2.2-notes-week-2-bank-recon1

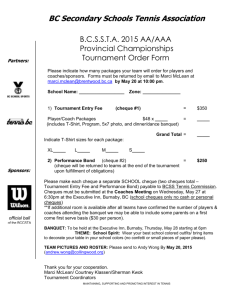

advertisement

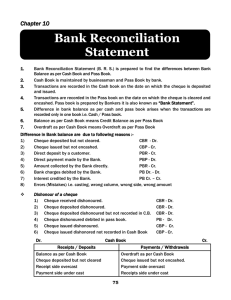

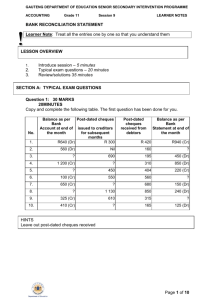

GRADE 11 LESSON WEEK 2 - Lesson 2 of 4 2 BANK RECONCILIATION WORKSHEET 2 BANK STATEMENT Records of the business The business keeps record of all cash transactions by entering information in the Cash Receipt Journal and Cash Payment Journal Records of the bank The bank keeps record of all the transactions done with the business in the books of the bank. The bank sends a statement to the business showing its record of transactions. This is called a bank statement. The bank statement is received from the bank which is a summary of all bank transactions of the business processed by the bank. The bank statement is the bank account in the books of the bank and is sent to the business at the end of the month so that it can be compared to the books of the business. There will be differences between the bank statement and the cash journals due to transactions by the bank, for example bank charges and interest. The bank statement is the source document 2 Accounting Grade 11 CAPS 1 Comparison between the bank statement and current account BOOKS OF THE BUSINESS GENERAL LEDGER OF SUN TRADERS + dr - BANK CRJ receipts (deposit slips) increase + CPJ payments (cheques) decrease - favourable unfavourable cr BOOKS OF THE BANK GENERAL LEDGER OF ABC BANK dr - SUN TRADERS + Cheques Deposits decrease - increase + unfavourable favourable cr When the business deposits money into the bank: the business will debit the bank account (CRJ) – it is an asset to the business the bank will credit the bank statement – it is a liability to the bank When the business issues cheques: the business will credit the bank account (CPJ) the bank will debit the bank statement Therefore: Favourable bank balance (when the business has money) debit balance in the bank account of the business credit balance on the bank statement Unfavourable bank balance (an overdraft) credit balance in the bank account of the business debit balance on the bank statement 2 Accounting Grade 11 CAPS 2 Comparing the cash journals and bank statement The books of the business and those of the bank should agree, and the bank balance should be the same in both sets of books. There are, however, differences. The CPJ and CRJ should be compared to the bank statement to see the differences. Reasons for the differences between the bank statement and the cash journals - Bank charges – is directly deducted from the bank statement by the bank - Debit orders – monthly payments directly deducted from the bank account - Dishonoured cheques – cheques received for payment and deposited by the business, are returned by the bank as dishonoured (R/D) because of the following reasons: it may be that there is no money in the account or it may be another reason e.g. the cheque is not signed or the cheque is stale i.e. older than 6 months. - Interest on overdraft – interest payable to the bank by the business and directly deducted by the bank - Interest on current account – interest received by the business on a favourable balance and credited directly to the account by the bank - Outstanding cheques – cheques paid by the business are entered in the CPJ, but some have not yet been presented for payment to the bank and are therefore outstanding - Outstanding deposits- deposits made by the business after the bank statement was finalized and which do not reflect on the bank statement - Direct deposits not yet entered in the CRJ – deposits directly deposited into the bank account of the business and reflect on the bank statement but not in the cash journal - Post-dated cheques issued – these cheques are entered in the CPJ, but the payee has not yet presented the cheque to the bank for payment, and therefore it is seen as an outstanding cheque. The Bank Reconciliation Statement is drawn up which reflects the differences between the balance in the Bank account from the business side and the balance on the Bank Statement, in order reconcile the books with those of the bank. . The Bank Reconciliation Statement is seen from the point of view of the bank 2 Accounting Grade 11 CAPS 3 EXAMPLE OF A BANK STATEMENT BANK STATEMENT SUN TRADERS SHOP 23 OLD MUTUAL CENTRE 43 CHURCH STREET PRETORIA 0001 XYZ BANK ARCADIA BRANCH 12 PICKET STREET PRETORIA 0001 Deposit by the business (credit on bank statement) ACCOUNT NUMBER 00786789 CURRENT ACCOUNT STATEMENT PERIOD 1 AUGUST 2013 Interest on overdraft (115-) Description Balance brought forward Credit Cheque 401 Cheque 402 Cheque 404 Cheque 403 Interest Unpaid cheque Credit Service fee Cheque 405 Levy on debit transactions Also Insurance Company Credit Cheque 406 Cheque 407 Credit Cheque 408 Credit card levy Credits, Debits 7 350 + 275 189 5 320 6 600 115 310 7 960 + 78 1 140 9220 7 080 + 6 585 3 710 13 000 + 1 320 22 - Stop order for insurance policy TO 30 AUGUST 2013 Date 01-08-2013 01-08-2013 02-08-2013 02-08-2013 05-08-2013 05-08-2013 06-08-2013 08-08-2013 09-08-2013 12-08-2013 14-08-2013 15-08-2013 21-08-2013 22 -08-2013 30-08-2013 credit balance Balance 8 8771 5271 8021 9917 31113 91114 02614 3366 3766 4547 5947 6037 8237437 328 11 0381 962 642 620 Debit balance (overdraft) Note: All deposits are credit (+) amounts All payments (cheques, bank charges, stop orders) are debit (-) amounts 2 Accounting Grade 11 CAPS 4 CHALK BOARD SUMMARY BOOKS OF THE BUSINESS GENERAL LEDGER OF SUN TRADERS + dr BANK - CRJ receipts (deposit slips) increase + CPJ payments (cheques) decease - favourable Unfavourable cr BOOKS OF THE BANK GENERAL LEDGER OF ABC BANK dr Cheques 2 Accounting Grade 11 CAPS SUN TRADERS + Deposits decease - increase + unfavourable Favourable cr 5