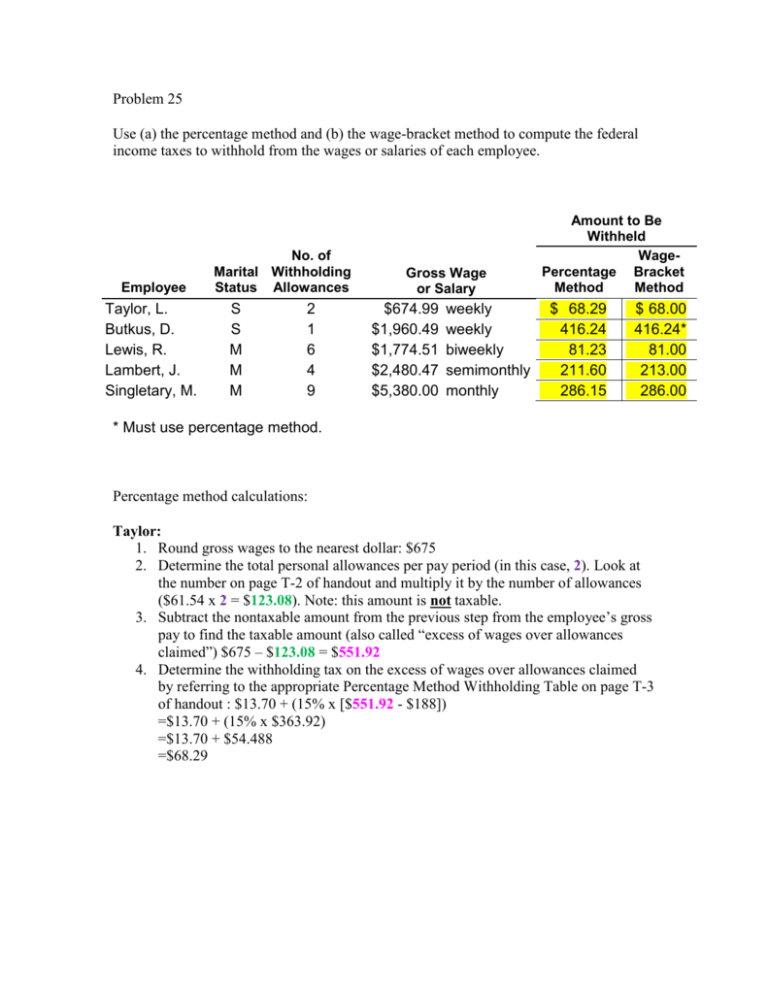

Problem 25 Use (a) the percentage method and (b) the wage

advertisement

Problem 25 Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Employee Taylor, L. Butkus, D. Lewis, R. Lambert, J. Singletary, M. No. of Marital Withholding Status Allowances S S M M M 2 1 6 4 9 Gross Wage or Salary $674.99 $1,960.49 $1,774.51 $2,480.47 $5,380.00 weekly weekly biweekly semimonthly monthly Amount to Be Withheld WagePercentage Bracket Method Method $ 68.29 416.24 81.23 211.60 286.15 $ 68.00 416.24* 81.00 213.00 286.00 * Must use percentage method. Percentage method calculations: Taylor: 1. Round gross wages to the nearest dollar: $675 2. Determine the total personal allowances per pay period (in this case, 2). Look at the number on page T-2 of handout and multiply it by the number of allowances ($61.54 x 2 = $123.08). Note: this amount is not taxable. 3. Subtract the nontaxable amount from the previous step from the employee’s gross pay to find the taxable amount (also called “excess of wages over allowances claimed”) $675 – $123.08 = $551.92 4. Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table on page T-3 of handout : $13.70 + (15% x [$551.92 - $188]) =$13.70 + (15% x $363.92) =$13.70 + $54.488 =$68.29 Butkus: 1. Round gross wages to the nearest dollar: $1,960 2. Determine the total personal allowances per pay period (in this case, 1). Look at the number on page T-2 of handout and multiply it by the number of allowances ($61.54 x 1 = $61.54). Note: this amount is not taxable. 3. Subtract the nontaxable amount from the previous step from the employee’s gross pay to find the taxable amount (also called “excess of wages over allowances claimed”) $1,960 – $61.54 = $1,898.46 4. Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table on page T-3 of handout : $260.15 + (28% x [$1,898.46 - $1,341]) =$260.15 + (28% x $557.46) =$260.15 + $156.0888 =$416.24 Lewis: 1. Round gross wages to the nearest dollar: $1,775 2. Determine the total personal allowances per pay period (in this case, 6). Look at the number on page T-2 of handout and multiply it by the number of allowances ($123.08 x 6 = $738.48). Note: this amount is not taxable. 3. Subtract the nontaxable amount from the previous step from the employee’s gross pay to find the taxable amount (also called “excess of wages over allowances claimed”) $1,775 – $738.48 = $1,036.52 4. Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table on page T-3 of handout : $56.10 + (15% x [$1,036.52 - $869]) =$56.10 + (15% x $167.52) =$56.10 + $25.128 =$81.23 Lambert: 1. Round gross wages to the nearest dollar: $2,480 2. Determine the total personal allowances per pay period (in this case, 4). Look at the number on page T-2 of handout and multiply it by the number of allowances ($133.33 x 4 = $533.32). Note: this amount is not taxable. 3. Subtract the nontaxable amount from the previous step from the employee’s gross pay to find the taxable amount (also called “excess of wages over allowances claimed”) $2,480 – $533.32 = $1,946.68 4. Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table on page T-3 of handout : $60.90 + (15% x [$1,946.68 - $942]) =$60.90 + (15% x $1,004.68) =$60.90 + $150.702 =$211.60 Singletary: 1. Round gross wages to the nearest dollar: $5,380 2. Determine the total personal allowances per pay period (in this case, 9). Look at the number on page T-2 of handout and multiply it by the number of allowances ($266.67 x 9 = $2,400.03). Note: this amount is not taxable. 3. Subtract the nontaxable amount from the previous step from the employee’s gross pay to find the taxable amount (also called “excess of wages over allowances claimed”) $5,380 – $2,400.03 = $2,979.97 4. Determine the withholding tax on the excess of wages over allowances claimed by referring to the appropriate Percentage Method Withholding Table on page T-3 of handout : $121.60 + (15% x [$2,979.97 - $1,883]) =$121.60 + (15% x $1,096.97) =$121.60 + $164.5455 =$286.15 2006 4-3