2006 - Berkshire Hathaway, Inc.

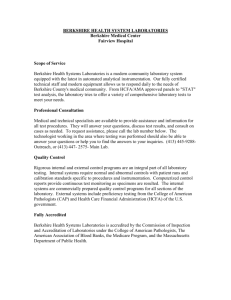

advertisement