Ecological Economics 26 (1998) 227 – 242

ANALYSIS

Biological and economic foundations of renewable resource

exploitation

U. Regev a,*, A.P. Gutierrez b, S.J. Schreiber b, D. Zilberman c

a

Department of Economics and the Monaster Center for Economic Research, Ben Gurion Uni6ersity, 84105 Beer-She6a, Israel

b

Di6ision of Ecosystem Science, College of Natural Resources, Uni6ersity of California, Berkeley CA 94720, USA

c

Department of Agricultural Economics, College of Natural Resources, Uni6ersity of California, Berkeley CA 94720, USA

Received 10 December 1996; received in revised form 2 June 1997; accepted 12 June 1997

Abstract

A physiologically based population dynamics model of a renewable resource is used as the basis to develop a model

of human harvesting. The model incorporates developing technology and the effects of market forces on the

sustainability of common property resources. The bases of the model are analogies between the economics of resource

harvesting and allocation by firms and adapted organisms in nature. Specifically, the paper makes the following

points: (1) it shows how economic and ecological theories may be unified; (2) it punctuates the importance of time

frame in the two systems (evolutionary versus market); (3) it shows, contrary to prevailing economic wisdom, how

technological progress may be detrimental to resource preservation; (4) it shows how the anticipated effects of high

discount rates on resource use can be catastrophic when synergized by progress in harvesting technology; (5) it

suggests that increases in efficiency of utilization of the harvest encourages higher levels of resource exploitation; and

(6) it shows the effects of environmental degradation on consumer and resource dynamics. The model leads to global

implications on the relationship between economic growth and the ability of modern societies to maintain the

environment at a sustainable level. © 1998 Elsevier Science B.V. All rights reserved.

Keywords: Population dynamics; Fitness; Adaptedness; Energy flow; Technological progress; Resource utilization

* Corresponding author.

0921-8009/98/$19.00 © 1998 Elsevier Science B.V. All rights reserved.

PII S0921-8009(97)00103-1

228

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

‘‘Man stalks across the landscape, and desert

follows his footsteps’’

Herodotus (5th century B.C.)

1. Introduction

The fate of humankind will be determined by

how sustainable ecosystems and the renewable

resource species in them are managed. Species in

nature evolved via Darwinian processes in response to interactions among members of the

same species, with other species, and their physical environment and its carrying capacity. Human

harvesting of some species is an additional ever

increasing burden of mortality that has only been

recently imposed, often based upon unrealistic

assumption of maximum sustainable yield (Getz

and Haight, 1989; Hilborn et al., 1995). Only the

human predator has escaped regulation of its

numbers, and through ingenuity forestalled

Malthus’ ‘doomsday prediction’ concerning excessive human population. This has been explained

by capital accumulation and technological progress (exogenous or endogenous) including the

discovery of new goods and methods of production since the industrial revolution (Schumpeter,

1934; Solow, 1956, 1970). This enabled increases

in production in agriculture in its various forms,

the harvests of naturally occurring resources, and

increase in resource processing and distribution.

Recent economic literature on growth posits that

given non-ending technological progress, food

production will continue to outpace demand for

several centuries, ignoring natural resource limitations with optimistic views about the role of technology in surmounting resource scarcity and

environmental degradation (Grossman and Helpman, 1994; Barro and Sala-I-Martin, 1995;

Romer, 1990).

In contrast, many ecologists and some

economists recognize limits to human population

growth set by the relative rates of renewable

resource exploitation and regeneration, and by the

increasing degradation our finite world (Hardin,

1993; Solow, 1993; Daly, 1994). Despite this, the

economic literature on renewable resource exploitation largely ignores or oversimplifies the biological basis of the ‘reproductive surplus’ that is

the basis of sustainable yield approaches (Hilborn

et al., 1995). While many technological advances

have produced positive private and societal economic benefits, some have caused disastrous environmental problems (e.g. excessive agronomic

inputs, van den Bosch, 1978) and others have led

to over-exploitation of renewable resource populations (e.g. fisheries worldwide, Hilborn et al.,

1995). The invisible hand of the market has especially failed to prevent the over-exploitation and

destruction of many common property resources

that have free access characteristics (Gordon,

1954; Hardin, 1968).

This paper examines the effects of technological

progress and discount rate on the sustainability of

free access renewable resources. The terms ‘human’ and ‘firm’ are used interchangeably as the

firm is single owner. A physiologically-based

predator-prey (i.e. firm-resource) population dynamics model is extended to include humans with

their associated technology as the top predator in

the food chain (e.g. alga krill whale

whalers). The model incorporates the realism of

hierarchical energy flow between feeding (i.e.

trophic) levels (Gutierrez and Baumgärtner, 1984)

and captures the essence of the competition between harvesting units (Gutierrez et al., 1994;

Schreiber and Gutierrez, 1997). Our analysis has

parallels in the bio-economic study of adapted

species in nature using the same model (Gutierrez

et al., 1997). That paper should be considered

dual to this one.

2. The biological basis of renewable resource

harvesting

2.1. A common model for humans and other

species

At the dawn of time, primitive humans were

scavenger-gatherers buffeted by the vagaries of

the environment. In their primal state, humans

differed little from all other animal species in

nature having finite demand for resources, and

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

229

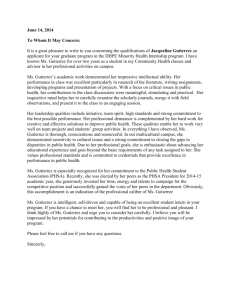

Fig. 1. Analogous allocation of resources in biology and human economies.

their numbers were regulated by bottom-up (decreasing resources) and top-down (natural enemies including diseases) factors which limited

their capacities to overexploit their environment.

They were an integral part of the food chain and

their capacities and demands for resources were

constrained by genetics molded by natural selection in an ecosystem context (Gutierrez et al.,

1997). However, evolving increased mental capacities enabled humans to escape some of the uncertainty of their environment and the regulation of

their numbers, and to develop technologies that

enabled them to exploit their environment at increasingly higher rates. As human societies developed, their demand rates for resources also

increased and larger investments were made in

social organization that further enhanced their

capacity to harvest resources. The model is flexible enough to capture these different stages of

human evolution.

Despite their progress, humans, like all organisms, must acquire resources and allocate them

(Gutierrez and Curry, 1989), and this is the basis

for extending the biological model to human

economies. Analogies between biological and

modern economic processes were proposed by

Winter (1971) and extended by Gutierrez and

Regev (1983). Nature (or the ecosystem) is

analogous to the economic system, energy is the

currency in biology, individual organisms are

equated to single-owner firms (individuals), fitness

is profit (i.e. what can be invested in the next

cycle), organism genetics are akin to firm decision

rules, adaptivity of individual species to long-term

firm survival strategies, and markets are

analogous to Darwinian processes, etc. Profit

maximization is the assumed goal of individuals

(fitness in other organisms), and selection for or

against strategies occurs at the level of the individual in both systems.

Fig. 1 shows the energy flow in a specific food

chain where humans are the top consumer

(Gutierrez and Curry, 1989), but harvesting of

more than one resource level (say, krill and whale)

is also possible. In nature, the source of energy

used by most life forms is the sun which is captured via photosynthesis by primary producers

(plants) in the chemical bonds of simple sugars.

Some of this energy is used to acquire other

essential nutrients required to form complex

molecules for growth. Plants, be they simple single celled alga or large trees, are ultimately eaten

by herbivores as the energy travels up the food

chain to other biological and economic consumers. At some point in human evolution, resources were valued by price so that monetary

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

230

value replaced energy. However, despite the different units of flow, the acquisition and allocation

functions per individual at all levels have the same

form, and the allocations of resources within levels uses the same priority scheme (Gutierrez and

Wang, 1977): first to unassimilated wastes (excretion in animals or wastage in human production

systems), respiration (maintenance costs), reproduction (profits) and somatic growth (capital investment). The analogies between the biological

and economic systems are consistent in most respects including the notion of the discount rate,

analogous in biology to the genetically based expectation of environmental hazard (Gutierrez et

al., 1997). Unlike most other species, the transition from primal humans (true animals) to modern humans has had both Darwinian (genetic) and

quasi-Lamarkian (non-genetic learning) aspects.

Further important differences are that modern

human economic rationale for resource acquisition is driven by hedonistic lust for material

goods, and allocations may be made to consumption that does not contribute to growth. In biology, demands for resources are genetically based

and finite, and allocations are invested in strategies that increase adaptivity to the environment

but may not contribute directly to growth

(Gutierrez et al., 1997). This conceptual model of

energy flow between trophic levels (i.e. the currency of biological systems) is the foundation for

our economic model of resource depletion

(Gutierrez et al., 1994).

2.2. The biological model

Assume a food chain with primal humans as

the top predator (e.g. Fig. 1). Let Mi (i =1,…, n)

denote the mass of the ith trophic level, where n is

the top predator, then following Gutierrez et al.

(1994) and Schreiber and Gutierrez (1997), the

dynamics of any trophic level (except for the top

predator) is governed by the following equation

of motion:

dMi (t)

= ui Mi Di h(si ) −ni (Di )Mi

dt

− Mi + 1Di + 1h(si + 1)

(1)

where h is concave with si = (ai Mi − 1)/(Di Mi ) and

h%(0)= h() = 1. A discussion of alternative preypredator models is given in Yodzis (1994). The

concavity of h is easily demonstrated in biology

by simple enzyme kinetics and animal feeding

experiments (Holling, 1966) or yield effort relationship of human harvesting. Since, d/dx[Dh(ax/

D)]x = 0 = a, and limx Dh(ax/D)=D the

conditions h%(0)= h() = 1 are not restrictive.

The top predator obeys the same relation, except

that the rightmost term in Eq. (1) is missing. The

lowest level resource (M0) in the food chain is

incident solar energy, and it is considered fixed.

The parameters of the model are: ai, i= 1,…, n is

the proportion of the i− 1 trophic level accessible

to the i-th trophic level (0B ai B 1); Di is the

maximal rate per unit mass of the i-th trophic

level extractable from level i −1; ui is the conversion efficiency of the i-th trophic level, and (1−

ui) is the proportion of the resource lost through

wastage; ni (Di ) is respiration or cost rate per unit

mass as a function of the potential extraction rate;

and Ci is per unit mass cost spent on adaptedness

to meet expected environmental hazards.

The function h(si ) incorporates the biology of

resource acquisition by individuals, and represents

the probability of achieving resource catch rate

Di. Specifically, the supply-demand ratio (Arditi

and Ginzburg, 1989) is included in the model

using the form h(si )= 1−exp(−ai Mi − 1/Di Mi )

(Gutierrez, 1992; Gutierrez et al., 1994). This

model captures the effects of random search, variable resource availability and demand for the

resource, as well as intra-trophic level competition

for resource acquisition. Thus h(si ) is the proportion of the demand acquired (i.e. the supply-demand ratio). The rate of resource (Mi − 1)

depletion by all members of the i-th trophic level

is DiMih(si ), and it is readily verified that

Di Mi h(si )5 ai Mi − 1 with ai 5 1 setting the limit

on the extraction from the lower trophic level.

When ai is sufficiently low compared to the maximum biomass reproductive rate of level i− 1

(ai 5 ui − 1Di − 1 − ni − 1(Di − 1)), the lower topic

level will survive any population size and demand

rate of its predator (Gutierrez et al., 1994). Thus

(1−ai ) can be viewed as a safe refuge of the i-1

trophic level from predation guaranteeing its sur-

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

vival. This point will be revisited later because of

its importance to harvesting policy for modern

humans. The biological model has been widely

applied to natural resource problems (Gutierrez,

1996).

231

benefit. The notation in Eq. (1) is simplified by

substituting y for Mn, the human predator that

harvests a lower resource level (x=Mn − 1). Using

this notation, Eq. (1) is rewritten as two differential equations for state variables x and y:

dx/dt x; = g(x)−yDh(s)

(2)

3. The economic model

dy/dt y; = uyDh(s)−(nD + C)y

(3)

An endogenous growth model based on Eq. (1)

for exploitive firms is used to examine the economic optimization of owner consumption of a

renewable resource. A single-owner firm or harvesting unit (e.g. a fishing boat per person) is

assumed. As in the biological model, the per

capita harvest rate is D · h(s), where h(s) = h(ax/

Dy) is the proportion of the potential harvest

demand D acquired of which the fraction 05 u 5

1 is usable. The extraction cost is nD, and the

remainder is either consumed (C) or reinvested in

the firm that grows at a rate u · D · h(s) − nD− C.

The new parameter c may be viewed as consumption by an individual or dividend of a modern

firm and has a biological analog. We assume that

each individual is interested in maximizing the

long-term utility or benefits of consumption

U(C). In other words, maximizing the present

value of benefits obtained from the consumption

stream: e − dt U(C) dt where d is an instantaneous discount rate. Consumption level depends,

of course, on firm size and its dynamics as described below. We argue that the differences between the biological (Gutierrez et al., 1997) and

economic objectives are due to combinations of

forces that drive the economic parameters as well

as the time scale (market versus evolutionary

time) within which human societies and biological

systems operate. The economic interpretation of

the biological model is facilitated by reducing the

notation.

where g(x) is the renewal rate of the resource and

assumed to be concave, yDh(s) is the harvest by

all firms and 05 1− u51 is the proportion

wasted. Increases in y imply recruitment of new

individuals to the industry. An important difference between Eq. (1) and Eq. (3) is the consumption term C. Potential harvest capacity (D) may

also be interpreted as capital, and cost n(D) is

assumed for simplicity to be linear in D, i.e.

n(D)= nD.

3.1. A dynamic model of human har6esting of a

renewable resource

Assume our system considers only the two top

trophic levels, while the third or base trophic level

(M0) is considered fixed. Further, assume that the

renewable resource is managed for societal

3.2. The economic har6esting model

Potential harvesting capacity (D) and consumption (C) are control variables determined by the

quest for profit or utility maximizing of individual

humans in economics, and fitness and adapted

maximization in biology (Gutierrez et al., 1997).

The parameter D in primal humans was small,

and became a control variable in modern societies. D may increase as firms seek to satisfy

expanding markets. The parameter a in h(s) is a

technology parameter that for primal humans was

small but may approach unity for highly efficient

modern harvesters. Thus, D · h(s) is the individual’s production function for search capacity D.

Our assumptions imply that h(s) satisfies the concavity and positive marginal productivity of the

control variables (c,D) as it is increasing with the

resource level (x), and decreases with competition

from the other users (y).

3.3. Societal optimization

The economic model Eq. (3) differs from the

original biological model Eq. (1) in two ways; first

consumption (C) is introduced as an additional

form of expending energy, and second, a positive

discount rate (d) is incorporated into the human

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

232

maximization process. Both terms have biological

analogs and are important components of the

biological (or primal human) model (Gutierrez et

al., 1997). In economics, dividends or consumption (C) rewards the individual agent, firm or end

user, and this reward (benefits) is conventionally

denoted by a monotone increasing concave utility

function U(C) that saturates. Thus the far-sighted

individual seeks to maximize the present value of

utility over an infinite time horizon, and hence the

long-run objective function of the society consisting of y individuals is assumed to be:

max

D,c

&

e − d · t yU(C) dt

(4)

where G is defined in the Appendix A, and C*(d)

is an increasing function of d. Since x; and l: 1

do not depend on y, we focus our attention on

them. As equations are defined only for l1 5

U%(C*)(u − n), we restrict attention to [0,] ×

[0,U%(C*)(u −x 2)] in the (x, l1) phase space. The

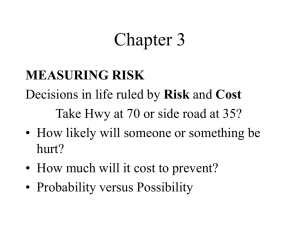

results summarized in Fig. 2a are derived in Appendix A. The definitions of the landmarks in this

figure are:

(a) xd is the level of x where its regeneration

rate g%(xd ) equals the discount rate d.

(b) xu is unexploited carrying capacity defined

by g(xu)= 0, and xu \ 0.

(c) xs is the optimal steady state resource level.

0

subject to Eq. (2) and Eq. (3), where e − dt is a

discounting factor. By Pontryagin’s maximum

principle, the maximization of Eq. (4) subject to

Eq. (2) and Eq. (3) is equivalent to maximization

of the current value Hamiltonian:

H= U(C)y+ l1(g− F) +l2[uF −(nD + C)y]

(5)

where l1(t) and l2(t) are current value multipliers,

known also as costate or auxiliary variables, associated with the constraints Eq. (2) and Eq. (3),

respectively. Necessary conditions for an optimal

solution (if one exists) are1:

(i ) HD = 0, HC = 0

(ii ) l: 1 =dl1 − Hx

(iii ) l: 2 =dl2 −Hy

(6)

(i6) tlim

e − dt li (t)= 0

Using Eq. (6), Appendix A shows the optimal

solution must satisfy

(i ) x; = g(x)− a x · h[G]/G

(ii ) y; =(u h(G) − n)ax/G −Cy

(iii ) l: 1 =l1(d− g%(x)) − a h%(G)(u U% −l1)

and C=C*(d)

(7)

1

Subscripted functions denote partial derivatives, e.g.

Hx =(H( · )/(x, and prime denotes the first derivative of a

single variable function, e.g. g%(x) =dg(x)/dx, or l: i (t)= dli /

dt.

Fig. 2. Phase diagrams of the bio-economic model: (a) in the

(X,l1) space; (b) the effect of increasing the discount rate d on

the general results in (a) (dotted lines denote isoclines with

higher a); (c) the effect of increasing the technology parameter

a (dotted lines denote isoclines with higher a); (d) the effect of

increasing the efficiency of processing parameter u; (e) the

effect of increasing the cost parameter n; and (f) the effect of

eroding the resource base.

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

Fig. 3. Steady state of human population.

(d) xc is the competitive solution for the resource level x.

(e) l *1 is shadow price of the resource x (i.e., the

marginal gains of y at the optimal solution).

(f) xe is the level of x that assures its extinction.

The resource level xc is the ultimate myopic

solution as d , and is the largest resource level

satisfying g(xc)= −axc[h(G(0))/G(0)] (see below).

The resource level xd is the lower bound on the

steady state value of x obtained in the societal

solution. Notice that xu \xec \xd, and xs \xc

always holds, but xd \xc holds only if d is sufficiently small and a is sufficiently large.

The implication of the above solution for the

optimal paths of the resource x and population of

harvesting units y is illustrated in Fig. 3 (Appendix B). This equilibrium solution for xs and

y*, denoted as the societal solution, can be viewed

as an optimization process for a human society

regulated by a ‘benevolent dictator’ whose objective is the long-run maximization of utilitarian

welfare, and is in sharp contrast to the solution

regulated exclusively by the competitive market.

3.4. The competiti6e market solution

The institutional framework of competitive

markets implies that the market solution will

force resource levels to xc as the long-run equilibrium (Appendix B). In a competitive framework, individuals maximize their own utility

function (related to consumption), disregarding

233

all harvesting effects of depletion of the free access resource. The competitive equilibrium solution implies that the price l1 = 0, and the optimal

solution is xc (Fig. 2a). This ignores biological

reality that there may be a critical level of x that

leads to extinction of the resource (i.e. xc xe).

The lower the slope of x; = 0 in the (x−l1) space,

the larger is the distance between societal and

competitive solutions xs and xc, and hence the

larger is the chance that a competitive solution

will lead to extinction. Examination of Eq. (B1)

and Eq. (B2) in Appendix B shows that the slope

of x; = 0 in the (x···l1) space is lower when g(x) is

less elastic and h(G) is more elastic; that is when

resource regeneration is relatively slow, and the

proportion of the demand satisfied is close to one.

Below we examine the sensitivity of the solution

to changes in parameter values. The proofs of

these results are given in Appendix C.

4. Sensitivity analysis

4.1. Increasing discount rate d

Fig. 2b shows that keeping all other parameters

constant, increasing the discount rate d reduces

the societal steady state solution xs but the level of

xc is unaffected. The solid lines indicate the original isoclines and the dashed lines indicate the

isoclines for a larger value of d (Appendix C). As

we have noted before, xc equals the limiting societal solution when the discount rate increases

without bound. The other effects of increasing d

are: the value of xd is also pushed to the left,

becoming the limiting resource level when A rises;

the shadow price of the resource (l1) decreases

(Appendix C); and C* increases with increasing d.

When d increases, the steady state levels of y

decrease because C*(d) increases and the payoff

decreases. The decrease in the population of human firms is mitigated by the effect of increases in

the discount rate that raise the individual’s rate of

resource exploitation. The lower bound xd on the

societal solution suggests that if the discount rate

(d) is sufficiently small, technological improvements should not drive a publicly regulated resource to extinction. Conversely, if the discount

234

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

rate becomes too large, the resource may be

driven to extinction even under a socially optimal

policy. It is generally recognized that the discount

rate is determined in the macro economy and

ignores its potential impact on a specific renewable resource. This decoupling may be an important factor in depleting resources, possibly leading

to their extinction.

Gutierrez et al. (1997) argue that the biological

discount rate is based upon the uncertainty of the

environment (i.e. expected hazards). It may be

large or small, and its effects on resource exploitation rate are in the same direction as the discount

rate in economics. So an obvious question is why

don’t primitive humans that live in a precarious

environment over exploit their resources or do

they? The answer lies in part on technical

progress.

4.2. Technological progress

The technology parameter (a) determines what

proportion of the resource can be exploited. In

general, if a is sufficiently low compared to the

maximum biomass regeneration rate of the resource, the resource will survive any size predator

population and demand rate (Gutierrez et al.,

1994). This parameter may also include social

constraints where individuals limit their capacity

to harvest (a form of private ownership). The

technical capabilities (a) of primitive societies

were small, and in our whale example the impact

was also small. However, as technology progresses, A may potentially be larger than unity

(i.e. using satellites we can find the last whale).

Fig. 2c illustrates the effects of increasing A on

the two isoclines in the phase diagram in the

(x···l1) space. The solid lines indicate the original

isoclines and the dashed lines indicate the isoclines

for a larger value of a (Appendix C). Under a

competitive market structure, technology that increases A reduce xc and increase the likelihood of

driving the resource x to xe. This result is in sharp

contrast to the conventional view that technological improvements are the driving force behind

increased income per capita and supports population growth. However, in our model when public

institutions take control of an endangered re-

source, increasing A increases the steady state

resource value (l1), and the resource equilibrium

level is reduced. This occurs because an increase

in harvesters results due to technological

improvements.

In a competitive economy, technological progress alone is potentially sufficient to drive the

resource population to extinction, independent of

the well-known effects of increasing the discount

rate. As discussed above, increasing the technology of harvesting (a) can also drive a resource

under public control to extinction, but this also

depends on the discount rate d. Thus, a synergistic combination of high technology (a) and a high

discount rate (d) may greatly increase the risk of

over-exploitation and resource extinction even under a socially optimal policy. As shown in Appendix C, the payoff and the steady state

population of y increase with a. The increase in y

has an additional negative effect on xs of increasing a.

4.3. Lower wastage

A higher u implies lowers wastage, and for the

competitive solution may drive the resource population quickly to extinction (Fig. 2d). Increasing u

does not affect xd, which is the lower bound on

the societal solution. The competitive solution

moves to the left, so that reducing waste has a

similar effect to that of improving technology. In

a competitive framework, the resource level may

be driven closer to extinction. The change in the

optimal societal solution xs is undetermined, but

l1 increases as wastage is reduced (u increases).

However, increasing u may reduce xs. If the social

discount rate d is sufficiently low, xd will remain

sufficiently distant from the extinction level. If,

however, d is sufficiently high, lowering wastage

may in fact put the resource at the risk of extinction as xc xe. u like a is a parameter of efficiency

and operates in the same direction, and hence

increasing either raises the risk of over exploitation and possibly extinction if the discount rate is

high enough.

However, the effects of u are constrained by the

value of a, and are best seen by reference to

primitive societies which are thought to waste

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

little of their harvests. Despite a higher u, their a

is typically low, hence regardless of their perception of environmental uncertainty, efficient utilization of resources may have little impact on the

renewable resource.

4.4. Higher maintenance costs n

An increase of n reduces l1 and the payoff and

consequently reduces the optimal population density. Note also that the competitive solution xc

moves to the right and away from extinction level

(Fig. 2e), but xd is not affected. As n approaches

u, xs approaches xu and marginal gains fall (i.e. it

is no longer cost effective to harvest) and suggests

that the societal level xs increases with n. From a

policy point of view, one may interpret an increase in n as a tax levied on harvesting capacity,

suggesting effective policy implications for preserving resources.

4.5. Eroding the resource base

The resource base for x is often eroded by

human activities including those used to harvest

the resource x. Decreasing the resource base

parameter (M0) has the obvious effect of shifting

x; to the left and l: 1 downward, implying lower

competitive and societal solutions. In addition,

the payoff and optimal population density increase (Fig. 2f). Clearly, there are synergistic effects of reduced environmental carrying capacity

and factors enhancing over exploitation increase

the likelihood of resource extinction.

5. Conclusion

5.1. Species 6ersus human optimal beha6ior

The time evolution of an ecosystem is driven by

Darwinian selection processes that determine

which individuals and species survive. All organisms in all trophic levels are part of the ecosystem,

and each has demand capacity for resource acquisition that operate within the bounds of its genetic

code — its objective is to perpetuate the survival

of its DNA (sensu Dawkins, 1995). As argued in

235

Gutierrez et al. (1997), individual organisms in

nature behave as if they are driven by a quest for

utility maximization to increases individual

fitness. Although the resource has free access,

there is a biological price to it implied by its

effects on marginal growth that leads to resource

sustainability. Similar arguments could be made

for humans in their primal state.

However as modern humans became the top

predators, their objective became more than simply perpetuating the survival of DNA. In economic terms, the objective function became

maximization of the present value of a non decreasing utility of consumption by all individuals

subject to the resource constraints. In contrast to

the ecosystem, competitive market forces are

driven by individual quest for utility maximization disregarding their individual effects on natural resource depletion, and this determines zero

prices for free access (common property) resources. These differences strike at the heart of

the renewable resource exploitation problem as

practiced by humans.

5.2. Analogies between economic and biological

systems

Analogies between biological and economic systems enabled the development of a common

model for both systems (this paper and Gutierrez

et al., 1997), but some very important differences

between economic and biological systems exist.

Among these are the fact that the extraction

capacity (D), the transformation parameter (u),

the maintenance cost (n) and the resource apparency parameter a may change rapidly in response

to economic factors. In contrast, their biological

analogues are relatively ‘fixed’ on an evolutionary

time scale. In fact, the demand in economics

might exceed all of the resource that is available.

The parameter a is interpreted in economics as

the technology parameter of resource harvesting

and plays an important role in the dynamics

leading to resource extinction. In the economic

model, a higher value of a means that the technology for exploiting previously inaccessible portions

of the population is increased. A higher value of u

means that wastage is reduced and increasing n

236

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

means that the per firm maintenance cost of harvesting capacity increases.

The concept of the discount rate (d) introduced

in the long-term objective function in the discount

factor (e − dt) also has a biological analog. In

economics, the discount rate reflects time preference, partly because of uncertainty about the future, and it is determined by market forces in the

whole economy. In biology, the analogous concept is the likelihood that investments in progeny

will survive to contribute to the genetics of future

generations (Gutierrez et al., 1997) and is implemented in the biological model as an ecological

discount factor in the objective function.

The concept of economic consumption also has

a biological analogue. In biology, some species

invest heavily in excess reproductive capacity and

other produce few progeny and invest more in

their care but these investments do not contribute

directly to growth (so called r- and K-selected

strategies, respectively, see Southwood and

Comins, 1976). These costs are, by analogy, consumption as defined in economics, but this allocation in biology is used to increase adaptivity and

not for hedonistic purposes.

5.3. The sustainable har6esting problem

Renewable resources (biological populations)

dynamics have spatial and temporal characteristics that affect their dynamics and those of populations that harvest them (i.e. firms).

Furthermore, if the environment of species is degraded, species may not be restored to its prior

abundance, and of course once a species has been

driven to extinction it cannot be brought back.

For these reasons, management policies for renewable resources must resolve questions that affect resource sustainability before the damage

becomes irreparable. Among these questions are

the optimal extraction rate, optimal human and

resource population levels, the appropriateness of

harvesting technology, and how market structure

affects harvesting behavior.

Competitive markets have failed to provide an

appropriate mechanism for pricing resources with

free access (Gordon, 1954; Hilborn et al., 1995),

and consequently, over exploitation of resources

has been a common practice in forestry and

fisheries because the cost of renewable resources is

largely neglected by harvesters. The consequences

of harvesting explored here using an micro-economic model that incorporated the dynamics of

both the resource being exploited and the exploiting population produced some conflicts with conventional economic wisdom.

5.4. Ecological conflicts with con6entional

economic wisdom

Economic growth theory has largely ignored

the relation between growth and natural renewable resources, and assumed population growth to

be exogenous (Barro and Sala-I-Martin, 1995).

Consequently, conventional economic models

have not incorporated the realistic biology of the

harvesting units extracting renewable resources

(Hilborn et al., 1995). Instead, neoclassical economic growth theory suggested that technological

improvements were the source of increasing per

capita income (Solow, 1956). The conventional

wisdom that follows is that increases in technology (including the discovery of new renewable

resources) enhance productivity and this maintains growth. The underlying biological realism of

our model, however, identified increases in harvesting and utilization technology as reducing

steady state resource levels and at the same time

increasing the number of users, in what would

appear to be a vicious cycle leading to over-exploitation of the resources and the collapse of the

industry.

The golden rule of economically balanced

growth (that maximizes the steady state per-capita

consumption) stipulates that the rate of saving

associated capital accumulation is obtained when

marginal productivity of capital is equated to

population growth and capital depreciation rates

(Phelps, 1966). Marginal productivity of capital

equals the interest (discount) rate, and this occurs

in our model as the lower bound of the societal

solution for resource exploitation xd. It is well

known that high discount rates increase the rate

of exploitation of natural resources. Since the

discount rate is determined by the market in the

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

whole economy, this value may be higher than the

socially optimal level for the environmental

preservation (Weitzman, 1994), and specifically

for maintaining a particular renewable resource at

a sustainable level. The socially optimal level of

the resource (xs) is that which is sustainable for

the optimal population of firms (y*). It has been

shown here that there is a synergistic effect between improvements in harvesting technology and

high discount rates that encourage faster exploitation of the resource, possibly leading to its

extinction.

The conventional wisdom for reducing the

wastage of harvest is that resources are preserved

if their utilization is improved. However, our

model shows that as wastage is reduced, the optimal steady state level of the resource is reduced,

again contradicting common wisdom. This effect

increases with increasing discount rate, and is

similar to the synergistic effect between technology and discount rate. This occurs because the

payoff for the firms increases following better

technology and lower wastage. Increases in the

cost to firms detract from growth, countering

gains from decreases in wastage, and thus leading

to higher resource levels. A way of increasing cost

is the use of Pigouvian taxes on firm capacity (D)

suggesting interesting policy implications. Of

course, restricting harvests may be efficient but

often hard to enforce as harvesters find ways to

circumvent regulations.

In modern economies, the resource base may be

increased, as is done in agriculture by improved

production methods, new varieties or breeds of

animals, more agronomic inputs, etc. but these

may also lead to unforeseen adverse consequences

(van den Bosch, 1978; Kenmore et al., 1985).

While privately owned agricultural systems are

highly managed, free access renewable resources

are overused inefficiently and productivity may be

lowered or destroyed as competing firms seek to

maximize profits while ignoring renewable resource depletion and environmental costs. This

is verified by our model where all of the steady

state levels in our system are reduced as the

base resources for the exploited population are

eroded.

237

5.5. Policy implications

All of the above results accrued via the dynamics of the biological model, rather than by a priori

assumptions. Our model points to the need to

simultaneously control technology and the discount rate. It is obviously impossible, nor is it

desirable to regulate the advance of technology,

hence the major option left is to reduce the discount rate below the market equilibrium and also

to regulate the harvest. If a society considers the

preservation of an environmental resource important, the social discount rate should be lower than

the private one (Weitzman, 1994). Regulation of

harvest can be accomplished via a Pigouvian tax

on the capacity of the firm which in our model

drives down firm numbers, but leaves open the

question of increasing size of the remaining firms.

In all cases, what is absolutely clear is that total

harvest by all firms should be only that level that

assures the sustainability of the resource at equilibrium density. This could be done without taxes,

but would require strong enforcement and sound

notions about the maximum sustainable yields

(MSY) — weak assumptions about carrying capacity will only lead to still more resource exploitation disasters. As pointed out by Hilborn et

al. (1995), the notion of MSY is unrealistic as

natural populations fluctuate (often widely) in

response to drastic changes in biotic and abiotic

factors. The possibility of over exploitation leading to extinction is more likely when stochastic

perturbations affect the resource (El Niño effects

on Pacific fisheries); however, this issue has not

been tackled in the present paper.

The dual goals of economic growth and ecosystem sustainability are often in conflict (Goodland,

1995). Impetus for resolving some of these issues

comes as the standard of living improves; this

despite the apparent contradiction that the improvement in a large part may have resulted from

resource depletion. Increasingly affluent societies

demand improved environmental quality leading

to public pressures for environmental regulation

via market and non-market mechanisms. On a

larger global scale, however, the difficulty lies in

the recognition that improvement in the standard

of living in heavily populated less developed coun-

238

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

tries would certainly lead to over exploitation

of fragile natural resources as technology and

the market interact to satisfy ever increasing consumer demands (Goodland, 1995). Sustainable

development must include viable environmental, social and economic sustainability but

not necessarily the sustained economic throughput growth that is the basis of the common worldwide economic paradigms (sensu Goodland,

1995).

5.6. Epilogue

In this paper we examined harvesting from a

food chain, but humans may harvest more than

one resource in the food chain (or web). For

example, humans harvest both whales and krill,

and we might ponder what the impact of interacting economic and technological parameters might

be on the system — will whales be placed in

greater danger by krill harvesters than whalers.

Schreiber and Gutierrez (1997) use the underlying

basis of this biological model to examine biological interactions in food webs, and demonstrate

how species displacements have occurred in several systems. This model can be used as the basis

for examining human harvesting of several

trophic levels in a renewable resource systems.

The questions of physical and human capital are

Lamarkian like processes that also impact renewable resource problems, but they were not

addressed in this paper, nor do we address

how big should firms be or how human capital

drives technology, and in what direction?

Can human capital be the basis for developing

viable renewable resource management schemes,

or will it simply contribute more to over exploitation?

Clearly, ecology and economics are at a crossroads of conflict: the alternatives are sustainable

renewable resource management based on sound

biology, or will over exploitation and mutual

annihilation result as we scramble for ever decreasing resources. If the latter is our fate, then

‘‘… as a final bit of irony, it will be insects that

polish the bones of the last of us that fall.’’

(Robert van den Bosch, 1978).

Appendix A

In this appendix, we derive equations of motion

for our maximization problem using the Pontragin maximum principle. Recall, the current

value Hamiltonian for this problem is given by

H= U(C)y+ l1(g(x)− F(x,y,D))

+ l2(uF(x,y,D)− (nD + C)y) where l1 and

l2 are the costates associated with x and y and

F(x,y,D)= Dyh(ax/Dy). The optimal solution

must satisfy HD = HC = limt e − dt li (t)=

0, l: 1 = dl1 − Hx and l: 2 = dl2 − Hy.

HC = 0 implies that l2 = U%(C) and, consequently, l: 2 = U¦(C)C: . HD = 0 implies that

(l2u− l1)FD (x,y,D)=l2ny. Since FD (x,y,D)=

yZ(ax/Dy) where Z(s)=h(s)− sh%(s),

l2n

ax

= Z−1

l2u− l1

Dy

(A1)

Furthermore

HDD = FDD (x,y,D)(ul2 − l1)5 0

implies l2u] l1 on the optimal path.

The equation of motion for x’s costate is given

by,

l: 1 = dl1 − Hx = l1(d−g%(x))

− ah% Z − 1

l2n

l2u− l1

(ul2 − l1)

where the second equality follows from Eq. (A1).

On the other hand, the equation of motion for y’s

costate is given by l: 2 = dl2 − Hy. Hence

l: 2 = dU%− U+Fy (x,y,D)(l1 − uU%)+ (nD + C)U%

=(d+ C)U% −U

where the last line follows from Eq. (A1) and

Fy (x,y,D)= DZ(ax/Dy). Putting this all together,

the equation of motion for candidate solution to

our maximization problem are given by,

x; = g(x)− ax

y; =

h(G)

G

(A2)

ax

(uh(G)− n)− Cy

G

(A3)

1

((d + C)U%− U)

U %%

(A4)

C: =

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

l: 1 = l1(d −g%)−ah%(G)(uU% −l1)

where

G =Z − 1

(A5)

U%n

U%u −l1

(A6)

(x;

h%(G)G −h(G)

= − ax

G%(l1) \0

(l1 x; = 0

G2

(B1)

)

(x;

h(G)

g(x)

=g%(x)−a

=g%(x) −

B0

(x x; = 0

G x; = 0

x

(B2)

where the second equality in Eq. (B2) follows

from the concavity of g. Therefore, (l1/(xx; = 0 \

0 and the x null isocline is a strictly increasing

function of x.

To prove the monotonocity of the l1 null-isocline, note that

(B3)

is greater than zero whenever (l1,x)[0,U%(u −

n)]×(xd,) where xd is the unique solution to

g%(x)= d if it exists else zero. On the other hand,

(l1/(x = −l1g%%(x)\ 0 by convexity of g.

Therefore

)

To find the equilibrium of Eq. (A2), Eq. (A3),

Eq. (A4), Eq. (A5), Eq. (A6), we first solve for

C: = 0. We begin with three observations: (/

(C (U%(C)(d +C)− U(C)) =U%%(C)(d +C) B0 as

U is concave; limC 0 U%(C)(d +C) −U(C) \0 as

U(0) = 0 and U%(0)\0. limC U%(C)(d +C) −

U(C)B0 (this follows from our assumption that

limC U%(C)=0). These observations imply

that there is a well defined differentiable function

C*(d)

such

that

U%(C*(d))(d +C*(d)) −

U(C*(d))= 0. Furthermore, C*%(d) \0, C*(0) =

0 and limd C*(d) =.

Since Eq. (A2) and Eq. (A5) do not depend on

y, the remainder of our isocline analysis is restricted to the x −l1 plane with C =C*(%). As

Z − 1 is only well defined on the interval [0,1], we

further restrict our analysis to (x,l1) [0,) ×

[0,U%(C*)(u −n)).

To prove monotnicity of the x nullcline, we first

observe that G%(l1)=Z − 1( · )(U%n)/(U%u− l1)2 \0

and h%(G)G−h(G)B 0 by convexity of h.

Therefore,

)

(l: 1

= d−g%(x)

(l1

− a[h%%(G)G%(l1)(uU%− l1)− h%(G)]

Appendix B

)

239

(l1

B0

(x l: 1 = 0

(B4)

whenever x\ xd. As x; B0 for any x\ xd, it follows that the entire l1 null isocline lies to the right

of x= xd and is strictly decreasing in x.

Putting this all together, we get the phase diagram shown in Fig. 2a. In this figure, xc is the

largest value of x such that g(x)= ax[h(Z − 1(n/

u))]/[Z − 1(n/u)] and xu is the largest value of x

such that g(x)= 0 (the equilibrium achieved by

the resource in the absence of harvesting).

Note: The level xc is also obtained as the solution of individual decision making in a competitive markets. The individual problem is then:

maxC,DU(C) subject to the constraint uF/y−

(nD + C) ]0. Using the Lagrangean L =

U(C)+ vC)uF/y− (nD +C)),

LC = 0

and

LD = 0 imply that ax/Dy=Z − 1(n/u). Inserting

this feedback rule into x; and solving for its largest

equilibrium determines xc.

To determine the stability of (x*,y*,C*), the

optimal equilibrium, we evaluate the variational

matrix of the equations of motion at this point.

Using Eq. (A4) and Eq. (B1), Eq. (B2), Eq. (B3),

Eq. (B4), we get

Á (x;

(x; Â

(x;

à (x l

(C Ã

1

à :

à Á−

(l (l: 1 (l: 1

à 1

Ã=Ã+

(x (l1 (C

Ã

à Ä0

:

:

:

(C

(C

(C

Ã

Ã

Ä (x (l 1 (C Å

+

+

0

Â

Ã

+Å

where − /+ indicate the sign of the entry and indicates that the sign is irrelevant. Since (0,0,1) is

an unstable eigenvector for this matrix, along the

optimal path C(t) C*. Furthermore, as

240

det

−

+

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

+

B0

+

there is an unstable and stable eigenvector in

x − l1 space. Hence along the optimal path l1(t)

and x(t) are monotonic and l1 is determined by a

feedback rule l1(x) that satisfies l %1(x) B0.

Using Eq. (A2) and Eq. (A3), we examine the

x − y phase for the optimal paths. The y null

isocline is defined by

cy =

ax

(h(G)− n).

g

(B5)

Taking the derivative of the right hand side of Eq.

(B5), we get

a

(uh(G)−n)+

G

(B6)

ax

(uh%(G)G− uh(G) +n)Gx

G2

(B7)

On the y nullcline, Eq. (B6) is strictly positive and

Eq. (B7) equals

U%(C*)n

ax

n−u

2

U%(C*)u −l1(x)

G

Gx.

Since l1(x)[0,U%(C*)(u −n)] and Gx B0 this

term is also strictly positive. Therefore, the y

nullcline is stricltly increasing with respect to x.

Notice that certain initial conditions of x and y

produce a ‘snowballing’ effect such that y is not

monotonic in time.

Appendix C

In this section, we examine how parameters

effect the isocline structure in x − l1 space, the

payoff, and the optimal equilibrium value of y.

Unfortunately, our conclusion with respect to x*

can be only speculative and are based on numerical simulations.

First, consider a. Notice that (x; /(a = −

x(h(G))/G B0 and (l: 1/(a = −h%(G)(U%(C)u −l1)

is strictly negative for (x,l1) R + ×[0,U%(C*)(u −

n)] (Fig. 2c). To see how the payoff changes with

a, consider the optimization problem defined by

Eq. (A1) subject to the constraints Eq. (A2) and

Eq. (A3) plus the addition constraint a; = 0. Let

v3 be the present value costate associated with

a.The equation of motion for this costate is given

by − v; 3 = xh%(ax/Dy)(uv2 − v1) where v1 and

v2 are present value costates associated with x

and y, respectively. Integrating with respect to t

and using the transverslity condition on v3, we

get v3(0)= 0 xh%(ax/Dy)(uv2 − v1) dt\ 0 where

x, D, C and y are evaluated on the optimal path.

Since (under the assumption that the payoff differentiable with respect to a) v3(0) equals the

derivative of the payoff as function of the a, the

payoff increases with a.

Consider the parameter u. Notice that Gu B 0

and therefore (x; /(u = −ax(h%(G)G−h(G))Gu /

G 2 and (l: 1/(u = −ah%%(G)Gu (uU%(C*)−l1)−

ah%(G)U%(C*) are strictly negative (Fig. 2d). As

with the payoff analysis for a, the payoff increases

as a function of u.

Consider the discount rate, d. C*(d) and xd are

increasing/decreasing functions of d and Gd B 0.

Therefore (x; /(d = − ax(h%(G)G− h(G))Gd /G 2 is

strictly positive. Unfortunately, we are unable to

draw a conclusion about the motion of the l1

nullcline. However, the motion of the xd and

simulations suggest that it is as indicated in Fig.

2b. A routine calculation shows that the payoff

decreases as a function of d.

Consider the parameter, n. We have G%(n)=

Z − 1%( · )(U%(C*))/(U%(C*)u− l1) is strictly positive. From this it follows that

(x;

h%(G(n))G(n)− G%(n)h(G)

= − axG%(n)

(n

G(n)2

and

(l: 1

= − ah%%(G(n))G%(n)(uU%(C*)− l1)

(n

are strictly positive by concavity of h (Fig. 2e).

These facts imply l1 at the optimal equilibrium

decreases as a function of n. The payoff also

decreases with n. Although we can draw no general conclusions about the effect of n on the

equilibrium resource, we can show that as n approaches u the equilibrium resource density approaches xu. This suggests that resource density

increases with n.

Eroding the resource base is equivalent to replacing the function g(x) with another function

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

g̃(x) such that g̃%(x)B g(x), g̃(0) = 0 and g̃ is

concave. Such a change only effects the x zero

growth isocline by shifting it left (Fig. 2f). Hence,

decreasing the resource base decreases the resource density and increases l1 at the optimal

equilibrium. It is easy to check that it also decreases the payoff.

To conclude, we want to understand how y*

changes with respect to the parameters. To do

this, we need the following lemma.

Lemma. Let h be one of the parameters of the

model (i.e. a,u,n or d). For any h̃ sufficiently close

to h, there exists an initial condition, (x0,y0), such

that the optimal paths y(t) and ỹ(t) associated with

h and h̃ that satisfy this initial condition are both

monotonically decreasing.

Proof. Given h, define the sector Sh =

{(x,y):x; (x,y)\0 and y; (x,y) B 0}. Since the x

nullcline is vertical and the y nullcline is

monotonically increasing with respect to x,y(t)

for all optimal paths with initial condition in S

are monotonically decreasing. By continuity there

exits a e\ 0 such that for all h̃ e-close to h, the

sectors, Sh and Sh̃ have a nonempty intersection. Choosing a point, (x0,y0), in this intersection

provides the desired initial condition.

Now, consider a. When a increases, the payoff

for any initial condition of x and y increases but

C(t)C* remains constant. Assume we are given

ã \a \0 such that ã −a is sufficiently small. The

lemma gives optimal paths ỹ and y with the same

initial conditions such that both paths are

monotonic in time. Since the payoff associated

with ã is larger than the payoff associated with

a, ỹ(t)]y(t) for all t ]0. Consequently, y* increases with a. Similarly, we can conclude that y*

increases with u and increasing resource base, but

decreases with d and n.

References

Arditi, R., Ginzburg, L., 1989. Coupling in Predator-Prey

Dynamics: Ratio-Dependence. J. Theor. Biol. 139, 311–

326.

Barro, R.J., Sala-I-Martin, X., 1995. Economic Growth. McGraw-Hill, New York, 539 pp.

Daly, H.E., 1994. Fostering environmentally sustainable development — 4 parting suggestions to the World Bank. Ecol.

Econ. 10, 183 – 187.

241

Dawkins R., 1995. God’s Utility Function. Scientific American

273(5), 80 – 85.

Getz, W.M., Haight, R.G., 1989. Population Harvesting.

Princeton University Press, Princeton NJ.

Goodland, R., 1995. The concept of environmental sustainability. Ann. Rev. Ecol. Systemat. 26, 1 – 24.

Gordon, H.S., 1954. The economic property of a common

property resource: The fishery. J. Polit. Econ. 62, 124 – 142.

Grossman, G.M., Helpman, E., 1994. Endogenous innovation

in the Theory of Growth. J. Econ. Perspective, Winter 8,

23 – 44.

Gutierrez, A.P., 1992. The physiological basis of ratio dependent theory. Ecology 73, 1552 – 1563.

Gutierrez, A.P., 1996. Applied Population Ecology: A Supply – Demand Approach. Wiley, New York.

Gutierrez, A.P., Baumgärtner, J.U., 1984. Multitrophic level

models of predator-resource energetics: II. A realistic

model of plant-herbivore-parasitoid-predator interactions.

Can. Entomol. 116, 933 – 949.

Gutierrez, A.P., Curry, G.L., 1989. Framework for studying

crop-pest systems. In: Frisbie, R.F. (ed.), Integrated Pest

Management Systems for Cotton Production. Wiley, New

York, pp. 37 – 64.

Gutierrez, A.P., Mills, S.J., Schreiber, S.J., Ellis, C.K., 1994. A

physiologically based tritrophic perspective on bottom uptop down regulation of populations. Ecology 75, 2227 –

2242.

Gutierrez, A.P., Regev, U., 1983. The economics of fitness and

adaptedness: the interaction of sylvan cotton (Gossypium

hirsutum L.) and the boll weevil (Anthonomus grandis

Boh.): An example. Acta Ecologica Ecol. Gener. 4 (3),

271 – 287.

Gutierrez, A.P., Schreiber, S.J., Regev, U., Zilberman, D.,

1997. The economics of predation: r- and K- strategies. In

review.

Gutierrez, A.P., Wang, Y.H., 1977. Applied population ecology for crop production and pest management. In: Norton,

G.A., Holling, C.S. (eds.), Pest Management. Pergamon

Press, Oxford: International Institute for Applied Systems

Analysis Proceedings Series.

Hardin, G., 1993. Living within Limits. Oxford University

Press, New York, Oxford.

Hardin, G., 1968. The tragedy of the commons. Science 162,

1243 – 1246.

Hilborn, R., Walters, C.J., Ludwig, D., 1995. Sustainable

exploitation of renewable resources. Annu. Rev. Ecol. Systemat. 26, 45 – 68.

Holling, C.S., 1966. The functional response of invertebrate

predators to prey densities. Memoirs Entomol. Soc. Can.

48, 949 – 965.

Kenmore, P.E., Carino, F.O., Perez, C.A., Dyck, V.A.,

Gutierrez, A.P., 1985. Population regulation of the rice

brown plant hopper (Nilapar6ata lugens Stal) within rice

fields in the Philippines. J. Plant Protec. Trop. 1 (1),

19 – 37.

Phelps, E.S., 1966. Golden Rules of Economic Growth. Norton, New York.

242

U. Rege6 et al. / Ecological Economics 26 (1998) 227–242

Romer, P.M., 1990. Endogenous technological change. J.

Polit. Econ. 98 (5)(2), S71–102.

Schumpeter, J., 1934. The Theory of Economic Development.

Harvard University Press, Cambridge MA.

Solow, R., 1956. A contribution to the theory of economic

growth. Q. J. Econ. 70, 65–94.

Solow, R., 1970. Growth Theory: An Exposition. Oxford

University Press, Oxford.

Solow, R., 1993. An almost practical step toward sustainability. Resources Policy 19 (3), 162–172.

Schreiber, S.J., Gutierrez, A.P., 1997. A supply-demand

perspective of species invasion and coexistence:

applications to biological control. Ecol. Modelling (In

press).

Southwood, T.R.E., Comins, H.N., 1976. A synoptic population model. J. Animal Ecol. 45, 949 – 965.

van den Bosch, R., 1978. The Pesticide Conspiracy. Doubleday, New York.

Weitzman, M.L., 1994. On the environmental discount rate. J.

Environ. Econ. Manage. 26, 200 – 209.

Winter, S.F., 1971. Satisficing, selection, and the innovating

remnant. Q. J. Econ. 85, 237 – 261.

Yodzis, Peter, 1994. Predator-Prey theory and management of

multispecies fisheries. Ecol. Apps. 4(1), 51 – 58

.

.