Chapter 13 – Breakeven Analysis - Industrial & Systems Engineering

advertisement

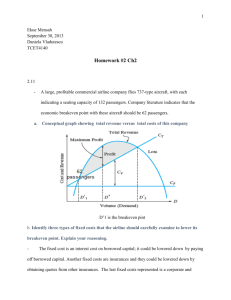

Breakeven Analysis for a Single Project Chapter 13 – Breakeven Analysis INEN 303 Sergiy Butenko Industrial & Systems Engineering Texas A&M University Given P, F, A, i, n If all of the parameters (variables) shown above are known except one, then the unknown parameter can be calculated or approximated A breakeven value can be determined by setting PW, FW, or AW = 0 and solve for (or approximate) the unknown parameter 1 Solving for a Breakeven Value 2 Cost – Revenue Model Approach A popular application of Breakeven (BE) is where cost-revenue-volume relationships are studied Define cost and revenue functions and assume some linear or non-linear cost or revenue relationships Find a parameter value -- denoted QBE – the break-even volume where cost equals revenue Find Q* that will minimize costs or maximize profits Three approaches to solve for breakeven for an unknown parameter: 1. Direct solution - manually if only one interest factor is involved in the setup 2. Trial and error – manually if multiple factors are present in the formulation; 3. Spreadsheet model - where the Excel functions PV, FV, RATE, IRR, NPV, PMT, and NPER are part of the solution process (use Excel’s Goal Seek or Solver) 3 Fixed Costs Variable Costs Essentially constant for all values of the variable (parameter) in question (say volume for example) Fixed Costs – Costs that do not vary with production or activity levels. Some examples: 4 Costs of buildings Insurance Equipment capital recovery Variable costs change with the level of activity - usually proportional to activity Costs that vary with the level of activity 5 Direct labor such as wages Materials Marketing 6 1 Total Costs Cost, Revenue Relationships Total Cost = Fixed Costs + Variable Costs TC = FC + VC Profit Relationships Profit = Revenue – Total Cost P = R – TC = R – (FC + VC) Linear or non-linear models capture the costvolume and revenue-volume relationships Linear and non-linear models are used as approximations to reality Typical cost, revenue relationships are shown on following slides 7 8 Breakeven The breakeven (BE) point QBE is the point where the revenue and total cost relationships intersect For non-linear relations, it is possible to have more than one QBE point 9 10 Breakeven… Revenue and total cost relationships tend to be static in nature May not truly reflect reality of the dynamics of the firm However, the breakeven point(s) can be useful for planning purposes 11 12 2 Non-linear BE Analysis For non-linear analysis the point of maximum profit is of interest And, multiple BE points may exist 13 14 Breakeven Analysis Between Two Alternatives Given two mutually exclusive alternatives Need to determine a variable or economic parameter common to both alternatives Parameter could be Interest rate, First cost (investment), Annual operating cost, etc. Incremental ROR analysis (Ch. 8) Replacement value (RV) analysis (Ch. 11) 15 16 Three Alternative Analysis If three alternatives are present, compare the alternatives pair-wise, or Use a spreadsheet model to plot the present worth or annual worth over a specified range of values. A typical three-alternative BE plot might look like …. 17 18 3 Example 13.3 Automatic Initial cost $23,000 Salvage $4000 AOC $3500 Life 10 yrs Labor cost $12/hr M/C Output 8tons/hr #operators reqd. 1 Manual $8000 $0 $1500 5 yrs $8/hr 6tons/hr 3 automatic manual MARR = 10% 20 19 Spreadsheet Application: Using Excel’s SOLVER for Breakeven Analysis Target Cell SOLVER is one of many built-in Excel analysis tools; SOLVER has been designed to aid in more complex forms of “goal seeking” and performing “what-if” evaluations of properly constructed models. For a properly constructed model SOLVER will require that the analyst: Specify a target cell (the objective); Identify one or more changing cell(s) that will have to change to achieve the desired target cell value The target cell MUST contain a valid Excel formula or function Options of what can happen to the target cell: Maximize the target cell value Minimize the cell value Set to some predetermined cell value (e.g., 0 or $10,000) The target cell cannot be a cell reference 21 Changing Cell(s) 22 Achieving the Target Cell Objective SOLVER requires the analyst to identify one or more cells that must change to achieve the desired result in the target cell Changing cells are, in reality, the decision variables in the model One or more cells are identified that directly or indirectly impact the target cell. If the model is properly constructed and the cell formulas/functions are logically linked then: 23 SOLVER will iterate the designated changing cells until the target cell value is achieved as closely as possible. SOLVER will generate either exact or closely approximated decision variable values See Example 13.5. Note application of Excel financial functions PMT and PV 24 4 Summary Typical breakeven models are: Linear Non-linear Two or more alternatives can be compared using breakeven analysis BE analysis can be a form of sensitivity analysis Complex models can be evaluated using Excel’s SOLVER tool 25 5