Council of California Goodwill Industries COUNCIL MEETING

Council of California Goodwill Industries

COUNCIL MEETING

December 1-2, 2011

Meeting Documents / Table of Contents

Updated 11/29/11 – 9:00 a.m.

DOCUMENT NAME – DATE POSTED / REVISED TO PDF MASTER DOCUMENT .................................................................... ADOBE / PDF PAGE #

Proposed Agenda – posted 11/22/11 ........................................................................................................... 2

Prospect Attendees Roster (COUNCIL) – revised 11/29/11 .......................................................................... 5

Prospect Attendees Roster (HR PILLAR) – revised 11/29/11 ........................................................................ 6

Minutes from June 27, 2011 Meeting – posted 11/22/11 ........................................................................... 7

Treasurer’s Report as of October 31, 2011 – to be posted ............................................................................

Agency Roundtable Discussion Prep Sheet & 2012 Projections Matrix – posted 11/22/11 ...................... 13

2012 Proposed Meeting Schedule – posted 11/29/11 ............................................................................... 16

Public Policy Committee Report – Legislative Update – posted 11/29/11 ................................................. 17

Public Policy Committee Report – 2011 Chaptered / Vetoed Bills – posted 11/29/11 .............................. 19

Public Policy Committee Report – 2011-2012 Bill Tracking – posted 11/29/11 ......................................... 25

GII’s Monthly Aggregate Data through September 2011 – posted 11/22/11 ............................................ 39

HR Pillar’s Proposed Agenda / Timeline – revised 11/29/11 ...................................................................... 47

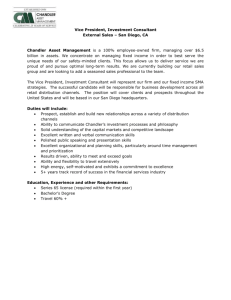

Promotional Flyer for December 1-2, 2011 Meeting – posted 9/20/11..................................................... 50

G REATER E AST B AY

Alameda, Contra Costa,

Solano Counties

C o u n c i l o f C a l if o r n i a

G O O O D W I I L L

COUNCIL MEETING

Council of California Goodwill Industries

Hosted by Goodwill Industries of San Diego County

Agency Headquarters

3663 Rosecrans Street, Executive Conference Room / 2 nd Floor

San Diego, California 92110

(park & enter building behind store - entrance on Sports Arena Blvd)

Thursday, December 1, 2011, 12:00 p.m. – 5:00 p.m.

Friday, December 2, 2011, 8:00 a.m. – 12:00 p.m.

PROPOSED AGENDA (V1)

O RANGE C OUNTY

I I N D U S T R I I E S

®

Thursday, December 1, 2011

R EDWOOD E MPIRE

Sonoma, Napa

Mendocino, Lake, Humboldt & 10:30–11:30

Trinity Counties

S AN D IEGO C OUNTY

AGENCY SHOWCASE TOUR:

Facilities tour – Mr. Mike Rowan , San Diego-based Goodwill agency

CEO / President

San Diego & Imperial Counties

S AN F RANCISCO 12:00–12:15

S AN M ATEO , & M ARIN

HOSTED LUNCH:

Light buffet or boxed lunch provided in or near conference rooms

C OUNTIES

S AN J OAQUIN V ALLEY

I.

Amador, San Joaquin,

Calaveras, Tuolumne, Stanislaus,

Mariposa, Madera, Fresno &

North Tulare Counties

S ANTA C RUZ , M ONTEREY

& S AN L UIS O BISPO

C OUNTIES

S ERVING THE P EOPLE

OF S OUTHERN L OS A NGELES

C OUNTY

S ILICON V ALLEY

Santa Clara &

San Benito Counties

S OUTH C ENTRAL C ALIFORNIA

Kern, Kings &

South Tulare Counties

S OUTHERN C ALIFORNIA

Northern Los Angeles, San

Bernardino & Riverside Counties

II.

III.

(JOINT SESSION WITH PILLAR) OPENING SESSION:

Call to order / opening remarks – Chairman David Miller

Welcome address – Mr. Mike Rowan , San Diego-based Goodwill agency CEO / President

Roundtable introductions – Chairman David Miller

Establishment of quorum – Secretary Kathy Leahy

Ref Doc: Prospect Attendees Roster

Review scope of meetings – Chairman David Miller

Call for breakout sessions – Chairman David Miller

APPROVAL OF THE AGENDA:

Consider changes / additions to agenda – Chairman David Miller

APPROVAL OF THE MINUTES:

Review previous meeting proceedings – Chairman David Miller

Ref Doc: Minutes of the Council Meeting – Sep 22-23 2011

S OUTHERN O REGON 12:15–3:00 IV.

Siskiyou & Del Norte Counties

V ENTURA & S ANTA

B ARBARA C OUNTIES

3:00–3:15

AGENCY ISSUES / ROUNDTABLE DISCUSSION:

Focus: agency reports highlighing 2012 projections / key initiatives

– Chairman David Miller

Ref Doc: Roundtable Issues Prep Sheet & 2012 Projections Matrix

BREAK: i n f o @ c a l if o r n i a g o o d w i l ls . o r g

● www.californiagoodwills.org

Council Meeting

Proposed Agenda (v1)

Thursday, December 1, 2011 & Friday, December 2, 2011

Page 2 of 3

3:15–4:15 V.

4:15–4:55

4:55–5:00

VI.

VOLUNTEERS:

Utilization trends and analysis – Chairman David Miller and Ms. Elise

Clowes

YEAR-END ISSUES:

Nominating Committee report – Chairman David Miller

Consultants contracts renewal – Chairman David Miller

2012 meeting schedule – Chairman David Miller

MEETING ADJOURNMENT:

Closing remarks & adjournment – Chairman David Miller

5:30–9:30 GROUP DINNER & THEATER:

Group dinner with HR Pillar Executives at Acapulco Mexican

Restaurant & Cantina (@ the Hacienda Hotel), 2467 Juan Street,

San Diego, CA 92110

Theater outing – “It’s a Wonderful Life: A Live Radio Play” – 7:30 p.m. curtain call

Friday, December 2, 2011

7:30–8:00 HOSTED BREAKFAST

Light / continental breakfast provided in or near conference room

8:00–8:05 CALL TO ORDER

Welcome & introductions – Chairman David Miller

Review remaining agenda items – Chairman David Miller

8:05–8:15

VII.

GII BOARD REPORT:

Strategic issues update – Ms. Deborah Alvarez-Rodriguez , San

Francisco-based agency CEO / President

8:15–10:15 VIII.

PUBLIC POLICY COMMITTEE REPORT:

Priority legislative initiatives overview – Cmte Chairs Deborah

Alvarez-Rodriguez / John Latchford , and / or Political Consultant

Kate Bell

Public Policy Survey – Cmte Chairs Deborah Alvarez-Rodriguez /

John Latchford

10:15–10:45 IX.

TREASURER’S REPORT:

Review of financial statements & position – Treasurer Michael Fox

Ref Doc: Treasurer’s Report

2012 dues structure – Treasurer Michael Fox

Council Meeting

Proposed Agenda (v1)

Thursday, December 1, 2011 & Friday, December 2, 2011

Page 3 of 3

10:15–11:45 X.

(JOINT SESSION WITH PILLAR) STRATEGIC PLAN ACTIONS:

Pillar liaisons’ reports

•

•

Retail – Secretary Kathy Leahy

Workforce – Ms. Sheryl Chalupa , Bakersfield-based Goodwill

CEO / President

HR – Mr. Michael Paul , Santa Cruz-based Goodwill CEO / •

President and HR Pillar Executives (Pillar Report)

Other collaborations

•

• CFOs / COOs – Vice-Chair Mark Ihde

•

Agency board members – Mr. Mike Rowan , San Diego-based

Goodwill CEO / President

•

Public Policy Committee – Co-Chairs Debbie Alvarez-Rodriguez

/ John Latchford

Fiscal & Economic Impact Project – Mr. Doug Barr , Los Angelesbased Goodwill CEO / President

11:45–12:00

XI.

(JOINT SESSION WITH PILLAR) MEETING RECAP &

ADJOURNMENT: Chairman David Miller

Review of proceedings & closing remarks

Promotion of next quarterly meeting

Ref Doc: February 19-21 COE promotional flyer

Adjournment

C:\otto backup files\CCGI\Council Meetings\2011\120111\proposed agenda-timeline 120111.doc

G REATER E AST B AY

Alameda, Contra Costa,

Solano Counties

O RANGE C OUNTY

R EDWOOD E MPIRE

Sonoma, Napa

Mendocino, Lake, Humboldt &

Trinity Counties

S AN D IEGO C OUNTY

San Diego & Imperial Counties

S AN F RANCISCO

S AN M ATEO , & M ARIN

C OUNTIES

S AN J OAQUIN V ALLEY

Amador, San Joaquin,

Calaveras, Tuolumne, Stanislaus,

Mariposa, Madera, Fresno &

North Tulare Counties

S ANTA C RUZ , M ONTEREY

& S AN L UIS O BISPO

C OUNTIES

S ERVING THE P EOPLE

OF S OUTHERN L OS A NGELES

C OUNTY

S ILICON V ALLEY

Santa Clara &

San Benito Counties

S OUTH C ENTRAL C ALIFORNIA

Kern, Kings &

South Tulare Counties

S OUTHERN C ALIFORNIA

Northern Los Angeles, San

Bernardino & Riverside Counties

C o u n c i l o f C a l if o r n i a

G O O D W I I L L I I N D U S T R I I

COUNCIL MEETING

Council of California Goodwill Industries

Hosted by Goodwill Industries of San Diego County

Agency Headquarters

3663 Rosecrans Street, Executive Conference Room / 2 nd Floor

San Diego, California 92110

(park & enter building behind store - entrance on Sports Arena Blvd)

Thursday, December 1, 2011, 12:00 p.m. – 5:00 p.m.

Friday, December 2, 2011, 8:00 a.m. – 12:00 p.m.

PROSPECT ATTENDEES (V3)

OFFICERS

Stockton-based Goodwill

Santa Rosa-based Goodwill

San Jose-based Goodwill

Oxnard-based Goodwill

Miller, David

COUNCIL CHAIR, PRESIDENT / CEO

Ihde, Mark

COUNCIL VICE-CHAIR, PRESIDENT / CEO

Fox, Michael

COUNCIL TREASURER, PRESIDENT / CEO

Leahy, Kathy

COUNCIL SECRETARY, PRESIDENT / CEO

MEMBERS

Alvarez-Rodriguez, Deborah

PRESIDENT / CEO

Barr, Doug

PRESIDENT / CEO

Clowes, Elise

AGENCY BOARD MEMBER

Latchford, John

PRESIDENT / CEO

Paul, Michael

PRESIDENT / CEO

Pollack, Shep

AGENCY BOARD MEMBER

Rogers, Dan

PRESIDENT / CEO

Rowan, Mike

CEO

Tibbitts, Jonathan

AGENCY BOARD MEMBER

GUESTS

San Francisco-based Goodwill

Los Angeles-based Goodwill

San Francisco-based Goodwill

Oakland-based Goodwill

Santa Cruz-based Goodwill

San Francisco-based Goodwill

Santa Ana-based Goodwill

San Diego-based Goodwill

San Diego-based Goodwill

Byrne, Gayle

PRESIDENT

Chalupa, Sheryl

PRESIDENT / CEO

McCarthy, Janet

PRESIDENT / CEO

C:\otto backup files\CCGI\Council Meetings\2011\120111\prospect attendees COUNCIL 120111.doc

CONSULTANTS

Bell, Kate

POLITICAL CONSULTANT

DeLeon, Otto

MANAGEMENT CONSULTANT

Based in Sacramento

Based in Sacramento

OFFICER & MEMBERS ABSENT

Medford-based Goodwill

Bakersfield-based Goodwill

Long Beach-based Goodwill

E S

®

S OUTHERN O REGON

Siskiyou & Del Norte Counties

V ENTURA & S ANTA

B ARBARA C OUNTIES i n f o @ c a l if o r n i a g o o d w i l ls . o r g

● www.californiagoodwills.org

G REATER E AST B AY

Alameda, Contra Costa,

Solano Counties

O RANGE C OUNTY

R EDWOOD E MPIRE

Sonoma, Napa

Mendocino, Lake, Humboldt &

Trinity Counties

S AN D IEGO C OUNTY

San Diego & Imperial Counties

S AN F RANCISCO

S AN M ATEO , & M ARIN

C OUNTIES

S AN J OAQUIN V ALLEY

Amador, San Joaquin,

Calaveras, Tuolumne, Stanislaus,

Mariposa, Madera, Fresno &

North Tulare Counties

S ANTA C RUZ , M ONTEREY

& S AN L UIS O BISPO

C OUNTIES

S ERVING THE P EOPLE

OF S OUTHERN L OS A NGELES

C OUNTY

S ILICON V ALLEY

Santa Clara &

San Benito Counties

S OUTH C ENTRAL C ALIFORNIA

Kern, Kings &

South Tulare Counties

S OUTHERN C ALIFORNIA

Northern Los Angeles, San

Bernardino & Riverside Counties

C o u n c i l o f C a l if o r n i a

G O O O D W I I L L I I N D

HUMAN RESOURCES PILLAR MEETING

U S T R I I E S

®

INDIVIDUALS PRESENT

Bell, Kate

COUNCIL’S POLITICAL CONSULTANT

Evans, Brandy

VP OF FINANCE

Leczkesy, Ed

Perez, Jose

Poon, Diane

Thursday, December 1, 2011, 12:00 p.m. – 5:00 p.m.

Friday, December 2, 2011, 8:00 a.m. – 12:00 p.m.

PROSPECT ATTENDEES (V2)

DIRECTOR OF HR

HR DIRECTOR

Sack, Donna

Sponsored by the Council of California Goodwill Industries

Hosted by Goodwill Industries of San Diego County

Agency Headquarters

3663 Rosecrans Street, Executive Conference Room / 2 nd Floor

San Diego, California 92110

(park & enter building behind store - entrance on Sports Arena Blvd)

Fitzgerald, Karla

DIRECTOR OF ENVIRONMENTAL HEALTH & SAFETY

Giffin, Toni

SR DIRECTOR OF HR & SUPPORT SERVICES

Gravino, Ronnie

DIR OF PEOPLE DEVELOPMENT

Howley, Jim

DIRECTOR OF HR

Justet, Judi

MANAGING DIRECTOR OF PEOPLE

Parkinson, Fabia

HR MANAGER

Pliskin, Lucy

GENERAL COUNSEL & VP OF HR

Seebach, Kim

VP OF HR

– CHAIR

Tovatt, Karen

DIRECTOR OF HR

Vaca, Sylvia

DIRECTOR OF HR

Anderson, Ahmad

Della Casa, Rosa

Grellamn, Gary

DIRECTOR OF HR

SR DIRECTOR OF HR

Walker, Randy

VP OF HR

HR DIRECTOR

CFO & COO

Based in Sacramento

Santa Rosa-based Goodwill

Los Angeles-based Goodwill

San Diego-based Goodwill

San Francisco-based Goodwill

Santa Cruz-based Goodwill

San Jose-based Goodwill

San Diego-based Goodwill

Los Angeles-based Goodwill

Santa Ana-based Goodwill

Long Beach-based Goodwill

Oxnard-based Goodwill

INDIVIDUALS ABSENT

Oakland-based Goodwill

San Francisco-based Goodwill

San Francisco-based Goodwill

VP OF ADMINISTRATIVE OPERATIONS

C:\otto backup files\CCGI\Council Meetings\2011\120111\prospect attendees 120111.doc

Stockton-based Goodwill

Santa Ana-based Goodwill

Los Angeles-based Goodwill

Medford-based Goodwill

Bakersfield-based Goodwill

S OUTHERN O REGON

Siskiyou & Del Norte Counties

V ENTURA & S ANTA

B ARBARA C OUNTIES i n f o @ c a l if o r n i a g o o d w i l ls . o r g

● www.californiagoodwills.org

C o u n c i l o f C a l if o r n i a

G O O D W I I L L I I N D U

MINUTES OF THE

COUNCIL MEETING (V1)

Council of California Goodwill Industries

Hosted by Southern Oregon Goodwill Industries

S T R I I E S

®

G REATER E AST B AY

Alameda, Contra Costa,

Solano Counties

O RANGE C OUNTY

R EDWOOD E MPIRE

Ashland Springs Hotel

212 East Main Street, Palm Room (2 nd Floor)

Ashland, Oregon

September 22-23, 2011

I.

CALL TO ORDER : Chairman David Miller called the meeting to order at 1:00 p.m. on

Thursday, September 22, 2012, at the Ashland Springs Hotel in Ashland, Oregon.

II.

ESTABLISHMENT OF QUORUM : Secretary Kathy Leahy determined that a quorum was present. The following were in attendance:

Sonoma, Napa

Mendocino, Lake, Humboldt &

Trinity Counties

S AN D IEGO C OUNTY

San Diego & Imperial Counties

S AN F RANCISCO

S AN M ATEO , & M ARIN

C OUNTIES

S AN J OAQUIN V ALLEY

Amador, San Joaquin,

Calaveras, Tuolumne, Stanislaus,

Mariposa, Madera, Fresno &

North Tulare Counties

S ANTA C RUZ , M ONTEREY

& S AN L UIS O BISPO

C OUNTIES

S ERVING THE P EOPLE

OF S OUTHERN L OS A NGELES

C OUNTY

S ILICON V ALLEY

Santa Clara &

San Benito Counties

S OUTH C ENTRAL C ALIFORNIA

Kern, Kings &

South Tulare Counties

S OUTHERN C ALIFORNIA

Northern Los Angeles, San

Bernardino & Riverside Counties

S OUTHERN O REGON

Siskiyou & Del Norte Counties

V ENTURA & S ANTA

B ARBARA C OUNTIES

(Note: Council members from five or more member agencies establish a quorum)

Officers Present :

Miller, David – Chairman ...................... Stockton, CA

Fox, Michael – Treasurer ..................... San Jose, CA

Leahy, Katherine – Secretary ............... Oxnard, CA

Members Present :

Alvarez-Rodriguez, Deborah .............. San Francisco, CA

Barr, Doug ............................................ Los Angeles, CA

Byrne, Gayle ........................................ Medford, OR

Clowes, Elise ....................................... San Francisco, CA

Latchford, John ................................... Oakland, CA

Pollack, Shepard ................................. San Francisco, CA

Rogers, Dan ......................................... Santa Ana, CA

Rowan, Mike ........................................ San Diego, CA

Tibbitts, Jonathan ................................ San Jose, CA

Guest Present :

Fletcher, Julie ...................................... Medford, CA

Consultants Present :

DeLeon, Otto – Coordinator Sacramento, CA

Snyder, Jennifer ................................... Sacramento, CA

Officer & Members Absent :

Chalupa, Sheryl ................................... Bakersfield, CA

Ihde, Mark – Vice-Chairman ................. Santa Rosa, CA

McCarthy-Wilson, Janet ...................... Long Beach, CA

Paul, Michael ........................................ Santa Cruz, CA

Ward, Brad ........................................... Long Beach, CA i n f o @ c a l if o r n i a g o o d w i l ls . o r g

● www.californiagoodwills.org

Minutes of the Council Meeting

September 22-23, 2011

Page 2 of 6

III.

APPROVAL OF THE AGENDA : Approved unanimously as presented.

IV.

APPROVAL OF THE MINUTES : Approved unanimously as presented on a Mr. Doug Barr /

Ms. Elise Clowes motion.

V.

TREASURER’S REPORT : Notice was issued that the Treasurer’s report was disseminated electronically and posted onto the Council’s website by Management Consultant Otto DeLeon on Tuesday, September 20, 2011, on behalf of Treasurer Michael Fox. The report outlined the

Council’s financial standing as of August 31, 2011, and included:

A.

Statement of Financial Position (Balance Sheet)

B.

Income Statement (Revenue & Expenses)

C.

2011 Forecast

D.

Check Register

E.

Dues Receivable Ledger

F.

Bank Reconciliation Summary

Treasurer Fox reported that appropriate paperwork was re-filed with the IRS to reinstate the

Council’s non-profit status and that the suit filed by Joseph Sia was completely resolved with no additional Council impact. The report was approved unanimously as presented on a Ms.

Gayle Byrne / Public Policy Co-Chairperson Deborah Alvarez-Rodriguez motion.

VI.

AGENCY ROUNDTABLE DISCUSSIONS : Referencing meeting handout “Agency Issues /

Roundtable Discussion (V1)” the Council discussed:

A.

Marketing and public relations activities related to donations

B.

Halloween promotions

C.

Contending with the uncertainty of workers compensation and healthcare costs

D.

Labor issues related to utilizing volunteers

Outcomes from these discussions include:

A.

Mr. Barr to showcase / share his agency’s television ads at the Council’s December meeting in San Diego.

B.

Management Consultant DeLeon to research GII website for a PowerPoint document from a September 21, 2011 webinar with information about healthcare (and disseminate it or post it onto Council’s website).

C.

Unanimous consent to engage the services of Ms. Clowes (board member from San

Francisco-based agency) to obtain a California legal opinion regarding the utilization of volunteer vs. paid labor.

D.

Secretary Leahy urged that court-ordered community service should be accounted for in the legal opinion to be outlined by Ms. Clowes.

E.

Management Consultant DeLeon to forward to Ms. Cloves the volunteer labor legal opinions obtained by GII (these documents were circulated for review / discussion at the

Council’s meeting on June 27, 2011, in Rochester, New York).

Minutes of the Council Meeting

September 22-23, 2011

Page 3 of 6

VII.

F.

Management Consultant DeLeon to work with Ms. Cloves to develop an online survey to determine how Council agencies utilize volunteers in their operations.

PUBLIC POLICY COMMITTEE REPORT : The following documents were discussed and / or referenced by Public Policy Committee Co-Chairpersons Alvarez-Rodriguez / John Latchford and / or Political Consultant Jennifer Snyder as part of the committee’s report:

A.

2011 Public Policy Update (key issues) dated September 15, 2011

B.

Legislative Summary (bill tracking by priority ranking) dated September 15, 2011

C.

State Budget Impact on Services

D.

Public Policy Agenda Survey for 2011

Outcomes from this report include:

A.

Public Policy Committee Co-Chairperson Alvarez-Rodriguez to forward to the Council a link with information regarding realignment of the state budget.

B.

Additional discussion regarding SB 201 (flexible purpose corporations) to be slotted for

Council’s December 1-2, 2011 meeting in San Diego.

C.

This year’s annual public policy agenda survey to be conducted to identify three key issues from each agency to help establish key Council initiatives for 2012 with a simplified survey format.

D.

Public policy agenda survey results / discussion to be slotted for Council’s December meeting in San Diego.

E.

Public Policy Committee Co-Chairperson Latchford stressed that we need more unattended donations bins ordinances to be passed by local municipalities to gain momentum with this initiative for enactment of legislation throughout the state. Cities that have passed ordinances include: Folsom, Elk Grove, Rancho Cordova and Sacramento.

F.

Management Consultant DeLeon to track down, disseminate and post onto Council’s website a GII PowerPoint document on Healthcare prepared by Mercer.

VIII.

ECONOMIC & FISCAL IMPACT PROJECT discussion regarding the economic and fiscal impact project, including data utilization.

: Mr. Barr provided a brief overview of and led

Outcomes from this discussion include:

A.

Management Consultant DeLeon to post 2011 aggregate data and Los Angeles-based

Goodwill’s reports onto Council’s website as password protected documents.

B.

Other agencies’ reports to be posted online as they are forwarded to Management

Consultant DeLeon.

IX.

STRATEGIC PLAN ACTIONS :

A.

RETAIL PILLAR : Secretary Leahy provided an overview of the Retail Pillar activities and key initiatives, including the development of a Retail Pillar matrix. Management Consultant

DeLeon to post the matrix onto the Council’s website.

B.

WORKFORCE PILLAR: A written report was provided in the meeting packets.

Minutes of the Council Meeting

September 22-23, 2011

Page 4 of 6

C.

HR PILLAR : A written report was provided in the meeting packets.

D.

AGENCY BOARD MEMBERS COLLABORATION : Mr. Mike Rowan reported having conducted outreach to board members. With input from board members present at the meeting, outcomes from this report include:

1.

Schedule a board member breakout session at the next GII Delegate Assembly in

Miami, Florida dedicated specifically to governance issues. Seek to line up a GII special speaker, facilitator to guide discussions.

2.

Possible discussion topics to include: committee structure (roles and duties); skill sets sought from board composition; meeting schedules and formats; board member terms; board / CEO models; board evaluations.

3.

Mr. Rowan, Chairperson Miller and Management Consultant DeLeon to work in concert to schedule / plan this meeting.

E.

CFOs / COOs : Mr. Mark Ihde submitted the following report via e-mail to Management

Consultant DeLeon:

For approximately two years, the Bay Area Goodwill CEOs have been meeting to discuss and implement collaborative efforts. As a precursor to establishing a Financial Pillar, we decided to include our financial staff in one of our meetings to test the interest and viability.

Based on discussions with those in attendance after the session, there was significant interest in expanding the financial collaboration to include the entire Council.

While there were no specific initiatives identified at the first meeting, there were a number of best practices which were ultimately shared within the group. I know for my agency, the information and documentation we received from John Latchford's staff will significantly minimize our efforts as we explore new banking relationships.

The group agreed to begin their exploration by developing a spreadsheet of finance departmental duties and vendor commonalities. This work is in process and no further meeting will be scheduled until its completion. Following are the list of goals the financial group developed for the immediate future.

1) Develop a spreadsheet application to list departmental duties, vendor commonalities, etc. including: a. Departmental Duties b. Departmental Staffing c. Banking – Commercial d. Banking – Credit Card e. Banking – Investment f. Auditors g. Health Insurance Brokers h. P&C Brokers i. IT Systems – Hardware

Minutes of the Council Meeting

September 22-23, 2011

Page 5 of 6 j. IT Structure and Support k. Procurement Commodities – Retail Racking g. Procurement Commodities – Office Supplies h. Procurement Commodities – Copier Systems

2) Have 5 Goodwill agencies populate data sheet information

3) Combine data, then look at common items. Focus on big ticket items where we might get large discounts or find EE hourly savings.

4) Conlon to look into expanding access for other Goodwill agencies to join our IT Cloud.

Primary goal is to find efficiencies by sharing data (i.e. RFP’s, Excel worksheets, analysis forms, etc.)

X.

PUBLIC POLICY COMMITTEE : Public Policy Committee Co-Chair Latchford reported that the

Council’s standing contractual agreement with Capitol Advocacy includes support to help advance the Council’s public policy related strategic objectives.

XI.

GII BOARD REPORT : Public Policy Committee Co-Chair Alvarez-Rodriguez reported and led discussion regarding key strategic issues including:

A.

Membership standards – bylaws amendments

B.

Focus on branding

C.

Development of a jobs creation work group and CEO leadership for the work group

D.

Finances

E.

Concerted push for increased participant involvement in GII’s advocacy day

XII.

PILLAR / COUNCIL CONNECTION : The Workforce Pillar’s report included an overview of:

A.

Public policy, including information to be provided to the Council’s Political Consultant to share with legislators

B.

A brainstorming session to identify how the Pillar can support the Council’s strategic plan

C.

Roundtable agency reports

D.

Funding opportunities for workforce development activities and programs

E.

The C4 initiative, including the line-up of an initiative representative to address the Pillar at its January / San Diego meeting

F.

The need for continuity of representatives to attend Pillar meetings to help advance and develop momentum for key Pillar initiatives

G.

2012 Pillar meeting schedule to include meetings in San Diego in January, at the GII

Spring Learning Event and in the fall with the Council

H.

Review of grant funding procurement models

XIII.

2012 MEETING SCHEDULE : With actual meeting dates to be brought forward at the

Council’s December 1-2, 2011 meeting in San Diego for final approval, it was approved unanimously for the the following agencies to host the Council’s 2012 meetings:

Minutes of the Council Meeting

September 22-23, 2011

Page 6 of 6

A.

San Francisco-based Goodwill in April / March

B.

Oxnard-based Goodwill in September

C.

Santa Ana-based Goodwill in December

XIV.

NOMINATING COMMITTEE : The following committee composition was approved unanimously to bring forward a 2012 officer slate at the Council’s December 1-2, 2011 meeting in San Diego:

A.

David Miller – Committee Char

B.

Doug Barr

C.

Dan Rogers

XV.

MEETING RECAP & ADJOURNMENT : Mr. Rowan provided brief promotional remarks regarding the Council’s and HR Pillar’s December 1-2, 2011 meeting in San Diego, CA There being no further issues to discuss, Chairman Miller adjourned the meeting at 11:05 a.m. on

Friday, September 22, 2011.

C:\otto backup files\CCGI\Council Meetings\2011\092211\092211 meeting minutes.doc

G REATER E AST B AY

Alameda, Contra Costa,

Solano Counties

O RANGE C OUNTY

R EDWOOD E MPIRE

Sonoma, Napa

Mendocino, Lake, Humboldt &

Trinity Counties

S AN D IEGO C OUNTY

San Diego & Imperial Counties

S AN F RANCISCO

S AN M ATEO , & M ARIN

C OUNTIES

S AN J OAQUIN V ALLEY

Amador, San Joaquin,

Calaveras, Tuolumne, Stanislaus,

Mariposa, Madera, Fresno &

North Tulare Counties

S ANTA C RUZ , M ONTEREY

& S AN L UIS O BISPO

C OUNTIES

S ERVING THE P EOPLE

OF S OUTHERN L OS A NGELES

C OUNTY

S ILICON V ALLEY

Santa Clara &

San Benito Counties

S OUTH C ENTRAL C ALIFORNIA

Kern, Kings &

South Tulare Counties

S OUTHERN C ALIFORNIA

Northern Los Angeles, San

Bernardino & Riverside Counties

S OUTHERN O REGON

C o u n c i l o f C a l if o r n i a

G O O D W I I L L I I N D U S T R I I E S

®

COUNCIL MEETING

Council of California Goodwill Industries

Hosted by Goodwill Industries of San Diego County

Agency Headquarters

3663 Rosecrans Street, Executive Conference Room / 2 nd Floor

San Diego, California 92110

(park & enter building behind store - entrance on Sports Arena Blvd)

Thursday, December 1, 2011, 12:00 p.m. – 5:00 p.m.

Friday, December 2, 2011, 8:00 a.m. – 12:00 p.m.

AGENCY ISSUES / ROUNDTABLE DISCUSSIONS (V1)

With the anticipation that budget planning is behind most of us (for those agencies whose fiscal year ends December 31 st ), our roundtable discussions will focus on 2012 projections and key initiatives in the following five areas:

1) DONATIONS: a) Share what new donations activity you have projected for 2012, including any significant changes in donations strategies.

2) RETAIL: a) Highlight plans for new store openings, expansions and relocations. b) Outline your agency’s strategies or position on the use of new goods. c) Provide an overview of your agency’s approach to loss prevention.

3) WORKFORCE DEVELOPMENT: a) Spotlight changes in direction related to workforce development activities. b) Address expansion or contraction of services and related funding issues.

4) BUDGET: a) Highlight key projections for 2012, including % of increase or decrease from 2011.

5) INSURANCE: a) Share what advice you are receiving regarding 2012 healthcare and workers compensation costs and how that advice or those projections are incorporated in your planning.

C:\otto backup files\CCGI\Council Meetings\2011\120111\120111 roundtable topics prep sheet.doc

Siskiyou & Del Norte Counties

V ENTURA & S ANTA

B ARBARA C OUNTIES i n f o @ c a l i f o r n i a g o o d w i l l s . o r g ● w w w . c a l i f o r n i a g o o d wi l l s . o r g

Bakersfield

Long Beach

Los Angeles

Medford

Oakland

Oxnard

San Diego

San Jose

San Francisco

Santa Ana

Santa Cruz

Santa Rosa

Stockton

Sum

Bakersfield

Long Beach

Los Angeles

Medford

Oakland

Oxnard

San Diego

San Jose

San Francisco

Santa Ana

Santa Cruz

Santa Rosa

Stockton

Sum

Current Contracts % Change

Council of California Goodwill Industries

Planning Report for 2012

EMPLOYMENT & TRAINING

Revenue

New Contracts Total Revenue

-

-

-

-

-

-

-

-

-

-

-

-

-

% Change

$ $ $ -

Same Stores

$ -

% Change

RETAIL STORE SALES REVENUE

New Stores Number

-

-

-

-

-

-

-

-

-

-

-

-

Total Store

-

-

-

-

-

-

-

-

-

-

-

-

-

$ $ -

Expense to

Revenue

DONORS

Salvage price Donor Count % Change

-

1

Bakersfield

Long Beach

Los Angeles

Medford

Oakland

Oxnard

San Diego

San Jose

San Francisco

Santa Ana

Santa Cruz

Santa Rosa

Stockton

Sum

Bakersfield

Long Beach

Los Angeles

Medford

Oakland

Oxnard

San Diego

San Jose

San Francisco

Santa Ana

Santa Cruz

Santa Rosa

Stockton

DEFINITIONS:

Current Contracts % Change

Council of California Goodwill Industries

Planning Report for 2012

CONTRACTS REVENUE

Revenue

New Contracts Total Revenue

-

-

-

-

-

-

-

-

-

-

-

-

-

% Change

$

Labor

-

Health &

Welfare

$ $ -

ALL DEPARTMENTS

Expense % Change

Utilities Occupancy

-

-

-

-

-

-

-

-

-

-

-

-

-

% Chamge = year over year change

2

Depreciation

Expense to

Revenue

DEVELOPMENT

Revenue

$

Expense to

Revenue

FINANCIAL

Expense to Expense to

All Expense Revenue (2011) Revenue (2012)

2012 PROPOSED MEETING SCHEULE

Feb 19-22 Concurrent with COE / San Antonio, TX

Mar 22-23

Jun 23-26

San Francisco, CA

Concurrent with Delegate Assembly / Miami, FL

Sep 20-21

Dec 6-7

Oxnard, CA

Santa Ana, CA

HOST AGENCY HISTORY FILE

Sep 2004 San Jose, CA

Dec 2004 Bakersfield, CA

Feb 2005 COE / New Orlean, LA

Mar 2005 Leg Days / Sacramento, CA

Jun 2005 Delegate Assembly / Appleton, WI

Sep 2005 Santa Rosa, CA

Dec 2005 Long Beach, CA

Mar 2006 Leg Days / Sacramento, CA

Jun 2006 Delegate Assembly / St Louis , MI

Sep 2006 San Diego, CA

Dec 2006 Oakland, CA

Feb 2007 COE / Las Vegas. NV

Mar 2007 Leg Days / Sacramento, CA

Jun 2007 Delegate Assembly / Pittsburg, PN

Sep 2007 Oxnard, CA

Dec 2007 San Fancisco, CA

Feb 2008 COE / Honolulu, HI

Apr 2008

Jun 2008

Leg Days / Sacramento, CA

Delegate Assembly / Washington DC

Sep 2008 Santa Ana, CA

Dec 2008 Stockton, CA

Feb 2009 COE / Santa Fe, NM

Mar 2009 Long Beach, CA

Jun 2009 Delegate Assembly / Indianapolis, IN

Sep 2009 Santa Rosa, CA

Dec 2009 San Diego, CA

Feb 2010 COE / Pasadena, CA

Apr 2010

Jun 2010

Oakland, CA

Delegate Assembly / Tacoma, WA

Sep 2010 Santa Cruz, CA

Dec 2010 Bakersfield, CA

Feb 2011 COE / Charleston, NC

Apr 2011

Jun 2011

San Jose, CA

Delegate Assembly / Rochester, NY

Sep 2011 Medford, OR

Dec 2011 San Diego, CA

HOST AGENCY RECORD

Bakersfield

Long Beach

Los Angeles

Medford,OR

Oakland

Oxnard

San Diego

San Francisco

San Jose

Santa Ana

Santa Cruz

Santa Rosa

Stockton

12/2004 & 12/2010

12/2005 & 03/2009

No host record

09/2011

12/2006 & 04/2010

09/2007

09/2006, 12/2009 & 12/2011

12/2007

09/2004 & 04/2011

09/2008

09/2010

09/2005 & 09/2009

12/2008

Bakersfield -

Long Beach -

Los Angeles -

Medford -

Oakland -

Oxnard -

San Diego -

San Francisco -

San Jose -

Santa Ana -

Santa Cruz -

Santa Rosa -

Stockton -

Sacramento -

2004

Dec

Sep

Mar

2005

Dec

Sep

Mar

BLOCK OUT DATES

State Compensation Insurance Fund Board Meetings

Apr 11-17 GII Spring Conference

GII Summer Conference

2006

Dec

Sep

Mar

2007

Sep

Dec

Mar

2008

Sep

Dec

Apr

2009 2010

Dec

Mar

COE/Feb

2011

Sep

Apr

Dec

Sep

Sep

Dec

Apr

2012

Sep

Mar

Dec

Council of California Goodwill Industries

2011 Public Policy Update

December 2, 2011

Budget Update – When they passed the state budget last year, Democratic lawmakers and

Governor Jerry Brown had hoped for a $4 billion increase in tax revenue through the current fiscal year. However, the state’s Legislative Analyst’s Office (LAO) report released last month shows that revenue — a majority of which comes from income, sales and corporate taxes — will run $3.7 billion lower than the state assumed. Therefore, California faces $2 billion in automatic “trigger” spending cuts. The cuts to be implemented after the first of the year include up to $100 million each to the University of California, California State University, developmental services and in-home support for seniors and the disabled. Community college fees would increase $10 per unit and reductions would be made for childcare assistance, library grants and prisons, among other programs. The LAO's report was one of two revenue projections called for in the state budget. The next will be released December 15 th

by the

Department of Finance. The automatic spending cuts will be based on whichever report contains the higher revenue projections.

With declining tax revenue and a rocky statewide economic outlook, the state can likely expect budget shortfalls for years to come. California's general fund has dropped from $103 billion at the start of the recession in 2007 to $86 billion this year, a decline of more than 16 percent.

Lawmakers have been making billions of dollars in cuts each year to cope with plunging tax revenue. California faces a $3 billion shortfall through the remainder of the fiscal year and is expected to have $10 billion less than the state needs in the fiscal year that begins July 1, 2012, resulting in a $13 billion gap over the next 18 months.

Legislative Update - The Senate and Assembly are on Legislative recess until January 4,

2012. The Governor had until October 11 to sign or veto all legislation sent to his desk. He signed AB 155 (Calderon), the “Expanded Nexus Law”. The bill was a negotiated deal giving

Amazon about a year reprieve from the tax and time to lobby at the federal level for legislation authorizing states to require sellers to collect taxes on sales of goods to in-state purchasers without regard to the seller's location. However, if federal legislation is not enacted by July 31,

2012, then Amazon will need to begin collecting the tax on September 15, 2012.

The Governor also signed AB 289 (Cedillo), which was supported by Goodwill. AB 289 extended the sunset date on the sales tax exemption for thrift stores operated for purposes of raising funds to provide medical or social services to AIDS patients.

Finally, the Governor signed SB 734 (DeSaulnier), a last minute gut-and-amend that contained the negotiated deal to SB 776 (DeSaulnier) and was supported by Goodwill. SB 734 requires that 25 percent of funds available under Title I of the federal Workforce Investment Act (WIA) that are provided to local workforce investment boards for adults and dislocated workers be spent on workforce training programs. This minimum may be met either by spending 25 percent of those base formula funds on training or by combining a portion of the base formula funds with leveraged funds, which was requested by Goodwill. The requirement increases to

30 percent in 2016.

Council of California Goodwill Industries

2011 Public Policy Update – December 2, 2011 – Page 2 of 2

Political Update - This year has been a flurry of activity on the political front; California welcomed a new Governor, replaced key legislative leaders and created new lines for

Legislative and Congressional districts. Furthermore, given the term-limited environment in

California and the adoption of the new “open primary” election process, we anticipate that there will be an almost 40% turnover of Legislators by November 2012. Therefore, it is imperative to continually educate Legislators on issues that are of key interest to Goodwill and focus on fostering relationships within the Capitol.

Health Care Reform - The California Health Benefit Exchange Board has met several times this year. The Board is empowered under California statutes to direct the Exchange for the state. If federal health care reform stays intact, California will be one of the first states to implement the important elements of reform, including a viable exchange for individuals to buy affordable insurance coverage. The Board recently adopted a resolution directing the

Exchange to move forward with a number of contracts to support its work in areas such as:

Communications, Health Plan Management and Small Business Health Options Programs. In the coming months, the Exchange will be conducting small group interview sessions across

California in conjunction with the Department of Health Care Services, the Managed Risk

Medical Insurance Board (MRMIB), leadership from the Department of Managed Health Care, the Department of Insurance and the Office of the Patient Advocate. These meetings will help inform both the Exchange and the California Health and Human Services Agency as it seeks input called for under a recently enacted statute, AB 1296.

Goodwill

2011 Legislative Update - Chaptered and Vetoed

November 28, 2011

AB 155 State Board of Equalization: administration: retailer engaged in business in this state

AB 289

AB 335

Sales and use taxes: exemption: charitable thrift stores

Workers' compensation: notices

CHAPTERED

CHAPTERED

CHAPTERED

CHAPTERED AB 554 Employment: workforce services

AB 1211

AB 1219

SB 201

Not-for-profit corporations

Credit cards: personal information

Flexible purpose corporations

State government: financial and administrative accountability

State and local workforce investment boards: funding

CHAPTERED

CHAPTERED

CHAPTERED

CHAPTERED SB 617

SB 734 CHAPTERED

VETOED AB 211 Workers' compensation: permanent disability benefits

AB 325

AB 584

Employee's right to bereavement leave

Workers' compensation: utilization review

VETOED

VETOED

AB 1310 Career technical education and workforce development

SB 931 Payroll cards

VETOED

VETOED

AB 155 ( Calderon, Charles D) State Board of Equalization: administration: retailer engaged in business in this state.

Status: 9/23/2011-Chaptered by the Secretary of State, Chapter Number 313, Statutes of 2011

Location: 9/23/2011-A. CHAPTERED

Summary:

Existing law imposes a sales tax on retailers measured by the gross receipts from the sale of tangible personal property sold at retail in this state, and a use tax on the storage, use, or other consumption in this state of tangible personal property purchased from a retailer for storage, use, or other consumption in this state, measured by sales price. That law requires every retailer engaged in business in this state, as defined, and making sales of tangible personal property for storage, use, or other consumption in this state to collect the tax from the purchaser. Existing law defines a "retailer engaged in business in this state" to include a retailer that has substantial nexus with this state and a retailer upon whom federal law permits the state to impose a use tax collection duty; a retailer entering into an agreement or agreements under which a person or persons in this state, for a commission or other consideration, directly or indirectly refer potential purchasers of tangible personal property to the retailer, whether by an Internet-based link or an Internet

Web site, or otherwise, provided that 2 specified conditions are met, including the condition that the retailer, within the preceding 12 months, has total cumulative sales of tangible personal property to purchasers in this state in excess of $500,000; and a retailer that is a member of a commonly controlled group, as defined under the Corporation Tax Law, and a member of a combined reporting group, as defined, that includes another member of the retailer's commonly controlled group that, pursuant to an agreement with or in cooperation with the retailer, performs services in this state in connection with tangible personal property to be sold by the retailer.

Position: Watch

Priority: 2

AB 211 ( Cedillo D) Workers' compensation: permanent disability benefits.

Status: 10/7/2011-Vetoed by the Governor

Location: 10/7/2011-A. VETOED

Summary:

Existing law establishes a workers' compensation system, administered by the Administrative Director of the Division of Workers' Compensation, to compensate an employee for injuries sustained in the course of his or her employment. Existing law, for injuries that cause permanent partial disability and occur on or after January 1, 2004, provides supplemental job displacement benefits in the form of a nontransferable voucher for education-related retraining or skill enhancement for an injured employee who does not return to work for the employer within 60 days of the termination of temporary disability, in accordance with a prescribed schedule based on the percentage of an injured employee's disability. Existing law provides an

1

exception for employers who meet specified criteria. This bill would provide that the above provisions shall apply to injuries occurring on or after January 1, 2004, and before January 1, 2012. This bill contains other related provisions.

Governor's Message:

I am returning Assembly Bill 211 without my signature. This bill represents an effort to improve benefits for workers by providing vouchers for those who need additional training in order to return to employment after permanently disabling injuries. I am, however, reluctant to enact piecemeal changes to the Workers'

Compensation system in the absence of more comprehensive reform that addresses both the cost and benefits under the system. Sincerely, Edmund G. Brown Jr.

Position: Watch

Priority: 2

AB 289 ( Cedillo D) Sales and use taxes: exemption: charitable thrift stores.

Status: 9/21/2011-Chaptered by the Secretary of State, Chapter Number 289, Statutes of 2011

Location: 9/21/2011-A. CHAPTERED

Summary:

The Sales and Use Tax Law imposes on retailers measured by the gross receipts from the sale in this state, or on the storage, use, or other consumption in this state of tangible personal property purchased from a retailer for storage, use, or other consumption in this state. The law provides various exemptions from this tax, including an exemption for retail items sold by thrift stores operated by nonprofit organizations, if the purpose of that thrift store is to obtain funding for medical, hospice, or social services provided to individuals with HIV or AIDS by the nonprofit organization. This exemption will be repealed January 1,

2012. This bill would extend that repeal date to January 1, 2019. This bill contains other related provisions and other existing laws.

Position: Support

Priority: 1

AB 325 ( Lowenthal, Bonnie D) Employee's right to bereavement leave.

Status: 10/9/2011-Vetoed by the Governor

Location: 10/9/2011-A. VETOED

Summary:

Existing law provides employees with the right to take time off work without discharge or discrimination for a number of reasons. This bill would prohibit an employer from refusing to grant a request by any employee to take up to 3 days of bereavement leave or to interfere with or restrain an employee from doing so. This bill would authorize an employee who has been discharged, disciplined, or discriminated against for exercising his or her right to bereavement leave to bring a civil action against his or her employer for reinstatement, specified damages, and attorney's fees. The provisions of the bill would not apply to an employee who is covered by a valid collective bargaining agreement that provides for bereavement leave and other specified working conditions.

Governor's Message:

I am returning Assembly Bill 325 without my signature. Granting bereavement leave when a close family member dies is the moral and decent thing to do and I believe that the vast majority of employers voluntarily make such an accommodation for the loss of a loved one. I am also concerned that this measure adds a more far reaching private right to sue than is contained in related statutes. Sincerely, Edmund G.

Brown Jr.

Position: Watch

Priority: 2

AB 335 ( Solorio D) Workers' compensation: notices.

Status: 10/7/2011-Chaptered by the Secretary of State, Chapter Number 544, Statutes of 2011

Location: 10/7/2011-A. CHAPTERED

Summary:

Existing law establishes a workers' compensation system, administered by the Administrative Director of the Division of Workers' Compensation, to compensate an employee for injuries sustained in the course of his or her employment. Existing law establishes, in the Department of Industrial Relations, the Commission on Health and Safety and Workers' Compensation. Existing law requires that specified notices be provided

2

to injured employees and prescribes the contents of notices that are required to be posted, given to, or mailed to an employee. Existing law provides for specified procedures to be used in notifying employees regarding benefits and required actions in pursuing a workers' compensation claim. This bill would require the administrative director, in consultation with the commission, to prescribe reasonable rules and regulations for serving certain notices on an employee. This bill would require the administrative director, in consultation with the commission, to develop, make fully accessible on the department's Internet Web site, and make available at district offices informational material written in plain language that describes the overall workers' compensation claims process. This bill would require each notice to be written in plain language and to reference the informational material to enable employees to understand the context of the notices. This bill would modify provisions required to be in, and procedures for, specified notices, and would delete a requirement for notice by certified mail, and would make conforming changes.

Position: Watch

Priority: 2

AB 554 ( Atkins D) Employment: workforce services.

Status: 10/6/2011-Chaptered by the Secretary of State, Chapter Number 499, Statutes of 2011

Location: 10/6/2011-A. CHAPTERED

Summary:

The federal Workforce Investment Act of 1998 provides for workforce investment activities, including activities in which states may participate. Existing law contains various programs for job training and employment investment, including work incentive programs, as specified. This bill would require the

California Workforce Investment Board and each local board to ensure that programs and services funded by the Workforce Investment Act of 1998 and directed to apprenticeable occupations, including preapprenticeship training, are conducted in coordination with one or more apprenticeship programs approved by the Division of Apprenticeship Standards for the occupation and geographic area. The bill would also require the California Workforce Investment Board and each local board to develop a policy of fostering collaboration between community colleges and approved apprenticeship programs in the geographic area to provide preapprenticeship training, apprenticeship training, and continuing education in apprenticeable occupations through the approved apprenticeship programs.

Position: Support

Priority: 1

AB 584 ( Fong D) Workers' compensation: utilization review.

Status: 10/7/2011-Vetoed by the Governor

Location: 10/7/2011-A. VETOED

Summary:

Existing workers' compensation law generally requires employers to secure the payment of workers' compensation, including medical treatment, for injuries incurred by their employees that arise out of, or in the course of, employment. This bill would require the psychologist to be licensed by California state law.

This bill contains other related provisions and other existing laws.

Governor's Message:

I am returning Assembly Bill 584 without my signature. This bill would require that the physician conducting utilization review of requests for medical treatment in Workers Compensation claims be licensed in California. This requirement of using only California-licensed physicians to conduct utilization review in Workers Compensation cases would be an abrupt change and inconsistent with the manner in which utilization review is conducted by health care service plans under the Knox-Keene Act and by those regulated by the California Department of Insurance. I am not convinced that establishing a separate standard for Workers Compensation utilization review makes sense. Sincerely, Edmund G. Brown Jr.

Position: Watch

Priority: 2

AB 1211 ( Silva R) Not-for-profit corporations.

Status: 10/3/2011-Chaptered by the Secretary of State, Chapter Number 442, Statutes of 2011

Location: 10/3/2011-A. CHAPTERED

Summary:

Existing law provides for the formation and operations of nonprofit corporations. Existing law provides for establishing a quorum of a board of directors to take action at a meeting and allows the articles of

3

incorporation or bylaws to require the presence of specified directors in order to constitute a quorum.

Existing law provides that the death of a director excuses requiring the presence of that director to establish a quorum. Existing law authorizes a board of directors to take action by unanimous written consent in lieu of a meeting without the consent of an interested director, as defined. This bill would instead provide that death or nonexistence of a director excuses requiring the presence of a specified director to establish a quorum. The bill would also revise the definition of an "interested director," as specified. This bill contains other related provisions and other existing laws.

Position: Watch

Priority: 2

AB 1219 ( Perea D) Credit cards: personal information.

Status: 10/9/2011-Chaptered by the Secretary of State, Chapter Number 690, Statutes of 2011

Location: 10/9/2011-A. CHAPTERED

Summary:

Existing state and federal law regulate the provision of credit and the use of credit cards. Existing state law prohibits a person, firm, partnership, association, or corporation that accepts credit cards for the transaction of business from requesting or requiring the cardholder to provide personal identification information, which is then recorded, as a condition to accepting the credit card as payment in full or in part for goods or services, but provides various exceptions to this prohibition. Existing law excepts from this prohibition the instance when the person or entity accepting the card is contractually obligated to provide personal identification information in order to complete the transaction or is obligated to collect and record the identification information by federal law. This bill would except from the prohibition described above the instance when the person or entity accepting the card uses Zip Code information for prevention of fraud, theft, or identity theft in specified retail motor fuel transactions, and would specify that state law obligations are also permissible reasons to collect and record personal information. This bill contains other related provisions.

Position: Watch

Priority: 2

AB 1310 ( Furutani D) Career technical education and workforce development.

Status: 10/8/2011-Vetoed by the Governor

Location: 10/8/2011-A. VETOED

Summary:

Existing law establishes the California Workforce Investment Board as the body responsible for assisting the Governor in the development, oversight, and continuous improvement of California's workforce investment system. Existing law also establishes the Labor and Workforce Development Agency, which consists of the Office of the Secretary of Labor and Workforce Development, the Agricultural Labor

Relations Board, the California Workforce Investment Board, the Department of Industrial Relations, and the Employment Development Department. This bill would require the Secretary of Labor and Workforce

Development, in conjunction with the California Workforce Investment Board, the Office of the Chancellor of the California Community Colleges, the State Department of Education, and the California

Postsecondary Education Commission, to develop a strategic plan, required to contain specified elements, for connecting the delivery of education and workforce development. The bill would authorize the

Secretary of Labor and Workforce Development to commence the strategic plan only upon a determination by the Director of Finance that sufficient federal funds or private donations are available to the state to fully support the activities required for development of the strategic plan.

Governor's Message:

I am returning Assembly Bill 1310 without my signature. This bill would require the Labor and Workforce

Development Agency, in conjunction with the California Workforce Investment Board, the Office of the

Chancellor of the California Community Colleges, the State Department of Education, to develop a strategic plan that connects the delivery of education and workforce development in California. Although I heartily agree with the author's goal, I don't think a new law is needed. My Senior Advisor for Jobs and

Economic Development and my Secretary of Labor are already working with educators, labor and business leaders to achieve the important objectives of this bill. I have asked them to work with the author and supporters of the bill to make sure their good ideas are acted on. Sincerely, Edmund G. Brown Jr.

Position: Watch

Priority: 2

4

SB 201 ( DeSaulnier D) Flexible purpose corporations.

Status: 10/9/2011-Chaptered by the Secretary of State, Chapter Number 740, Statutes of 2011

Location: 10/9/2011-S. CHAPTERED

Summary:

Existing law authorizes and regulates the formation and operation of corporations and nonprofit corporations and specifies the respective purposes for which they may lawfully be formed. Existing law specifies the duties of corporate directors and the rights of shareholders. This bill would enact the

Corporate Flexibility Act of 2011 and would authorize and regulate the formation and operation of a new form of corporate entity known as a flexible purpose corporation. The bill would authorize existing corporations and other forms of business entities to merge into or convert into a flexible purpose corporation upon completion of specified requirements, including approval of the transaction by a supermajority 2/3 vote of shareholders, or a greater vote if required in the articles, as specified. The bill would also authorize a flexible purpose corporation to convert into a nonprofit corporation, a corporation, or a domestic other business entity, upon satisfaction of equivalent conditions. The bill would also provide dissenters' rights of appraisal for shareholders voting against certain transactions, as specified. The bill would specify the required and permitted contents of articles of incorporation that a flexible purpose corporation would be required to file with the Secretary of State, including the special purposes, in addition to any other lawful purpose, that the corporation shall engage in, which may include, but are not limited to, charitable and public purpose activities that could be carried out by a nonprofit public benefit corporation.

The bill would also require management and directors to specify objectives for measuring the impact of the flexible purpose corporation's efforts relating to its special purpose, and to include an analysis of those efforts in annual reports, together with specified financial statements, to shareholders and would require specified information to be made publicly available, as specified. The bill would also specify that a flexible purpose corporation is subject to many existing provisions of the Corporations Code. The bill would also make conforming changes. This bill contains other related provisions.

Position: Watch

Priority: 1

SB 617 ( Calderon D) State government: financial and administrative accountability.

Status: 10/6/2011-Chaptered by the Secretary of State, Chapter Number 496, Statutes of 2011

Location: 10/6/2011-S. CHAPTERED

Summary:

The Administrative Procedure Act governs the procedures for the adoption, amendment, or repeal of regulations by state agencies and for the review of those regulatory actions by the Office of Administrative

Law. Existing law establishes procedures for notifying interested persons of the proposed adoption, amendment, or repeal of a regulation. Existing law establishes procedures a state agency is required to use to make a determination of whether a proposed administrative regulation or proposed amendment to an administrative regulation has the potential for significant, statewide adverse economic impact directly affecting California business enterprises. This bill would revise various provisions of the act with respect to the duties of the Office of Administrative Law and state agencies in the adoption, amendment, or repeal of regulations. The bill would also require each state agency to prepare a standardized regulatory impact analysis, as specified, with respect to the adoption, amendment, or repeal of a major regulation, as defined, that is proposed on or after November 1, 2013. The bill would require that the agency submit the analysis to the Department of Finance for review and comments, as specified, which would be required to be included with the notice of proposed action. This bill contains other related provisions and other existing laws.

Position: Support

Priority: 2

SB 734 ( DeSaulnier D) State and local workforce investment boards: funding.

Status: 10/6/2011-Chaptered by the Secretary of State, Chapter Number 498, Statutes of 2011

Location: 10/6/2011-S. CHAPTERED

Summary:

The federal Workforce Investment Act of 1998 provides for workforce investment activities, including activities in which states may participate. Existing law establishes the California Workforce Investment

Board (CWIB), and specifies that the CWIB is responsible for assisting the Governor in the development, oversight, and continuous improvement of California's workforce investment system. Existing law contains various programs for job training and employment investment, including work incentive programs, as

5

specified, and establishes local workforce investment boards to perform various duties related to the implementation and coordination of local workforce investment activities. This bill would require local workforce investment boards to spend a certain percentage of available federal funds for adults and dislocated workers on workforce training programs in a manner consistent with federal law, as prescribed, and would allow the boards to leverage specified funds to meet the funding requirements, as specified. This bill contains other related provisions and other existing laws.

Position: Support

Priority: 1

SB 931 ( Evans D) Payroll cards.

Status: 10/9/2011-Vetoed by the Governor

Location: 10/10/2011-S. VETOED

Summary:

Existing law prohibits an employer from issuing in payment of wages due certain instruments, including an order, check, draft, note, memorandum, scrip, coupon, card, or other acknowledgment of indebtedness or redeemable instrument, unless specified requirements are satisfied. This bill would authorize an employer to pay an employee's wages by means of a payroll card, as defined, provided that specified requirements are satisfied. In addition, the bill would make a violation of its provisions a misdemeanor and would subject a violator to specified civil penalties. By creating new crimes, this bill would impose a state-mandated local program. This bill contains other related provisions and other existing laws.

Governor's Message:

I am returning Senate Bill 931 without my signature. Pay cards provide workers without bank accounts a way of avoiding high check cashing fees. They are now used by thousands of California employees and employers. This bill seeks to contain costs for workers who choose to accept pay cards, a goal with which I agree. Unfortunately, this bill goes too far. It would impose numerous and costly new requirements on pay card providers. A likely result of these mandates is that banks and employers may simply stop offering this service, injuring the very workers this bill aims to protect. I strongly believe that reasonable protections are needed for those who use pay cards. I will work with the bill's proponents and the financial institutions to forge a better solution that I can sign into law. Sincerely, Edmund G. Brown Jr.

Position: Watch

Priority: 1

6

Goodwill

2011-12 Legislative Update

November 28, 2011

Priority 1

AB 350 ( Solorio D) Displaced Janitor Opportunity Act.

Last Amended: 9/2/2011

Status: 9/10/2011-Read third time. Refused passage. (Ayes 17. Noes 18. Page 2488.).

Location: 9/6/2011-S. THIRD READING

Summary:

Existing law, the Displaced Janitor Opportunity Act, requires contractors and subcontractors, that are awarded contracts or subcontracts by an awarding authority to provide janitorial or building maintenance services at a particular job site or sites, to retain, for a period of 60 days, certain employees who were employed at that site by the previous contractor or subcontractor. The act requires the successor contractors and subcontractors to offer continued employment to those employees retained for the 60-day period if their performance during that 60-day period is satisfactory. The act authorizes an employee who was not offered employment or who has been discharged in violation of these provisions by a successor contractor or successor subcontractor, or an agent of the employee, to bring an action against a successor contractor or successor subcontractor in any superior court of the state having jurisdiction over the successor contractor or successor subcontractor, as specified. This bill would rename the act the Displaced

Property Service Employee Opportunity Act and make the provisions of the act applicable to property services, which would consist of licensed security, as defined, window cleaning, food cafeteria and dietary services, janitorial services, andbuilding maintenance services. This bill would exclude from the definitions of "contractor" and

"subcontractor" specified types of food service providers. The bill also would make conforming changes.

Position: Oppose_Unless_Amended

Priority: 1

AB 1294 ( Furutani D) Juvenile reentry programs.

Last Amended: 4/25/2011

Status: 5/28/2011-Failed Deadline pursuant to Rule 61(a)(5). (Last location was APPR. on 5/27/2011)

Location: 5/28/2011-A. 2 YEAR

Summary:

Existing law generally regulates juvenile offenders, including provisions pertaining to juveniles under the jurisdiction of county probation departments. This bill would, to the extent funding is appropriated for its purposes, require that not more than 45 days before a youth is scheduled to be released from a facility or program operated by a county juvenile probation department, that department shall determine whether the youth is eligible for one or more community reentry programs, as specified. The bill would provide that upon a determination of eligibility, the county probation department would,

1

not less than 20 days before release, coordinate an evaluation for enrollment and actual enrollment of the youth into a community reentry program. The bill would establish the minimum level of services to be provided by the community reentry programs. F By imposing additional burdens on local governments, this bill would impose a statemandated local program. This bill contains other related provisions and other existing laws.

Position: Support

Priority: 1

SB 776 ( DeSaulnier D) State and local workforce investment boards: funding.

Last Amended: 8/15/2011

Status: 8/26/2011-Failed Deadline pursuant to Rule 61(a)(11). (Last location was APPR.

SUSPENSE FILE on 8/18/2011)

Location: 8/26/2011-S. 2 YEAR

Summary:

The federal Workforce Investment Act of 1998 provides for workforce investment activities, including activities in which states may participate. Existing law establishes the

California Workforce Investment Board (CWIB), and specifies that the CWIB is responsible for assisting the Governor in the development, oversight, and continuous improvement of California's workforce investment system. Existing law contains various programs for job training and employment investment, including work incentive programs, as specified, and establishes local workforce investment boards to perform various duties related to the implementation and coordination of local workforce investment activities. This bill would require local workforce investment boards to spend a certain percentage of available federal funds for adults and dislocated workers on workforce training programs in a manner consistent with federal law, as prescribed. This bill contains other related provisions and other existing laws.

Position: Support as amended

Priority: 1

Priority 2

AB 10 ( Alejo D) Minimum wage: annual adjustment.

Last Amended: 3/14/2011

Status: 5/28/2011-Failed Deadline pursuant to Rule 61(a)(5). (Last location was APPR. on 5/27/2011)

Location: 5/28/2011-A. 2 YEAR

Summary:

Existing law requires that, on and after January 1, 2008, the minimum wage for all industries be not less than $8.00 per hour. This bill would increase the minimum wage, as of January 1, 2012, to not less than $8.50 per hour. This bill contains other related provisions.

Position: Watch

Priority: 2

2

AB 15 ( V. Manuel Pérez D) Workforce development: California Renewable

Energy Workforce Readiness Initiative: local workforce investment boards.

Status: 5/10/2011-Failed Deadline pursuant to Rule 61(a)(2). (Last location was L. & E. on 1/24/2011)

Location: 5/10/2011-A. 2 YEAR

Summary:

Existing law, the California Workforce Investment Act, establishes the California

Workforce Investment Board (CWIB), which is the body responsible for assisting the

Governor in the development, oversight, and continuous improvement of California's workforce investment system, and prescribes the functions and duties of the board with regard to the implementation and administration of workforce training and development programs. Existing law establishes the Green Collar Jobs Council (GCJC) as a special committee in the CWIB, comprised of specified members, to assist in providing workforce development and job training relating to green collar jobs. This bill would require the CWIB, by July 1, 2012, in consultation with the Green Collar Jobs Council

(GCJC), to establish the California Renewable Energy Workforce Readiness Initiative to ensure green collar career placement and advancement opportunities within California's renewable energy generation, manufacturing, construction, installation, maintenance, and operation sectors that is targeted toward specified populations.

Position: Watch

Priority: 2

AB 59 ( Swanson D) Family and medical leave.

Status: 5/28/2011-Failed Deadline pursuant to Rule 61(a)(5). (Last location was APPR. on 5/27/2011)

Location: 5/28/2011-A. 2 YEAR

Summary:

Existing law, the Moore-Brown-Roberti Family Rights Act, makes it an unlawful employment practice for an employer, as defined, to refuse to grant a request by an eligible employee to take up to 12 workweeks of unpaid protected leave during any 12month period (1) to bond with a child who was born to, adopted by, or placed for foster care with, the employee, (2) to care for the employee's parent, spouse, or child who has a serious health condition, as defined, or (3) because the employee is suffering from a serious health condition rendering him or her unable to perform the functions of the job.

Under the act, "child" means a biological, adopted, foster, or stepchild, a legal ward, or a child of a person standing in loco parentis, who is either under 18 years of age or an adult dependent child. The act defines "parent" to mean the employee's biological, foster, or adoptive parent, stepparent, legal guardian, or other person who stood in loco parentis to the employee when the employee was a child.

Position: Watch

Priority: 2

3

AB 153 ( Skinner D) State Board of Equalization: administration: retailer engaged in business in this state.

Last Amended: 6/27/2011

Status: 7/8/2011-Failed Deadline pursuant to Rule 61(a)(10). (Last location was G. & F. on 6/27/2011)

Location: 7/8/2011-S. 2 YEAR

Summary:

The Sales and Use Tax Law imposes a tax on retailers measured by the gross receipts from the sale of tangible personal property sold at retail in this state, or on the storage, use, or other consumption in this state of tangible personal property purchased from a retailer for storage, use, or other consumption in this state, measured by sales price. That law defines a "retailer engaged in business in this state" to include retailers that engage in specified activities in this state and requires every retailer engaged in business in this state and making sales of tangible personal property for storage, use, or other consumption in this state to register with the State Board of Equalization and to collect the tax from the purchaser and remit it to the board.

Position: Watch

Priority: 2

AB 254 ( Beall D) Developmental services: Employment First Policy.

Status: 5/10/2011-Failed Deadline pursuant to Rule 61(a)(2). (Last location was HUM.

S. on 2/18/2011)

Location: 5/10/2011-A. 2 YEAR

Summary:

The Lanterman Developmental Disabilities Services Act authorizes the State Department of Developmental Services to contract with regional centers to provide support and services to individuals with developmental disabilities. The services and supports to be provided to a regional center consumer are contained in an individual program plan (IPP), developed in accordance with prescribed requirements. This bill would require the regional center, when developing an individual program plan for a transition age youth or working age adult, to be guided by the Employment First Policy. The bill also, beginning when a consumer is 14 years of age, would require the planning team to discuss schoolto-work opportunities during individual program plan meetings and to inform the consumer, parent, legal guardian, or conservator that the regional center is available, upon request, to participate in the consumer's individualized education plan meetings to discuss transition planning. The bill would require the planning team, as part of the individual program plan process for working age adults, to address integrated employment opportunities, while respecting the consumer's right to choose. This bill contains other existing laws.

Position: Watch

Priority: 2

AB 298 ( Brownley D) Recycling: reusable bags.

4

Last Amended: 4/14/2011

Status: 7/8/2011-Failed Deadline pursuant to Rule 61(a)(10). (Last location was E.Q. on

5/12/2011)

Location: 7/8/2011-S. 2 YEAR

Summary:

Existing law, part of the California Integrated Waste Management Act of 1989, as administered by the Department of Resources Recycling and Recovery, requires an operator of a store, as defined, to establish an at-store recycling program that provides customers the opportunity to return clean plastic carryout bags to that store and to make reusable bags available to customers. A violation of these requirements is subject to civil liability penalties imposed by a local agency or the state. These requirements are repealed on January 1, 2013. This bill would prohibit a manufacturer from selling or distributing a reusable bag, as defined, in this state if the bag is designed or intended to be sold or distributed to a store's customers, unless the guidelines for the cleaning and disinfection of the bag are printed on the bag or on a tag attached to the bag.

Position: Watch

Priority: 2

AB 326 ( Cedillo D) Counterfeit marks.

Status: 5/13/2011-Failed Deadline pursuant to Rule 61(a)(3). (Last location was PUB. S. on 3/3/2011)

Location: 5/13/2011-A. 2 YEAR

Summary: