2014 Budget Book - Hartsfield-Jackson Atlanta International Airport

Department of Aviation

Fiscal Year 2014 Budget Book

Department of Accounting and Finance

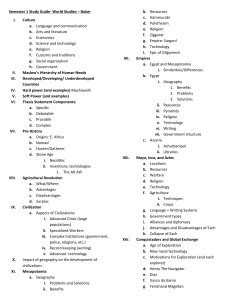

Table of Contents

Table of Contents

Page | i

GENERAL MANAGER’S MESSAGE

General Manager’s Message

General Manager’s Message

Fiscal Year 2014 (FY14) should prove to be an exciting yet challenging year for the operation and development of

Hartsfield-Jackson Atlanta International Airport (ATL). The airport industry here in the United States is faced with the challenge of a slow recovery rate for the country's employment levels. CNN economists state that, although improvement has been seen over the past year, the employment rate is hovering near its lowest level in three decades and is unlikely to improve in the upcoming Jobs

Report (May 2013) of the U.S. Department of Labor. The unemployment rate for April 2013 is 7.7% and forecasted to be 7.4% in May 2014 as studied by Forecast-Chart.com.

With such slow movement regarding employment levels, it is difficult to predict with a degree of certainty what the future holds as it relates to air travel. The unemployment rate has the greatest impact on discretionary income which certainly is a factor in airline passenger sales.

High fuel costs will continue to hinder airlines’ efforts to expand service and widen operating margins. The overall U.S. political climate continues to play a part in the uncertainty surrounding our national economy. In spite of these external pressures, the passenger volumes at ATL have remained stable. ATL anticipates an enplaned passenger rate of 49.2 million in FY14 versus an estimated 48.2 million for FY13. This equates to a 2% growth rate even in the face of what may be a stagnant economy in the upcoming year. Hence, we feel positive about the future of ATL and its airline partners, and will continue to drive toward our vision to be the global leader in airport efficiency and customer service excellence in FY14.

Because of the low cost of operations, its geographic location relative to U.S. population centers, and its efficient airfield design, ATL is an ideal choice for airline operations. Currently,

Delta Air Lines utilizes ATL as the largest hub in their system. This has been chief among several factors that have allowed ATL passenger volumes to remain strong despite the economic recession and downturn in the aviation industry. The integration of AirTran with Southwest is going smoothly and Southwest will have a strong presence at ATL in the future. The FY14 enplanement forecast of 49.2 million assumes an annual domestic enplanement volume of 44.2 million and international enplanement volume of 5 million. Domestic enplanements are expected to increase by 1.97%, which is above the average annual growth rate over the past 5 years. International enplanements are expected to be approximately the same with minor growth over FY14.

ATL developed its FY14 operating budget with an estimated increase of approximately 1 million passengers in mind; but realizing the need to continue the development of operations of the

Maynard H. Jackson Jr. International Terminal (MHJIT) and its concessions program. ATL

Page | 1

General Manager’s Message continued its budgetary strategy utilizing cost containment methods and required all business units to justify and account for every dollar budgeted. The end product resulted in a budget that would maintain ATL's financial health by:

1.

Allowing for operating margins that satisfy debt service coverage over 150%

2.

Keeping airline payments at very low levels relative to other airports

3.

Maximizing non-aeronautical revenues to ensure ATL’s financial flexibility so goals are achieved and customer service is supported

Some significant events anticipated in FY14 will be the completion of all construction related to the 126 new food and beverage locations, and the 26 retail and business service locations. The customer service program will expand its service to better assist those travelling through ATL.

ATL is also poised to construct a new premises for the U.S. Department of Agriculture (USDA) which will provide improved plant inspection capabilities to facilitate the continued emphasis on cargo growth. Towards the end of FY14, ATL will complete its Master Plan “Navigate to

2030 ATL Master Plan” which outlines its future plans for expansion and construction.

In closing, I would like to thank all of the Department of Aviation’s (Department) employees for their hard work and dedication, and acknowledge their efforts in preparing the FY14 budget. I would also like to recognize the Accounting and Finance Department for their tireless effort and professionalism preparing the FY14 Budget Book and their dedicated focus on the financial health of ATL.

Finally, a special acknowledgement is extended to Mayor Kasim Reed, Duriya Farooqui, Chief

Operating Officer, and the Atlanta City Council and the members of the Transportation and

Finance Executive committees, for their continued leadership in enabling the Department to fulfill its role.

Page | 2

EXECUTIVE SUMMARY

Executive Summary

Executive Summary

Airport Overview

Hartsfield-Jackson Atlanta International Airport (ATL, the

Airport) is owned by the City of Atlanta (City) and

Top 10 Passenger Airports

Worldwide operated by the Department of Aviation (Department) as an enterprise fund using only its funds for operations and capital development. ATL occupies a 4,750 acre site in

Clayton and Fulton counties about ten miles south of downtown Atlanta. It is classified as a large hub by the

Federal Aviation Administration (FAA) and is the principal air carrier airport serving Georgia and the southeastern

United States. ATL serves as a primary transfer point in the national air transportation system and is the world’s busiest airport handling more than 95.5 million passengers and over 930,000 aircraft operations.

RANK

1

2

3

4

5

6

7

8

9

(Calendar Year 2012)

AIRPORT

Atlanta

Bei ji ng

London Hea throw

Chi ca go O'Ha re

Tokyo Ha neda

Los Angel es

Pa ri s Cha rl es de Ga ul l e

Soeka rno-Ha tta (Ja ka rta )

Da l l a s /Fort Worth

10 Duba i Interna ti ona l

This has resulted in a large number of destination offerings from Atlanta compared with similarly-sized

Source: Aviation Media Airport World metropolitan areas. With an annual economic impact of more than $32.6 billion on metro-

Atlanta, ATL is one of the largest economic generators in the Southeast. Each day about 12.6% of the nation’s air travelers utilize ATL, leading many experts to consider ATL the most important transportation node in the U.S. and perhaps the world. The continued safe efficient functioning of ATL is critically important to city, state, and even national interests. ATL operates to ensure maximum efficiency and the best possible experience for travelers. ATL's mission is to "provide the Atlanta region a safe, secure and cost-competitive gateway to the world that drives economic development, operates with the highest level of customer service and efficiency, and exercises fiscal and environmental responsibility."

ATL operates 24 hours per day, 365 days per year. The Department employs 673 full-time employees, as well as 247 firefighting personnel and 216 police personnel. This represents a small portion of the more than 58,000 airline employees, concessionaires, contractors, and other professionals whose expertise and professionalism facilitate an average of over 2,500 aircraft operations per day. So effective are these collective efforts that for 11 consecutive years, ATL has been recognized for excellence in efficiency by the Air Transport Research

Society. In 2013, ATL was named the most efficient airport in the world.

Page | 3

Executive Summary

Airline Service

An airport’s originating and destination passenger volumes are determined by the population and economy of its service region. Connecting passenger numbers are determined primarily by airline decisions to provide connecting service at an airport. Approximately 32% of ATL's passengers are originating passengers; the remaining 68% are passengers connecting between flights. Scheduled air carriers operating at ATL are:

Mainline Passenger Airlines (associated regional airlines not shown)

AirTran Airways

Alaska Airlines

American Airlines

Delta Air Lines

Frontier Air Lines

Southwest Airlines

Spirit Airlines

US Airways

United Airlines

Regional Airlines

American Eagle

Chautauqua Airlines

Compass Airlines

ExpressJet Airlines

GoJet Airlines

Foreign Flag Airlines

Aeromexico

Air Canada Jazz

Air France

Cargo Airlines

ABX

Air France/KLM Cargo

Asiana Airlines

British Airways

Cargolux Airlines

Cathay Pacific Airways

Mesa Airlines

Omni Air International

Pinnacle Airlines

Republic Airlines

British Airways

KLM Royal Dutch Airlines

China Airlines

DHL Worldwide Express

EVA Airways

FedEx

Korean Air

Shuttle America

Silver Airways

SkyWest Airlines

Vision Airlines

Korean Air

Lufthansa German Airlines

Lufthansa German Airlines

Mountain Air Cargo

Qatar Airways Cargo

Singapore Airlines

UPS Air Cargo

Page | 4

Executive Summary

Airport Facilities

The design and location of ATL has made it an ideal facility for large volumes of passengers and aircraft operations since it was opened in 1980. Since that time, various airlines have used ATL as a major hub. Approximately eighty percent (80%) of the U.S. population resides within a two hour flight from Atlanta, making it an ideal location for airline operations. Two major airlines use ATL as a major airport for their operations, Delta Air Lines and Southwest Airlines. While

Delta Air Lines operates in a traditional hub-and-spoke model and Southwest Airlines operates using a point-to-point transit model, the design and location of ATL gives it the flexibility to enhance travel via either model.

ATL consists of five parallel runways, multiple associated taxiways, a domestic terminal with five concourses and an international terminal with two concourses. Additionally, ATL has extensive parking facilities, a state-of-the-art rental car center, a ground transportation center, three cargo complexes, a Metropolitan Atlanta Rapid Transit Authority (MARTA) station, and other facilities that one would expect to find at a world-class airport of its size.

Runways & Taxiways

The efficiency in ATL’s design rests, in large part, in its five parallel east-west oriented runways.

This runway design allows five different aircraft to land and/or take-off nearly simultaneously.

Additionally, ATL’s seven concourses are oriented north-south with ample ramp space in between them to allow for rapid aircraft movement between the runways and the gates.

Page | 5

Executive Summary

Central Passenger Terminal Complex

The Central Passenger Terminal Complex (CPTC) measures approximately 7 million square feet, or 160 acres. The CPTC includes a domestic terminal and an international terminal that houses all airline check-in facilities, ground transportation facilities, administrative offices, access to parking facilities, concessions, and security checkpoints. The domestic terminal includes five domestic concourses (T, A, B, C, and D), and a three story atrium. The international terminal includes two international concourses (E and F), with concourse F serving as the primary originating and destination terminal for international flights. Within these seven concourses, there are a total of 202 gates, including 162 domestic and 40 international. The entire complex is connected via an underground tunnel system which houses both moving sidewalks and a train system called the automated people mover (APM). The APM operates on a 3.5 mile loop track which runs underneath the terminals, the concourses, and the ramp. On average, the

APM transports more than 200,000 passengers per day. Both the terminal buildings and the concourses are free of any architectural barriers to people with disabilities.

Metropolitan Atlanta Rapid Transit Authority

MARTA provides train and bus service to and from the metro Atlanta area. MARTA’s airport station connects to ATL at the west end of the domestic terminal atrium between the North and South baggage claim areas.

Cargo Facilities

There are three main air cargo complexes: North, South, and midfield. The midfield complex contains a perishables complex and a USDA propagated plant inspection station. The total onairport air cargo warehouse space measures 29.8 acres or 1.3 million square feet. There are 28 parking positions for cargo aircraft, 19 at the north complex and nine at the south complex.

Concessions

There are 263 concession outlets throughout ATL, including kiosks. These consist of 114 food and beverage locations (including 5 food courts), 90 retail and convenience outlets, duty-free stores, and 56 service locations. These service locations include a banking center, Georgia

Lottery outlets, shoe shine booths, ATMs, vending machines and spas. Concessions space within

ATL covers approximately 230,000 square feet.

Ground Transportation Center

The ground transportation center is located at the west end of the terminal and offers the following services:

1.

Shuttle bus services offer door-to-door and on-demand pickup service from ATL to the metro Atlanta area and bordering states. These depart every 15 minutes within the Atlanta metro area and every 30 minutes for all other areas

2.

Taxi, limo and sedan services

3.

Area hotel and off-site parking shuttle buses

Page | 6

Executive Summary

Rental Car Center

The Rental Car Center (RCC) is a convenient, stateof-the-art, 67.5-acre facility that houses all rental car company operations and vehicles. The RCC includes two four-story parking decks, more than

8,700 parking spaces, and a 137,000 square foot customer service center. The RCC features 12 rental car companies - Advantage, Airport, Avis,

Budget, Dollar, Enterprise, E-Z, Hertz, SIXT Rent A

Car, Thrifty, Payless Rent-a-Car, and Vanguard companies. Connecting customers to the RCC is an elevated train, called the ATL SkyTrain. In five minutes, passengers are connected to the RCC, the Georgia International Convention

Center (GICC), and multiple hotels and office buildings. The train operates six two-car trains which can carry 100 passengers and their baggage.

Page | 7

Executive Summary

Page | 8

Executive Summary

Vision, Mission, and Strategic Priorities

ATL takes great pride in its strategic planning process. This process enables management to collectively define, develop, and update its strategy. Further, it provides a framework which facilitates the organization’s decision making process. In order to determine the direction of the organization, it is necessary to understand its current position and the possible avenues through which it can pursue a particular course of action.

Vision

To Be the Global Leader in Airport Efficiency and Customer Service Excellence.

Mission

To provide the Atlanta region a safe, secure and cost-competitive gateway to the world that drives economic development, operates with the highest level of customer service and efficiency, and exercises fiscal and environmental responsibility.

Strategic Priorities

To support the vision and mission, the strategic plan has four strategic priorities. These priorities directly affect ATL’s ability to serve its customers (including the airlines and their passengers), be a critical regional economic generator, and support the people working at ATL.

1. Employees – Employee Engagement and Satisfaction

2. Customers – Enhance and Deliver Best-In-Class Customer Experience

3. Finance – Preserve ATL’s Financial Health

4. Future – Focus ATL for the Future

These four specific strategic priorities are the distinct building blocks of the strategic plan. Each of these strategic priorities is supported by objectives and initiatives that directly support the priority. Each strategic priority has simple, high-level metrics that help measure performance.

By categorizing our objectives and initiatives by priority, it allows our employees to best see how their efforts support the vision and mission.

Page | 9

Executive Summary

Organizational Structure

Page | 10

Executive Summary

FY14 Budget Highlights

Listed below are some of the initiatives that directly support the four strategic priorities of ATL, which are part of the FY14 budget.

Employee Engagement and Satisfaction

Initiate the roll-out of the succession planning program

Design and implement an employee safety awareness program

Upgrade the department intranet with Office SharePoint Server 2013

Enhance & Deliver Best in Class Customer Service

Execute a new customer service contract to meet the demands of the increasing passenger throughput

Install additional automated pay-in-lane equipment to allow customers to use cash or credit cards in an unmanned hourly parking exit lanes at the international terminal

Implement an online parking reservation system

Install interactive way-finding touchscreens throughout the CPTC

Install mobile concessions carts

Establish a new food court adjacent to Concourse T North

Complete all construction related to the 126 new food and beverage locations that were awarded in FY12 with the exception of Concourse C midpoint

Complete construction of Concourse D midpoint expansion concessions

Add new amenities and services for passengers including sleep units, play area, nursing station and game room

Preserve the Airport’s Financial Health

Complete a concessions market pricing exception report that ties in to concessionaire’s

POs to ensure that pricing is in line with contractually agreed upon upper limits

In the Airport maintenance stockroom, automate purchasing and receiving controls to improve customer service, to control inventory costs, to prevent overstocking, to identify low use items, and to improve productivity

Conduct internal and external audits that focus on the key risk areas of ATL

Focus on the Future

Complete the Master Plan

Hire a full-time wildlife biologist to manage the FAA mandated wildlife hazard at ATL

Install energy-saving concourse lighting

Complete planning and preconstruction of Concourse C midpoint expansion

Complete construction of new premises for the USDA

Complete the construction of the sanitary sewer upgrade on Concourse A

Complete North deicing facility construction

Page | 11

Executive Summary

Industry Overview

The global airport services industry is comprised of airport operators and companies providing support such as landing and take-off services, operation of fueling, runway maintenance, hangar rental, duty-free shops, security, baggage handling services, and cargo handling services.

The global airport services industry, which reached $123.6 billion in 2012, is forecast to reach an estimated $157.2 billion in 2018 with a compound annual growth rate of 4.1% over the next five years (2013-2018). Lucintel, a leading global management consulting and market research firm, has conducted a competitive analysis of the industry and presents its findings in “Global

Airport Services Industry 2013-2018: Trend, Profit, and Forecast Analysis.” The findings show that the North American region dominates the industry and represents the largest industry share. A combination of factors such as air traffic rates and the emergence of low-cost carriers affect market dynamics significantly. The airport services industry registered dynamic growth in the last couple of years because of the growth in the passenger and cargo movement and ground handling services. Despite challenges to the industry, it has several growth drivers that are covered by the report as well. Increasing traffic of air transportation services of passengers and cargo, strong demand of low-cost carriers especially in emerging nations, and implementation of open skies policies are some of the growth drivers of this industry.

Development of infrastructure in emerging nations also provides an additional impetus to the growth of global airport services industry.

Airports, like other enterprises and corporations are increasingly driven by the bottom line.

Airports are in the service industry and provide services to travelling passengers. Airports that are designed to effectively accommodate passenger needs and habits are likely to succeed far beyond those that do not. Ultimately, all airport revenue is derived from the people who use airports: from airline and concessionaire fees, passenger facility charges (PFC), and even federal funding itself derived from passenger ticket taxes. Airports that are designed to respond to human needs, capabilities, culture, desires and aspirations can find both happy users and prosperous tenants.

In order to provide services that satisfactorily accommodate both passengers and tenants, airports must recognize and deal with the following key factors in the industry:

Economic and political conditions

Financial health of the airline industry

Airline service and routes

Airline competition and airfares

Airline consolidation and alliances

Availability and price of aviation fuel

Aviation safety and security concerns

Capacity of the national air traffic control system

Capacity of the airport

Page | 12

Executive Summary

In today’s environment these factors also highlight challenges facing the industry. Some key challenges include the economy, establishing a safe and secure environment, and providing a pleasing variety of retail & restaurant offerings for those travelling through the airport.

Particularly in today’s time the chief challenge is the state of the economy which is intertwined with economic and political conditions. The economy certainly is a chief component in the success of the airline industry’s financial health. The volume of passenger travel, aircraft operations, and cargo movement is largely dependent upon the state of the economy.

The U.S. airport sector is stable due to projected modest economic growth in the U.S. and global economies that should support enplanement and subsequent revenue increases. Most bond rated U.S.

airports are regaining financial resiliency, as demonstrated in Moody's Airport

Medians report. Profitable airline partners that maintain rational route networks support stable financial performance given the residual rate making structure of a large portion of U.S. rated airports. While the baseline expectation is for slow, stable growth, the industry remains below levels seen pre-recession and sensitive to downside. Lingering downside risks for the economy are joined by potential Federal funding cuts for aviation activities that could affect airport operations and long term grant funding.

However, in stable to good economic times some airports' passenger travel, aircraft operations, and cargo still experience growth. In fact, a few airports realize growth even in a slowed economy. Airports must be ready to successfully plan and achieve levels of capacity that accommodate the growth of passenger travel and cargo. This not only includes acreage/ square footage but also abundant airport support services. Some of these services include the following:

Counter services

Aircraft ramp handling

Fuel systems

Baggage systems

Cargo aircraft handling

Cargo warehousing

Ramp tower control operations

Flight supervision and coordination

Appropriate levels of security personnel

ATL has positioned itself such that it successfully handles its service region, passenger and cargo growth. ATL continues to lead all airports in passengers handled dating back to 1998 and is also the industry leader in the number of aircraft operations. As the economy emerged from recession, cargo weight at ATL increased 17.8% between 2009 and 2011 with a slight decline in

2012. ATL has included in its FY14 capital plan a new cargo facility ($36.9 million) to further enhance and support the City’s priority of driving cargo business throughout the region. Lastly,

Page | 13

Executive Summary

ATL is in the midst of completing a new concessions program for its food & beverage and retail locations, which began at the end of FY12.

As a longtime industry leader in passengers handled and aircraft operations, ATL has demonstrated its ability to plan and execute strategies and projects that keep it at the forefront. Plans are also ongoing at ATL to better facilitate cargo operations which is meant to drive increases in future cargo weights. Additionally, ATL continues to move forward in upgrading its concessions program further satisfying the needs of its customers. Failure to do any of the aforementioned would work to ATL's detriment in terms of providing continued service as a leader in the airport industry.

Page | 14

Executive Summary

Financial Summary

Operating Revenue

ATL anticipates total operating revenues for FY14 to be $497.7 million, which represents a

$10.4 million increase, or 2.13% over projected revenues of $487.3 million for FY13. ATL revenues are classified in two major categories (aeronautical and non-aeronautical). Below is a chart illustrating the breakdown of the two categories utilizing FY14 and FY13 data.

Aeronautical Revenues:

Landing Fees

CPTC Rentals

Concessions Credit

Airside Rentals

Cost Recoveries

Total Aeronautical Revenues

Non Aeronautical Revenues:

Landside Rentals

Public Parking

Inside Concessions

Rental Car

Ground Transportation

Other

Non Airline Cost Recoveries

Other Revenues

Total Non Aeronautical Revenues

FY13

Projected

$ 47,213,684

155,798,796

(47,119,000)

22,841,537

33,433,513

$ 212,168,530

$ 15,876,348

115,056,684

90,389,910

32,119,497

1,811,129

2,261,220

10,401,751

7,194,461

$ 275,111,000

FY14

Budget

$ 47,976,664

150,162,609

(47,155,254)

23,561,178

36,424,255

$ 210,969,452

$ 16,864,822

118,476,402

94,310,508

32,922,484

1,992,190

2,541,000

12,477,166

7,140,000

$ 286,724,572

Total Operating Revenues $ 487,279,530 $ 497,694,024

Aeronautical revenues are expected to reach $211 million representing a $1.2 million decrease from FY13 projected actuals. This decrease is driven by a $9.3 million non-recurring project in

FY13 CPTC rentals for cost recovery related to the installation of an enhanced distributed antennae system. This is being offset by approximately $4.6 million due to new tenant finish projects to be billed in FY14 and the full-year impact of FY13 projects which were completed in the latter half of FY13. The second factor helping to offset the loss of the non-recurring revenue is the account group cost recoveries which is expected to increase $3 million in FY14 over FY13 projected actuals. This increase is related to rising costs for police, security, operations and the APM contract. The changes in landing fees and airside rentals are nominal.

Page | 15

Executive Summary

Non-aeronautical revenues are expected to increase by $11.6 million, or 4.2% over FY13.

Several account categories will experience growth in FY14 but most notable are parking with a

$3.4 million increase and inside concessions with a $3.9 million increase. Parking's estimated increase is based upon the anticipated growth in originating passengers. The estimated increase in inside concessions is based upon the anticipated enplanement growth along with additional concession locations, and concession agreements with higher rents. Non-airline cost recoveries are expected to increase by $2.1 million. This growth should materialize as a result of cost recoveries from increased maintenance and SkyTrain service and charges associated with the RCC. The expected change in landside rentals, rental car, ground transportation, and other revenue are nominal.

Operating Expenses

Operating expenses for FY14 are budgeted at $255.1 million which represents a $25.8 million, or 11.2%, increase over FY13 projected expenses of $229.3 million. We capture our expenses in six basic categories: personnel, contract services, supply accounts, capital expenses, interfund charges, and other operating costs. A more detailed discussion of each category can be found in the Financial Structure section of the book.

FY13

Projected

FY14

Budget

Salaries & Benefits

3rd Party Operating & Maintenance Contracts:

Parking Operations

Security (Access Control/Gate Guard/Fingerprints)

AGTS System/ ATL Sky Train

Customer Service

Rental Car Center Operations (180601)

CPTC Maintenance

Total 3rd Party Op. & Maint. Contracts

Other Contract Services

Total Contract Services

Supply Accounts (excluding Utilities)

Utilities

Total Supply Accounts

Capital Expenses

Interfund Charges

Other Operating Costs

Total Operating Fund Expense Budget

(+) Operating Expense Projects (5502 Fund)

Total Operating Expenses

$ 77,642,168

$ 29,646,726

8,053,239

23,661,908

2,077,166

3,150,337

2,552,892

69,142,268

34,653,582

$ 103,795,850

$ 4,796,681

9,738,716

$ 14,535,397

$ 443,734

$ 14,403,604

$ 2,546,667

$ 213,367,420

15,982,295

$ 229,349,715

$ 88,930,807

$ 32,211,167

8,224,340

24,205,000

3,000,000

3,150,337

2,900,000

73,690,844

42,721,459

$ 116,412,303

$ 6,754,046

9,474,900

$ 16,228,946

$ 622,700

$ 12,898,479

$ 4,987,823

$ 240,081,058

15,000,000

$ 255,081,058

Page | 16

Executive Summary

Salaries and benefits reflects an increase of $11.3 million in FY14 over the FY13 projection. The change covers salary increases for police officers, fire fighters and other aviation employees.

This increase also accounts for vacancies that are fully budgeted in FY14, but do not have actual costs in FY13.

Total contract services reflects an increase of $12.6 million over the FY13 projection. The 3rd party operating & maintenance contracts reflects a budget increase of $4.5 million with parking and customer service as the biggest drivers. Parking includes a $2.6 million increase for annual contract escalation and increased services transporting passengers to and from the international terminal. Customer service increased $923k to increase the presence and to enhance the overall customer service level throughout ATL. The budget for other contract services includes an $8.1 million increase over FY13 projected expenses. This is primarily attributable to four items:

1) $3.7 million for new planning & development contracts and initiatives

2) $2.2 million for various information technology initiatives

3) $1.0 million increase for fuel farm maintenance

4) $900k for new business development initiatives

The FY14 budget for the supply accounts reflects an increase of $1.7 million over the FY13 projected expenses. The combination of an increased need in consumable supplies, nonconsumable supplies, and small equipment offset by an anticipated decrease in utilities account for this increase.

The budget for interfund charges reflect a decrease of $1.5 million primarily due to anticipated reductions in City services recorded on our books as indirect charges.

Other operating costs reflect a $2.4 million increase in FY14 over the FY13 projection. This is primarily due to a $2.5 million increase in property tax payments.

Page | 17

FINANCIAL STRUCTURE

Financial Structure

Financial Structure

Overview

ATL's financial activities can be classified into two categories: operating and non-operating.

Operating activities include those revenues and expenses which are directly related to operating and maintaining ATL and its related facilities. Non-operating activities include the collection of certain fees and charges used to fund the development of ATL’s capital assets, costs incurred in the planning and construction of such capital assets, as well as the interest income collected from ATL’s invested cash. In most cases, the non-operating revenues are restricted, by law, only to certain applications that enhance safety, security, or capacity; reduce noise; increase air carrier competition; or, in the case of customer facility charges (CFC), continue the upkeep of specifically designated facilities such as the RCC.

As required by City ordinances, the financial activities of the Department are accounted for in separate funds which were established for various purposes. For financial reporting purposes, however, the activities in each of these funds are combined into consolidated financial statements. These financial statements represent the Department as a single enterprise in order that its financial performance may be evaluated as a single entity.

Page | 18

Financial Structure

S

Sources of Revenue

Operating Revenues

Aeronautical Revenues

Landing Fees

CPTC Rentals

Airside Rentals

CPTC Cost Recoveries

Non-Aeronautical Revenues

Landside Rentals

Parking Revenues

Inside Concessions Revenues

Ground Transportation & Other

Non-Operating Revenues

Passenger Facility Charges (PFCs)

Customer Facility Charges (CFCs)

Grants (or Capital Contributions)

Investment Income

Other

Operating Revenues

Operating revenues are categorized as either being aeronautical or non-aeronautical in nature.

Aeronautical revenues are those revenues which are directly attributable to airline or airlinerelated activities, such as fees paid for the landing of aircraft or rents paid for the airlines’ occupation of ATL facilities. Non-aeronautical revenues, are those which are not directly attributable to airline activities such as parking revenues, concessions revenues, or car rental revenues. While ATL would not collect such revenues without the passenger traffic resulting from the airlines’ patronage, these revenues represent additional income to ATL that is not paid directly by the airlines. The significance in this distinction is that non-aeronautical revenues represent additional income to ATL that does not impose additional cost burdens to the airlines.

Aeronautical Revenues

Landing Fees - ATL collects two different types of landing fees: basic landing fees and Airfield

Improvement Program (AIP) landing fees. Basic landing fees are charged to the airlines at $0.16 per 1,000 pounds of maximum certificated gross aircraft landed weight. The intent of this basic fee is to recover the cost of operating and maintaining ATL’s runways, taxiways, and other areas of the airfield. AIP landing fees are charged to the airlines at a fixed rate, proportional to their respective airfield usages, and are intended to recover the cost of capital improvements made to the airfield. The rates established for these AIP landing fees include a 20% coverage factor and are for a fixed duration.

Page | 19

Financial Structure

CPTC Rentals – These are charges imposed on the airlines for occupying space within ATL’s

CPTC. These charges are apportioned to the airlines based on the actual square footage occupied within the facilities. The rates established for these charges are based on full cost recovery for both the construction of these facilities and any periodic capital upgrades made to them. Under the terms of the CPTC leases, the contracting airlines pay terminal facilities rentals, on a modified commercial compensatory basis, to allow ATL to recover the amortized capital costs, plus 20% coverage, of facilities financed with unrestricted airport revenues, including general airport revenue bonds (GARBs). Generally, 100% of the capital costs of terminal facilities are recoverable. Although shown separately, the inside concessions credit provided to the airlines is reflected as a reduction of overall CPTC charges.

Airside Rentals – Airside ground and building rentals consist of rentals for fixed base operator’s facilities and for cargo buildings in the north complex, south complex, and the Central Terminal

Support Area (CTSA).

CPTC Cost Recoveries - Under the terms of the CPTC leases, the contracting airlines pay operations charges to reimburse ATL for certain expenses related to:

1.

APM operating and maintenance

2.

Fire protection services

3.

Police protection services

4.

Security checkpoint services

5.

A pre-determined percentage of ATL’s liability insurance premiums

6.

The management fee associated with a 3 rd

party maintenance agreement for certain common use areas within the CPTC

7.

Certain operating and maintenance expenses associated with MHJIT

Non-Aeronautical Revenues

Landside Rentals – ATL receives rental revenue from the lease of over 100 acres of land. Such leased properties include land occupied by Delta’s corporate headquarters, Delta’s technical operations center, certain cargo storage facilities, and various other facilities in the Central

Terminal Support Area. It also includes rental revenue received from certain non-aeronautical tenants such as rental car companies.

Parking Revenues – These include all revenues generated from ATL’s parking facilities which includes over 33,000 available spaces for passenger parking. These include covered and uncovered parking options. ATL’s parking facilities are operated by a third party entity whose expenses are paid through ATL's operating expenses. All parking revenues are reported gross with the appropriate third-party expenses being reflected in the operating expense budget.

Inside Concessions Revenues – ATL maintains 263 concessions and service outlets from which it collects fees and charges based on each concessionaire’s gross revenues. These concessionaires pay ATL a percentage of their gross sales, based on their individual contracts, in

Page | 20

Financial Structure return for occupying space within the CPTC. In order to ensure adequate revenue performance, each concessionaire contract includes a minimum annual guarantee (MAG). Rent paid by most concessionaires is the greater of the MAG or percentage rent of gross receipts per category.

The percentage rent calculation is trued up monthly and at the end of the lease year.

Rental Car Revenues – The RCC houses 12 rental car companies and 8,700 parking spaces. Each of the rental car companies pays ATL 10% of annual gross sales in return for occupying RCC space. Like ATL’s concessionaires, the rental car companies are subject to a MAG which is reconciled on a monthly basis to ensure a minimum level of revenue performance. The reconciliation is also done at the end of the lease year.

Ground Transportation Revenues – These include fees and charges received from taxicab, limousine, hotel shuttles, off-airport parking shuttles, and other commercial ground transportation services.

Other Concession Revenues – ATL also receives revenues for services provided through its public telephones and WiFi providers.

Non-Airline Cost Recoveries – ATL incurs annual expenses for the operation and maintenance of the RCC, both from maintaining the facility itself as well as operating the SkyTrain that connects the RCC to the CPTC. Through its agreements with the rental car companies, ATL recovers

100% of these operating expenses on a monthly basis. Because all of the RCC operating expenses are passed through to the rental car companies, ATL maintains this facility at essentially zero cost.

Other Revenues – This category is relatively small and contains various revenue streams including fees collected for the issuance of security badges, the sale of timber from ATL owned properties, and other sources which may or may not be recurring from year to year.

Non-Operating Revenues

ATL generates non-operating revenue from four main sources: interest earned from invested cash, PFCs, CFCs, and capital contributions in the form of grants. These revenues are not classified as operating because they either are not generated from operating activity, or are restricted in their use such that they cannot be used to pay for operating expenses. A description of each non-operating revenue source is contained below:

Investment Income – ATL continues to maximize investment income within the constraints imposed by State of Georgia statutes and City Ordinances. Wherever legal requirements permit, cash is pooled in order to achieve maximum cash yields on short-term investments of otherwise idle cash. These investments are highly liquid, usually with maturities of three months or less.

Passenger Facility Charges – In 1990, the U.S. Congress established PFCs as part of the Aviation

Safety and Capacity Expansion Act of 1990 (Act). The Act states that an airport may collect PFCs from passengers in order to pay for the cost of designing and constructing eligible airport

Page | 21

Financial Structure capital projects or to repay debt service issued to build such projects. PFCs are collected by the air carriers when passengers purchase their tickets and are remitted to ATL on a monthly basis.

PFCs are a major source of funding for ATL’s capital improvement program. ATL currently collects a $4.50 PFC per enplaned passenger, which amounts to nearly $180 million a year. ATL currently has FAA approval to use PFCs on projects totaling more than $3.9 billion. Through

March, 2013, ATL collected $2.5 billion of which $2 billion has been expended. Pay as you go projects absorbed $1.4 billion and $600k was spent on principal, interest, and other financing expenses.

Customer Facility Charges – ATL collects CFCs as a means to fund the construction and certain operations associated with the RCC. These CFCs are collected by the rental car tenants and remitted to ATL on a monthly basis. ATL collects $5.00 for each transaction day.

Capital Contributions (Grants) – ATL receives AIP and other grants through the FAA,

Transportation Security Administration (TSA) and other federal and state agencies in order to support its capital program and operations.

Page | 22

Financial Structure

Expense Structure

In accordance with generally accepted accounting principles (GAAP), ATL classifies its expenses as either operating, non-operating or capital in nature. Generally, all expenses which are operating in nature are budgeted in the revenue fund (5501). There are a few exceptions which include projects that were previously budgeted and funded in a capital fund (5502-5528) but are later either written off or deemed to be operating in nature. Any activities related to these projects are expensed at the time of project close-out or at the time the project is discontinued.

ATL includes a placeholder for these types of projects when it does its annual financial planning.

Operating Expenses

In accordance with City code, ATL budgets its operating expenses in one of six general categories:

Account Code Expense Type

51xxxxx

52xxxxx

53xxxxx

54xxxxx

Personnel & employee benefits

Purchased & contracted services

Supplies

Capital planning

55xxxxx

57xxxxx

Interfund charges

Other costs

Within each of these categories, however, there are subcategories which provide greater detail to ATL’s budgeted operating expenses. It is useful to reclassify these subcategories in order to gain a clearer understanding of how the Airport operates. A description of each expense category is contained below:

Salaries & Benefits – Included in this category are all costs associated with ATL’s full-time employees. These include salaries, overtime, insurance benefits, payroll taxes, retirement plan contributions, and other miscellaneous personnel related expenses. It does not include any of the personnel expenses related to contracted employees.

3rd Party Operating & Maintenance Contracts – This category contains budgeted costs associated with the major contracts ATL has procured to operate various portions of the airport. These contracted services include parking operations, control of access to the airfield, various security-related operations, operation of the APM, operation of the SkyTrain, customer service operations, operation and maintenance of ATL's common use facilities, and the operation and maintenance of the RCC.

Consulting & Other Contracted Services – Expenses in this category include those services offered by consultants and other entities which provide assistance to ATL in its planning, operations, and other supporting activities. Examples of such services include, but are not limited to, lobbyist support, employee support programs, training support, internal audit

Page | 23

Financial Structure support, software and network support, external legal support, and various other activities which support the technical aspects of ATL’s operations and maintenance.

Expense Type Projects – Earlier it was mentioned that a portion of ATL’s operating expenses are sourced from funds other than the revenue fund (5501). The majority of these expenses are classified as expense type projects. These expenses represent costs associated with large scale projects that involve major repair and maintenance to ATL’s infrastructure, and are most often funded through ATL’s renewal & extension fund (5502). These projects require resources that are beyond those organic to ATL’s maintenance division, and thus are managed through the planning & development division. Because many of these projects are not planned or routine their costs are expensed as they are incurred in order to ensure that they are captured as operating expenses and not capital outlays.

Indirect Costs to the City – ATL is a government enterprise wholly owned by the City. Although the City maintains ownership, it is restricted by law from diverting any of the revenues earned at ATL to pay for other City expenses. It is recognized, though, that the City does commit a sizeable amount of resources in support of ATL for which it deserves compensation.

Periodically, the City conducts a formal analysis to determine the annual amount of resources that it contributes to support ATL and charges this amount to ATL as indirect costs. Examples of these costs are: a.

The cost of the City’s consolidated annual financial audit b.

The allocation of certain City maintained software and network resources that are shared between the City and ATL c.

City executives’ time and resources devoted to ATL affairs d.

Time and resources expended by City Council in deliberating over ATL related issues

Utilities – This category represents the amount budgeted for ATL’s use of water, sewer, electricity, natural gas, wireless service, and land line telephone.

Other Expenses – This category contains all other expenses budgeted to operate ATL on an annual basis. Included are such costs as insurance premiums, supplies, fuel, vehicle maintenance, property taxes, pensioners’ benefits expense, employee training, and a myriad of other costs.

Page | 24

Financial Structure

Airline Use and Lease Agreements

The City has landing agreements with most of the airlines serving the Airport. These airlines are considered signatory air carriers. These agreements are referred to as airport use agreements

(AUA). In general, AUAs state that the city will maintain and operate ATL and grant the signatory air carriers the right in common with others to use ATL together with all its facilities and services not exclusively leased to others. The provisions of this agreement govern the use of the airfield stipulating that the signatory airlines pay landing fees which are calculated to recover certain airfield costs. These costs include airfield operating and maintenance expenses as well as amounts to recover the amortized capital costs (including a 20% coverage) of approved airfield improvements financed with GARBs. Landing fees are paid per 1,000 pounds of maximum certificated gross aircraft landed weight. The fees payable are the sum of a basic landing fee and landing fees for successive AIPs.

The AUA is one that has governed the operation of ATL dating back to 1980. However, since

2001, the City has not entered into AUAs with new entrant carriers. Instead, it has entered into an airport use license agreement (AULA). This agreement allows for the payment of landing fees at the signatory airline rate. The AULA has a term of five years and may be terminated by the City or the airline with 30 days advance notice.

The City also contracts with airlines via a CPTC lease. This agreement governs the lease and occupancy of the CPTC. The contracting airlines agree to pay rentals and other charges calculated to recover certain CPTC costs. These costs include CPTC operating and maintenance expenses as well as amounts that recover amortized capital costs (including a 20% coverage) of approved terminal improvements financed with GARBs or ATL funds.

Page | 25

Financial Structure

Budget Process Overview

For operating expenses, ATL has developed a budget process that seeks to maximize small unit managers’ ingenuity and resourcefulness while also ensuring that ATL administration’s strategic goals are met with the utmost fiscal responsibility. A diagram of this process is included below:

STRATEGIC

PLAN

VALIDATION

LRFP

VALIDATION

BUSINESS

PLANS

NEXT-FY

REVENUE

FORECAST

NO

AGM

APPROV

YES

BUSINESS

UNIT

BUDGETS

DERIVE MAX

OPERATING

EXPENSES

UNIT-LEVEL

BUDGET

TARGETS

YES BUDGET

EXCEEDS

TARGETS

NO

GENERAL

MANAGER’S

APPROVAL

MAYOR’S

OFFICE

APPROVAL

: Department of Aviation Operational Units

: Department of Aviation Finance & Budget

: Department of Aviation & City Executives

CITY COUNCIL

ADOPTS

BUDGET

As demonstrated in the preceding diagram, the budgeting process occurs on two separate but concurrent tracks during the early phases of planning. The track on the left side involves the strategic and business planning for ATL and its various business units. This process produces a collection of business plans that seek to actualize ATL’s long term strategic vision. The track on

Page | 26

Financial Structure the right side involves tracking ATL’s current financial performance, forecasting future performance, and creating a long-range financial plan that ensures that ATL’s strategic plan can be achieved while maintaining sound financial performance.

1.

Strategic Plan Validation – Each year prior to the budgeting process, ATL’s executive staff reviews the strategic plan in order to ensure that it still adequately addresses both the vision and the current challenges and opportunities that face ATL. At the conclusion of this process, ATL’s strategic plan is presented to business unit managers so that they can begin their business planning for the next fiscal year.

2.

Long Range Financial Plan (LRFP) Validation – The LRFP is a financial model that integrates ATL’s revenue forecasts, expense forecasts, capital improvement plan, and capital financing structure into one cohesive long-range plan.

3.

Business Plans – Using the strategic plan as a guide, the individual business units create annual business plans which roadmap how each unit will execute its assigned mission.

The business plans tie each proposed initiative or activity to one or more of ATL’s strategic priorities contained within the strategic plan. Each business plan contains the business unit’s proposed budget.

4.

Next-FY Revenue Forecast – Contained within the LRFP is the revenue forecast for the next fiscal year. This revenue forecast is referred to by the City as an anticipations budget and is eventually voted on and officially adopted by the City Council.

5.

AGM Approval – Each individual business unit budget is approved by the appropriate assistant general manager (AGM) prior to being submitted to ATL’s budget group.

6.

Business Unit Budgets – After each business plan is approved by the appropriate AGM, the proposed budgets are submitted to ATL’s budget group for inclusion in the consolidated budget.

7.

Budget Exceeds Targets – ATL’s budget group will validate the business units’ proposed budgets to ensure they align with the business plan of the business unit, and with the overall strategic objectives of ATL. Once validated, the budgets are included in the consolidated budget. Additionally, an analysis is done to ensure all budgeted revenues and expenses result in the financial performance as set by executive management.

Adjustments are made, if necessary, to ensure the performance is met or exceeded.

8.

General Manager’s Approval – The general manager (GM) of ATL is presented with ATL's budget and is able to review the individual units’ business plans with the appropriate managers and AGMs.

9.

Mayor’s Office Approval – Once approved by the GM, ATL's budget is submitted to the

Mayor’s office for review and approval.

10.

City Council Adopts Budget – Before the beginning of the fiscal year, City Council formally approves ATL's operating budget. The City formally refers to expenses as appropriations.

In an effort to maintain the utmost financial health, ATL strives to maintain a high level of debt service coverage (DSC), meaning the number of times its operating income (operating revenues

Page | 27

Financial Structure

– operating expenses) will cover its annual debt service. By law, ATL must adhere to its master bond ordinance (MBO) and bond covenant. An excerpt from the ordinance/covenant states:

The City has covenanted and agreed that at all times while bonds are outstanding and unpaid to prescribe, fix, maintain, and collect rates, fees, and other charges for the services and facilities of the Airport to: (a) provide for 100% of the Operating Expenses of the airport (except for certain specific facilities) and for the accumulation in the Revenue Fund of a reasonable reserve therefore, and

(b) produce Net General Revenues in each fiscal year which will: (i) equal at least

120%”.

Thus, in order to comply with the MBO and the bond covenant, ATL must have a DSC of at least

120% of its operating income, or 1.2 times. The formula for DSC is:

In order to balance the budget, the City requires that each department place into its annual budget a reserve which is equal to the total operating revenues minus all operating expenses and debt service. The term reserve is somewhat misleading, as this amount is best interpreted as an expected end of year net income (less principle payment on the debt service). It represents all of the expected cash which, at the end of the fiscal year, will be transferred to the renewal & extension fund for use on capital improvements, upgrades, or renovations. ATL’s budget formula can be displayed as follows:

Operating Revenues – Operating Expenses – Annual GARB Debt Service = Reserves

Page | 28

OPERATING BUDGET

Operating Budget

Operating Budget

Operating Revenue Budget

FY2012

Actual Budget

FY2013

Projected

FY2014

Budget

Aeronautical Revenues

Landing Fees

Signatory Landing Fees

AIP Landing Fees

Non-Signatory, Itinerant, & Charter Landing Fees

Total Landing Fees

$ 12,461,410

$ 35,250,915

$ 297,037

$ 48,009,362

$ 13,044,061

$ 35,063,495

$ 300,252

$ 48,407,808

$ 12,722,290

$ 34,198,549

$ 292,845

$ 47,213,684

$ 13,362,099

$ 34,296,070

$ 318,495

$ 47,976,664

CPTC Rentals

CPTC Building & Rental

CPTC Tenant Finishes

Supplemental Rentals

Total CPTC Rentals

Concessions Credits

Airside Rentals

Ground Rentals

Other Building Rentals - Airlines

Total Airside Rentals

$ 34,982,151

$ 52,565,031

$ -

$ 87,547,182

$ 66,966,374

$ 70,121,623

$ 12,000,000

$ 149,087,997

$ 65,810,659

$ 77,988,137

$ 12,000,000

$ 155,798,796

$ 66,528,287

$ 75,634,322

$ 8,000,000

$ 150,162,609

$ (44,862,190) $ (44,465,103) $ (47,119,000) $ (47,155,254)

$ 16,914,095

$ 4,922,470

$ 21,836,565

$ 15,632,900

$ 6,800,539

$ 22,433,439

$ 15,917,286

$ 6,924,251

$ 22,841,537

$ 18,031,673

$ 5,529,505

$ 23,561,178

Cost Recoveries

Operations Charges

AGTS Charges

Insurance Charges

MHJIT O&M

3rd Party Common-Use Agreement

Total Cost Recoveries

Total Aeronautical Revenues

$ 12,891,891

$ 8,437,289

$ 524,115

$ 211,717

$ -

$ 22,065,012

$ 12,548,197

$ 12,326,697

$ 614,592

$ 7,105,052

$ 1,500,000

$ 34,094,538

$ 12,304,913

$ 12,087,707

$ 602,676

$ 6,967,299

$ 1,470,918

$ 33,433,513

$ 17,044,447

$ 15,799,001

$ 680,559

$ 1,400,248

$ 1,500,000

$ 36,424,255

$ 134,595,931 $ 209,558,679 $ 212,168,530 $ 210,969,452

Non-Aeronautical Revenues

Landside Rentals

Land Rentals

Other Building Rentals

Total Landside Rentals

Commercial Revenues

Public Parking

Inside Concessions

Rental Car

Ground Transportation

Executive Conference Center

Public Telephone

Marketing Fee

WIFI Wireless

Registered Traveler

Total Commercial Revenues

Non-Airline Cost Recoveries

RCC APM

RCC O&M

Total Non-Airline Cost Recoveries

Other Revenues

Total Non-Aeronautical Revenues

Total Operating Revenues

$ 6,768,326

$ 9,287,935

$ 16,056,261

$ 10,008,101

$ 6,095,163

$ 16,103,264

$ 9,867,074

$ 6,009,274

$ 15,876,348

$ 11,579,223

$ 5,285,599

$ 16,864,822

$ 114,128,697

$ 75,383,394

$ 30,763,697

$ 1,621,075

$ -

$ 103,131

$ (45,373)

$ 7,630,473

$ -

$ 229,585,094

$ 114,175,764

$ 88,930,206

$ 31,644,825

$ 1,876,477

$ -

$ 50,000

$ -

$ 4,146,000

$ -

$ 240,823,272

$ 115,056,684

$ 90,389,910

$ 32,119,497

$ 1,811,129

$ -

$ 45,000

$ -

$ 2,216,220

$ -

$ 241,638,440

$ 118,476,402

$ 94,310,508

$ 32,922,484

$ 1,992,190

$ -

$ -

$ -

$ 2,541,000

$ -

$ 250,242,584

$ 4,837,619

$ 4,364,395

$ 9,202,015

$ 6,994,584

$ 4,836,388

$ 11,830,972

$ 6,149,615

$ 4,252,136

$ 10,401,751

$ 7,376,620

$ 5,100,546

$ 12,477,166

$ 4,692,886 $ 5,191,172 $ 7,194,461 $ 7,140,000

$ 259,536,255 $ 273,948,680 $ 275,111,000 $ 286,724,572

$ 394,132,186 $ 483,507,359 $ 487,279,530 $ 497,694,024

Page | 29

Operating Budget

Breakdown of Landing Fee Revenue

The following table depicts a more detail view of ATL landing fees:

Signatory Landing Fees

FY 2012

Actual Budget

FY 2013

Projected

FY 2014

Budget

$ 12,461,410 $ 13,044,061 $ 12,722,290 $ 13,362,099

AIP Landing Fees

AIP 3

AIP 5

AIP 6

AIP 7

AIP 8

AIP 9

AIP 10

AIP 11

AIP 12

AIP 13

AIP 14

AIP 15

AIP 16

AIP 17

AIP 18

Total AIP Landing Fees

Non-Signatory Landing Fees

Total Landing Fees

$ 1,145,737

1,795,234

304,465

330,268

322,952

161,298

47,386

27,613,597

760,003

174,550

183,602

147,812

817,940

522,967

923,104

$ 35,250,915

$ 1,144,575

1,608,732

268,741

293,172

289,117

145,153

47,382

27,611,565

759,943

174,537

183,591

147,657

818,350

619,109

951,871

$ 35,063,495

$ 1,127,484

1,572,333

264,490

288,480

284,544

142,856

46,635

26,984,790

749,197

172,066

180,978

145,742

806,491

496,774

935,689

$ 34,198,549

$ 1,123,403

1,577,540

263,896

289,772

283,859

142,505

46,455

27,068,658

745,026

171,108

179,970

144,931

802,000

495,765

961,182

$ 34,296,070

$ 297,037 $ 300,252 $ 292,845 $ 318,495

$ 48,009,362 $ 48,407,808 $ 47,213,684 $ 47,976,664

Page | 30

Operating Budget

Parking Rates

The following table depicts the most current parking rates at ATL:

Hourly Rate

Parking Rates

Hourly Parking (Domestic/ International)

Daily Parking (Domestic)

Economy Parking - West (Domestic)

Economy Parking - North & South (Domestic)

Park-Ride Lots - Domestic

Park-Ride Lots - International

$2.00/$3.00

$3.00

$3.00

$3.00

$3.00

$3.00

Max. Daily Rate

$32.00/$36.00

$16.00

$12.00

$12.00

$9.00/$12.00

$12.00

Ground Transportation Rates

The following table depicts the most current ground transportation fees at ATL:

Ground Transportation Fees

Taxi

Off-Airport Parking

Hotel

Limousine

Shared Ride

Charter

1.50 per trip

$360 annually per vehicle + $10 per space

$360 annually per vehicle + $10 per room

$100 annually per vehicle + parking fees

5 - 7% of gross sales

$0.10 per seat per trip

Page | 31

Operating Budget

Operating Expense Budget

The following two tables depict the operating expense budget in two separate views, by account group and by department.

Operating Expense Budget by Account Group

FY2012

Actual

Salaries & Benefits:

Salaries

Overtime & Extra Help

Benefits

Other

Total Salaries & Benefits

Budget

FY2013

Projected

FY2014

Budget

$ 47,086,900

3,990,668

20,518,426

3,927,259

$ 75,523,253

$ 53,287,622

5,953,994

21,911,674

5,392,033

$ 86,545,323

$ 48,437,611

5,137,323

19,081,483

4,985,751

$ 77,642,168

$ 56,948,740

6,540,957

20,839,605

4,601,505

$ 88,930,807

3rd Party Operating & Maintenance Contracts:

Parking Operations

Security (Access Control & Gate Guard)

Security Operations (Fingerprints & STA)

AGTS System

ATL SkyTrain (180602)

Customer Service

Rental Car Center Operations (180601)

CPTC Maintenance

Total 3rd Party Op. & Maint. Contracts

Other Contract Services:

Consulting Professional Services

Repair & Maintenance (Bldg. & Equip.)

Training Travel per Diem & Registration

Insurance

Other Purchased Contracted Services

Total Purchased Contract Services

$ 19,378,410

5,238,498

790,000

16,673,260

4,433,471

2,077,166

2,853,797

2,413,183

$ 53,857,785

$ 27,466,726

6,770,360

763,700

17,655,000

6,001,658

2,077,166

3,150,337

2,092,666

$ 65,977,613

$ 29,646,726

7,783,239

270,000

17,657,750

6,004,158

2,077,166

3,150,337

2,552,892

$ 69,142,268

$ 32,211,167

7,599,340

625,000

19,545,000

4,660,000

3,000,000

3,150,337

2,900,000

$ 73,690,844

$ 15,735,524

1,814,180

661,324

3,709,410

4,213,808

$ 79,992,031

$ 23,912,319

2,058,867

804,724

4,305,547

5,741,069

$ 102,800,139

$ 19,084,205

2,075,917

400,000

4,051,547

9,041,913

$ 103,795,850

$ 22,886,175

2,702,082

1,037,499

4,105,547

11,990,156

$ 116,412,303

Supplies Consumable & Non Consumable

Utilities

Other Supply accounts

Total Supply Accounts

Capital Expenses

Interfund Charges:

Indirect Costs

Motor Fuel/ Repair & Data Processing

Total Interfund Charges

$ 2,997,975

8,036,478

1,460,865

$ 12,495,318

$ 3,522,961

10,981,073

2,349,915

$ 16,853,949

$ 3,052,433

9,738,716

1,744,248

$ 14,535,397

$ 4,655,227

9,474,900

2,098,819

$ 16,228,946

$ 184,626 $ 623,734 $ 443,734 $ 622,700

$ 12,052,852

2,658,168

$ 14,711,020

$ 8,690,754

3,142,597

$ 11,833,351

$ 12,099,027

2,304,577

$ 14,403,604

$ 9,903,960

2,994,519

$ 12,898,479

Other Costs:

Property Taxes

Other & Contingency

Total Other Operating Costs

$ 2,262,424

3,068,238

$ 5,330,662

$ 1,619,852

1,913,684

$ 3,533,536

$ 1,509,279

1,037,388

$ 2,546,667

$ 4,165,452

822,371

$ 4,987,823

Subtotal $ 188,236,910 $ 222,190,032 $ 213,367,420 $ 240,081,058

OPER TRANSF OUT TO 5502

Total Operating Fund Expense Budget (5501)

$ 20,090,592

$ 208,327,502

$ 17,863,000

$ 240,053,032

$ 15,982,295

$ 229,349,715

$ 15,000,000

$ 255,081,058

Page | 32

Operating Budget

Operating Expense Budget by Department

FY2012

Actual

DOA Executive

Office of the GM

Office of Deputy GM

Internal Audit

Total DOA Executive

Human Resources/TSOD

Human Resources

Training & Safety

Total Human Resources/TSOD

Marketing & SHE

DIT - Aviation

CFO

CFO Executive

Accounting

Budgeting, Financial Analysis & Risk Mgmt

Procurement

DOA Unallocated Expenses

Treasury

Total CFO

Planning & Development

Executive

Art Program

Asset Management & Sustainability

Project Development

Facilities Management

Environmental & Planning

Total Planning & Development

Operations, Maintenance & Security

Maintenance

Parking

Operations

Security

APM Systems

Ground Transportation

C4

Airport Fire

Airport Police

Total Operations, Maintenance & Security

Commercial Development

Commercial Development Executive

Concessions

Properties

Dawson County

Paulding County

New Business Development

Customer Service

Total Commercial Development

$ 27,611,742

20,629,586

10,770,913

9,641,850

23,281,408

1,429,116

1,285,490

22,582,772

14,535,080

$ 131,767,957

Budget

FY2013

Projected Actual

$ 1,358,041

-

259,916

$ 4,257,959

-

806,043

$ 1,272,321

-

744,523

$ 1,282,923

260,773

843,675

$ 1,617,957 $ 5,064,002 $ 2,016,844 $ 2,387,371

$ 336,913

564,742

$ 421,289

932,056

$ 285,642

628,490

$ 554,327

1,033,002

$ 901,655 $ 1,353,345 $ 914,132 $ 1,587,329

$ 2,203,939

$ 7,087,135

$

$

2,103,628

9,327,082

$

$

1,677,219

7,224,214

$

$

2,307,890

10,804,045

$ 357,880

1,248,008

4,536,426

501,217

(52,914)

207,349

$ 6,797,966

$ 509,422

1,272,754

5,015,869

629,559

204,000

265,512

$ 7,897,116

$ 28,202,783

29,164,286

12,021,967

11,458,170

26,877,557

1,957,829

1,327,896

24,059,477

18,569,583

$ 153,639,548

$ 382,119

1,088,350

4,652,690

530,250

75,000

128,116

$ 6,856,524

$ 27,130,678

29,188,741

11,730,901

11,036,481

26,086,202

1,936,082

1,313,091

21,556,888

17,947,815

$ 147,926,880

FY2014

Budget

$ 580,280

858,611

5,575,261

635,674

152,130

479,416

$ 8,281,372

$ 667,005

(2,965)

2,041,934

889,083

1,530,431

1,850,394

$ 668,351

-

2,807,931

1,022,643

4,268,142

3,527,411

$ 6,975,882 $ 12,294,478

$ 618,257

-

1,808,412

905,280

7,828,253

2,154,291

$ 13,314,493

$ 525,144

-

3,414,124

2,581,648

8,329,529

2,962,685

$ 17,813,130

$ 29,313,014

33,634,131

12,502,123

12,871,781

26,915,115

2,555,371

1,689,606

23,778,928

18,499,280

$ 161,759,349

$

2,193,889

195,141

982,070

495,653

375,616

1,017,911

471,739

$ 172,307

1,244,376

1,727,798

505,452

394,400

1,231,813

552,219

$ 5,732,019 $ 5,828,365

$ 294,273

868,752

1,426,713

445,320

399,255

965,134

532,040

$ 4,931,486

$ 572,606

1,392,873

4,150,493

505,452

400,000

1,955,922

560,104

$ 9,537,450

City of Atlanta Cost Centers

Mayors Office

Department of Information Technology

Law

Department of Finance

Procurement

Human Resources Administration

Audit

Pensioners & Dependent Exp

Other City Departments

Total City of Atlanta Cost Centers

Total DOA Operating Expense

$ 400,764 $ 481,449

42,394 467,495

4,178,458

242,827

631,328

1,437,074

670,093

5,481,507

12,067,954

7,071,367

305,442

806,808

1,663,647

670,110

3,954,042

9,262,109

$ 25,152,400 $ 24,682,469

$ 400,764

457,112

5,479,471

235,965

556,435

1,411,840

642,052

5,112,801

14,209,188

$ 28,505,628

$ 688,202

633,871

5,915,180

516,265

783,438

1,591,122

916,576

4,321,218

10,237,250

$ 25,603,122

$ 188,236,910 $ 222,190,033 $ 213,367,420 $ 240,081,058

Page | 33

Operating Budget

Personnel

The following table depicts the headcount by department for personnel included in the operating budget presented in the previous tables:

DOA Executive & Internal Audit

Human Resources/Training, Safety, & Organizational Development

Marketing & Stakholder Engagement

ISD

CFO

Planning & Development

Commercial Development

Operations, Maintenance, & Transportation:

Maintenance

Operations

APM Systems

Ground Transportation

Parking Operations

Total Operations, Maintenance & Transportation

Public Safety:

Centralized Command & Control Center

Security

Airport Firefighting & EMS

Airport Police

Total Public Safety

City of Atlanta Cost Centers

Total DOA Anticipated Staffing Levels

Total DOA Internal Operating Positions

Total DOA Capital Positions (R&E Fund)

Total Police & Fire Positions

Total DOA-Funded City Positions

Total DOA-Funded Positions

FY 2012

11

22

15

40

42

113

31

179

57

3

9

5

253

21

46

241

208

516

48

1091

538

56

449

48

1091

22

46

243

183

494

62

1070

523

59

426

62

1070

FY 2013

13

4

14

39

43

114

34

179

57

3

9

5

253

FY 2014

15

4

14

41

43

110

35

181

58

3

14

6

262

25

49

247

216

537

75

1136

545

53

463

75

1136

Page | 34

Operating Budget

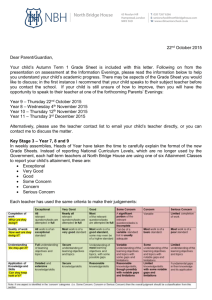

Cost Per Enplaned Passenger

Airline rates and charges will continue to be charged per the standing airfield use agreements and CPTC lease agreements. Rates and charges associated with these agreements will continue to keep airline cost per enplaned passenger (CPE) at competitively low rates. The estimated airline CPE for FY13 and FY14 is displayed below:

FY2012

Actual

FY2013

Budget

FY2013

Projected

FY2014

Budget

Aeronautical Revenues

Landing Fees

CPTC Rentals

(-) Concessions Credits

Cost Recoveries

Total Aeronautical Revenues

$ 48,009,362

$ 87,547,182

$ (44,862,190)

$ 22,065,012

$ 112,759,366

$ 48,407,808

$ 149,087,997

$ (44,465,103)

$ 34,094,538

$ 187,125,240

$ 47,213,684

$ 155,798,796

$ (47,119,000)

$ 33,433,513

$ 189,326,993

$ 47,976,664

$ 150,162,609

$ (47,155,254)

$ 36,424,255

$ 187,408,274

Non-Airline Adjustments

Non-Airline Tenant Building Rents

Non-Airline Tenant Apron Rents

Cargo Landing Fees

Total Non-Airline Adjustments

Total All-In Airline Payments at ATL

Total Enplaned Passengers

$ (1,238,369)

$ (202,364)

$ (2,404,852)

$ (3,845,585)

$ (2,920,886)

$ (167,229)

$ (2,420,390)

$ (5,508,505)

$ (1,237,467)

$ (784,813)

$ (2,360,684)

$ (4,382,964)

$ (1,245,396)

$ (872,735)

$ (2,398,833)

$ (4,516,964)

Total Airline Payments to City of Atlanta $ 108,913,781 $ 181,616,735 $ 184,944,029 $ 182,891,310

Airline Payments to non-City of Atlanta Entities

Terminal Operator

Common-Use Operator

$ 17,488,391

$ 55,339,177

Total Airline Payments to non-City of Atlanta Entities $ 72,827,567

$ 21,377,000

$ 72,755,000

$ 94,132,000

$ 22,422,115

$ 68,243,624

$ 90,665,739

$ 23,912,673

$ 69,608,497

$ 93,521,170

$ 181,741,348

47,147,315

$ 275,748,735

48,350,000

$ 275,609,768

48,200,000

$ 276,412,480

49,150,000

CPE, City of Atlanta

CPE, All-In

$ 2.31

$ 3.85

$ 3.76

$ 5.70

$ 3.84

$ 5.72

$ 3.72

$ 5.62

Page | 35

LONG-TERM DEBT

Long-Term Debt

L

ong-Term Debt

Overview

The City has issued various types of bonds on behalf of ATL which have been issued to finance portions of ATL’s CIP. The various types of bonds outstanding include GARBs, PFC subordinate revenue bonds, and CFC bonds. ATL’s debt program is guided by the City’s Master Bond

Ordinance which authorizes the issuance of bonds and stipulates the conditions and requirements for these funds’ administration and use.

In addition to this, governing language is included in each bond issue’s official statement which establishes the use of all funds generated by each issue. Specifically, for GARBs, these official statements contain provisions which state how much of the funds raised are apportioned to:

(1) payment of project costs (deposits to the construction funds, reimbursements to the renewal and extension fund, and refunding of any outstanding notes), (2) deposits to the capitalized interest accounts to pay interest during construction; (3) payment of any bond insurance premiums; (4) deposits to the debt service reserve account (or payment of the costs of sureties) to meet debt service requirements; and (5) payment of underwriters’ discount, financing, legal, and other issuance costs.

Capital Finance

At the start of FY14, ATL’s debt consists of the following:

Government Airport Revenue Bonds

Passenger Facility Charge Hybrid Bonds

Customer Facility Charge Bonds

Total Debt Outstanding

$ 1,946,430,000

914,350,000

198,675,000

$ 3,059,455,000

ATL’s PFC bonds are secured by a senior lien on PFC revenues. In general, the purpose of the

PFC is to develop additional capital funding sources to provide for the expansion and improvements of the national airport system. The proceeds from PFCs must be used to finance eligible airport related projects as prescribed by the FAA.