Discussion Paper - Australian Small Business Commissioner

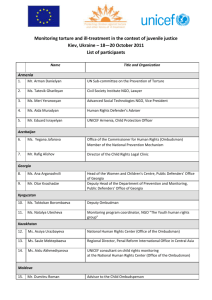

advertisement