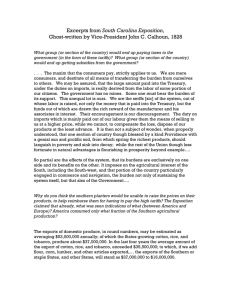

trade restrictions and africa's exports

advertisement