IPOs - a source of opportunity

advertisement

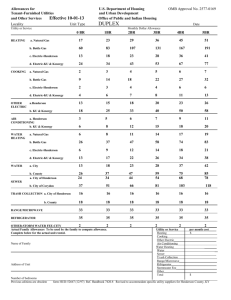

Henderson Smaller Companies Investment Trust Inside The Mind: Neil Hermon IPOs - a source of opportunity Although not always portrayed by the media, equity markets are in very good shape. In the UK, anecdotally, corporates express confidence when talking of trading conditions and the strength in the UK economy. Forward looking economic data is supportive of their views. Equities represent good value when compared to bonds. As such, the air of optimism among investors is understandable. With investors feeling confident, Initial Public Offerings (IPOs) – where companies float on the stock exchange for the first time and raise cash in exchange for equity ownership – have soared. Many have been driven by private equity sellers following a long period out in the cold, as they look to cash-in on legacy investments made during or before the financial crisis. Below is a graphic highlighting IPOs in the UK. Up to July this year we have seen more deals, of higher value, than any entire year over the past five; the enthusiasm for capital is certainly high. Consumer cyclicals, namely the retailers, are leading the pack, with flotations in household names such as Poundland, Pets At Home, and most recently, Shoezone. Casting a discerning eye The enthusiasm for IPOs has led to an interesting shift in market dynamics: as the volume of deals has grown so has the choice, switching power from the hands of issuers into the hands of investors. When facing such choice investors require a discerning eye as it’s all too easy to become intoxicated by the exuberance of business executives pitching their exciting new ventures. With eye-watering valuations often placed upon these companies, particularly as private equity houses look to extract the maximum value from their own investments, we continue to stick to a fundamental principal: buying Henderson Smaller Companies Investment Trust (continued) growth stocks at reasonable prices. The strategy aims to provide investors a decent capital return but it also serves to keep the long line of new issues trimmed down to those we think will really benefit the portfolio. With this strategy firmly in place, we have found some great companies to invest in and whose valuations I think are reasonable considering the potential for growth. Here I highlight three. Please bear in mind that nothing in this document is intended to or should be construed as advice. The roadside warriors The AA - a roadside assistance company that also offers motor insurance and driving lessons - has become th the largest IPO in the UK market this year so far, floating on 24 June. It provides a partial exit of ownership for a trio of private equity houses (Premira, Charterhouse, and CVC) whose time with the company has been marked by turmoil following tensions with unions and politicians alike; in 2007 they met tough questions by the treasury select committee regarding asset disposals. The business is headed up by Chris Jansen, chief executive and a former British Gas executive, and executive and deputy chairs Bob McKenzie and Nick Hewitt, a duo that have on/off worked together for 19 years. What we saw was a strong brand built over the 108 years - surveys reveal their brand is perceived very favourably among customers. It enables them to price their services at a premium to their nearest competitor, RAC, and affords loyalty from a customer base that has remained stable at around the four million mark for over 40 years. In terms of adding value there’s work to be done, with cost reduction, web improvement, and debt reduction all important areas to be tackled. Coupled with its historically strong brand and good management, I think AA is a great investment. Fashion in India rd My second pick is Koovs, the Indian online fashion site that floated in March and approaches its 3 major clothing season since launch. It’s chaired by Lord Waheed Alli, whom oversaw the expansion of ASOS from 2000 – 2012 (and a market cap that grew from £4m to over £3bn). He’s joined by Anant Nahata, co-founder and Indian entrepreneur, and Robert Bready, ASOS product director from 2006 – 2012. The company has been structured to have its logistics and operations capabilities based in India – essential in these markets and its design team based in London. The strategy is to repeat the successes of ASOS but in India (ASOS decided India was not a strategic priority for them). Its products come online at a time where ecommerce is growing at a rapid rate in large emerging economies (including China); physical retail is simply unable to expand fast enough to meet growing 1 consumer demand. It is estimated that ecommerce in India is currently valued at around $0.6bn , or 0.1% of 1 total retail sales; by 2017 it is estimated to be $17bn , or 2% of total retail sales. This we find very attractive. We hope the combination of a proven management team and structural growth drivers as well as the high profile designer tie-ups and positive local press should make this a fantastic long term growth story. Having your cake and eating it Our final pick is Patisserie Holdings, the owner of 5 bakery brands including, most famously, the Patisserie Valerie chain. Having come to the market in May, it is headed-up by serial entrepreneur Luke Johnson known for his successes with pizza chain restaurant Pizza Express, bistro La Strada, and ‘world food’ chain Giraffe. 1 Peel Hunt; as of 3/4/14 Henderson Smaller Companies Investment Trust (continued) Having bought the small set of 8 Patisserie Valerie stores in 2006, Luke has already taken it to over 130. The pace of store roll-outs, which are forecast to continue at a rapid rate, is an attractive part of the investment case. From an operational perspective there are also further efficiencies that could squeeze more value out of the company, for example bolstering the sales of online and takeout food which do not attract VAT. With a highly credible management team, popular brand, and aggressive store roll-out strategy, this is another investment with fantastic long term potential. A careful consideration The deal volume has certainly led to some lethargy and scepticism among investors, but it’s important to remember that, broadly, IPOs have performed positively post-IPO this year. Our opinion remains that, as long as you apply a disciplined approach to the analysis of the companies coming through your door, and you invest in them at reasonable prices, the current flurry of IPOs can be a great source of opportunity and long term growth. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. Issued in the UK by Henderson Global Investors. Henderson Global Investors is the name under which Henderson Global Investors Limited (reg. no. 906355), Henderson Fund Management Limited (reg. no. 2607112), Henderson Investment Funds Limited (reg. no. 2678531), Henderson Investment Management Limited (reg. no. 1795354), Henderson Alternative Investment Advisor Limited (reg. no. 962757), Henderson Equity Partners Limited (reg. no.2606646), Gartmore Investment Limited (reg. no. 1508030), (each incorporated and registered in England and Wales with registered office at 201 Bishopsgate, London EC2M 3AE) are authorised and regulated by the Financial Conduct Authority to provide investment products and services. Ref: 34V