2015 Guide to Your USAA Mutual Funds Forms 1099-R

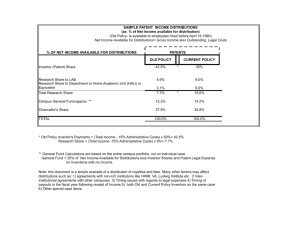

advertisement

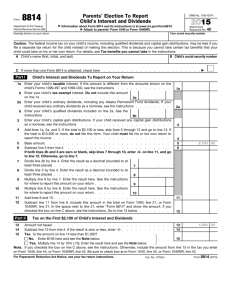

Guide To Your USAA Investment Management Company Forms 1099-R (mutual fund IRAs), 1099-Q (mutual fund Coverdell ESAs), USAA529CollegeSavingsPlanaccountsand1099-SA For Tax Year 2015 We are committed to providing accuracy in reporting tax information related to your mutual fund account(s) and help in understanding how it is used. In this guide you will find helpful information regarding your USAA mutual fund account including a general overview of: • a general overview of tax reporting requirements. • methods used to determine reported distributions from your investments. • the way the IRS treats distributions from your investments. • descriptions and explanations of tax forms related to your investments. If applicable to any of your USAA accounts above, you may have received form(s) 1099-R, 1099-Q or 1099-SA. The information in this brochure is not legal or tax advice. We recommend that you consult your legal and tax advisors if you need advice regarding your specific situation. If a tax advisor prepares your income tax return, we encourage you to include the instructions for recipient when providing copies of your form(s) 1099. Tax Return Assistance on usaa.com From the usaa.com home page, scroll down to “Documents and Forms” and sign up to receive your tax forms electronically in the future. In addition to the information in this guide, on usaa.com/taxes you may: • view and print your USAA form(s) 1099. • learn how to download Form 1099 information into TurboTax®. • receive a discount on your Federal filing using TurboTax® online. • read articles on recent tax law changes. • access other tools and information to answer general tax questions and help you complete your tax return. • link to IRS publications and forms. TurboTax is a registered trademark, and TurboTax Online is a service mark of Intuit Inc. They are used with permission. This document is not legal, tax, or investment advice. Consult your tax and legal advisers regarding your specific situation. 1 Form 1099-R � The Form 1099-R you receive from USAA IMCO provides information to you and the IRS regarding distributions from your: Form 1099-R What is it? • IRAs (Traditional, Roth, SEP and SIMPLE) • 403(b)(7)s • Keogh plans Form 1099-R is delivered to shareholders who had total or partial distributions throughout the year from these types of accounts. Conversions and recharacterizations are also shown on Form 1099-R. Who receives it? A conversion is a distribution of money from a traditional, SEP or SIMPLE IRA that is rolled over to a Roth IRA. Recharacterization refers to the treatment of a contribution to one type of IRA as having been made to a different type of IRA, or to the treatment of a conversion to a Roth IRA as though it had not occurred. You will use information from Form 1099-R when completing IRS form 1040 or 1040A, and you may also need to report it on one or more of these IRS forms: Where is it reported? � • Form 8606 (Nondeductible IRAs) • Form 4972 (Tax on Lump-Sum Distributions) • Form 5329 (Additional Taxes on Qualified Plans [Including IRAs] and Other Tax-Favored Accounts) 2 Form 1099-R � ] 1040 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return For the year Jan. 1-Dec. 31, 2015, or other tax year beginning Your first name and initial If a joint return, spouse's first name and initial Last name I 2015 , 2015, ending 1 0M B No. 1545-00741 IRS Use Only-Do not write or staple in this See separate instructions. Your social security number , 20 Last name Spouse's social security number i ! 1 ! : Home address (number and street). If you have a P.O. box, see instructions. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Apt. no. I : Make sure the SSN(s) above and on line 6c are correct. : : Presidential Election Campaign Check here if you, or your spouse if filing want$3to go to this fund. Checking -------------,jointly, -----------------------Foreign postal code a box below will not change your tax or Foreign province/state/county Foreign country name refund. I I You Spouse D Single D Married filing jointly (even if only one had income) D Married filing separately. Enter spouse's SSN above 4 D D Head of household (with qualifying person). (See instructions.) If Filing Status the qualifying person is a child but not your dependent, enter this child's name here. Check only one 3 box. and full name here. 5 Qualifying widow(er) with dependent child Boxes checked 6a Yourself. If someone can claim you as a dependent, do not check box 6a . Exemptions on 6a and 6b Department of the Treasury-Internal Revenue Service (99) b Spouse · } No. of children 1 0M B No. write or staple in this (4) 1545-00741 .! if child underIRS ageUse 17 Only-Do onnot 6cwho: U.S. (2) Dependent's (3) Dependent's C Individual Dependents: Income Tax Return qualifying for child tax credit • livedwith you social security number , 2015, relationship See separate instructions. First name Last name For the year Jan. 1-Dec.(1) 31, 2015, or other tax year beginning ending to you , 20 (see instructions) • did not live with duesecurity to divorce Your first name and initial Last name Your you social number Form 1040 � 1 2 I 2015 D D ] 1040 D D If more than four dependents, see If a joint return, spouse's first name and initial Last name instructions and check here Home address (number and you haveof a P.O. box, see instructions. d street). TotalIf number exemptions claimed D D D D D (seei instructions) ! : : Dependents on 6c number Spouse security 's social not entered above or separation Apt. no. D : Add: numbers on linessure above Make the SSN(s) above and on line 6c are correct. ! 1 I 7 Ba Presidential Election Campaign Taxable interest. Attach Schedule B if required Check here if you, or your spouse if filing b Tax-exempt interest. Do not include on line 8a I ab I - ------------- - - I- --,jointly, want$3to go to this fund. Checking -----------------------Attach Foreign postal code 9a Foreign province/state/county ForeignForm(s) country name 9a Ordinary dividends. Attach Schedule B if required a box below will not change your tax or W-2 here. Also refund. I I You Spouse b Qualified dividends I 9b I I attach Forms 10 person). (See instructions.) If 10 Taxable W-2G and 1 Single refunds, credits, or offsets of state and local income 4 taxesHead of household (with qualifying Filing Status 1099-R if tax 11 Alimony the qualifying person is a child 11 but not your dependent, enter this Marriedreceived filing jointly (even if only one had income) 2 was withheld. child's name here. 12 12 Business or (loss). Attach ScheduleSSN C orabove C-EZ Check only one Marriedincome filing separately. Enter spouse's 3 box. and full name here. Attach 5 Qualifying widow(er) with dependent child 13 13 Capital gain or (loss). Schedule D if required. If not required, check here If you did not Boxes checked 14 14 gains orIf(losses). Attach Form you 4797 6a Other Yourself. someone can claim as. a dependent, do not check box 6a . Exemptions get a W-2, on 6a and 6b 15b b Taxable amount 15ab IRA Spouse distributions · } No. of children see instructions. (4) .! if child under age 17 on 6cwho: 16b 16a Pensions and annuities b Taxable amount (2) Dependent's (3) Dependent's C Dependents: qualifying for child tax credit • livedwith you social securitySnumber relationship to etc. you Attach 17 Rental real estate, royalties, partnerships, corporations, trusts, Schedule E (1)17First name Last name (see instructions) • did not live with you due to divorce 18 18 Farm income or (loss). Attach Schedule F 7 Wages, salaries, tips, etc. Attach Form(s) W-2 Income City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Ba D D If more than four dependents, see instructions and check here 19 D Income Adjusted Gross Attach Form(s) Income W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld. If you did not get a W-2, see instructions. 20a 21 22d 23 7 24 Ba b 25 9a 26b 27 10 28 11 29 12 30 13 D D D D D I :: I Unemployment compensation Social security benefits i 2oa I D I I D D D D I I b Taxable amount D ------------------------------ Other income. List type and amount Combine the amounts in the far claimed right column for lines 7 through 21. This is your total income Total number of exemptions Educatorsalaries, expenses 23 Wages, tips, etc. Attach Form(s) W-2 Certain business expenses reservists,Bperforming Taxable interest. Attach of Schedule if requiredartists, and The amount in fee-basis government officials. Attach Formon 2106 2106-EZ 24 b I Tax-exempt interest. Do not include lineor8a I a D Refer to the IRS instruction book for IRS Form 1040 for more information. 19 20b 21 22 7 (see instructions) Dependents on 6c not entered above or separation Add numbers on lines above D Ba I Health savings account deduction. Attach Form 8889 Form 251040 or line 11a of IRS of IRS Ordinary dividends. Attach Schedule B if required 9a Form 1040A. (Special reporting Moving 26 I 9b Qualifiedexpenses. dividendsAttach Form 3903 I I rules SE may apply for direct distributions to qualified charities made Deductible part of self-employment tax.ofAttach Taxable refunds, credits, or offsets stateSchedule and local income27 taxes 10 1 IRS instructions for form 1040 by taxpayers Self-employed SEP, SIMPLE, and qualified plans 28 age 70 /2 or over. See 11 Alimony received box 1 of Form 1099-R should be reported on line 15a Account Distributions 31a 14 32 15a Self-employed health insurance Business income or (loss). Attachdeduction Schedule C or C-EZ or 1040A.) 29 30 Penalty on early withdrawal savings D . if required. If not required, Capital gain or (loss). Attachof Schedule check here ! Alimonygains paid orb(losses). Recipient's SSN 4797 .: 31a Other Attach Form : b 32 Taxable amount IRA deduction distributions I :: I I I D 12 13 14 15b Student 16b Pensionsloan and interest annuitiesdeduction . b 33 Taxable amount 34 etc. Attach Schedule E Tuition and estate, fees. Attach Form 8917 . 17 Rental real royalties, partnerships, S corporations, trusts, If the amount in box 1 of Form 1099-R is a lump-sum distribution from Domestic production activities Form 8903 35 18 Farm income or (loss). Attachdeduction. ScheduleAttach F a Keogh plan, “Total Distribution” Add lines 23 through 35 36 19 should be checked in box 2b. Use IRS Unemployment compensation Subtract line 36 from linei 222. is your adjustedI gross income 37 20b Social security benefits amount oa This I I b Taxable Form 4972 (Tax on Lump-Sum Distribution) to choose the tax treatment Form 1040 (2014) For Disclosure, Privacy and income. Paperwork Act Notice, see separate instructions. Cat. No. 11320B 21 21 Act, Other List Reduction type and amount -----------------------------may21. beThisfavorable to you, if22you are eligible. 22 Combine the amounts in the far right column for that lines 7 through is your total income 33 16a 34 17 35 18 36 19 37 20a Lump-Sum Distribution from Keogh Plan Adjusted Gross Income 23 24 25 26 27 Educator expenses Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ Health savings account deduction. Attach Form 8889 Moving expenses. Attach Form 3903 Deductible part of self-employment tax. Attach Schedule SE ... 23 24 25 26 27 3 Form 1099-R Form 8606 Form 8606 Nondeductible IRAs OMB No. 1545-0074 a Information about Form 8606 and its separate instructions is at www.irs.gov/form8606. Department of the Treasury Internal Revenue Service (99) a Attach to Form 1040, Form 1040A, or Form 1040NR. Name. If married, file a separate form for each spouse required to file Form 8606. See instructions. 7 8 9 10 11 12 g rollovers (see instructio Enter your distributions from traditional, SEP, and SIMPLE IRAs in 2015. Do not include rollovers, a one-time distribution to fund an HSA, conversions to a Roth IRA, certain returned contributions, or recharacterizations of traditional IRA contributions (see instructions) . Enter the net amount you converted from traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2015. Do not include amounts converted that you later recharacterized (see instructions). Also enter this amount on line 16 . Add lines 6, 7, and 8 .............................................. 9 Divide line 5 by line 9. Enter the result as a decimal rounded to at least 3 places. If the result is 1.000 or more, enter “1.000” . . . . . . Multiply line 8 by line 10. This is the nontaxable portion of the amount you converted to Roth IRAs. Also enter this amount on line 17 . . . Multiply line 7 by line 10. This is the nontaxable portion of your dis ibutions that you did not convert to . . . Nondeductible IRA Contributions 2015 Attachment Sequence No. 48 Your social security number 7 8 10 × . 11 12 If you made nondeductible IRA contributions for 201 5 or in previous years, report the amount of these contributions on IRS Form 8606 (Nondeductible IRAs) to determine the taxable portion of your distribution. Report the distribution amount from box 1 of Form 1099-R on line 7 or 8 of Form 8606. 4 Form 1099-R � Form 5329 Department of the Treasury Internal Revenue Service (99) Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts a a OMB No. 1545-0074 2015 Attach to Form 1040 or Form 1040NR. Information about Form 5329 and its separate instructions is at www.irs.gov/form5329. Name of individual subject to additional tax. If married filing jointly, see instructions. Your social security number Home address (number and street), or P.O. box if mail is not delivered to your home Form by Itself and Not With Your Tax Return Form 5329 F Fill in Your Address Only FormIf5329 You Are Filing This City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces below (see instructions). Attachment Sequence No. 29 Apt. no. If this is an amended return, check here a province/state/county Foreign postal code OMB No. 1545-0074 Additional Taxes onForeign Qualified Plans (Including IRAs) and Other Tax-Favored Accounts Foreign country name 2015 If you only owe the additional 10% tax on early distributions, you may be able to report this tax directly on Form 1040, line 59, or Form 1040NR, line 57, without filing Form 5329. a See the instructions fororForm line 59, or for Form 1040NR, line 57. Attach to Form 1040 Form1040, 1040NR. Department of the Treasury Part I Service a Information Internal Revenue (99) this partinstructions if you took aistaxable distribution before you Additional Tax on Earlyabout Distributions. Form 5329 Complete and its separate at www.irs.gov/form5329. Attachment F Sequence No. 29 reached age 59½ from a qualified retirement plan (including IRA) or modified endowment contract (unless you are reporting taxsecurity directlynumber on Name of individual subject to additional tax. If married filing jointly,an see instructions. Your this social Form 1040 or Form 1040NR—see above). You may also have to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for certain Roth IRA distributions (see instructions). Home address (number and street), or P.O. box if mail is not delivered to your home Apt. no. 1 Early distributions included in income. For Roth IRA distributions, see instructions . . . . . . 1 Early distributions on line 1 that are not subject to the additional tax (see instructions). Fill in2Your Address Only included City, town or post office, state, and ZIP code. If you have a foreign address, also complete Enter the appropriate exception number from the instructions: . . . . . . . . . 2 the spaces below (see instructions). If You Are Filing This If this is an amended Amount subject 3 Form3by Itself and Not to additional tax. Subtract line 2 from line 1 . . . . . . . . . . . . . return, check here a With 4YourAdditional Tax Return tax. Enter 10% (.10) of line 3. Include this amount on Form 1040, line 59, or Form 1040NR, line 57 . 4 Foreign country name Foreign province/state/county Foreign postal code Caution: If any part of the amount on line 3 was a distribution from a SIMPLE IRA, you may have to include 25% of that amount lineForm 4 instead of 10% (see instructions). Box on 7 of 1099-R identifies the distribution type. See Instructions for Recipient, Part II owe If you only the additional early distributions, you able to report this taxAccounts. directly onComplete Form here. 1040, Additional Tax on10% Certain Distributions Education Accounts and ABLE this line part 59, if or Boxtax7, on of your Form From 1099-R formay an be explanation of the code(s) appearing Form 1040NR, line 57, without filing Form 5329.onSee the1040 instructions for Form line 1040, or for Form 1040NR, line 57. you included an amount in income, Form or Form 1040NR, 21,line from59, a Coverdell education savings account Part I (ESA), a qualified tuition program (QTP), or anComplete ABLE account. Additional Tax on Early Distributions. thisdistributions part if you took made a taxable distribution before youage reached 59½ For example, code 1 indicates before you reached 59 1/age 2 5 Distributions included in income from a Coverdell ESA, a QTP, or an ABLE account . . . . . 5 from a qualified retirement plan (including an IRA) or modified endowment contract (unless you are reporting this tax directly on and5 that are, general,thesubject to tax a 10% additional tax. as explained 6 Distributions included on line that above). are notinsubject additional (seethis instructions) . . However, . you 6 qualify Form 1040 or Form 1040NR—see You maytoalso have to complete part to indicate that for an exception to Distribution Type 7 Amount subject to additional tax. Subtract line 6 from line 5 . . . . . . . . . . . . . 7 in the Form 1040 instructions, certain exceptions to the additional tax apply the additional tax on early distributions or for certain Roth IRA distributions (see instructions). Additional tax. Enter 10% (.10) line 7. Include this amount on Form 1040,see line 59, or Form 1040NR, 1 8 Early distributions included inofincome. Forto Roth IRA distributions, . .homebuyers’ .line. 57. . 8 expenses, 1 with respect qualified withdrawals instructions for first-time higher Part III Additional Tax on Excess to Traditional IRAs. Complete this part if you contributed more to your 2 Early distributions included on line Contributions 1 that are not subject to the additional tax (see instructions). education expenses, medical insurance premiums and deductible medical expenses. IRAs for 2015 than is allowable or you had an amount on line 17 of your 2014 Form 5329. Enter traditional the appropriate exception number from the instructions: . . . . . . . . . 2 Forfrom further of5329 exceptions, see IRS Publication 9 Enter your excess contributions line 16clarification of your 2014 Form (see instructions). If zero, go to line 15 590-B 9 Individual 3 Amount subject to additional tax. Subtract line 2 from line 1 . . . . . . . . . . . . . 3 10 If your traditional IRA contributions for 2015 are lessdiscussed than yourin Chapter 1 under Early Distributions. Retirement Arrangements 4 Additional tax. Enter 10% (.10) of line 3. Include this amount on Form 1040, line 59, or Form 1040NR, line 57 . 4 maximum allowable contribution, see instructions. Otherwise, enter -010 Caution: If any part of the amount on line 3 was a distribution from a SIMPLE IRA, you may have 11 2015 traditional IRA distributions included in income (see instructions) . 11 to include 25% of that amount on line 4 instead of 10% (see instructions). 12 2015 distributions of prior year excess contributions (see instructions) . 12 Part Additional Tax on12Certain and Complete 13 II Add lines 10, 11, and .If your . . Distributions .Form . . 1099-R . . . From . . aEducation .distribution . . . .Accounts . code . . 1 .in .box .ABLE . Accounts. . you 13qualify has 7. and for anthis part if you year included ancontributions. amount in income, online Form 1040 or Form 1040NR, line 21,-0from. a .Coverdell education savings account 14 Prior excess Subtract 13 from line 9. If zero or less, enter . . . 14 exception to the additional tax, you may be required to file Form 5329 (Additional (ESA), contributions a qualified tuition program (QTP), or an .ABLE 15 Excess for 2015 (see instructions) . . account. . . . . . . . . . . . . . . 15 Distribution Code 1 Taxes on Qualified Plans [Including and 5 16 Distributions included in income ABLE .. .. .. . 16 5Accounts). Total excess contributions. Add from lines a 14Coverdell and 15 .ESA, . .a QTP, . . or . an . IRAs] . . .account . Other . . . . Tax-Favored 6 17 Distributions included line are of not the additional tax (see instructions) .5329, . 6 Report the amount intobox 1 of Form on Form line 1. Additional tax. Enter 6%on (.06) of 5 thethat smaller linesubject 16 or the value of youryour traditional IRAs1099-R on December 31, .2015 7 Amount subject to additional tax. Subtract line from line 5 .1040, . line . 59, . or . Form . .1040NR, . . line . 57 . .. . 17 7 (including 2015 contributions made in 2016). Include this6amount on Form tax. EnterTax 10%on (.10) of line 7. Include this amount on Form 1040, line 59, orthis Form line 57 8PartAdditional IV Additional 8 Excess Contributions to Roth IRAs. Complete part1040NR, if you contributed more to your Roth IRAs for 2015 than is allowable or you had an amount on line 25 of your 2014 Form 5329. Part III Additional Tax on Excess Contributions to Traditional IRAs. Complete this part if you contributed more to your Enter your excess fromisline 24 of your 5329 (see instructions). go2014 to lineForm 23 5329. 18 18 traditional IRAscontributions for 2015 than allowable or2014 you Form had an amount on line 17Ifofzero, your If your IRA contributions than your maximum 9 19 Enter your Roth excess contributions fromfor line2015 16 ofare yourless 2014 Form 5329 (see instructions). If zero, go to line 15 9 contribution, instructions. for Otherwise, enterless -0- .than . . your . 19 10 If allowable your traditional IRA see contributions 2015 are 20 maximum 2015 distributions your Rothsee IRAs (see instructions) . . enter . . -0. 2010 allowable from contribution, instructions. Otherwise, 21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . .11 . . . . . . . 21 11 2015 traditional IRA distributions included in income (see instructions) . 22 Prior year excess contributions. Subtract line 21 from line 18. If zero or less, enter -0- . . . . . 22 5 Form 1099-R � State Income Tax Any state income tax withheld from retirement account distributions will be shown in box 12. For more information, see IRS Publication 590-B (Individual Retirement Arrangements). 6 Form 1099-Q � The Form 1099-Q you receive from USAA IMCO provides information to you and the IRS regarding distributions or trustee-to-trustee transfers from your: Form 1099-Q What is it? Who receives it? • Coverdell Education Savings Account (ESA). • 529 College Savings Plan Account, a qualified tuition program (QTP) defined under Internal Revenue Code section 529. In the event you took distributions from both a USAA Coverdell ESA and a USAA 529 College Savings Plan Account, you will receive a separate Form 1099-Q for each account. Where is it reported? You may need to use information from Form 1099-Q when completing IRS form 1040 or 1040A, and you may also need to report it on IRS Form 5329 (Additional Taxes on Qualified Plans [including IRAs] and Other Tax-Favored Accounts). 7 Form 1099-Q � Taxable Distributions IRS Publication 970 (Tax Benefits for Education) provides information to recipients for figuring and reporting the taxable portion of a withdrawal, if any, reported on Form 1099-Q. We also recommend that you consult a tax advisor regarding: • the benefits and taxable events of ESAs and qualified tuition programs. • the restrictions that apply to designating a beneficiary. • the calculation of taxable amounts. In general, part or all of the amount shown in box 1 is taxable to the beneficiary, who should report the taxable amount on Form 1040, line 21 (“Other income”). (The payer—USAA—is not required to and does not compute the taxable amount of any ESA or 529 College Savings Plan Account distribution.) See Form 1040 on the next page. Distributions that meet certain criteria are not taxable and need not be reported on Form 1040. These distributions may include: Non-Taxable Distributions • One transfer or rollover per beneficiary in a 12-month period to another education program, completed within 60 days of the distribution. • Qualified education expenses (limited to higher education expenses for a 529 College Savings Plan Account) totaling at least as much as the amount withdrawn. 8 instructions and check here D Income Form 1040 � d 7 not entered above D D Total number of exemptions claimed Wages, salaries, tips, etc. Attach Form(s) W-2 Taxable interest. Attach Schedule B if required b Tax-exempt interest. Do not include on line 8a 9a Ordinary dividends. Attach B if(99) required Department of the Treasury-Internal Revenue Schedule Service 7 Add numbers on lines above D I ab I I Attach Form(s) 9a W-2 here. Also IRS Use Only-Do not write or staple in this 9b I1 0M B No. 1545-00741 b Qualified dividends I I attach Forms U.S. Individual Income Tax Return 10 Taxable refunds, credits, or offsets of state and local income taxes 10 W-2G See separate instructions. For theand year Jan. 1-Dec. 31, 2015, or other tax year beginning , 2015, ending , 20 OMB No. 1545-0074 1099-R if tax 11Your social 11 Alimony received Your first name and initial Last name security number was withheld. Form 12 12 Business income or (loss). Attach Schedule C or C-EZ ! i : : 13 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here Spouse's social security number If a joint return, spouse's first name and initial Last name a Attach to Form 1040 or Form 1040NR. If you did not 14 Other gains or (losses). Attach Form 4797 . Department of the Treasury 14 ! Attachment 1 get a W-2, : : Internal Revenue Service (99)15a aIRA Sequence No. 29 Information about Form 5329 and its separate instructions is at www.irs.gov/form5329. b Taxable amount Home address (number and street). distributions If you have a P.O. box, see instructions. Apt. no. 15b Make sure the SSN(s) above see instructions. Name of individual subject to additional tax. If married filing jointly, see instructions. Your social security number 16a Pensions and annuities b Taxable amount I 16b and on line 6c are correct. 17 Presidential Election Campaign 17 andRental real estate, partnerships, S corporations, trusts, etc. Attach Schedule E City, town or post office, state, ZIP code. If you have aroyalties, foreign address, also complete spaces below (see instructions). Ba ] 1040 5329 Ba I 2015 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts D I :: I I I 2015 18 Farm income or (loss). Attach Schedule F 18 Check here if you, or your spouse if filing - -------------- - - - --,jointly, -----------------------19 want$3to go to this fund. Checking 19 Unemployment compensation postal Foreig code Foreign province/state/county Foreign country name n a box below will not change your tax or Fill in Your Address Only City, town or post office, state, and ZIP code. If you have a foreign address, also complete 20a Social security benefits i 2oa I 20b I refund. I b Taxable amount I I You Spouse the spaces below (see instructions). If You Are Filing This 21 Other income. List type and amount ------------------------------ If this 21 is an amended Form by Itself and Not 1 Single 4 Head of household (with qualifying person). (See instructions.) If return, Filing Status 22 Combine the amounts in the far right column for lines 7 through 21. This is your total income 22 check here a With Your Tax Return the qualifying person is a child but not your code dependent, enter this 2 Married filingcountry jointly name (even if only one had income) Foreign Foreign province/state/county Foreign postal 23 Educator expenses 23 child's name here. Check only one 3 Married filing separately. Enter spouse's SSN above Adjusted 24 Certain business expenses of reser v ists, performing artists, and box. and full name here. 5 Qualifying widow(er) with dependent child fee-basis government Attach Form 2106 or 2106-EZ 24to report this tax directly on Form If Gross you only owe the additional 10% tax on officials. early distributions, you may be able 1040, line 59, or Boxes checked 6a Yourself. If someone can claim you as a dependent, do not check box 6a . Income Exemptions Form 1040NR, line 57, filing Form 5329.deduction. See the instructions Form 1040, 57. on 6a and 6b 25 without Health savings account Attach Form for 8889 25 line 59, or for Form 1040NR, line b Spouse · } No. of children Part I Additional Form 5329 26 Tax Moving expenses. Attach Form 3903 26 a taxable Complete this part if you took distribution before on Early Distributions. (4) .! if child under age 17 youonreached 6cwho: age 59½ (2) Dependent's (3) Dependent's C Dependents: qualifying for childare tax reporting credit • lived with you on 27 Deductible part of (including self-employment tax. or Attach Schedule SErelationship 27contract from a qualified retirement plan an IRA) modified endowment (unless you this tax directly social security number to you (1) First name Last name (see instructions) • did not live with Form 104028 or Form 1040NR—see You also have fordue an Self-employed SEP,above). SIMPLE, andmay qualified plansto complete 28this part to indicate that you qualify you toexception divorce OMB No. 1545-0074 to or separation the additional on early distributions or for certain Roth IRA distributions 29 taxSelf-employed health insurance deduction 29 (see instructions). Form If more than four (see instructions) 1 Early distributions income. For Roth IRA distributions, see instructions . . . . . . 1 dependents, see 30 included 30 Penalty oninearly withdrawal of savings . Dependents on 6c not entered above ! additional tax (see instructions). instructions 2 Early and distributions on line 1 that a are not subject to the 31a included Alimony paid b Recipient's SSN 31a : : Attach to Form 1040 or Form 1040NR. Department of the Treasury check here Attachment numbers on Enter the appropriate exception number from the instructions: . is. at.www.irs.gov/form5329. . . . . . . 2 Add 32 deductionabout Internal Revenue Service (99)32d aIRA Sequence Information Form 5329 and its separate instructions Total number of exemptions claimed lines above No. 29 3 Amount subject to additional tax. Subtract line 2 from line 1 . . . . . . . . . . . . . 3 Student interest 33 Name of individual subject 33 to additional tax. loan If married filingdeduction jointly, see .instructions. Your social security number 7 7 Wages, salaries, tips, etc. Attach Form(s) W-2 4 Additional tax.34 Enter Tuition 10% (.10) line 3. Include this8917 amount on Form 1040, line 59, 4 Income 34 or Form 1040NR, line 57 . andoffees. Attach Form . Ba Taxable interest. Attach Schedule B if required Ba Caution: If any of theHome amount on line 3 was a distribution from a SIMPLE IRA, you may have 35 partDomestic production activities deduction. Attach Form 8903 35 address (number and street), or P.O. box if mail is not delivered to your home Apt. no. b Tax-exempt interest. Do not include on line 8a I ab I I to include 25% on line 435instead of 10% (see instructions). 36of that Addamount lines 23 through 36 Attach Form(s) 9a Ordinary dividends. Attach Schedule B if required 9a Part II Also Subtract linetown 36 from line 22. This your gross W-2 Fill in here. Your Address 37 Only 37 Additional Tax on Certain Distributions From Education andalso ABLE Accounts. Complete this part if City, or post office, state,is and ZIPadjusted code. If you haveAccounts aincome foreign address, complete b Qualified dividends I 9b I I Forms the spaces below (see instructions). If attach You Are Filing This 1040 (2014) Formaccount you included an amount in income, on Form 1040 or Form 1040NR, line 21, from a Coverdell savings For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. education 11320B If this 10 Taxable refunds, credits, or offsets of state and local income taxes 10 is an amended W-2Gby and Form Itself and Not (ESA), a qualified tuition program (QTP), or an ABLE account. a return, 1099-R if tax 11 check here 11 Alimony received With Your Tax Return 5 postal code 5 withheld. Distributions included in income from aname Coverdell ESA, a QTP, or an ABLE account . . . . . Foreign was Foreign country Foreign province/state/county 12 12 Business income or (loss). Attach Schedule C or C-EZ 6 Distributions included on line 5 that are not subject to the additional tax (see instructions) . . . 6 13 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 7 Amount subject to additional tax. Subtract line 6 from line 5 . . . . . . . . . . . . . 7 you only did not If Ifyou owe the additional on early distributions, may beline able this taxline directly on 14 Form 1040, line 59, or gains tax (losses). Attach 4797 you 8 a W-2, Additional tax.14 Enter Other 10% 10% (.10) oforline 7. Include thisForm amount on. Form 1040, 59,to or report Form 1040NR, 57 8 get Form 1040NR, line 57, without filing Form 5329. See the instructions for Form 1040, line amount 59, or for Form 1040NR, 15b line 57. 15a IRA distributions b Taxable see instructions. Home address (number and street), or P.O. box if mail is not delivered to your home F D D D D D D D D D 5329 Apt. no. Additional Taxes on Qualified Plans D D (Including IRAs) and Other Tax-Favored Accounts D D D 2015 D F ... I :: I I I D Part III Additional Tax on Excess Contributions to Traditional IRAs. Complete this part if you contributed more to your Part I Additional 16b 16aTax Pensions and annuities btook Taxable amount on2015 Early Distributions. thisamount part if you a taxable traditional IRAs for than is allowable or Complete you had an on line 17 of your distribution 2014 Form before 5329. you reached age 59½ 17 this tax directly on 17 Rental real plan estate, royalties,an partnerships, S corporations, trusts, etc. Attach Schedule from a qualified retirement (including IRA) or modified endowment contract (unless you areE reporting 9 Enter your excess contributions from line 16 of your 2014 Form 5329 (see instructions). If zero, go to line 15 9 Form 104018 or Form 1040NR—see above). You may also have to complete this part to indicate that you qualify for anincluded exception in to 18 Farm income or (loss). Attach Schedule F An2015 additional 10% tax your may apply to part or all of the amount 10 If your traditional IRA contributions for are less than the additional on early distributions or for certain Roth IRA distributions (see instructions). 19 19 taxUnemployment compensation income from an ESA or-0529 College Savings Plan Account. (Publication maximum allowable contribution, see instructions. Otherwise, enter 10 1 Early distributions in income. . . . . . . 20b 1 20a included Social security benefitsFor b Taxable amount i 2Roth oa I IRA distributions, I seeI instructions 11 2015 traditional IRA distributions included in income (see instructions) . 11 970 outlines in the detail the exceptions to this tax.) 21 Additional Taxes � 2 Early distributions on line that and are not subject to additional tax (see instructions). 21 included Other income. List1 type amount -----------------------------12 2015 distributions of prior year excess contributions (see instructions) . 12 Enter the appropriate exception number from the column instructions: . . total . income . . . . 2 22 Combine the amounts in the far right for lines 7 through 21. .This. is your 22 13 Add lines 10, 11, and 12 . . . . . . Generally, . . . . . amount . . . . . . taxable . . . . . . . . is to 13 be reported on 3 Amount subject tax. Subtract line 2 from the line 1 . . . of. the . . . . distribution . . . . . 3 23 to additional Educator expenses 23 14 Prior year excess contributions. Subtract line 13 from line 9. If zero or less, enter -0- . . . . . 14 Adjusted 4 Additional tax. 24 Enter 10% of lineexpenses 3. Include this vamount on Form 1040,and line 59, or Form 1040NR, line 57 . 4 Form 5329. Certain(.10) business of reser ists, performing artists, 15 Excess contributions for 2015 (see instructions) . . . . . . . . . . . . . . . . . 15 Gross Caution: If any partfee-basis of the government amount on line 3Attach was Form a distribution from a SIMPLE IRA, you may have officials. 2106 or 2106-EZ 24 16 Total excess contributions. Addonlines and 15of .10% . (see . . instructions). . . . . . . . . . . . . . 16 to include 25% amount line 14 4 instead Income 25of that Health savings account deduction. Attach Form 8889 25 17 Additional tax. Enter 6% (.06) of the smaller of line 16 or the value of your traditional IRAs on December 31, 2015 Part II Additional 26 TaxMoving expenses. Attach Form 3903 26 on Certain Distributions From Education Accounts and ABLE Accounts. Complete this part if (including 2015 contributions made in 2016). Include this amount on Form 1040, line 59, or Form 1040NR, line 57 . 17 you included amount in income, on Form 1040 or Form 1040NR, line 27 anDeductible part of self-employment tax. Attach Schedule SE 27 21, from a Coverdell education savings account Part IV Additional Tax on Excess Contributions to Roth IRAs. Complete this part if you contributed more to your Roth (ESA), a qualified tuition program or and an ABLE account. 28 Self-employed SEP,(QTP), SIMPLE, qualified plans 28 IRAs for 2015 than is allowable or you had an amount on line 25 of your 2014 Form 5329. 5 Distributions included in income from Coverdelldeduction ESA, a QTP, or an ABLE 5 29 Self-employed healthainsurance 29account . . . . . Enter your excess contributions from line 24 of your 2014 Form 5329 (see instructions). If zero, go to line 23 18 18 6 Distributions included on line 5 thatwithdrawal are not subject to the additional tax (see 6 30 30 instructions) . . . Penalty on early of savings . 19 If your Roth IRA contributions for 2015 are less than ! maximum 7 Amount subject line 6 from lineyour . . . 31a . . . . . . . . . 7 31ato additional Alimony paidtax. b Subtract Recipient's SSN : 5 :. allowable tax. contribution, see Otherwise, enter -0- . 1040, . .line. 59, 19 Additional Enter 10% (.10)instructions. of line 7. Include this amount on Form 8 8 32 32 or Form 1040NR, line 57 IRA deduction 20 distributions from your Roth IRAs (see instructions) . . . . . 20 Part III2015 Additional Tax on Excess Contributions to Traditional IRAs. Complete this part if you contributed more to your 33 Student loan interest deduction . 33 21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . . . 21 traditional 34 IRAs for 2015 than is allowable or you had an amount on line 17 of your 2014 Form 5329. 34 Tuition and fees. Attach Form 8917 . 22 Prior year excess contributions. Subtract line 21 from line 18. If zero or less, enter -0- . . . . . 22 9 Enter your excess from lineactivities 16 of your 2014 Form 5329 (see instructions). If zero, go to line 15 9 35 contributions Domestic production deduction. Attach Form 8903 35 23 Excess contributions for 2015 (see instructions) . . . . . . . . . . . . . . . . . 23 10 If your traditional IRAlines contributions 36 Add 23 through 35for 2015 are less than your 36 24 Total excess contributions. Add lines 22 and 23 . . . . . . . . . . . . . . . . . 24 maximum allowable contribution, enter -0- income 10 37 Subtract line 36 see frominstructions. line 22. This isOtherwise, your adjusted gross 37 Additional tax. Enter 6% (.06) of the smaller of line 24 or the value of your Roth IRAs on December 31, 2015 25 11 2015 traditional included in income (see see instructions) . 11 Form 1040 (2014) For Disclosure, PrivacyIRA Act,distributions and Paperwork Reduction Act Notice, separate instructions. (including 2015 contributions made in 2016). Include this amount on Form 1040, line 59, or Form 1040NR,Cat. lineNo. 5711320B25 12 2015 distributions of prior year excess contributions (see instructions) . 12 Form 5329 (2015) For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions. 13 Add lines 10, 11, and 12 . . . . . . . . . . . . . . . . . . . . . Cat. . No. . 13329Q . . 13 14 Prior year excess contributions. Subtract line 13 from line 9. If zero or less, enter -0- . . . . . 14 ... 9 Form 1099-SA � Form 8853 Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Archer MSAs and Long-Term Care Insurance Contracts ▶ OMB No. 1545-0074 Information about Form 8853 and its separate instructions is available at www.irs.gov/form8853. ▶ Attach to Form 1040 or Form 1040NR. 2015 Attachment Sequence No. 39 Social security number of MSA account holder. If both spouses have MSAs, see instructions ▶ Section A. Archer MSAs. If you have only a Medicare Advantage MSA, skip Section A and complete Section B. Part I Archer MSA Contributions and Deductions. See instructions before completing this part. If you are filing jointly and both you and your spouse have high deductible health plans with self-only coverage, complete a separate Part I for each spouse. 1 2 Total employer contributions to your Archer MSA(s) for 2015 . . . . 1 Archer MSA contributions you made for 2015, including those made from January 1, 2015, through April 15, 2016, that were for 2015. Do not include rollovers (see instructions) . . . . . 3 8853 Limitation from the Line 3 Limitation Chart and Worksheet in the instructions . . . . . . . Form 4 Compensation (see instructions) from the employer maintaining the high deductible health plan. (If self-employed, enter your earned income from the trade or business under which the high deductible health plan was established.) . .Archer . . . MSAs . . . . and . . . . . . . . . . Form 5 8853 Long-Term Care Contracts Archer MSA deduction. Enter the smallest of line 2, 3, orInsurance 4 here. Also include this amount on 2 3 4 ▶ Information about Form 8853 and its separate instructions is available at www.irs.gov/form8853. Department of the1040, Treasuryline 36, Form or Form 1040NR, line 35. On the dotted line next to Form 1040, line 36, or ▶ Attach to Form 1040 or Form 1040NR. Internal Revenue Service (99) Form 1040NR, line 35, enter “MSA” and the amount . . . . . . . . . . . . . . . . 5 Social security number of MSA Name(s) shown on return Caution: If line 2 is more than line 5, you may have to pay an account additional taxIf both (seespouses instructions). holder. have MSAs, see instructions ▶ OMB No. 1545-0074 2015 Attachment Sequence No. 39 Archer MSA Distributions Part II Section A. Archer MSAs. If you have only a Medicare Advantage MSA, skip Section A and complete Section B. 6a Total distributions you and your spouse received in 2015 from all Archer MSAs (see instructions) . 6a Part I Archer MSA Contributions and Deductions. See instructions before completing this part. If you are filing b Distributions included on line 6a that you rolled over to another Archer MSA or a health savings jointly and both you and your spouse have high deductible health plans with self-only coverage, complete a account. Also include any excess contributions (and the earnings on those excess contributions) separate Part I for each spouse. included on line 6a that were withdrawn by the due date of your return (see instructions) . . . . 6b Total employer contributions to your Archer MSA(s) for 2015 . . . . 1 Subtract line 6b from line 6a . . . . . . . . . . . . . . . . . . . . . . . 6c Archer MSA contributions you made for 2015, including those made from January 1, 2015, Unreimbursed qualified medical expenses (see instructions) . . . . . . . . . . . . . 7 through April 15, 2016, that were for 2015. Do not include rollovers (see instructions) . . . . .from2Archer Medical Form shareholder distributions Taxable Archer MSA distributions. Subtract line 71099-SA from lineshows 6c. If zero or less, enter -0-. Also Limitation from theWhat Line 3 Limitation Chart and Worksheet in the (MSAs). instructions . . receive . . .one . if . you3 had distributions Form is it? � Savings You include1099-SA this amount in the total on Form 1040, line 21,Accounts or Form 1040NR, line 21.will On the dotted Compensation (see instructions) from the employer maintaining the high deductible health plan. (If during line next to line 21,receives enter “MSA” and the amount . the . . year. . . (Archer . . . MSAs . . are . . no. longer . . .offered . Who it? � 8 by USAA IMCO self-employed, enter your earned income from trade or business under which the high forthe new accounts.) 9a If any of the distributions included on line 8 meet any of the Exceptions to the Additional deductible health plan was established.) . . . . . . . . . . . . . . . . . . . 4 20% Tax (see instructions), check here . . . . . . . . . . . . . . . . . . ▶ 5 Archer MSA deduction. Enter the smallestYou of line 2, 3, or 4 here. Also include this amount on file Form 8853 (Archer MSAs and Long-Term Care b Additional 20% tax (see instructions). Enter 20%must (.20) of theIRS distributions included on line 8 that Form 1040, line 36, or Form 1040NR, line 35. On the dotted line next to Form 1040, line 36, or Insurance Contracts) IRS1040, Formline 1040 are subject to the additional 20% tax. Also include this amount in thewith total your on Form 62, to report a distribution Form 1040NR, line 35, enter “MSA” and the amount . . . . . . . . . . . . . . . . 5 MSA andline calculate the taxable or Form 1040NR, line 60. On the dotted line from next toan Form 1040, 62, or Form 1040NR,portion. line 60, (The payer—USAA—is Caution: If line 2 is more than line 5, you may have to pay an additional tax (see instructions). enter “MSA” and the amount . . . . .not . required . . . .to .and . does . . not . . compute . . . the . . taxable . . amount of any 9b 1 c 2 7 8 3 4 Archer MSA Distributions Part II Section B. Medicare Advantage MSA Distributions. If you are filing jointly and both you and your spouse received MSA distribution.) 6a Total Where distributions and your spouse received in 2015 from all Archer MSAs (see instructions) . 6a is ityou reported? distributions in 2014 from a Medicare Advantage MSA, complete a separate Section B for each spouse (see b Distributions included on line 6a that you rolled over to another Archer MSA or a health savings instructions). An MSA distribution, shown in box 1, generally is not taxable if you used account. Also include any excess contributions (and the earnings on those excess contributions) pay qualified medical expenses for yourself 10 Total distributions you received in 2014 fromitalltoMedicare Advantage MSAs (see instructions) . . or your 10 family, or if you included on line 6a that were withdrawn by the due date of your return (see instructions) . . . . 6b rolled it over to.another 11 Unreimbursed qualified medical expenses (see instructions) . . . MSA . . or. health . . savings . . . .account 11 (HSA). Otherwise, c Subtract line 6b from line 6a . . . . . . . . . . . . . . . . . . . . . . . you must include distribution your on6c IRS Form 8853, and 12 Taxable Medicare Advantage MSA distributions. Subtract linethe 11 from line 10. Ifinzero or income less, 7 Unreimbursed qualified medical expenses (see instructions) . . . . . . . . . . . . . 7 enter -0-. Also include this amount in the total on may Formowe 1040, 21,penalty. or FormFor 1040NR, 21. you a line 20% moreline information, see IRS Publication 8 On Taxable Archer Subtract line 7 and from lineamount 6c. If zero the dotted lineMSA nextdistributions. to line 21, enter “Med969 MSA” . or. less, . and . enter . Other .-0-. . Also . . . 12 Health Plans). (Healththe Savings Accounts Tax-Favored include this amount in the total on Form 1040, line 21, or Form 1040NR, line 21. On the dotted If any of the distributions included on line 12 meet any of the Exceptions to the Additional line next to line 21, enter “MSA” and the amount . . . . . . . . . . . . . . . . . 8 50% Tax (see instructions), check here . . . . . . . . . . . . . . . . . . ▶ of the distributions included on lineTax 8 meet any of the please Exceptions the Additional or contact one of our Member For 9a moreIf any information regarding your USAA Documents, visit to usaa.com/taxes 50%instructions), tax (see instructions). Enter that b Additional 20% Tax (see check here . . 50% . .(.50) . of. the . distributions . . . specific . .included . tax . situation .on. line . 12 . ▶ Service are Representatives at 800-531-6347. Questions regarding be directed to your subject to the additional 50% tax. Also include this amount your in the total on Form 1040, lineshould 62, b or Additional 20% tax instructions). 20%to(.20) of 1040, the distributions included on lineline 8 that Form 1040NR, line(see 60. On the dottedEnter line next Form line 62, or Form 1040NR, 60, tax and legal advisers. are subject to the and additional 20% tax. enter “Med MSA” the amount . . Also . include . . . this . .amount . . in. the . total . . on. Form . . 1040, . . line . 62, . . 13b or United Form 1040NR, line 60. On the dotted next to Form 1040, line 62, orother Form 1040NR,Banks line 60, USAA means Services Automobile Association and line its insurance, banking, investment and companies. Member FDIC. Investments provided Form 8853 (2015) For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 24091H by USAA Investment Management enter “MSA” and theCompany amountand.USAA . .Financial . . Advisors . . . Inc., . both . . registered . . . broker . . dealers. . . . . . . . 9b 13a The contents of document is Advantage not intended to be, and is not, legal or tax advice. Theare applicable law isand complex, theyou penalties non-compliance are severe, Section B.thisMedicare MSA Distributions. If you filing tax jointly both andforyour spouse received and the applicable tax law of your state may differ from federal tax law. Therefore, you should consult your tax and legal advisers regarding your specific situation. distributions in 2014 from a Medicare Advantage MSA, complete a separate Section B for each spouse (see The applicable law concerning retirement plans, Coverdell ESAs, 529 plans and MSAs is very complex, the penalties for noncompliance are severe, and the instructions). applicable tax laws of your state may differ from the federal laws. Therefore, you should consult your tax and legal advisors regarding your specific situation. 10 11 12 Total distributions you received in 2014 from all Medicare Advantage MSAs (see instructions) . . Unreimbursed qualified medical expenses (see instructions) . . . . . . . . . . . . . Taxable Medicare Advantage MSA distributions. Subtract line 11 from line 10. If zero or less, enter -0-. Also include this amount in the total on Form 1040, line 21, or Form 1040NR, line 21. On the dotted line next to line 21, enter “Med MSA” and the amount . . . . . . . . . . 10 11 12 45370-011 6 10