/Analysis: The Board of Water Commissioners is being asked to adopt a final set

of resolutions (one for both the water and sewer systems) to complete the bondholder consent

process. An explanatory memo and the related resolutions prepared by Ms. Ann Fillingham of

Dykema are attached. Ms. Fillingham will be present at the Finance Committee to review these

resolutions with the Committee.

Proposed Action: The Finance Committee recommends that the Board of Water

Commissioners approve the Resolutions Adopting Amendment to Ordinance and Authorizing

Execution of Supplement to Indenture for Both the Water Supply System and the Sewage

Disposal System.

PAGE 14

PAGE 15

PAGE 16

PAGE 17

PAGE 18

PAGE 19

PAGE 20

PAGE 21

PAGE 22

PAGE 23

PAGE 24

PAGE 25

PAGE 26

PAGE 27

PAGE 28

PAGE 29

PAGE 30

PAGE 31

PAGE 32

PAGE 33

PAGE 34

PAGE 35

PAGE 36

PAGE 37

PAGE 38

PAGE 39

PAGE 40

PAGE 41

PAGE 42

PAGE 43

PAGE 44

PAGE 45

AGENDA ITEM #8B

City of Detroit

Water & Sewerage Department

Financial Services Division

DT: December 9, 2015

TO: Board of Water Commissioners Finance Committee

FM: Nicolette Bateson, CPA, Chief Financial Officer

RE: CFO Report – Thank you!

I want to express my most heartfelt appreciation to serve our customers as the Chief Financial

Officer for the City of Detroit Water & sewerage Department (DWSD) since February 2013.

The past 2+ years have been incredibly rewarding as a member of s a strong team that navigated

through the City of Detroit’s Chapter 9 with a successful tender/refunding, achieved regional

engagement resulting in the formation of the Great Lakes Water Authority (GLWA), rolled out

entity-wide optimization, engaged finance transformation, achieved cross-functional

collaboration, demonstrated a commitment to transparency, evaluated numerous ERP strategies,

and deployed just about any other tool in the management toolkit to craft a long and sustainable

future for our local and regional water system. These things could not have been achieved

without a thoughtful, supportive, and dedicated Board of Water Commissioners.

I have also been honored to work with a fine team of dedicated staff throughout DWSD. I do

give special thanks to the Financial Services Group team that have embraced and advance

continuous improvement. Presently we continue to press forward on the long list of prioritized

transition issues to stand up the GLWA and the DWSD-R entities. The status on all key finance

tasks for the January 1, 2016 operational effective date is green (on target).

The quick on-ramping to DWSD in 2013 would not have occurred without the active participants

in the wholesale customer outreach program. I am especially appreciative for their support of

our continuous improvement efforts and look forward to their engagement as I begin my tenure

as the Treasurer/Chief Financial Officer for the GLWA. In that role, I also look forward to

continuing to serve the City of Detroit in collaboration with, and support to, the leadership of the

new, local system focused DWSD.

PAGE 46