THOMSON REUTERS

CORE COMMODITY CRB INDEX

CRB – the first name in commodities

For more than 50 years, the CRB Index has served as the most recognized

measure of global commodities markets.

The index is comprised of 19 commodities

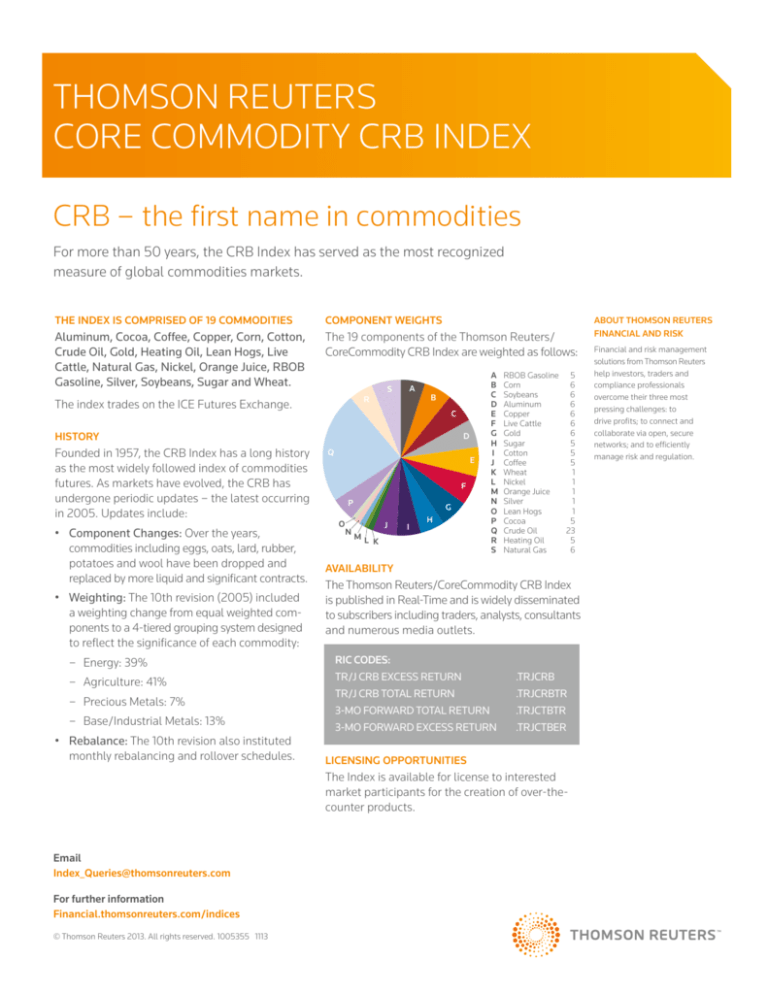

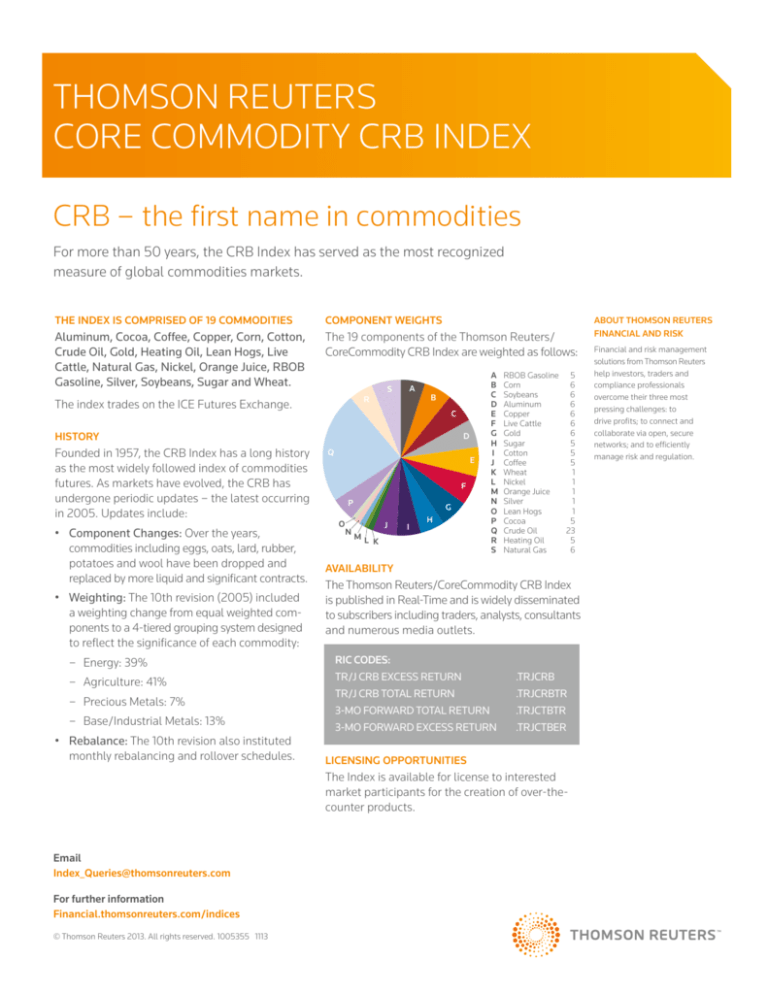

COMPONENT WEIGHTS

Aluminum, Cocoa, Coffee, Copper, Corn, Cotton,

Crude Oil, Gold, Heating Oil, Lean Hogs, Live

Cattle, Natural Gas, Nickel, Orange Juice, RBOB

Gasoline, Silver, Soybeans, Sugar and Wheat.

The 19 components of the Thomson Reuters/

CoreCommodity CRB Index are weighted as follows:

R

The index trades on the ICE Futures Exchange.

A

S

B

C

HISTORY

Founded in 1957, the CRB Index has a long history

as the most widely followed index of commodities

futures. As markets have evolved, the CRB has

undergone periodic updates – the latest occurring

in 2005. Updates include:

•Component Changes: Over the years,

commodities including eggs, oats, lard, rubber,

potatoes and wool have been dropped and

replaced by more liquid and significant contracts.

• W

eighting: The 10th revision (2005) included

a weighting change from equal weighted components to a 4-tiered grouping system designed

to reflect the significance of each commodity:

– Energy: 39%

– Agriculture: 41%

– Precious Metals: 7%

– Base/Industrial Metals: 13%

• R

ebalance: The 10th revision also instituted

monthly rebalancing and rollover schedules.

D

Q

E

F

P

O

N

G

J

ML

K

I

H

A RBOB Gasoline 5

BCorn

6

CSoybeans

6

DAluminum

6

ECopper

6

F Live Cattle

6

GGold

6

HSugar

5

ICotton

5

JCoffee

5

KWheat

1

LNickel

1

M Orange Juice

1

NSilver

1

O Lean Hogs

1

PCocoa

5

Q Crude Oil

23

R Heating Oil

5

S Natural Gas

6

AVAILABILITY

The Thomson Reuters/CoreCommodity CRB Index

is published in Real-Time and is widely disseminated

to subscribers including traders, analysts, consultants

and numerous media outlets.

RIC CODES:

TR/J CRB EXCESS RETURN

TR/J CRB TOTAL RETURN

3-MO FORWARD TOTAL RETURN 3-MO FORWARD EXCESS RETURN .TRJCRB

.TRJCRBTR

.TRJCTBTR

.TRJCTBER

LICENSING OPPORTUNITIES

The Index is available for license to interested

market participants for the creation of over-thecounter products.

Email

Index_Queries@thomsonreuters.com

For further information

Financial.thomsonreuters.com/indices

© Thomson Reuters 2013. All rights reserved. 1005355 1113

About thomson reuters

financial and risk

Financial and risk management

solutions from Thomson Reuters

help investors, traders and

compliance professionals

overcome their three most

pressing challenges: to

drive profits; to connect and

collaborate via open, secure

networks; and to efficiently

manage risk and regulation.