Key Highlights 2014

advertisement

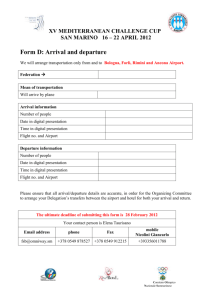

Where everything takes off Key Highlights 2014 1 Message from the CEO 2014 was the best year ever for Budapest Airport in terms March connecting Bu- of passenger traffic growth and improvement of service dapest with Baku and quality as well. This short sentence speaks for itself, but further to the East with it does not reflect the daily effort made by our people and Central Asia and the Far our partners to turn Budapest Airport into the best East. airport in the CEE region. In fact this has also happened as Budapest Airport won the prestigious Skytrax ”Best The impressive results and Airport in Eastern Europe” title in 2014 and also 2015 improvements mentioned awarded on the basis of feedback from our passengers. above may also have contributed to the successful These acknowledgements do not come by chance – completion of the refinancing they reflect long years of focused performance. Of of the loan facilities of Buda- course, many other factors lie behind the record passen- pest Airport which has been ger traffic of 9 155 961 (7.5 % growth over 2013) and 86 completed in September 682 Air Traffic Movements. The arrival of new airlines and 2014 and has won a series of the opening of many new destinations marked 2014 for financial awards in the category us at the airport and by the same token for the Hungar- of European transport-related fi- ian tourism industry. It would be highly unjust to pick out nancing deals – a clear indicator just a few as there were lots of newcomers and our of the stability, transparency, and existing partners have contributed to this growth too. the good prospects of the airport operating company. We are de- termined to stay on Air Serbia was amongst the first with the start of daily track and follow the road leading to new achievements. service between Belgrade and Budapest, a route that was missing since 2012. Our largest airport partner Wizz There is no better way to really see our performance than Air brought an additional aircraft (their 8th) to increase coming to Budapest as a passenger – and you are in- frequency on high-density routes like London Luton, deed more than welcome to do so! Moscow Vnukovo or Istanbul Sabiha Gökcen Airport. Turkish carrier Pegasus Airlines also launched its flight between Budapest and Istanbul as of mid-July, and Transavia France started its service to Paris Orly. By the end of October we had regular wide-body flights again Jost Lammers, with the arrival of Emirates of Dubai. Daily flights by their CEO Budapest Airport A 330-200 aircraft from the Persian Gulf region represent another turning point in the history of Budapest Airport. 2014 was marked not only by increasing passenger traffic but also by the arrival of a new cargo service provider from the beginning of the year. With the strongly increasing business ties of Hungary and the government’s Opening to the East policy, the arrival of Azerbaijan’s Silk Way West airlines to Budapest came as a natural development. The first Boeing 767-300F freighter aircraft was greeted at the airport in early 2 3 Highlights of 2014 October Budapest Airport created a strategic partnership with Future FM regarding its Airport Facility Management (AFM) subsidiary. March The airport sold 75 percent of its share in AFM to Hungarian A new Azerbaijani cargo airline Silk Way Future FM – a dedicated facility management provider. The new West starts regular cargo flights between owner takes over operation as of 1st January 2015. Baku and Budapest with Boeing 767- January 300F aircraft. The Azeri carrier operates The first direct Dubai-Budapest daily flight of Emirates was cel- regular flights between China, the Far ebrated at the end of the month. After long years of preparations, November East and Central Asia and connects May July the Gulf carrier started daily service to Budapest with an Airbus A brand new inflatable hangar was new flight is erected for Lufthansa Technik Buda- tion to pest at the airport. The new facility and enables Lufthansa Technik to service A brand new 10-kV third power supply these areas to Europe Budapest Airport starts major refurbish- Budapest Airport finished the reconstruc- A 330 wide body jet. The line and a transformer sub-station was through Buda- ment works on the airfield including both tion of the General Aviation Terminal not only a connec- inaugurated in the town of Vecsés pest, Frank- runways. The total cost of the project is (GAT) by the end of July and together the Persian Gulf and EUR 2.7 million and the project was com- with Celebi Ground Handling opened a the tion connecting the airport to a third, in- London . pleted before the main summer tourist new business lounge in it. The schedule East but months of maintenance. The EUR 2 dependent power supply line increas- By the season began. Both runway surfaces and was tight since all the works had to be also signifi- million project helped Lufthansa es operational safety of the airport and end of lighting systems were repaired, and, as a completed in time before the Formula cantly cuts Technik Budapest this winter to adds to the two existing electric power the year consequence major reconstruction works 1 team arrivals at the GAT by the end of flight time contract 12 Norwegian Boeing 737- are not necessary during the next ten July. between 800 aircraft to be refurbished with an Budapest and the in-flight Wi-Fi neighboring the airport. The new sta- furt supplies from Budapest city. Silk Way West changed years. its aircraft to larger system. Australia. Highlights increased market demand. April BUD recognizes the performance of key A new airline, airline and airport partners in 2013 for their Air Serbia Budapest Airport hosted the Freight- role in keeping the airport on the right was cele- ers and Belly Cargo World Conference track. This is reflected not only in increas- brated in the Hungarian Capital. Conference ing passenger numbers but also in con- on the delegates could convince themselves stantly increasing quality standards of first day of of the logistical advantages of the air- airport service recognized in the quar- the month port and the development potential of terly ASQ survey results. starting a daily service between the capital of Serbia and 4 more aircraft during the winter peak Far East, China and Boeing 747-400 due to February Middle September June August Budapest Airport with regards to air Buda- Budapest Airport cargo. cele- started a commercial campaign series to December Hungary. After major reorganization and brated the 10th anniversary of Wizz Air promote Hungarian products in Sky- The 9 millionth passenger was cele- involvement of professional investor operations in Hungary with signing a Court. The so-called trinity promotion brated on 17th December in SkyCourt Etihad to Air Serbia the national carrier lease agreement to build a line mainte- where the airport, the Hungarian produc- with flowers and a brass band orches- started flights to Belgrade with an ATR-42 nance hangar for the low cost carrier. Wizz er and Heinemann Duty Free join forces tra. The lucky winner was a young aircraft. This new service offers a series of Air will take over the new facility in 2015. proved to be extremely successful and Hungarian family arriving with Brus- transfer opportunities to important des- Wizz Air has increased its fleet to eight air- has led to double-digit increases in sales sels Airlines from Brussels. This event tinations in the Balkans. craft in Budapest in June 2014. due to tasting and discounted price pro- also marked that Budapest Airport is motions in the given month. Different in for a record-breaking year in 2014. Hungarian wines, spirits and sweets were By the end of the year the passenger promoted every month until November. number was best ever: 9,155,961. pest Airport 5 Airport completes award-winning refinancing Together with its financial advisor, Rothschild, BUD approached over 65 financial institutions in the market- In spite of difficult conditions, Budapest Airport suc- point of concern for all involved and many lenders testing phase drilling it down to a final group of 19 cessfully achieved its market-based refinancing at the were passing on the Budapest Airport loan to their senior and junior lenders. Headline terms for the end of September 2014. Budapest Airport could refi- restructuring teams,” explained Ingo Ludwig. Next market-based refinancing were: nance all of its existing bank loans with new and exist- to the high leverage, the refinancing process was ing banks in the amount of EUR 1.1 billion senior debt and also burdened by a long-term interest rate swap with EUR 300 million junior debt. The refinancing was well a negative market value of around EUR 250 million. maturing at the end of 2019 • EUR 300 million of 6.25 year junior debt, maturing at oversubscribed and the new loan agreements run for a period of more than five years. • EUR 1.05 billion of 5.25 year senior bank facilities, The financial and economic crisis had hit Hungary the end of 2020 and part of the junior debt originat- hard. The country missed its original ambitious ing from shareholders “This is really a great success for the Airport,” said growth targets and on top of that in 2009 the Hun- • Extension of EUR 1.1 billion interest rate swap arrange- Ingo Ludwig, Chief Financial Officer and Deputy garian GDP decreased by 6.7%. This also translated ments, including a EUR 770 million off-market swap, CEO of the Airport and responsible for the refinanc- into more or less zero passenger growth for the air- a EUR 132 million reverse swap and a new EUR 142 ing project. “Yet, when we started the project in late port from 2007 to 2012 and, while the airport was million on-market swap 2012, it seemed anything but certain that the exist- nicely recovering in 2011, it was hit hard again by the ing facilities could be refinanced” he adds, when re- collapse of national airline Malév in February 2012. The stretched leverage refinancing represented membering initial considerations to refinance the These factors caused many lenders to lose confi- senior leverage of 7.2 times EBITDA and 9.2 times loan package that was taken out in 2007 to finance dence and become more cautious. Special bank tax- incorporating the junior debt. The lending consor- the acquisition of the airport from the British BAA es and the forced currency exchange for loans made tium includes existing lenders rolling or upsizing which had taken it over from the Hungarian govern- in Swiss Francs to Forint at a fixed rate implied huge their participation in the senior loan like SMBC, ment only one year before. Completed just before losses for the banks, which added to the negative Unicredit, Crédit Agricole, HSH Nordbank and ING the 2008 financial crisis, the transaction was distin- sentiment. Nevertheless, management worked in- as well as new senior lenders such as RBC, Natixis gration of a new holding company into the existing guished by high leverage (with debt to EBITDA of tensively during this period to mitigate the lack of and Deutsche Bank. Out of the group of senior lend- shareholder structure of Budapest Airport. The shares more than 16 times) and optimistic passenger passenger growth and collapse of Malév, substan- ers several lenders acted also as swap counter par- of the new company were pledged to the new Senior growth projections. At the end of 2012 the leverage tially improving the profitability and cash flow gen- ties. On the junior loan key investors were Park B lenders. was still 11 times, while the market level for financ- eration of the company by increasing EBITDA from Square, Macquarie and Deutsche Bank, who partic- ing of comparable assets was between five to seven EUR 83 million in 2007 to EUR 115 million in 2012 ipated both in the senior and junior financing as well A key element of the successful refinancing was the times at this point. “This overleverage was a major (+39%). as the swap. cooperation with the Hungarian state. Budapest Airport management approached the state-owned hold- “The successful refinancing is a great success for the airport and provides a stable platform for future growth” While preparing for the refinancing, it became to consider it as part of an overall market-based refi- quickly evident through discussions with the lend- nancing of the existing facilities. This structured solu- ers that the thirty-strong bank consortium was quite tion enabled BUD to: polarized. Ingo Ludwig describes it as “While half of ing company MNV quite early in the process and held by winning a total of four internationally recognized various meetings with MNV and the ministries to keep deal of the year awards by specialist finance maga- them in the loop. Budapest Airport ensured that the zines Project Finance International, Global Transport financing structure was in line with the privatization Finance, IJ Global as well as emeafinance. contracts, particularly with respect to leverage and interest service ratios. The Hungarian state was very As is typical with diversified financing structures, the cooperative throughout the lengthy process and in rights and obligations of each specific group were the end approved the transaction. the bank consortium liked the asset and was very • Provide an exit for some existing senior lenders while integrated into the financing contracts and the in- supportive of a refinancing, the other half was very allowing others to participate in the new financing tercreditor agreement. Budapest Airport, supported “The successful and oversubscribed refinancing is of keen to exit rather sooner than later.” Many banks in • Significantly delever the company allowing BUD to by their financial advisor Rothschild, worked with a course a great acknowledgement of our work and the the latter group had effectively left the project and in- achieve a market-based refinancing of the senior debt total of six different law firms. One key challenge trust that the lenders place in the management of frastructure financing market for good, thus making • Restructure, roll and partially break the existing inter- was the implementation of a completely new security Budapest Airport,” summarized Ingo Ludwig. “But structure that considers the difference in rankings be- more importantly the new financing provide us with discussions with the consortium quite challenging. As 6 The refinancing was also recognized by the industry est rate swaps negotiations continued into late 2013, BUD’s trading • Get consent of the Hungarian State and an extension tween Senior A and Senior B lenders. This requirement, a stable platform to further drive the growth and Ingo Ludwig (Chief Financial continued to improve while at the same time the ju- of the direct agreement between the Hungarian State from the lenders themselves, was fulfilled via the inte- profitability of the business.” Officer and Deputy CEO) nior debt market developed favorably enabling BUD and the lenders 7 Report 2014 Aviation business Passengers The annual passenger traffic hit a record high of 9.2 million passengers in 2014, 2014 2013 2012 2011 9,155,961 8,520,880 8,504,020 8,920,653 which exceeded the 2013 figure by 7.5%. Aircraft Movements After the market consolidation during the past 2 years, 2014 saw a significant expansion of airline capacity and passenger traffic. In comparison with Budapest 2014 2013 2012 2011 86,682 83,830 87,560 109,949 2014 2013 2012 2011 89,987 92,112 93,123 106,595 Airport’s 7.5% traffic growth the EU av- Cargo Volume erage growth was only 5.3% in 2014. The Hungarian capital airport handled a total of 9,155,961 departing and arriving passengers which was even high- Business Unit Property er than in the last year of Malév’ operation. However, the and Vueling. In addition, existing airlines’ development aircraft movements, i.e. the number of take offs and land- was driven by either frequency or capacity increases or ings, did not show a similar recovery as it remained at the launch of new routes. The most important development Property revenues increased by 2.9% in 2014 driven level of 86,682 movements, which is still an improvement was demonstrated by Wizz Air with their 8th based aircraft by new tenants as well as new facilities built and Air traffic performance compared with 2013 (+3.4%) but remained far below 2011 starting to operate from April 2014 and providing addition- rented at the airport. These include the new DHL Airlines: 38 scheduled airlines operated in 2014 movements by 26.8%. This confirms the trend of airlines’ al capacity either to new destinations such as Kutaisi, and logistics center (new facility and new tenant) as efforts to increase efficiency via load factor improve- Alicante or increasing frequencies on existing routes such well as a spare parts facility and inflatable hangar ments and deploying larger aircraft. as Barcelona, Moscow or Istanbul. In the meantime many for Lufthansa Technik (new facilities). The DHL logis- 7 Low-cost other airlines increased traffic e.g. Norwegian (new flight tics center is also the first development of the Airport 31 Full-service The above record traffic was achieved by attracting new to London Gatwick), Turkish Airlines (frequency increase), Business Park on the southern edge of the airport. airlines to BUD, such as Emirates flying to Dubai from Jet2.com (new flight to Leeds) and El-Al through the The new building comprises 3,000 square meters October 2014 or new flights by Pegasus, Transavia France launch of its own low-cost subsidiary UP. of office space, 7,800 square meters of warehouse 7 31 space and 5,700 square meters of maneuvering space. Consumer and landside business Destinations: 88 88 airports 74 cities 35 countries Revenues in the consumer and landside business improved by 2.7% compared with 2014. The consumer business continued to benefit from the increased 88 74 35 2014 2014 retail and food & beverage offering after completion of SkyCourt and the refurbishment of the terminal areas T2A and T2B in 2012. Altogether, the airport currently offers more than 50 stores and catering 2014 outlets on a total area of around 6,300 square meters. In 2014 additional new outlets were opened, such as Victoria`s Secret and Vodafone. 2014 saw the first full year of operation of the improved curbside and car park access system as well as the online booking system contributing to a substantial increase of landside business revenues. 8 9 Financial Highlights Consolidated statement of financial position (in EUR `000) Consolidated income statement 31 December 2014 31 December 2013 (in EUR `000) for the period ended 31 December 2014 for the period ended 31 December 2013 265,658 246,818 (72,711) (64,741) (6,231) (7,683) Employee benefit expense (19,038) (17,936) Depreciation and amortization (18,681) (20,594) Other income, costs and expenses (25,325) (25,929) Operating profit 123,672 109,935 Finance income 527 1,066 ASSETS Revenue Non-current assets Raw materials and consumables Property, plant and equipment used 27,911 32,663 2,176,314 2,169,931 49,091 - 50,408 62,076 2,303,928 2,275,404 1,710 2,496 Trade receivables 17,400 20,163 Finance costs (180,272) (121,249) Cash and cash equivalents 112,241 131,285 Loss before income tax (56,073) (10,248) 8,601 8,106 (31,917) (8,315) 139,952 162,050 (87,990) (18,563) 2,443,880 2,437,454 28,311 159,684 2014 2013 Aviation revenues 130,171 121,721 Fuel supply revenues 75,730 66,503 52,169 51,657 7,588 6,937 265,658 246,818 Intangible assets Derivative financial instruments Other non-current assets Total non-current assets Current assets Inventories Other receivables Total current assets Total assets EQUITY Utility expenses Income tax expense Loss for the period Income statement notes LIABILITIES Revenues (in EUR `000) Non-current liabilities Borrowings 1,968,503 672,330 256,698 200,170 Other non-current liabilities 82,163 74,767 Total non-current liabilities 2,307,364 947,267 Derivative financial instruments Other Current liabilities Trade payables Borrowings Derivative financial instruments Other current assets Total current liabilities Total liabilities Total equity and liabilities Rental revenues 8,769 8,339 73,432 1,278,753 - 15,985 26,004 27,426 108,205 1,330,503 2,415,569 2,277,770 2,443,880 2,437,454 Total The reason of the increase in aviation revenues is increased flight and passenger numbers in 2014. Statement of financial position notes Borrowings The Group refinanced its bank loans with expiration date of end of 2014 on 25 September 2014. As of 31 December 2014 the total amount of borrowings (both short and long term) consisted of EUR 765 million shareholder loans, EUR 1,100 million bank borrowings and EUR 177 million other borrowings. 10 11 Raw materials and consumables used (in EUR `000) 2014 2013 (70,542) (62,025) Other (2,169) (2,716) Total (72,711) (64,741) Cost of fuel sale Outlook for 2015 Budapest Airport foresees for 2015 the traffic to reach of Emirates, Wizz Air basing its ninth aircraft, and new 10.1 million (+10.7 percent), with a moderate growth of airlines, for instance Iberia, Air Transat and Air China. movements by 5.7 percent. This growth will be driven Frequency increases are also expected (Pegasus to among other things by the first full year of operation Istanbul, Transavia France to Paris). Finance costs Top 10 airlines The main reason of the increase in the accounted borrowing costs related to the refinancing of the senior bank borrowings of the Group. Income tax expense (in EUR `000) 2014 2013 (4,358) (4,575) Deferred tax (27,559) (3,740) Total (31,917) (8,315) Current tax The main reason of the increase in income tax expense is that in 2014 the Group realized a one-off effect on the revaluation of the deferred taxes due to the tax law change. Key figures Key figures 2014 2013 265,658 246,818 Revenue excluding fuel supply (EUR `000) 189,928 180,315 EBITDA (EUR m) 142,583 130,709 10.9 19.1 Debt (EUR m) 1,358 1,282 Cash (EUR m) 112 131 1,246 1,151 Revenue (EUR `000) Capex (EUR m) Net debt (EUR m) 12 Wizz Air Ryanair Lufthansa easyJet KLM Norwegian British Airways Air France Germanwings Travel Service Top 10 destinations London Paris Brussels Frankfurt Amsterdam Munich Istanbul Rome Moscow Milan Top Ten Ranking of 2014 13 Budapest Airport at a glance Budapest Airport is Hungary’s largest international airport. Operations Terms of concession 100 percent privatization, duration until 2080, contract concluded 22 December 2005 Ownership structure Ownership structure: 52.666 % AviAlliance, 22.167 % Malton Investment Pte Ltd, 20.167 % Caisse de dépôt et placement du Québec, 5 % Kf W IPEX-Bank Technical Data Total area of airport 1,515 hectares Location Budapest Ferihegy, 16 kilometers south-east of Budapest’s city center Geographical coordinates 47° 26’ 22” N, 19° 15’ 43” O Airport codes BUD (IATA), LHBP (ICAO) Terminal 1 T1 (opened 1950, reconstructed 2005, but temporarily closed) Terminal 2 2A (opened 1985) 2B (opened 1998) SkyCourt (opened 2011 between 2A and 2B, the new large Terminal 2) Runways Runway 1 (13R-31L) 3,010 m Runway 2 (13L-31R) 3,707 m Passengers (in million) Aircraft Movements Cargo Volume (in tons) 9.2 8.5 86,682 83,830 89,987 92,112 267 248 2014 2013 2014 2013 2014 2013 2014 2013 Publisher: Budapest Airport Zrt., Communication, Tel.: + 36 1 296-6753, E-mail: mihaly.hardy@bud.hu 14 Revenues (in EUR m incl. fueling) Status: October 2015