Finding The Story Behind The Numbers

advertisement

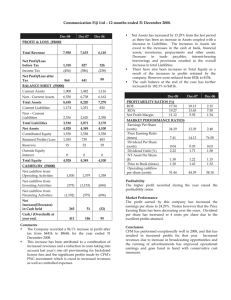

Finding The Story Behind The Numbers Training Journalists to Report on How a Company is Governed and Controlled Objectives: • Discuss financial statements – Why they matter to journalists • Analyze financial statements to uncover stories – Theft of assets – Fake profits – Hidden losses • Apply training to strengthen reporting and analysis of companies’ finances – Simplify the complex “Spotting irregularities in financial and nonfinancial disclosures made in regulatory filings is a must for investigative business reporting. That often means reading the fine print and doggedly attempting to understand the financial information and technical language.” Guide Olympus, AIG, Fortis Healthcare... Olympus ─“One of the biggest and longestrunning loss-hiding arrangements in Japanese corporate history“ Wall Street Journal AIG ”suddenly collapsed in September 2008 under the weight of bad bets it made insuring mortgagebacked securities. … [Federal] rescue packages brought the total to $182 billion, making it the biggest federal bailout in United States history.” New York Times “The Economic Times of India questioned whether Fortis Healthcare India was paying a premium of as much as 20 percent to buy a family owned healthcare business.” Guide Many Stories To Uncover ─ Why? Pressure Management increasingly driven to generate profits in tough economic times Unethical business practices • One-in-five surveyed saw financial “manipulation” in their companies • 57% believe bribery and corruption are widespread in their countries Compliance works, but not well enough Ernst & Young, 2013 fraud survey “Intentional, deliberate, misstatement or omission of material facts, or accounting data which is misleading and, when considered with all the information made available, would cause the reader to change or alter his or her judgment or decision.” Association of Certified Fraud Examiners Cooking The Books “An alarming number appear to be comfortable with or aware of unethical conduct. This includes recording revenues early; under-reporting costs or encouraging customers to buy unnecessary stock. This is coupled with the perception that bribery and corruption remain widespread in several markets.” David L. Stulb Ernst and Young Hiding Losses, Inflating Profits Company Accounting Frauds Losses Satyam Manipulated accounts to disguise losses $1.8 billion Parmalat Falsified accounting documents to hide: nonBankruptcy in 2003 existent cash in bank; fake transactions; debts; use of derivatives $20 billion Enron • Hid huge debts off the balance sheet through complex structures • Inflated revenue and profits Olympus Accounting disguised investment losses Perwaja Steel (Malaysia) Joint venture between government-owned and private steel company used accounting frauds to hide theft of assets, other crimes $74 billion Bankruptcy Scandal wiped out 75% stock value ($6 billion) Malaysian Ringgit10 billion ($3 billion) Market Peaks, CEO Spending Habits • More managers commit accounting fraud in the two years before economy peaks (Davidson) • CEOs with excessive spending on yacht, high-end car, and home ─ 10 times more likely to preside over firms engaged in fraud “Market-wide incentives for managers to manipulate earnings influence the decision to commit accounting fraud.” Spendthrift CEOs “change the composition of the firm’s board [and] compensation structure.” Robert H. Davidson Developing Sources, Driving Reforms • Good companies are open to reporters, especially if you understand accounting – Expertise widens access – Trust comes from sources’ confidence in reporter’s knowledge, reputation • Exposing wrongdoing leads to reforms – Accounting frauds in 2001-02 in United States led to Sarbanes-Oxley • Insights, analysis benefit many • Investors, regulators, policymakers, board directors, senior management, stakeholders “Maintaining our trust with our audience is fundamental to our mission. Reporting truthfully, reporting accurately, correcting errors, obeying our standards are all vital and cannot be compromised.” David Schlesinger Editor-in-Chief Reuters k AC/Controls Audit Risk Compliance Control Environment Disclosure “Ensuring the integrity of the corporation’s accounting and financial reporting systems, including the independent audit, and that appropriate systems of control are in place, in particular, systems for risk management, financial and operational control, and compliance with the law and relevant standards” OECD Principles of Corporate Governance 9 Dissect Financial Statements • Statement of Financial Position (“balance sheet”) – Financial health – “Snapshot" • Statement of Comprehensive Income (“profits and loss” or “P&L”) – Performance • Statement of Cash Flows – Changes in financial position • Notes – Most interesting information to uncover fraud – What’s hidden? Why? “They show where a company’s money came from, where it went, and where it is now.“ SEC Maintain a healthy skepticism toward all financial reports “Details create the big picture.“ Balance Sheet Snapshot of a company at close of reporting period: • Assets • Liabilities • Shareholders’ equity Example Source: Accounting Coach Assets (Left Side) • Current: turn to cash or to be depleted within one year of balance sheet date (e.g., inventory) • Noncurrent: not likely to convert to cash within one year (may take longer than one year to sell) • Investments: stocks, bonds, and life insurance policies company owns for top executives • Property, Plant, and Equipment (“fixed”) • Intangible: copyrights, patents, goodwill, trade names, trademarks • Other Assets: bond issue costs amortized to expense over bonds’ life; property readied for sale • Vary greatly year to year Assets help companies: • weather emergencies • borrow at lowest rates • promote longterm thinking and growth • earn high stock prices Company’s assets have to “balance” Apple: Assets Liabilities (Right Side) • Liabilities: company’s obligations during business operations (listed by due dates) • Current liabilities: expect to pay off within the year • Wages • Accounts • Taxes • Long-term liabilities: obligations due more than one year away • Long-term bonds/debt (principal and interest) • Leases • Pensions, other retirement benefits • Product warranties Helps reporter to quickly detect the financial strength and capabilities of the business Rising liabilities may signal problems Value may be reduced Apple: Liabilities Shareholder Equity “Net Worth” = Assets – Liabilities Or = Capital + Retained Earnings – Treasury Shares • Share capital: portion of company held as stock • Retained earnings: profits • Treasury shares: shares the company sells and then repurchases Helps reporter quickly detect the financial strength and capabilities of the business Typical changes in equity result from company profits or losses, dividends, or stock issuances Apple: Shareholder Equity Income Statement • Sales (Minus) Cost of Goods = Gross Profit • (Minus) Expenses = Net Operating Income • (Minus) Other Income and Expenses • (Minus) Extraordinary Items • (Minus) Income Taxes = • Net Income (Profits) • Retained Earnings (if any) • Amount of revenue a company earned over a specific time period (usually one year) • Costs and expenses associated with earning that revenue • “Bottom line” reveals company’s net earnings or losses Apple Income Statement Cash Flow: Key Terms Cash generated and used during the interval specified: • Operations: day-to-day business operations • Investing : asset investments and proceeds from the sale of other businesses, equipment, or other long-term assets • Financing: cash paid or received from issuing and borrowing of funds (includes dividends paid) • Net Increase or Decrease in Cash To survive and succeed, every business depends on its ability to create or otherwise attain cash. Strong cash flow allows a company to increase dividends, develop new products, enter new markets, pay off liabilities, buy back shares, and become an acquisition target. Cash Flow Statement How much money did the company generate? Where is the cash coming from? Can the company pay its bills? Does it have money to expand? Apple Cash Flow Financial Statements ─ Notes • Enhance understanding of financial statements • Contain accounting policies, key assumptions and judgments made in preparing the financial statements • Explain items in greater detail (for example, pension accounting assumptions) • Provide detail on any uncertainties • Required by national or listing requirements • Some companies voluntarily provide additional information What accounting methods were used for recording and reporting transactions? Assets overvalued? Liabilities undervalued? Earnings Manipulation • Recording revenue too soon • Booking bogus revenue • Boosting income using onetime or unsustainable activities • Shifting current expenses to a later period • Employing other techniques to hide expenses or losses • Shifting current income to a later period • Shifting future expenses to an earlier period SOURCE: Schilit/Perler, Financial Shenanigans "I give you the seven-billion-dollar pup, then you give me back the seven-billion-dollar pup, and we’ve each made seven billion dollars.” Cash Flow Games • Shifting financing cash inflows to the operating section • Shifting normal operating cash outflows to the investing section • Inflating operating cash flow using acquisitions or disposals • Boosting operating cash flow using unsustainable activities SOURCE: Schilit/Perler, Financial Shenanigans “Sorry, sir — we seem to have lost five-million dollars in the fog of accounting.” AC/Controls Audit Risk Compliance Disclosure External Audit vs. Internal Audit External audit means business activities involving independent audit of accounting records and financial (accounting) reporting of companies and individual entrepreneurs “The most common auditor failings were lack of competence and diligence, lack of professional skepticism, and failure to assess and respond to fraud risks,” according to a 2013 study. Internal audit means an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes Reuters May 9, 2013 27 Unqualified vs. Qualified Opinion Auditor’s report helps attract investors, obtain loans, and improve public appearance Unqualified/”clean” opinion Financial statements give a “true and fair” view, comply with: • Accounting principles • Relevant statutory requirements, regulations • Disclosure obligations of all material matters – Changes in accounting principles, methods Qualified ─ not good Information incomplete and/or the company has not prepared statements according to sound accounting principles Auditors may fail to: • gather sufficient evidence to verify management’s information • exercise professional care • be sufficiently skeptical • express the appropriate opinion Annual Report Contents Chairman’s Report CEO’s Report Directors’ Report Corporate Governance Statement Statement of Directors’ Responsibilities • Auditors’ Report on Financial Statements • Financial Statements • Invitation to the AGM plus proxy form • • • • • The annual report provides a summary of exactly how a company has performed in the preceding year, and offers a glimpse of the future. An Acquisition • Nevaris Enterprises wants to buy another company, Alexey Holdings, to expand sales worldwide. • What broad questions would you ask about each company’s financial statement? • Divide participants into two groups: – Group A develops questions for Nevaris – Group B develops questions for Alexey Key Questions Nevaris Enterprises Alexey Holdings Red Flags Topics Questions Changes Size? Reasons? Make sense in light of economy? Accounting New accountants, auditors? Methods changed in valuing assets, liabilities Risks Properly assessed and prepared for? Footnotes Insights into relationships with clients, suppliers? Debt Increase? By how much? Company’s revenues adequate to repay loans? Lawsuits From investors, vendors, competitors, government? Why? Management Discussion and Analysis Unaudited information – shed light on soundness of business model and management’s style? Growth outlook realistic? Questions Action Ideas • I plan to apply the following ideas, skills, and procedures: • Obstacles that may prevent me from implementing improvements in my reporting and analysis are: • Opportunities to acquire skills and resources include: THANK YOU