BANK RECONCILIATION STATEMENT Learner Note Treat All The

advertisement

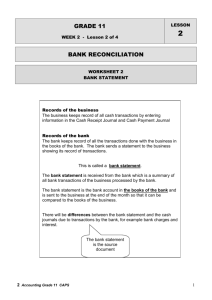

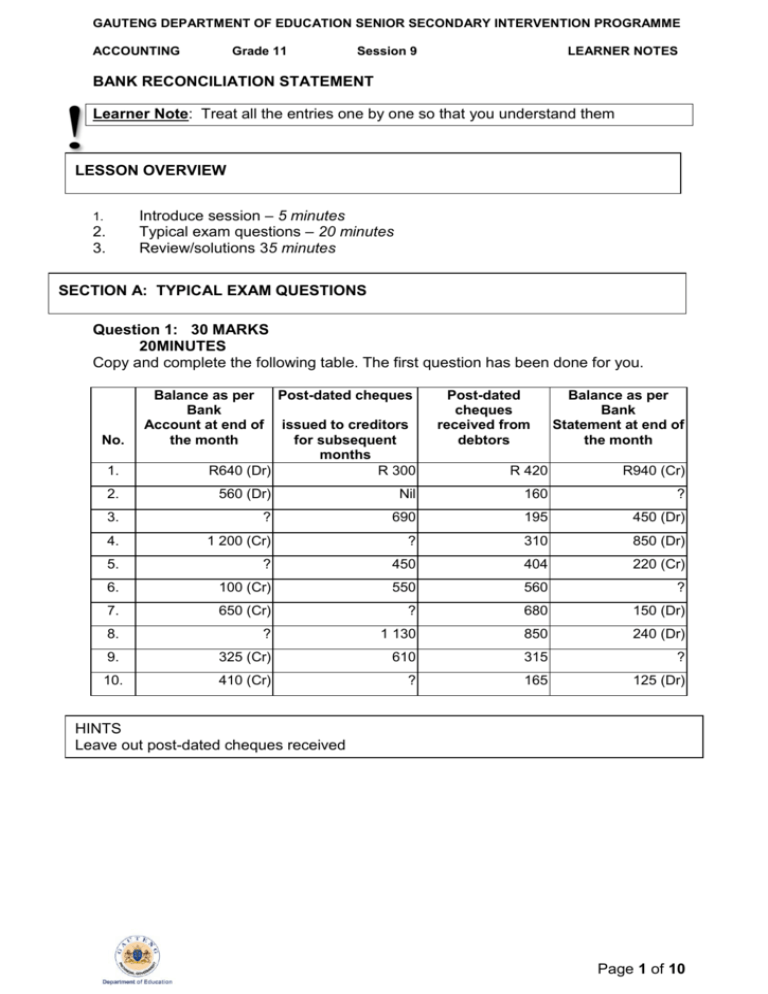

GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES BANK RECONCILIATION STATEMENT Learner Note: Treat all the entries one by one so that you understand them LESSON OVERVIEW Introduce session – 5 minutes Typical exam questions – 20 minutes Review/solutions 35 minutes 1. 2. 3. SECTION A: TYPICAL EXAM QUESTIONS Question 1: 30 MARKS 20MINUTES Copy and complete the following table. The first question has been done for you. No. 1. Balance as per Post-dated cheques Bank Account at end of issued to creditors the month for subsequent months R640 (Dr) R 300 Post-dated cheques received from debtors Balance as per Bank Statement at end of the month R 420 R940 (Cr) 2. 560 (Dr) Nil 160 ? 3. ? 690 195 450 (Dr) 4. 1 200 (Cr) ? 310 850 (Dr) 5. ? 450 404 220 (Cr) 6. 100 (Cr) 550 560 ? 7. 650 (Cr) ? 680 150 (Dr) 8. ? 1 130 850 240 (Dr) 9. 325 (Cr) 610 315 ? 10. 410 (Cr) ? 165 125 (Dr) HINTS Leave out post-dated cheques received Page 1 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES SECTION B: SOLUTIONS AND HINTS HINTS REMEMBER THE RELATIONSHIP BETWEEN A BANK AND ITS CLIENT. A DEBIT IN THE BANK ACCOUNT MEANS A CREDIT IN THE BOOKS OF THE BANK REMEMBER WHAT IS DONE TO POST DATED CHEQUES ISSUED AND RECEIVED HINT Explanation of solution No. 1 and 3 1. Solution no. 1: R940 (Cr) – R300 (Dr) = R640 (Dr) [Leave out post-dated cheques received] 2. Solution no.3: R450 (Dr) + R690 (Dr) = R1 140 (Cr) [Leave out post-dated cheques received] Post-dated cheques Balance as per Bank issued to creditors Account at end of for subsequent No. the month months Post-dated cheques Received from debtors R 300 R 420 Balance as per Bank Statement at end of the month 1. R640 Dr R940 Cr 2. 560 Dr Nil 160 3. 1 140 Cr 690 195 450 Dr 4. 1 200 Cr 350 310 850 Dr 5. 230 Cr 450 404 220 Cr 6. 100 Cr 550 560 450 Cr 7. 650 Cr 500 680 150 Dr 8. 1370 Cr 1 130 850 240 Dr 9. 325 Cr 610 315 285 Cr 10. 410 Cr 285 165 125 Dr 560 Cr Learner Note: Bank reconciliation is an integral part of internal control Page 2 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES SECTION D: ADDITIONAL CONTENT NOTES Post-dated cheques issued A post-dated cheque is a cheque which is dated for the future. It cannot be presented to the bank for payment or be deposited into a banking account until the date specified on the cheque. A cheque can for example, be written out on 1 July 2010 but dated 1 August 2010. This means that the cheque is post-dated to 1 August 2010. It becomes valid on that date and only then can it be presented to the bank for payment. A major advantage of post-dated cheques is that the creditor is assured of payment on a fixed date in the future. No reminders need be sent to the debtors and the creditor enjoys the satisfaction of knowing that he has a written undertaking of payment through a bank. Post-dated cheques have replaced bills of exchange and promissory notes to a large extent in the settlement of debts between parties. A business can receive post-dated cheques from its debtors. To budget and simplify its payments, a business can also issue post-dated cheques to its creditors. Post-dated cheques received from debtors When a post-dated cheque is received from a debtor, no receipt is made out; in other words a post-dated cheque received is not receipted. The receipt will only be written out on the date when the cheque becomes valid (due). In the above example a receipt will only be written out on 1 August. A post-dated cheque will not be recorded in the books of account before it becomes valid. On that day the cheque will be receipted and thereafter recorded into the CRJ. All post-dated cheques must be kept in a safe place until they become due. No bank will accept a post-dated cheque before it becomes valid. The business will enter these post-dated cheques in a register for post-dated cheques. On the due date these cheques will be handled in the normal way; a receipt will be issued, it will be entered into the bank deposit book and will be deposited into the banking account. A post-dated cheque received will therefore not affect the bank account or reconciliation procedures as it is recorded in the CRJ on the due date. NO ENTRY IS MADE IN THE CRJ. Post-dated cheques issued to creditors All cheques issued are recorded in cheque number sequence and not in date order. Therefore when a post-dated cheque is issued, it is recorded immediately in the CPJ even though the cheque is dated 2 months hence. The reason for recording all cheques in numerical sequence is to maintain absolute control over their issue and to account for immediate verification of each cheque issue, otherwise the sequence of cheque numbers will be lost. When a post-dated cheque is issued it will not reach our bank until the due date. It will therefore not be reflected on the bank statement for the current month. Such a cheque must be treated as an outstanding cheque in the Bank Reconciliation Statement until it is presented to the bank for payment. Page 3 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES Treatment of post-dated cheques at the end of the financial year All post-dated cheques must be shown in the Balance Sheet as creditors. The reason for this is that post-dated cheques do not really settle the accounts of creditors. These amounts are in actual fact still owing to the creditors and the debt will only be cancelled when the cheques fall due and are paid out by the bank. At the end the financial year when drawing up the balance sheet the post-dated cheque amounts will be added to the bank balance if favourable (or deducted from the bank overdraft) and creditors increased accordingly. BANK RECONCILIATION STATEMENT OF THE PREVIOUS MONTH Sometimes cheques issued by a firm remain outstanding for periods longer than one month. The payee may have temporarily mislaid the cheque or the cheque could have gone astray in transit. These cheques are reflected as outstanding in the first month of the reconciliation. However, they can also remain outstanding in subsequent month and will therefore affect the process of bank reconciliation. For this reason when we compare the current month’s bank statement with the current month’s cash journals to determine outstanding cheques not yet presented to the bank for payment, we must, in addition, check the current month’s Bank Statement with the previous month’s bank reconciliation statement to determine which cheques are still outstanding from the previous months. These cheques must again be listed as outstanding when preparing the current month’s reconciliation statement. It should be remembered that all cheques are normally valid for a period of six months after which they are regarded as stale. The bank will not pay out a stale cheque. The payee usually returns the stale cheque to the drawer who then cancels the cheque and issues a fresh cheque. Stale cheques are dealt with further on in this module. OUTSTANDING SALARY CHEQUES NOT YET PRESENTED TO THE BANK FOR PAYMENT Firms that have a large number of employees usually record their salary cheques in the Salaries Journal. Only the total amount paid for salaries is indicated in the Cash Payments Journal. Many employees who receive their salary cheques on the last working day of the month normally cash their cheques or deposit these into their savings/current account during the first few days of the new month. The Bank Reconciliation Statement of the firm at the end of the month will therefore include uncashed salary cheques as part of outstanding cheques in the normal way. All outstanding cheques should therefore be ascertained by comparing the monthly bank statement with the Cash Payments Journal as well as the Salaries Journal. It should be noted that the rapid progress made in electronic banking, the need to issue salary cheques will fall away. Salaries will then be transferred electronically from the business’s bank account to the individual transmission/savings/current account of each employee. 3. Note: SALARY CHEQUES NOT YET CASHED MUST BE SHOWN IN THE BANK RECONCILIATION AS OUTSTANDING CHEQUES i.e. DEBIT OUTSTANDING CHEQUES. Page 4 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES CHEQUES STOPPED FOR PAYMENT AT THE BANK Reasons for stopping payment on cheques A cheque is an instruction to the bank to pay a party a specified sum of money. Sometimes it becomes necessary to instruct the bank not to pay out a particular cheque. This procedure is called a “stop payment”. A stop payment form (see below) is completed by the drawer and handed to the bank whenever he wishes to stop payment on a cheque. Possible reasons for stopping payment on cheques by businessmen are: The cheque may be lost or stolen-the payee is then unable to cash or bank the cheque. The drawer must then place a stop payment immediately as someone else may cash the cheque. The drawer may have been dissatisfied with the work performed or with the quality of the goods delivered. Merchandise ordered may not have been timeously delivered. The cheque may have been acquired illegally or dishonestly. The debt may already have been settled, e.g. merchandise returned to the creditor after the cheque was posted. Accounting entries for cheques stopped for payment When a cheque is issued it is recorded in the Cash Payments Journal. When payment of the cheque is stopped, this entry must be cancelled. The majority of the transactions recorded in the Cash Payments Journal are posted to the Ledgers on a daily basis. Therefore when a cheque is stopped for payment the entry cannot simply be struck off in the CPJ. The original entry has to be reversed. The Bank Account had originally been credited with total payments for the month. The reversal transaction therefore has to be recorded in the Cash Receipts Journal. When posted to the Ledger this entry ensures that the Bank Account is debited and the relevant creditors (or expense) account credited to cancel the original entry. If a fresh cheque is issued, it will be recorded in the CPJ in the normal way. ERRORS IN THE CASH JOURNALS Errors in the Cash Receipts Journal The only type of error involving the CRJ is the receipt and depositing of money. If for example a debtor or tenant pays R466 but only R66 is recorded in the CRJ, then the error can be discovered in one of the following ways within a very short time: The cashier will count the cash received for the day and find that he has an extra R400 in his possession. Since the amount received is always deposited as a total, i.e. R466, as a control measure, the teller at the bank will find that the deposit is overcast by R400. Since errors involving the receipt and depositing of money can be discovered on the same day, the error can be rectified immediately as the transaction has not been posted from the CRJ to the Ledger. The incorrect figure is deleted neatly in the CRJ and the correct amount inserted. Such types of errors rarely occur because in business practice great care is exercised over the control of cash received. NO ENTRY IS MADE IN THE CRJ Page 5 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES Errors in the Cash Payments Journal Errors can occur when writing out cheques. These will only be discovered when payments are checked against paid cheques returned by the bank together with the monthly bank statement. If a cheque is made out for R109 but recorded in the CPJ as R9, the error cannot be corrected by deletion as the transaction has already been posted to the Ledger. Since the majority of entries are posted from the CPJ to the ledgers on a daily basis, an entry in one of the cash journals will be required to correct errors in the CPJ. The correction can be dealt with in one of 2 ways: Where the amount is recorded in the CPJ at a lower figure (undercast) but the value of the cheque is higher, then another entry is required in the CPJ. This entry will show the difference between the amount originally recorded in the CPJ and the correct value of the cheque issued. When posted to the ledger the bank account will be credited and the relevant contra account e.g., creditors (or expense) account debited to arrive at the correct entry. Where the amount recorded in the CPJ is higher (overcast) than the value of the cheque issued, then another entry is recorded in the CRJ. This entry will show the difference between the amount originally recorded in the CPJ and the correct value of the cheque issued. When posted to the ledger, the bank account will be debited and the relevant contra account e.g. creditors (or expense) account credited to arrive at the correct entry. ERRORS IN THE BANK STATEMENT It is possible for the banks to make mistakes. The general rule to follow is to correct the errors where it was made. If the bank makes the error it must be corrected by the bank. For reconciliation purposes the correction will be shown in the Bank Reconciliation Statement as error corrected. e.g. If the business account was wrongly debited by the bank, then in the Bank Reconciliation Statement it will appear as follows: Debit Credit Credit error made by Bank (Account wrongly debited) xxx and If the business account was wrongly credited by the bank, then in the Bank Reconciliation Statement it will appear as follows: Debit Debit error made by Bank (Account wrongly credited) Credit xxx DISHONOURED CHEQUES Cheques received from tenants, debtors and customers are deposited to the credit of the business banking account and presented for payment at the drawer’s bank. Some times, these cheques are not honoured by the drawer’s bank,i.e. payment on these cheques is refused because of various reasons. Such cheques are regarded as dishonoured cheques. Page 6 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES Some reasons why cheques dishonoured: Insufficient funds in the drawer’s account. The cheque has been damaged. The amount in words and the amount in figures differ. The cheque has not been correctly prepared. The signature of the drawer is queried or omitted. The drawer has stopped the cheque. The words or figures are illegible. The full signature of the drawer does not verify alterations on cheque. The dishonoured cheque appears as a debit entry on the bank statement usually prefixed by the abbreviation UN. This debit cannot be ticked off against a corresponding credit in the Cash Payments Journal. In the case of a cheque dishonoured the credit entry is made through the Cash Payments Journal. The effect of this is to debit a debtor for the amount that has not been paid The cheque is sent back to the drawer for replacement. . Stale cheques When a cheque is older than six months, the bank will refuse payment. Such a cheque has become stale. The cheque that has not yet been presented to the bank for payment must appear on the bank reconciliation statement every month, until it becomes stale. When it becomes stale, the cheque must be cancelled in the Cash Receipts Journal. Cheques from certain concerns become stale after three months. If a replacement cheque is issued then the normal entry is made in the Cash Payments Journal. Reversal (Cancellation) A reversal (cancellation) of the original entry takes place in the following two categories in the CPJ of dishonoured cheques: Where the cheque was dishonoured because the drawer did not have sufficient funds to meet the cheque in his bank account. Where there is good reason to believe that the debtor or customer has no intention of meeting his debt, irrespective of the reason for dishonouring of the cheque. When a cheque is received from a debtor it is recorded in the CRJ and thereafter banked as a part of receipts. The Bank Account is debited and the Debtor’s Account is credited. When a debtor’s cheque has to be cancelled, the original accounting procedure has to be reversed, viz. 1. The unpaid cheque has to be shown in the CPJ and reflected in the “Debtors control” column. (Unpaid cheques appear as a debit on the Bank Statement.) 2. The Debtor’s account is debited (re-opens) and the Bank Account is credited. 3. When a debtor’s cheque is dishonoured owing to insufficient funds, any discount previously allowed should be cancelled by means of a Journal entry. The Debtor’s account is debited and the Discount allowed account is credited. The effect of the above entries is that the debtor once again owes the amount of the unpaid cheque. It is also important to remember that cheques dishonoured because of insufficient funds will involve a significant waiting period before the debt is settled. The amount of the cheque reversed should be clearly indicated on the monthly statement sent to the drawer (debtor) to Page 7 of 10 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING Grade 11 Session 9 LEARNER NOTES ensure that he is fully aware of the unpaid cheque and the need to make proper arrangements to settle the debt. e.g. A. Smith’s cheque returned by the bank marked R/D, R400. CASH PAYMENTS JOURNAL Doc. No. Date Details Bank B/S A. Smith (R/D cheque) 400 Debtors Control 400 SECTION D: HOMEWORK The following information was taken from UnitedTraders, a sole trader. REQUIRED: Make use of the information provided below to calculate the following as at 30 November 2010. 1. Balance as per bank account. 2. Value of cheques not yet presented for payment. 3. Balance as per bank statement. 4. Prepare a Bank Reconciliation Statement as at 30 November 2010. INFORMATION: The following details were extracted from the accounting records of United Traders. (a) W.Rooney deposited R10 000 in a current account in the name of United Traders At Trafford Bank on 20 August 2010. (b) United Traders started formal trading on 1 October 2010 (c) An examination of the cash journals and the bank statements received from Trafford Bank for October and November 2010 revealed the following: (i) (ii) Cheques recorded in the CPJ in October 2010 Recorded on bank statement in October Recorded on bank statement in November Still not recorded on a bank statement R23 000 17 000 4 000 2 000 Cheques recorded in the CPJ in November 2010 Recorded on bank statement in November Still not recorded on a bank statement R38 600 (iii) Deposits recorded in the CRJ in October 2010 Recorded on bank statement in October Recorded on bank statement in November R19 200 17 800 1 400 (iv) Deposits recorded in the CRJ in November 2010 Recorded on bank statement in November Still not recorded on a bank statement R37 100 (v) Deposits made by tenant at Trafford Bank and not Recorded in cash journals of United Traders As per November bank statement 31 300 7 300 33 700 3 400 R 1 300 1 300 Learner Note: When you attempt the homework, you need to ensure that you are able to answer the questions in the allocated time frames. Page 8 of 10 SECTION E: SOLUTIONS TO SESSION 8 HOMEWORK Doc. No. Day Cash Receipts Journal of Liverpool Traders – June 2010 Cost of Debtors Details Fol. Bank Sales Sales control Discount Allowed 30 Totals B/S B.Smith B/S Gerrard Bank b/f 3350 No 982 779 12 910 200 200 16 16 3566 Doc. 1673 Fol: CRJ 27 Sundry Account Amount Fol. Details 1673 982 779 12 Rent Income Interest on current a/c 1126 Cash Payments Journal of Liverpool Traders – June 2010 Fol: CPJ 27 Day Name of payee Fol. Bank Trading Wages Debtors Creditors Sundry Accounts Control Stock Control Discount Amount Fol. Details received 30 Totals b/f 2 065 420 460 1 140 15 60 B/S PE Insurance Co 100 B/S J.Lang (cheque R/D) 120 B/S Gerrard Bank 100 120 48 2333 Insurance 48 420 460 120 1140 15 Bank Charges 208 Page 9 of 10 SUBJECT Grade 11 Session 8: BANK RECONCILIATION – TEACHER SET GENERAL LEDGER OF LIVERPOOL TRADERS BALANCE SHEET ACCOUNTS SECTION Dr 2010 June BANK 1 Balance 30 Sundry Accounts b/d 546 3566 Cr 2010 June 30 SUNDRY Accounts Balance c/d 4112 July 1 Bal b/d 2333 1779 4112 1779 BANK RECONCILIATION STATEMENT OF LIVERPOOL TRADERS AS AT 30 JUNE 201 DEBIT CREDIT Dr Balance as per bank a/c 1874 530 Cr outstanding deposit Dr outstanding cheques: No. 0021 160 0024 220 0025 245 Dr balance as per bank a/c 1779 2404 The SSIP is supported by Page 10 of 10 2404