Labour Law, Judicial Efficiency & Informal Employment in India

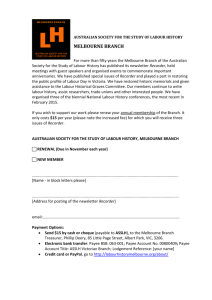

advertisement