The role of managers' attitudes in corporate fraud: Extending

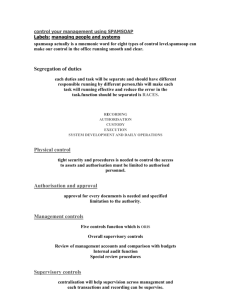

advertisement