File - (Catherine) Chen's Economic Website

advertisement

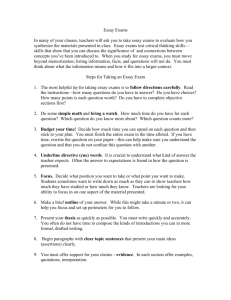

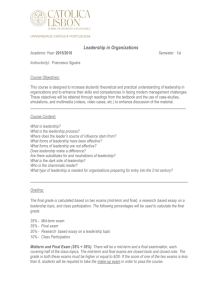

ECN 310- 101 Money and Banking Marshall University, Fall 2015 Name: Dr. Yuanyuan (Catherine) Chen, Assistant Professor of Economics Office: CH 262 Phone: (304) 696-2827 Course Schedule: MW230pm - 345pm Classroom: CH 267 Office Hours: MW 12:45-2:30pm, 3:50pm5:05pm or by appointment Email: chenyu@marshall.edu REQUIRED TEXTS, ADDITIONAL READING, AND OTHER MATERIALS Money, Banking, and the Financial System R. Glenn Hubbard & Anthony P. O’brien, 2nd Ed. Publisher: Prentice Hall CATALOG COURSE DESCRIPTION AND PREREQUISITES Course description from the catalog: ECN 310 is concerned with the study of the theory, the history, and the institutions of money and credit in the U.S. The monetary and banking functions of the Federal Reserve System receive extensive coverage. Prerequisites: ECN 253 -- Principles of Macroeconomics, or ECN 200 -- Survey of Economics EXPANDED COURSE DESCRIPTION ECN 310 Money, Banking, and the Financial System, serves as a higher-level course for those who show interests in money and banking or related areas. This course studies topics of aggregate economies. It will help you understand fundamentals such as definitions and principles in the context of financial markets and banking System and it will also provide basic understandings for tools applications. All of these are useful to analyze miscellaneous economic events and monetary policies nationally and internationally. COURSE LEARNING OUTCOMES: After this course, you will: 1. Participate in conversations using the language of money and banking: the key concepts and variables identifying money, financial system, and the payments system. 2. Analyze mathematically the financial markets using basic value models among different interest rates and rates of return. 3. Employ comprehensive graphs to illustrate monetary policies developed by policy makers as well as economists and to analyze the banking system and monetary policies from different banking accounts. 4. Explain models in aggregate terms embodied in monetary theories. 5. Analyze events relating to money, banking, and financial system by comprehensive writings, mathematical functions, and monetary models. COURSE CONTENT AND TENTATIVE SCHEDULE Objectives Money and Interest Rates Chapters 2 3 Banking 10 14 Policy Analyses 15 & 17 Topics Money and Payments System Interest Rates and Rates of Return The Economics of Banking The Federal Reserve’s Balance Sheet and the Money Supply Process Monetary Policy & Monetary Theory: The AD-AS Model TENTATIVE DUE DATES, EXAM DATES, AND HOLIDAYS (subjected to changes) Exercise due dates: (Exact schedule is subject to changes) It is very important to know that although the homework assignments are distributed on MUonline , they MUST be turned in in the form of hard copies by due dates in the class! Submissions via MUonline are NOT going to be graded and therefore will get a ZERO grade. All exercise due dates are to be announced in the class! Mark them immediately on your calendar! Exam Dates: Exam 1---Sep 28(Planned) Exam 2---Oct 28(Planned) Exam 3---Nov 30(Planned) Final Exam---December 7(12:45-2:45) Study Dates: Exam 1--- Sep 23 (planned) Exam 2--- Oct 26 (planned) Exam 3---Nov 18(planned) Review Day: Final Exam--- Dec 2 Essay Submission Dates: Essay 1---Sep 2 Essay 2---Sep 21 Essay 3---Oct 7 Essay 4---Oct 21 Essay 5---Nov 16 Dates without classes: Sep 7--- Labor Day (University Closed) Nov 23~ 28--- Fall Break/Thanksgiving (Classes Dismissed) COURSE REQUIREMENTS AND GRADING POLICY Grading Scale A 539~600 B 479~538 C 419~478 D 359~418 F < 358 No shading grade will be provided. Your final grade comprises five main parts: exam 1, exam 2, final exam, exercises, and essay. Random bonus points are given during the lectures. Any activity to be recorded as bonus points CANNOT be made up. Your overall grade is distributed as follows: Exam 1 50 Exam 2 50 Exam 3 50 Final Exam 100 Exercises 200 Short Essays 150 Total 600 Exams: three mid-term exams and one final exam are distributed in this semester. Tentative dates are listed above. Tentative dates are listed above. Mid-term exams provide appropriate guide for the final exam which include all contents throughout the semester. The mid-term exam is 50 points each and the final exam is 100 points. As stated below, exams are not available for makeup. To enhance student to understand the chapters and to prepare for the exam, when an objective is to be finished, the instructor will provide study guide for each exam on the class date before the exam date. On that day, students are allowed to review the contents and study as convenient as they like. They can study in the library, in the classroom, or even at home. There will be one day to review the mid-term exams. But all these steps do not guarantee the students to gain high points in the exams! To prepare for the final exam, store up your previous exams and mark your confusing questions. These questions can be answered using the office hours or on the review day. Make sure you take your own exams on the days the instructor gives them back. Do not ask others to take your exams if you do not trust them. Exercises: There will be only FIVE exercises companying each chapter. The exercises will be given out at the beginning of the section (objective) and the due dates are to be announced in the class! The instructor suggests students to finish it progressively; it will reduce the burden if you complete it one the day before due dates. There will be NO exercise dropped to calculate your overall points! Each exercise takes 40 points, which almost reach the points for a mid-term exam! Short essays: The individual essays are supposed to be completed and submitted by the essay submission dates. There are five essay topics accompanying each main chapter. Different from the requirements of both exams and exercises, this part is designed to motivate students for multiple ideas, logics, ways of thinking that can be either in line with what have been taught in the class or not. In other words, it is a brainstorm game! So please grasp it! The criteria are to be given out during the class. For example, no students should have the same content! That is definitely a plagiarism. Instructors may provide possible topics for you to select, but you can choose others. Essay have to been submitted in person with hard copy. Each essay is 30 points. Each portion of your overall grade can be found on http://muwwwnew.marshall.edu/muonline/ (Note that some categories may not be reflected on MUOnline due to the systematic issues, they will show by the end of the semester) The final result of your grade will be posted on http://mymu.marshall.edu/ For missing exams/essay/exercises, please see policies below. ATTENDANCE POLICY This class encourages students to attend class. A responsible and mature student is expected to attend class. There may be times when the student is not able to attend class. The instructor may occasionally check attendance and it will not be included in your final grades as a main category. But, due to the performances of the students, attendance may be added to your final grade as bonus points. The instructor may decide not to scale exams for those who have more than one unexcused absence or tardiness between exams. Scaling is completely at the discretion of the instructor. A missed exercise: to be accepted, an exercise must be turned in on time. It is very important to know that although the exercises are distributed on MUonline , they MUST be turned in in the form of hard copies by due dates in the class! Submissions via MUonline are NOT going to be graded and therefore will get a ZERO grade. There will be no make-up opportunities for them. A missed test: If a student misses an exam, he/she will receive an incomplete grade for the course. The incomplete grade may then be completed as regulated by University policy. This will require completing extra material in the following semester. To avoid this problematic situation, a student is strongly encouraged to attend tests on-time. The tests will NOT be given online! Again, since all the exams are given online, there will be no exceptions or no make-up exams. If you cannot make the test on that day for officially-taken reason, please notify the instructor one week prior to the exam. A missed essay: If a student is not able to submit the essay, the 100 points will be reduced from his/her final grade. This part takes 100 points out of 600. Late submission will cause points reduction! It is very important to know that although the essay topics are distributed on MUonline, they MUST be turned in in the form of hard copies by due dates in the class! Submissions via MUonline are NOT going to be graded and therefore will get a ZERO grade. A Note about Text Messaging, Web Surfing and Grades: Text messaging and noncourse-related web-surfing are not appropriate during class time. It disrupts the attention of the other students and the instructor. In the case of emergencies it is OK to take and send text messages. But please first ask for permission to leave the classroom, and then text outside of the room. The instructor will take note of students who are texting or inappropriately web-surfing. The instructor will deduct 2 points from the Final Semester Score for each infraction. UNIVERSITY POLICIES (Please read carefully!) By enrolling in this course, you agree to the University Policies listed below. Please read the full text of each policy be going to www.marshall.edu/academic-affairs and clicking on “Marshall University Policies.” Or, you can access the policies directly by going to http://www.marshall.edu/academic-affairs/?page_id=802 Academic Dishonesty/ Excused Absence Policy for Undergraduates/ Computing Services Acceptable Use/ Inclement Weather/ Dead Week/ Students with Disabilities/ Academic Forgiveness/ Academic Probation and Suspension/ Academic Rights and Responsibilities of Students/ Affirmative Action/ Sexual Harassment. HOW THE COURSE LEARNING OUTCOMES WILL BEPRACTICED AND ASSESSED How Assessed in this Course Exams I, II, and III, and Final Exam Course Learning Outcomes How Practiced in this Course Participate in conversations using the language of money and banking: the key concepts and variables identifying money, financial system, and the payments system. Lectures, videos, interactive discussions, homework assignments, and bonus points quizzes for all Chapters Analyze mathematically the financial markets using basic value models among different interest rates and rates of return. Lectures, videos, interactive discussions, homework assignments, and bonus points quizzes for all Chapters Exams I, II, and III, and Final Exam Employ comprehensive graphs to illustrate monetary policies developed by policy makers as well as economists and to analyze the banking system and monetary policies from different banking accounts. Lectures, videos, interactive discussions, homework assignments, and bonus points quizzes for all Chapters Exams I, II, and III, and Final Exam Explain models in aggregate terms Lectures, videos, interactive discussions, homework assignments, embodied in monetary theories. and bonus points quizzes for all Chapters Exams I, II, and III, and Final Exam Analyze events relating to money, Short Essays banking, and financial system by comprehensive writings, mathematical functions, and monetary models. Short Essays