View - Tanzania Ports Authority

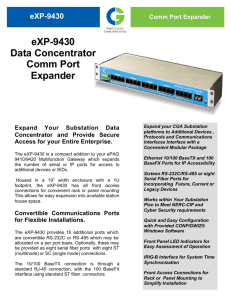

advertisement