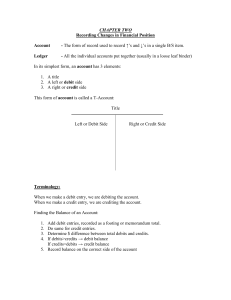

CHAPTER 7 – General Journal Entries

advertisement