Facilitating trade with the MENA region

advertisement

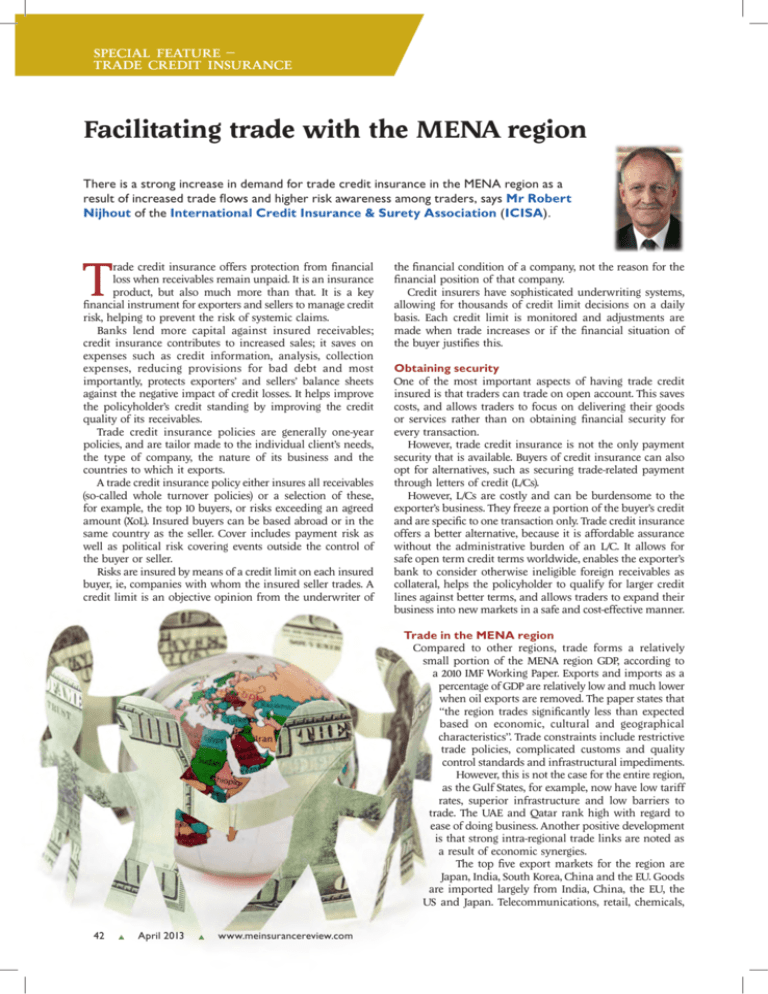

SPECIAL FEATURE – TRADE CREDIT INSURANCE Facilitating trade with the MENA region There is a strong increase in demand for trade credit insurance in the MENA region as a result of increased trade flows and higher risk awareness among traders, says Mr Robert Nijhout of the International Credit Insurance & Surety Association (ICISA). T rade credit insurance offers protection from financial loss when receivables remain unpaid. It is an insurance product, but also much more than that. It is a key financial instrument for exporters and sellers to manage credit risk, helping to prevent the risk of systemic claims. Banks lend more capital against insured receivables; credit insurance contributes to increased sales; it saves on expenses such as credit information, analysis, collection expenses, reducing provisions for bad debt and most importantly, protects exporters’ and sellers’ balance sheets against the negative impact of credit losses. It helps improve the policyholder’s credit standing by improving the credit quality of its receivables. Trade credit insurance policies are generally one-year policies, and are tailor made to the individual client’s needs, the type of company, the nature of its business and the countries to which it exports. A trade credit insurance policy either insures all receivables (so-called whole turnover policies) or a selection of these, for example, the top 10 buyers, or risks exceeding an agreed amount (XoL). Insured buyers can be based abroad or in the same country as the seller. Cover includes payment risk as well as political risk covering events outside the control of the buyer or seller. Risks are insured by means of a credit limit on each insured buyer, ie, companies with whom the insured seller trades. A credit limit is an objective opinion from the underwriter of the financial condition of a company, not the reason for the financial position of that company. Credit insurers have sophisticated underwriting systems, allowing for thousands of credit limit decisions on a daily basis. Each credit limit is monitored and adjustments are made when trade increases or if the financial situation of the buyer justifies this. Obtaining security One of the most important aspects of having trade credit insured is that traders can trade on open account. This saves costs, and allows traders to focus on delivering their goods or services rather than on obtaining financial security for every transaction. However, trade credit insurance is not the only payment security that is available. Buyers of credit insurance can also opt for alternatives, such as securing trade-related payment through letters of credit (L/Cs). However, L/Cs are costly and can be burdensome to the exporter’s business. They freeze a portion of the buyer’s credit and are specific to one transaction only. Trade credit insurance offers a better alternative, because it is affordable assurance without the administrative burden of an L/C. It allows for safe open term credit terms worldwide, enables the exporter’s bank to consider otherwise ineligible foreign receivables as collateral, helps the policyholder to qualify for larger credit lines against better terms, and allows traders to expand their business into new markets in a safe and cost-effective manner. Trade in the MENA region Compared to other regions, trade forms a relatively small portion of the MENA region GDP, according to a 2010 IMF Working Paper. Exports and imports as a percentage of GDP are relatively low and much lower when oil exports are removed. The paper states that “the region trades significantly less than expected based on economic, cultural and geographical characteristics”. Trade constraints include restrictive trade policies, complicated customs and quality control standards and infrastructural impediments. However, this is not the case for the entire region, as the Gulf States, for example, now have low tariff rates, superior infrastructure and low barriers to trade. The UAE and Qatar rank high with regard to ease of doing business. Another positive development is that strong intra-regional trade links are noted as a result of economic synergies. The top five export markets for the region are Japan, India, South Korea, China and the EU. Goods are imported largely from India, China, the EU, the US and Japan. Telecommunications, retail, chemicals, 42 April 2013 www.meinsurancereview.com SPECIAL FEATURE – TRADE CREDIT INSURANCE pharmaceuticals and the automotive sector stand out as well-performing sectors. A higher disposable income, increased government spending and a young and growing population leads to growth in consumption and in trade. The non-oil industry is demonstrating robust growth, in particular in the UAE. As trade on open account increases, so does the demand for trade credit insurance. The availability of credit insurance cover in the region will benefit from greater transparency in obtaining financial information, reliable financials, recognition of retention of title and faster bankruptcy procedures. MENA market review About The ICISA T he ICISA was founded in 1928 as the first credit insurance association. Surety companies have been joining since the 1950s, allowing the association to grow into the leading international organisation in the field of trade credit and surety bonds. ICISA members account for over 95% of global private trade credit insurance business, and form a central role in facilitating trade, by insuring trade credit risks or by providing security for the performance of a contract. ICISA counts 49 members insuring risks in practically every country in the world. 2012 was a relatively good year for trade credit insurers in the MENA region, in particular with regard to the GCC. Surety bonds are similar to bank guarantees, but The trade credit insurance market in the region grew by there are also differences: surety bonds are typically approximately 15% in 2012. ICISA members Atradius, Coface conditional, whereas bank guarantees are on demand. and Euler Hermes accounted for most of the policies signed Only the performance risk lies with the surety, where the last year. bank has the financial risk on the construction project. Estimated premium for the region in 2012 was around Accounting wise, surety is accounted for as a liability like US$50 million. Atradius, Coface, Euler Hermes and the other insurance products whereas credit risks in a bank by Islamic Corporation for the Insurance of Investments nature are accounted for on the asset side. and Export Credit (ICIEC) Although in many countries jointly represent around 85% originally bonds are issued by of the MENA market share. banks, the security provided The Gulf region is one of the The average loss ratio over by an insurer has proven 2012 is expected to range equally acceptable. This has areas where notable growth in between 20% and 25%, with enabled many enterprises demand for trade credit insurance total exposure in a range of to set up separate lines of $35 billion to $40 billion. credit and bonds with surety of some 15% is expected for 2013. I n 2 01 3, t r a d e c r e d it or insurance companies. In Some demand for non-traditional insurance members see a doing so, they protect their mixed picture; some markets lines of credit with banks, cover, in addition to the locally are expected to harden while which might otherwise be others will soften. Concern dominant whole insurable blocked at such time when i s e x p r e s s e d a b o ut t he this working capital was turnover cover, is also seen. political instability in parts needed. Bank s usually of the MENA region and the prefer to issue so-called “onvolatility in Southern Europe. demand” bonds and must The economic slowdown therefore treat them as unin Europe and the ongoing financing constraints of banks presented letters of credit. are other external factors negatively influencing the 2013 Unlike traditional insurance, sureties do not undertake outlook for trade credit insurance. The Gulf region is one of to spread risk, but rather to pre-qualify and rigorously the areas where notable growth in demand for trade credit select their principals. insurance of some 15% is expected for 2013. Some demand for To regulate the issuance of surety bonds, a supporting non-traditional cover, in addition to the locally dominant legislative framework is a requirement. Such legislation is whole insurable turnover cover, is also seen, in particular common in most OECD countries. To create a level playing from banks, manufacturers and global trading houses. field for providers of these types of guarantees, thus giving clients a genuine choice, countries that have not done so The surety bond alternative yet are recommended to introduce surety legislation. Construction projects often involve more complex risks. The risk that payment is not received is just one of them. Increasing importance Contractors can fail, and there are many other elements The MENA region is of increasing importance to the trade that can jeopardise the successful ending of a project. Surety credit insurance sector. A trade credit insurance policy bonds are a useful tool in this context. supports traders in transacting securely on open account A surety bond is a means of providing security to protect while financiers welcome the additional security that is a beneficiary against the default or insolvency of a principal offered. As trade continues to grow in the region, so will up to the limit of the bond. An example is the failure of the demand for trade credit insurance, facilitating trade, a contractor to complete a contract in accordance with its for the benefit of sellers, buyers and the wider economy. terms and specifications or the failure of an enterprise to Mr Robert Nijhout is Executive Director of the International Credit pay taxes or customs duties to a government or department. Insurance & Surety Association (ICISA). 44 April 2013 www.meinsurancereview.com